Answered step by step

Verified Expert Solution

Question

1 Approved Answer

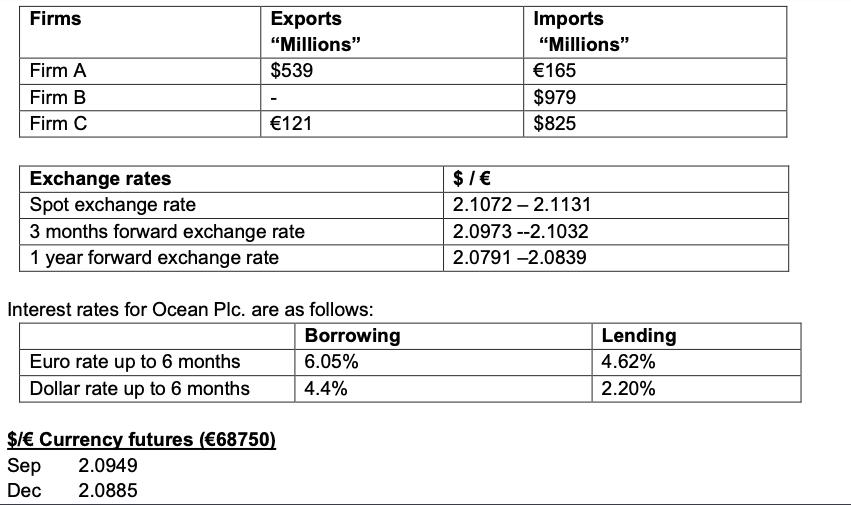

Ocean Plc. is an Ireland based company, that is in import and export trade with USA based companies. Various large transactions that are expected to

Ocean Plc. is an Ireland based company, that is in import and export trade with USA based companies.

Various large transactions that are expected to be due in 5 months time are shown below. For the calculation of future and forward contracts, assume a date of 1st of June.

Required:

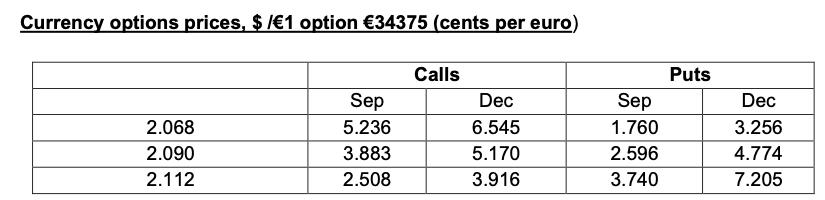

- a) Explain minimum of four alternative hedging techniques to hedge 5 months currency risk with all relevant supporting calculations.

- b) Discuss why money market hedge is better than traded derivatives for hedging currency risk?

Firms Firm A Firm B Firm C Exports "Millions" $539 121 Exchange rates Spot exchange rate 3 months forward exchange rate 1 year forward exchange rate Euro rate up to 6 months Dollar rate up to 6 months Interest rates for Ocean Plc. are as follows: Borrowing $/ Currency futures (68750) Sep 2.0949 Dec 2.0885 6.05% 4.4% $/ Imports "Millions" 165 $979 $825 2.1072-2.1131 2.0973 -2.1032 2.0791-2.0839 Lending 4.62% 2.20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Four Alternative Hedging Techniques to Hedge 5 Months Currency Risk 1 Forward Contract Firm A has a euro receivable of 165 To hedge against currency ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started