Answered step by step

Verified Expert Solution

Question

1 Approved Answer

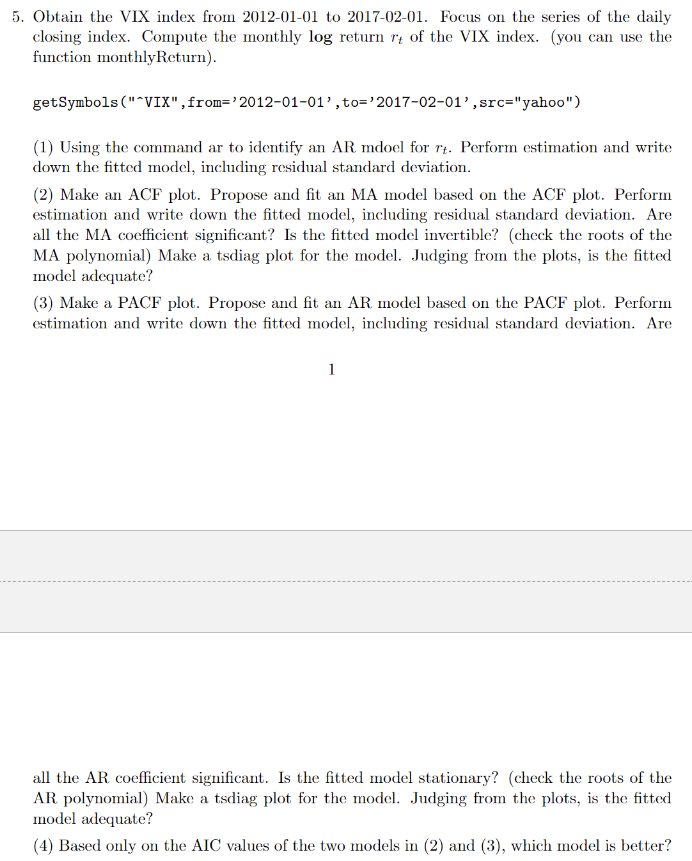

Obtain the VIX index from 2 0 1 2 - 0 1 - 0 1 to 2 0 1 7 - 0 2 - 0

Obtain the VIX index from to Focus on the series of the daily

closing index. Compute the monthly return of the VIX index. you can use the

function monthlyReturn

getSymbols VIX", from to src"yahoo"

Using the command ar to identify an AR mdoel for Perform estimation and write

down the fitted model, including residual standard deviation.

Make an ACF plot. Propose and fit an MA model based on the ACF plot. Perform

estimation and write down the fitted model, including residual standard deviation. Are

all the MA coefficient significant? Is the fitted model invertible? check the roots of the

MA polynomial Make a tsdiag plot for the model. Judging from the plots, is the fitted

model adequate?

Make a PACF plot. Propose and fit an AR model based on the PACF plot. Perform

estimation and write down the fitted model, including residual standard deviation. Are

all the AR coefficient significant. Is the fitted model stationary? check the roots of the

AR polynomial Make a tsdiag plot for the model. Judging from the plots, is the fitted

model adequate?

Based only on the AIC values of the two models in and which model is better?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started