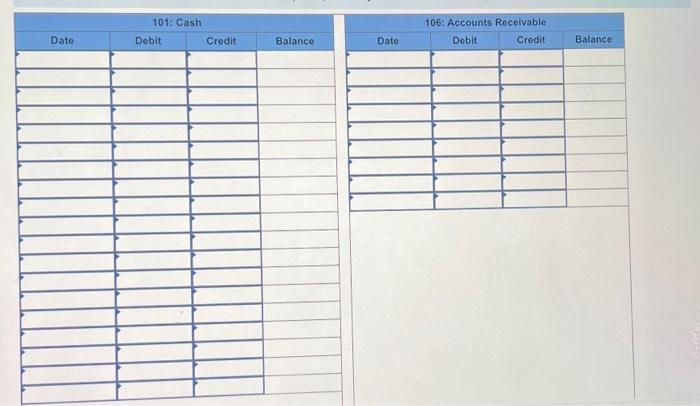

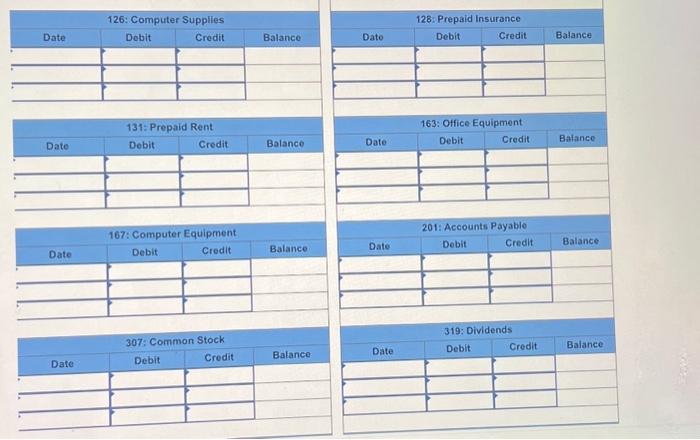

October 6 The company billed Easy Leasing $5,200 for services performed in installing a new Web server. october 8 The company paid $1,480 cash for the computer supplies purchased from Harris office Products on october 3. October 10 The company hired Lyn Addie as a part-tine assistant. October 12 The company billed Easy Leasing another $1,800 for services performed. october 15 The company received $5,200 cash fros Easy Leasing as partial payment on its account. October 17 The company paid $800 cash to repair computer equipment that was damaged when noving it. october 20 The company paid $1,723 cash for advertisements. october 22 The conpany received $1,800 cash from Easy Leasing on its account. October 28 The company billed IFM Company $6,008 for services performed. October 31 The company paid $910 cash for Lyn Addie's wages for seven days' work. October 31 The company paid a $3,500 cash dividend. November 1 The company paid $290 cash for mileage expenses. November 2 The company received $4,833 cash from Liu Corporation for computer services perforned. November 5 The company purchased computer supplies for $1,125 cash from Harris office Products. November 8 The company billed Gomez Company $5,768 for services performed. November 13 The company agreed to perform future services for Alex's Engineering Company. No work has yet been performed. November 18 The company received $2,508 cash from IFM Company as partial paynent of the 0ctober 28 bitl. November 22 The company paid $180 cash for miscellaneous expenses. Hint: Debit Miscellaneous Expenses for $180. November 24 The company completed work and sent a bill for $4,950 to Alex's Engineering Company. November 25 The company sent another bill to IFM Company for the past-due anount of $3,500. November 28 The company paid $348 cash for mileage expenses. November 30 The company paid $1,820 cash for Lyn Addie's wages for 14 days' work. November 30 The company paid a $1,600 cash dividend. On October 1, 2021, Santana Rey launched a computer services company called Business Solutions, which provides consulting services, computer system installations, and custom program development. The company's initial chart of accounts follows. October 1 S. Rey invested $51,000 cash, a $21,000 computer system, and $9,000 of office equipnent in the company in exchange for common stock. October 2 The company paid $3,280 cash for four nonth's rent. Hint: Debit Prepaid Rent for $3,280. october 3 The company purchased $1,400 of computer supplies on credit from Harris office Products. october 5 The company paid $2,040 cash for one year's premium on a property and liability insurance policy. Hint: Debit Prepaid Insurance for $2,040. october 6 The company billed Easy Leasing $5,200 for services performed in installing a new web server. october 8 The company paid $1,490 cash for the computer supplies purchased from Harris 0ffice Produets on october 3. October 10 The company hired Lyn Addie as a part-time assistant. october 12 The company billed Easy Leasing another $1,800 for services performed. october 15 The company received $5,200 cash from Easy Leasing as partial payment on its account. October 17 The company paid $800 cash to repair conputer equipment that was damaged when moving it. October 20 The company paid $1,723 cash for advertisements. october 22 The company received $1,800 cash from Easy Leasing on its account. october 28 The company billed IFM Company $6,008 for services performed. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 101: Cash } & \multicolumn{4}{|c|}{ 106: Accounts Recelvable } \\ \hline Date & Debit & Credit & Balanco & Date & Debit & Credit & Balance \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Trial Balance } \\ \hline \multicolumn{2}{|c|}{ November 30} \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline 126: Computer Supplies \\ Date & Dobit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ 131: Prepaid Rent } \\ \hline Dato & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{ 167: Computer Equipment } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline & \multicolumn{3}{|c|}{ 307: Common Stock } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{ 163: Otfice Equipment } \\ \hline Date & Debit & Credit & Batance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{3}{|c|}{201 : Accounts Payable } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ 319: Dividends } \\ \hline Date & Debit & Credit & Balance \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular}