Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Octoberfest Event Center Inc. borrowed $1,000,000 from First Union Bank to acquire its events center. The loan bears interest at the rate of 5%.

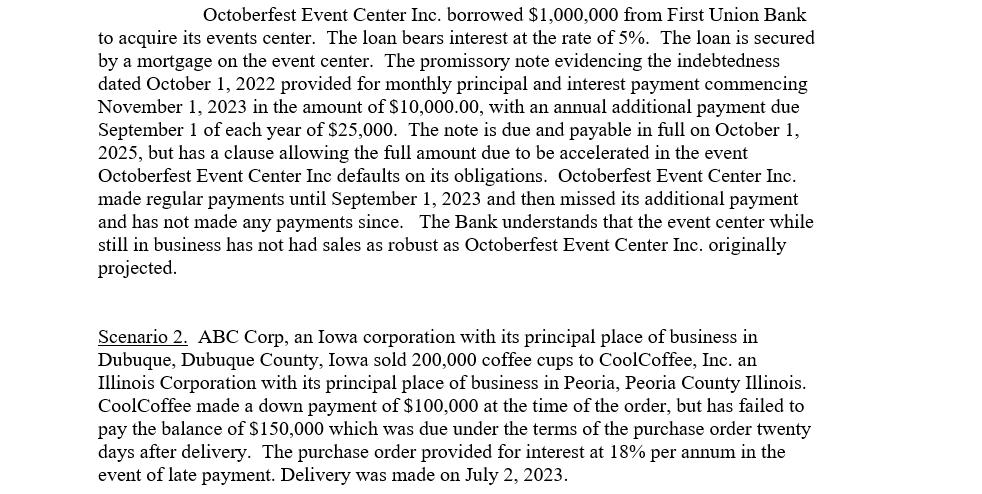

Octoberfest Event Center Inc. borrowed $1,000,000 from First Union Bank to acquire its events center. The loan bears interest at the rate of 5%. The loan is secured by a mortgage on the event center. The promissory note evidencing the indebtedness dated October 1, 2022 provided for monthly principal and interest payment commencing November 1, 2023 in the amount of $10,000.00, with an annual additional payment due September 1 of each year of $25,000. The note is due and payable in full on October 1, 2025, but has a clause allowing the full amount due to be accelerated in the event Octoberfest Event Center Inc defaults on its obligations. Octoberfest Event Center Inc. made regular payments until September 1, 2023 and then missed its additional payment and has not made any payments since. The Bank understands that the event center while still in business has not had sales as robust as Octoberfest Event Center Inc. originally projected. Scenario 2. ABC Corp, an Iowa corporation with its principal place of business in Dubuque, Dubuque County, Iowa sold 200,000 coffee cups to CoolCoffee, Inc. an Illinois Corporation with its principal place of business in Peoria, Peoria County Illinois. CoolCoffee made a down payment of $100,000 at the time of the order, but has failed to pay the balance of $150,000 which was due under the terms of the purchase order twenty days after delivery. The purchase order provided for interest at 18% per annum in the event of late payment. Delivery was made on July 2, 2023.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In Scenario 1 Octoberfest Event Center Inc borrowed 1000000 from First Union Bank to acquire its eve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started