Question

Financial Analysis and Written Paper Project Requirements: 1. Obtain the most recent annual report for two companies in the retail grocery store industry -Kroger and

Financial Analysis and Written Paper Project Requirements:

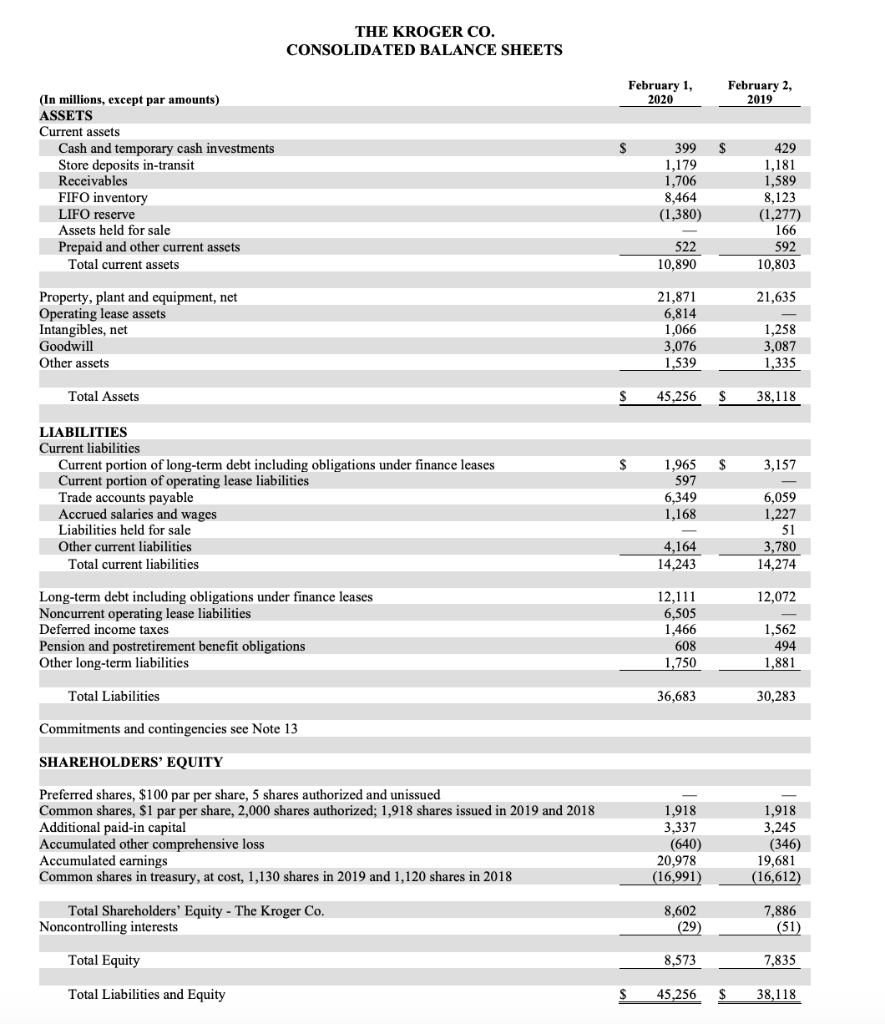

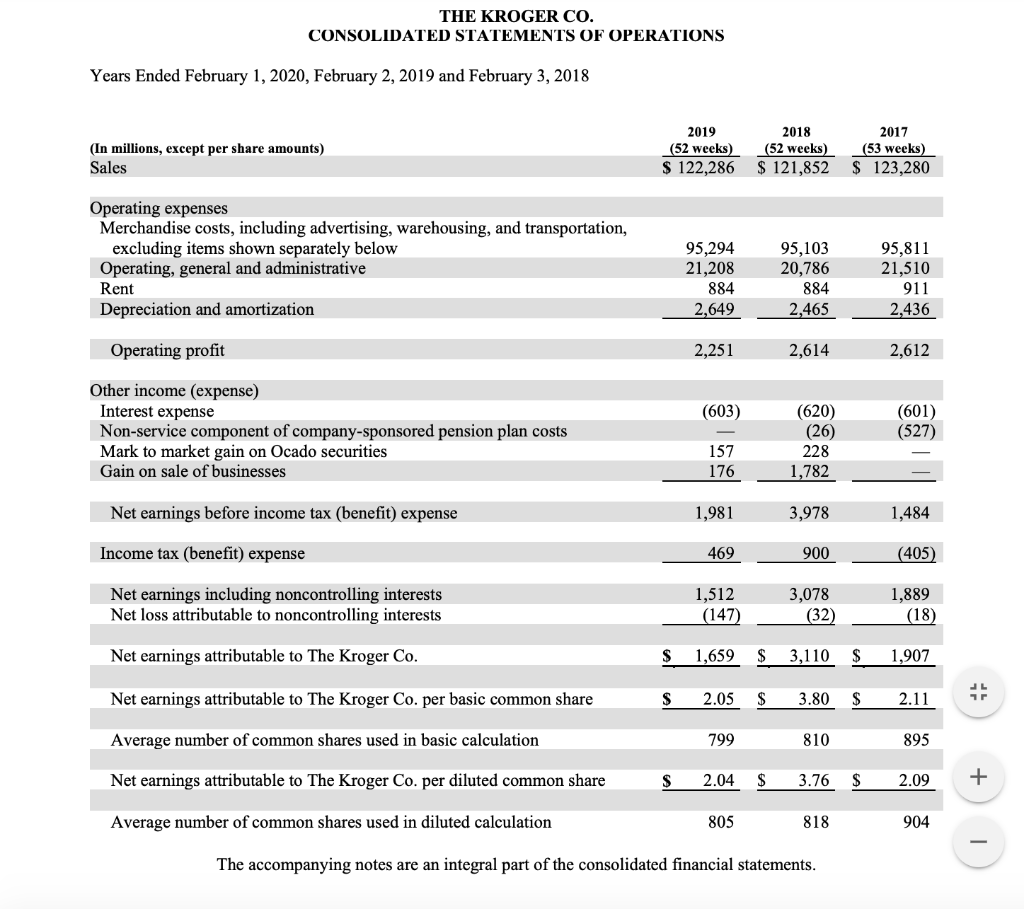

1. Obtain the most recent annual report for two companies in the retail grocery store industry -Kroger and Safeway. Kroger is your bases company. The reports should contain at least three years of income statement data and two years of balance sheet data.

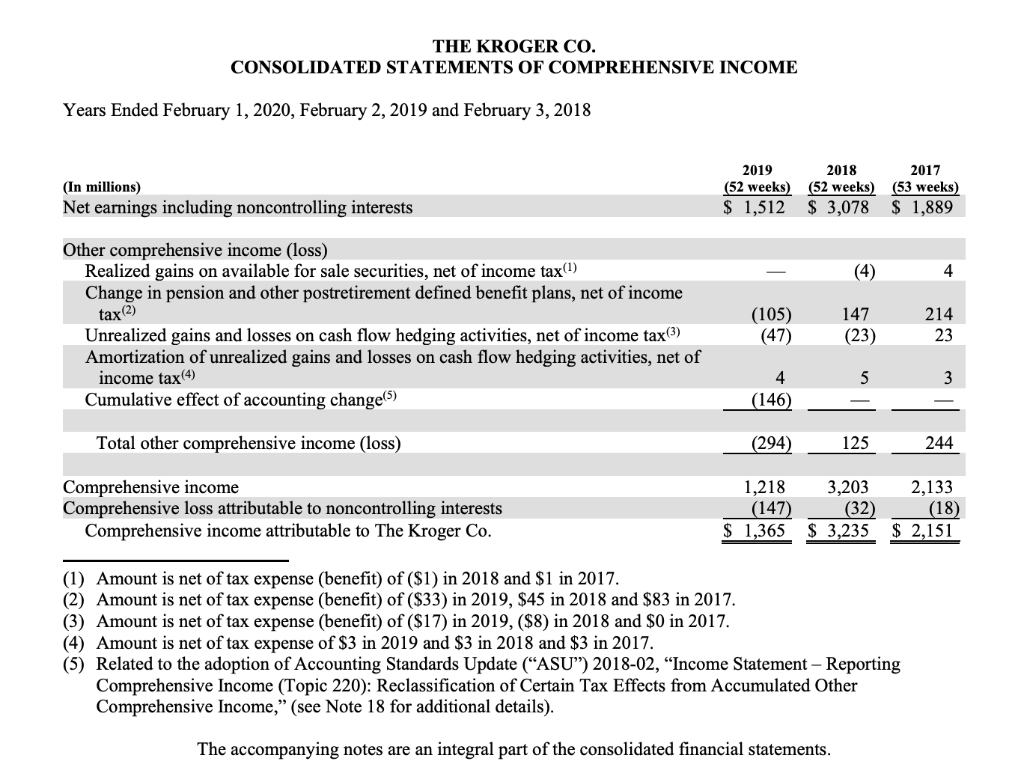

2. Analyze at least 3 -5 (three - five) items on the income statement for your base company that would be important to an investor and discuss whether your company?s performance related to these items appeared to be improving, deteriorating, or remaining stable. Justify and expand in writing on your answer. NOTE: See the supplement information to this document for additional guidelines on the suggested financial analysis requirements.

3. Analyze at least 4-6 (four- six) items on the balance sheet for your base company that would be important to an investor and discuss whether your company?s performance related to these items appeared to be improving, deteriorating, or remaining stable. Justify and expand in writing on your answer.

4. Analyze your base company?s investing and financing activities for the most recent year as identified in the statement of cash flows, specifically identifying the two largest investing activities and the two largest financing activities. Discuss whether you agree or disagree with the investing and financing strategies that your company appears to be employing.

5. Identify 2 (two) items not included in (or derived from) the financial statements that you think would be important to someone considering whether to invest in your company. Discuss your reasons for believing that these two items about the company would be important in making an investment decision. (Hint: you might want to consider items discussed in other business classes.)

6. Compare Kroger, your base company?s financial statements with those of the second company; Safeway. Both companies are in the retail grocery industry. Your purpose for undertaking the research and financial analysis is because you are an investor. You need to make a decision to invest in one of the two companies. Which company would you recommend? Explain Why?

Note: You must recommend one of the two companies. Also note that your recommendation in this section of your paper must include a discussion of some financial issues you observed in your analysis process. However, your reasons for making the decision need not be limited to a discussion of just financial issues. Other non-financial factors like management, marketing strategies, technology advancements, sustainability, etc., can be included in your written justification for making your decision)

kroger:?

