Answered step by step

Verified Expert Solution

Question

1 Approved Answer

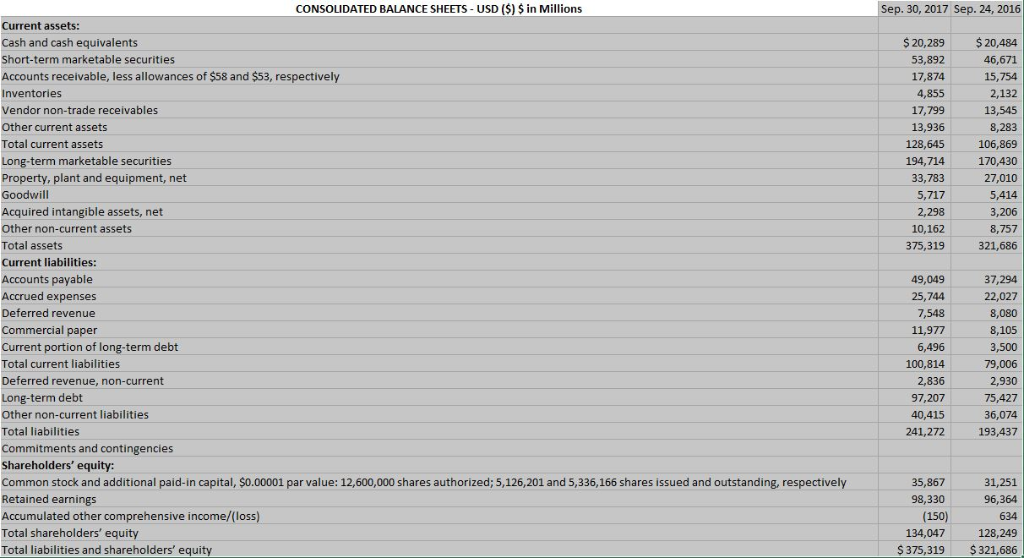

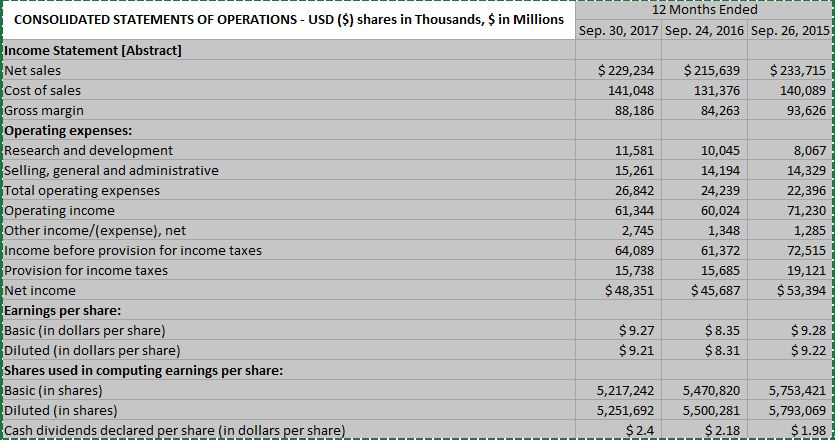

Obtain the balance sheet and income statement from Apple from their latest 10-K annual reports. Cut and paste all years shown of the balance sheet

Obtain the balance sheet and income statement from Apple from their latest 10-K annual reports.

Cut and paste all years shown of the balance sheet and income statement into a new EXCEL spreadsheet. Omit any extraneous information (e.g., # shares of stock issued, outstanding, eps for other than the net income, etc.), Compute the ratios and financial analysis for each company as indicated below:

- Horizontal analysis of the balance sheet and income statement (% change from year to year) for all the years presented.

- Vertical analysis of the balance sheet and income statement for all years shown.

- Ratio Analysis (Illustration 5A-1 p. 232) for two years for each company

- Current ratio

- Quick ratio

- Profit Margin on Sales

- Price-Earnings ratio (you will have to google stock price on the balance sheet date)

- Debt to Assets ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started