Question

Oceans 3 Shipping is considering replacing an existing ship with a new, more efficient one. The existing ship is three years old, cost $30 million,

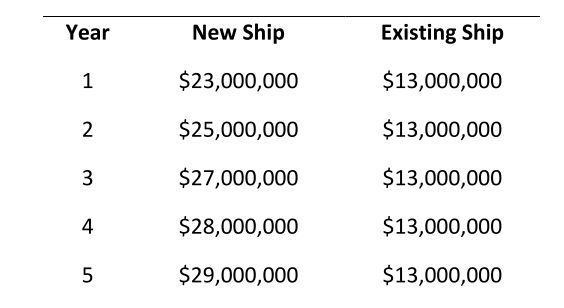

Oceans 3 Shipping is considering replacing an existing ship with a new, more efficient one. The existing ship is three years old, cost $30 million, and is being depreciated using straight line method over a 5-year recovery period. Although the existing ship has only two years (years 4 and 5) of depreciation remaining, it has a remaining usable life of five years. The new ship costs $45 million to purchase and $7 million to outfit for service. It has a 5-year usable life and will be depreciated using a straight line depreciation method. Increased investments in net working capital will accompany the decision to acquire the new ship. Purchase of the new ship would result in a $4 million increase in net working capital. The projected profits before depreciation and taxes with the new ship and the existing ship are given in the following table.

The existing ship can currently be sold for $17 million and will not incur any removal or clean- up costs. At the end of five years, the existing ship can be sold to net $1 million before taxes.

The new ship can be sold to net $11 million before taxes at the end of the 5-year period. The firm is subject to a 30 percent tax rate on both ordinary income and capital gains.

Required:

a. Calculate the initial outlay at t=0 associated with each alternative.

b. Calculate the operating cash flows associated with each alternative.

c. Calculate the terminal cash flow at the end of year 5 associated with each alternative.

d. Calculate NPV for each alternative.

Year New Ship Existing Ship 1 $23,000,000 $13,000,000 2 $25,000,000 $13,000,000 3 $27,000,000 $13,000,000 4 $28,000,000 $13,000,000 5 $29,000,000 $13,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started