Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $74,000. The PPE subledger

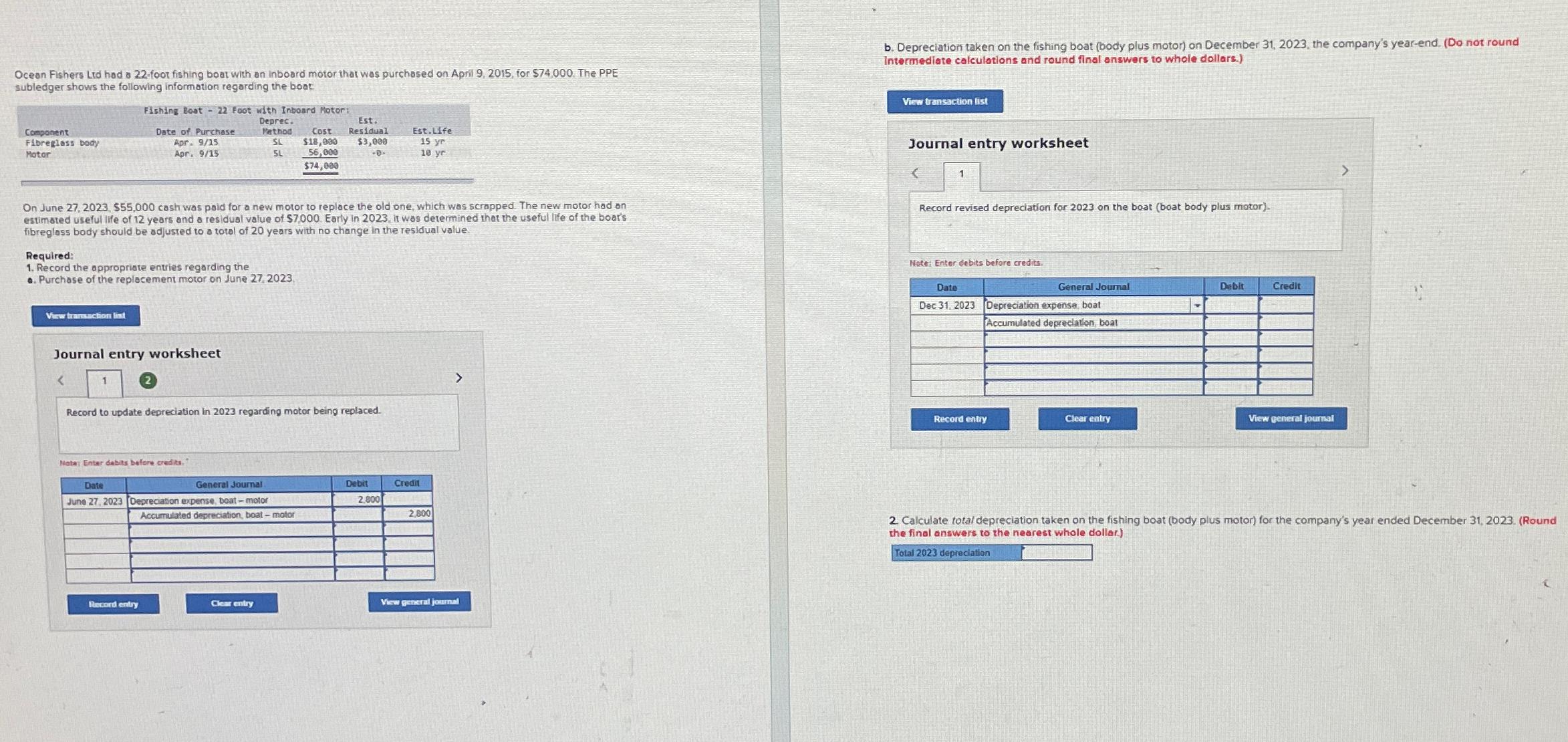

Ocean Fishers Ltd had a 22-foot fishing boat with an inboard motor that was purchased on April 9, 2015, for $74,000. The PPE subledger shows the following information regarding the boat b. Depreciation taken on the fishing boat (body plus motor) on December 31, 2023, the company's year-end. (Do not round Intermediate calculations and round final answers to whole dollars.) Fishing Boat -22 Foot with Inboard Motor: Component Fibreglass body Date of Purchase Apr. 9/15 Motor Apr. 9/15 Deprec. Pethod SL SL Cost $18,000 56,000 $74,000 Est. Residual $3,000 -0. Est.Life 15 yr 10 yr On June 27, 2023, $55,000 cash was paid for a new motor to replace the old one, which was scrapped. The new motor had an estimated useful life of 12 years and a residual value of $7,000. Early in 2023, it was determined that the useful life of the boat's fibreglass body should be adjusted to a total of 20 years with no change in the residual value. Required: 1. Record the appropriate entries regarding the e. Purchase of the replacement motor on June 27, 2023, View transaction list Journal entry worksheet 1 Record to update depreciation in 2023 regarding motor being replaced. Nota: Enter dabits before credits. Date General Journal June 27, 2023 [Depreciation expense, boat-motor Accumulated depreciation, boat - motor Debit Credit 2.800 2,800 > Record entry Clear entry View general journal View transaction list Journal entry worksheet < 1 Record revised depreciation for 2023 on the boat (boat body plus motor). Note: Enter debits before credits. Date General Journal Dec 31, 2023 Depreciation expense, boat Accumulated depreciation, boat Debit Credit Record entry Clear entry View general journal > 2. Calculate total depreciation taken on the fishing boat (body plus motor) for the company's year ended December 31, 2023. (Round the final answers to the nearest whole dollar.) Total 2023 depreciation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the requirements in the given question we need to follow these steps 1 Record the appropriate entries regarding the purchase of the replace...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started