Question

O'Brien Corporation had the balance sheet shown in Table 5E at the end of last year. The company had net income of $150,000 on sales

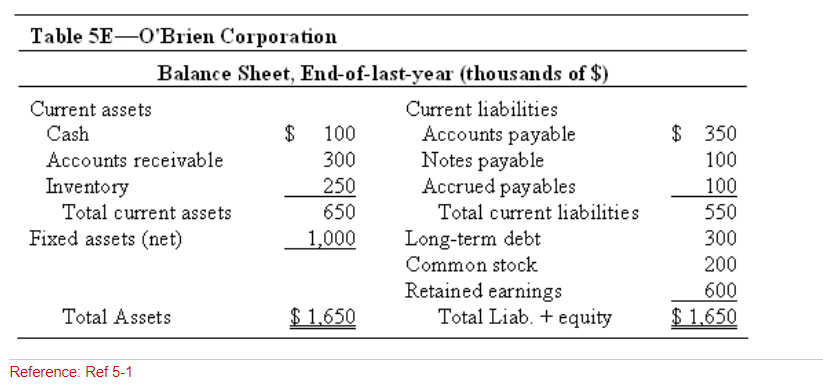

O'Brien Corporation had the balance sheet shown in Table 5E at the end of last year. The company had net income of $150,000 on sales of $3,000,000, and paid $50,000 in dividends last year. O'Brien is at full capacity and considers all its assets, accounts payable, and accrued liabilities as spontaneous. Assume the net profit margin and dividend payout ratio remain the same this year, and that sales are projected to be $3,300,000.

Reference: Ref 5E Below need to refresh

Using the percentage-of-sales method, what is the forecasted end-of-this-year external financing need (EFN) or excess cash (in thousands of dollars)?

Using the percentage-of-sales method, what is the forecasted end-of-this-year external financing need (EFN) or excess cash (in thousands of dollars)?

Group of answer choices

EFN of $25.

EFN of $10.

Excess cash of $25.

Excess cash of $10.

Table 5E-O'Brien Corporation Balance Sheet, End-of-last-year (thousands of $) Current assets Current liabilities Cash $ 100 Accounts payable Accounts receivable 300 Notes payable Inventory 250 Accrued payables Total current assets 650 Total current liabilities Fixed assets (net) 1,000 Long-term debt Common stock Retained earnings Total Assets $1,650 Total Liab. + equity $ 350 100 100 550 300 200 600 $ 1,650 Reference: Ref 5-1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started