Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ocean Inc aims to merge Salt Ltd in the near future. As an analyst, you have compiled the data as follows: Characteristic Revenues -

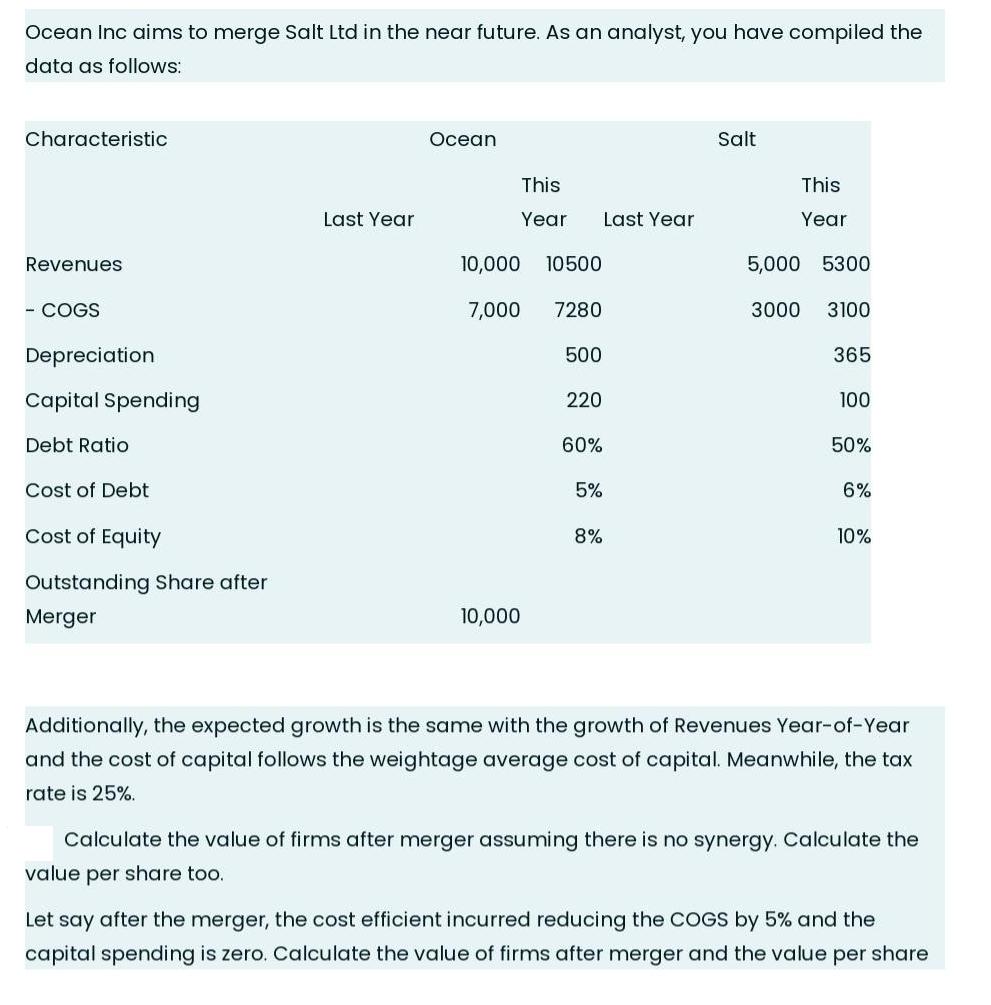

Ocean Inc aims to merge Salt Ltd in the near future. As an analyst, you have compiled the data as follows: Characteristic Revenues - COGS Depreciation Capital Spending Debt Ratio Cost of Debt Cost of Equity Outstanding Share after Merger Last Year Ocean This Year 10,000 10500 7,000 7280 10,000 500 220 Last Year 60% 5% 8% Salt This Year 5,000 5300 3000 3100 365 100 50% 6% 10% Additionally, the expected growth is the same with the growth of Revenues Year-of-Year and the cost of capital follows the weightage average cost of capital. Meanwhile, the tax rate is 25%. Calculate the value of firms after merger assuming there is no synergy. Calculate the value per share too. Let say after the merger, the cost efficient incurred reducing the COGS by 5% and the capital spending is zero. Calculate the value of firms after merger and the value per share

Step by Step Solution

★★★★★

3.29 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of firms after the merger we need to consider the cost savings and tax implications Since there is no synergy mentioned we will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started