(In millions, except par amounts) ASSETS Current assets Cash and temporary cash investments Store deposits in-transit Receivables FIFO inventory LIFO reserve Assets held for sale Prepaid and other current assets Total current assets Property, plant and equipment, net Operating lease assets Intangibles, net Goodwill Other assets Total Assets LIABILITIES Current liabilities Current portion of long-term debt including obligations under finance leases Current portion of operating lease liabilities Trade accounts payable Accrued salaries and wages Liabilities held for sale Other current liabilities Total current liabilities THE KROGER CO. CONSOLIDATED BALANCE SHEETS Long-term debt including obligations under finance leases Noncurrent operating lease liabilities Deferred income taxes Pension and postretirement benefit obligations Other long-term liabilities Total Liabilities Commitments and contingencies see Note 13 SHAREHOLDERS' EQUITY Preferred shares, $100 par per share, 5 shares authorized and unissued Common shares, $1 par per share, 2,000 shares authorized; 1,918 shares issued in 2019 and 2018 Additional paid-in capital Accumulated other comprehensive loss Accumulated earnings Common shares in treasury, at cost, 1,130 shares in 2019 and 1,120 shares in 2018 Total Shareholders' Equity - The Kroger Co. Noncontrolling interests Total Equity Total Liabilities and Equity S $ February 1, 2020 $ $ 399 1,179 1,706 8,464 (1,380) 522 10,890 21,871 6,814 1,066 3,076 1,539 45,256 $ 6,349 1.168 1.965 $ 597 4,164 14,243 12,111 6,505 1,466 608 1,750 36,683 1,918 3,337 (640) 20,978 (16,991) 8,602 $ (29) 8,573 45,256 February 2, 2019 429 1,181 1,589 8,123 (1,277) 166 592 10,803 21,635 1,258 3,087 1,335 38,118 3,157 6,059 1,227 51 3,780 14,274 12,072 1,562 494 1,881 30,283 1,918 3,245 (346) 19,681 (16,612) 7,886 (51) 7,835 38,118 THE KROGER CO. CONSOLIDATED STATEMENTS OF OPERATIONS Years Ended February 1, 2020, February 2, 2019 and February 3, 2018 (In millions, except per share amounts) Sales Operating expenses Merchandise costs, including advertising, warehousing, and transportation, excluding items shown separately below Operating, general and administrative Rent Depreciation and amortization Operating profit Other income (expense) Interest expense Non-service component of company-sponsored pension plan costs Mark to market gain on Ocado securities Gain on sale of businesses Net earnings before income tax (benefit) expense Income tax (benefit) expense Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests Net earnings attributable to The Kroger Co. Net earnings attributable to The Kroger Co. per basic common share Average number of common shares used in basic calculation Net earnings attributable to The Kroger Co. per diluted common share Average number of common shares used in diluted calculation 2019 (52 weeks) $ 122,286 $ $ S 95,294 21,208 884 2,649 2,251 (603) 157 176 1,981 469 1,512 2.05 $ 799 2018 (52 weeks) $ 121,852 2.04 805 95,103 20,786 884 2,465 2,614 (620) (26) 228 1,782 3,978 (147) 1,659 $ 3,110 $ 900 3,078 (32) 2017 (53 weeks) $ 123,280 3.80 $ 810 $ 3.76 $ 818 The accompanying notes are an integral part of the consolidated financial statements. 95,811 21,510 911 2,436 2,612 (601) (527) 1,484 (405) 1,889 (18) 1,907 2.11 895 2.09 904 + THE KROGER CO. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Years Ended February 1, 2020, February 2, 2019 and February 3, 2018 (In millions) Net earnings including noncontrolling interests Other comprehensive income (loss) Realized gains on available for sale securities, net of income tax() Change in pension and other postretirement defined benefit plans, net of income tax (2) Unrealized gains and losses on cash flow hedging activities, net of income tax(3) Amortization of unrealized gains and losses on cash flow hedging activities, net of income tax(4) Cumulative effect of accounting change (5) Total other comprehensive income (loss) Comprehensive income Comprehensive loss attributable to noncontrolling interests Comprehensive income attributable to The Kroger Co. 2019 (52 weeks) $ 1,512 (105) (47) 2018 (52 weeks) $ 3,078 $ 1,365 (4) 147 (23) 5 (146) (294) 1,218 3,203 (147) (32) 125 $ 3,235 2017 (53 weeks) $ 1,889 4 (1) Amount is net of tax expense (benefit) of ($1) in 2018 and $1 in 2017. (2) Amount is net of tax expense (benefit) of ($33) in 2019, $45 in 2018 and $83 in 2017. (3) Amount is net of tax expense (benefit) of ($17) in 2019, ($8) in 2018 and $0 in 2017. (4) Amount is net of tax expense of $3 in 2019 and $3 in 2018 and $3 in 2017. (5) Related to the adoption of Accounting Standards Update ("ASU") 2018-02, "Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income," (see Note 18 for additional details). The accompanying notes are an integral part of the consolidated financial statements. 214 23 3 244 2,133 (18) $ 2,151

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Financial analysis It includes evaluating projects budgets and business transactions to examine the firms suitability and its performance It is done to determine the firms solvency ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started