Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Objectives Develop an ability to identify and assume an assigned role. Identify and rank the importance of explicit issues. Illustrate the importance of hidden (undirected)

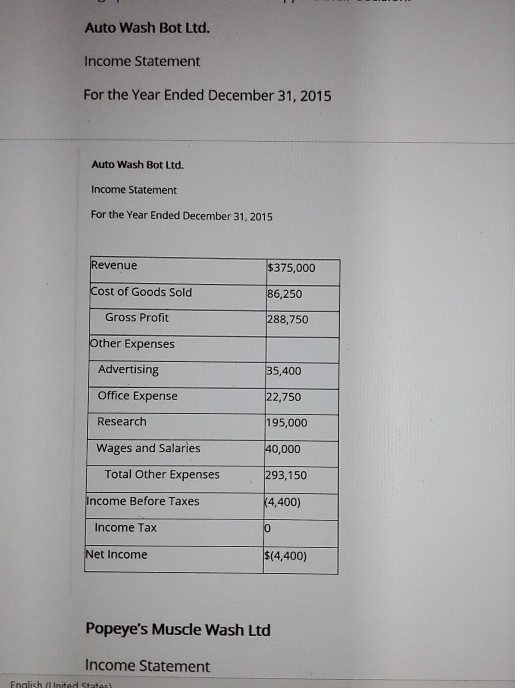

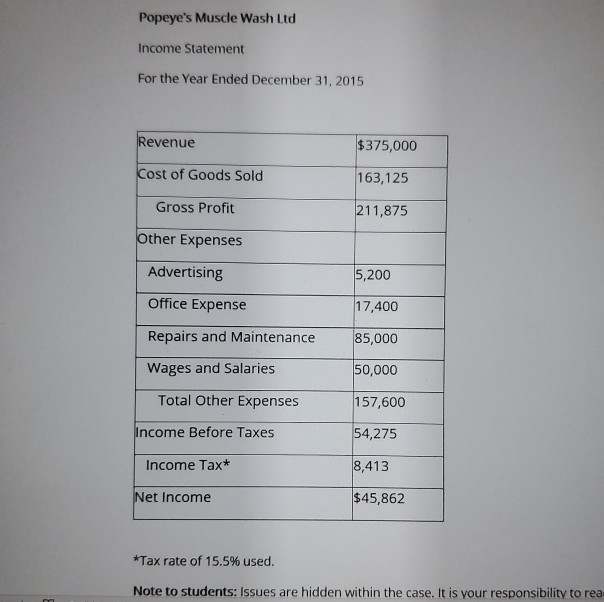

Objectives Develop an ability to identify and assume an assigned role. Identify and rank the importance of explicit issues. Illustrate the importance of hidden (undirected) issues that arise from a detailed analysis. Identify accounting issues (GAAP/IFRS compliance issues), assess their implications, generate alternatives, and provide recommendations within the bounds of GAAP/IFRS to meet the client's needs. Examine how accounting standards impact financial measures (ratios, covenants, etc.). Prepare a coherent report and integrated analysis that meets specific user needs. Instructions In order to complete your case analysis successfully, you should consider identifying the role you are playing, assessing the financial reporting landscape considering the user needs, constraints, and business environment, identifying the issues, analyzing the issues (qualitatively and quantitatively), and providing a recommendation for each issue identified in the case. You are required to prepare for the case before the class and bring any documents that will support your analysis. An average grade will come from you answering questions with basic coverage and accuracy, showing all your preparation. Additional points come from including greater detail, astute and informed commentary where appropriate, and connections to readings and other content. Respond in a single Word doc (or comparable text editor). Investment Decisions for Big Spenders Inc. Background You are an Analyst for the professional service firm, FINACC LLP. Your firm specializes in providing a wide variety of internal business solutions for different clients. It is your first day on the job and a Manager in the Consulting area asks you for some help with an investment decision for one of your large clients, Big Spenders Inc. Ready to make an impression on your first day, you start reading the background information provided by the Manager. Additional Information nsert Design Layout References Mailings Review View Help Share Comments Additional Information Investment Decisions for Big Spenders Inc. Background You are an Analyst for the professional service firm, FINACC LLP. Your firm specializes in providing a wide variety of internal business solutions for different clients. It is your first day on the job and a Manager in the Consulting area asks you for some help with an investment decision for one of your large clients, Big Spenders Inc. Ready to make an impression on your first day, you start reading the background information provided by the Manager. Additional Information Big Spenders Inc, has been working on diversifying its portfolio of investments and requires accounting advice for a decision between two car cleaning and detailing companies. Your responsibility is to perform a comparative analysis of the profitability of two potential equity investments. Your engagement manager on this job has given you a brief background on the operations of the two companies: Auto Wash Bot Ltd. (AWBL) has recently completed the research and development of a new touch screen app for all mobile devices. This new technology is both more user friendly than the current technology on the market. Auto Wash Bot Ltd has just signed a major contract to provide the Auto Wash Bot terminal to a major producer of mobile devices. The founder of the business would like to sell a 50% interest in the business for $100,000 in order to finance further expansion of operations. Popeye's Muscle Wash Ltd (PMWL) is a self-service, coin operated car wash located in a busy residential area. The company provides all of the services of a typical car wash, including soap, wax, vacuuming as well as pressure washing. PMWL has been long established and enjoys the loyalty and repeat business of many local residents. The current owner is getting up in age and would like to sell 100% ownership interest in the business for $100,000 to pursue retirement. The current year's income statement is consistent with prior years. One of the first tasks in the analysis of the potential equity acquisition is an assessment of each company's current and future profitability. Your manager has provided you with copies of each company's income statement (see below). Next, you are to calculate the expected return on the investment for each company. You have been asked to discuss any other issues that you believe are relevant to the investment decision. The Consulting Manager would like you to prepare the report and have it on his desk for review first thing tomorrow morning. Once reviewed, this report will be submitted to Big Spenders Inc. in order to support their decision. Auto Wash Bot Ltd. Income Statement For the Year Ended December 31, 2015 Auto Wash Bot Ltd. Income Statement For the Year Ended December 31, 2015 Auto Wash Bot Ltd. Income Statement For the Year Ended December 31, 2015 $375,000 Revenue Cost of Goods Sold 86,250 Gross Profit 288,750 Other Expenses Advertising Office Expense 35,400 22,750 195,000 Research Wages and Salaries 40,000 Total Other Expenses 293,150 Income Before Taxes (4,400) Income Tax Net Income $(4,400) Popeye's Muscle Wash Ltd Income Statement Popeye's Muscle Wash Ltd Income Statement For the Year Ended December 31, 2015 Revenue Cost of Goods Sold $375,000 163,125 211,875 Gross Profit Other Expenses Advertising Office Expense 5,200 17,400 Repairs and Maintenance 85,000 Wages and Salaries 50,000 Total Other Expenses 157,600 54,275 Income Before Taxes Income Tax* 8,413 Net Income $45,862 *Tax rate of 15.5% used. Note to students: Issues are hidden within the case. It is your responsibility to red

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started