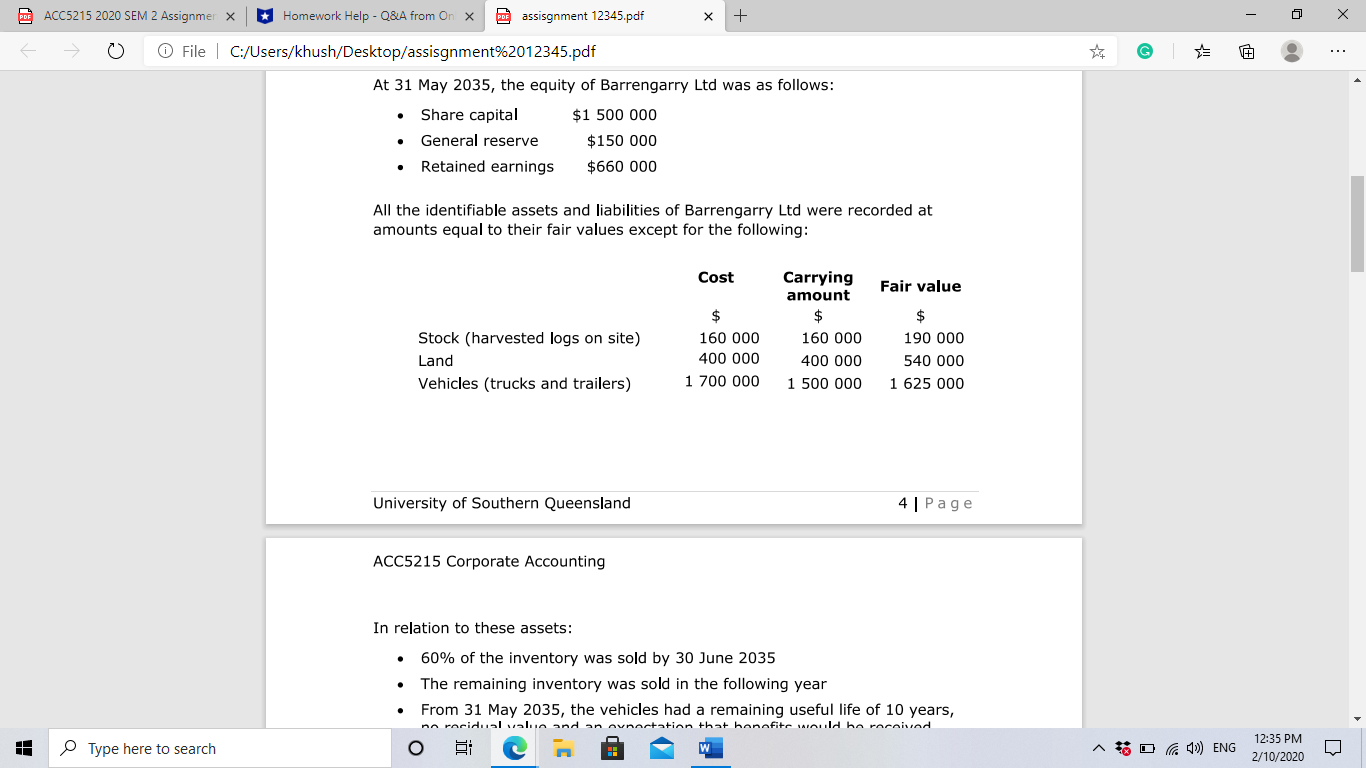

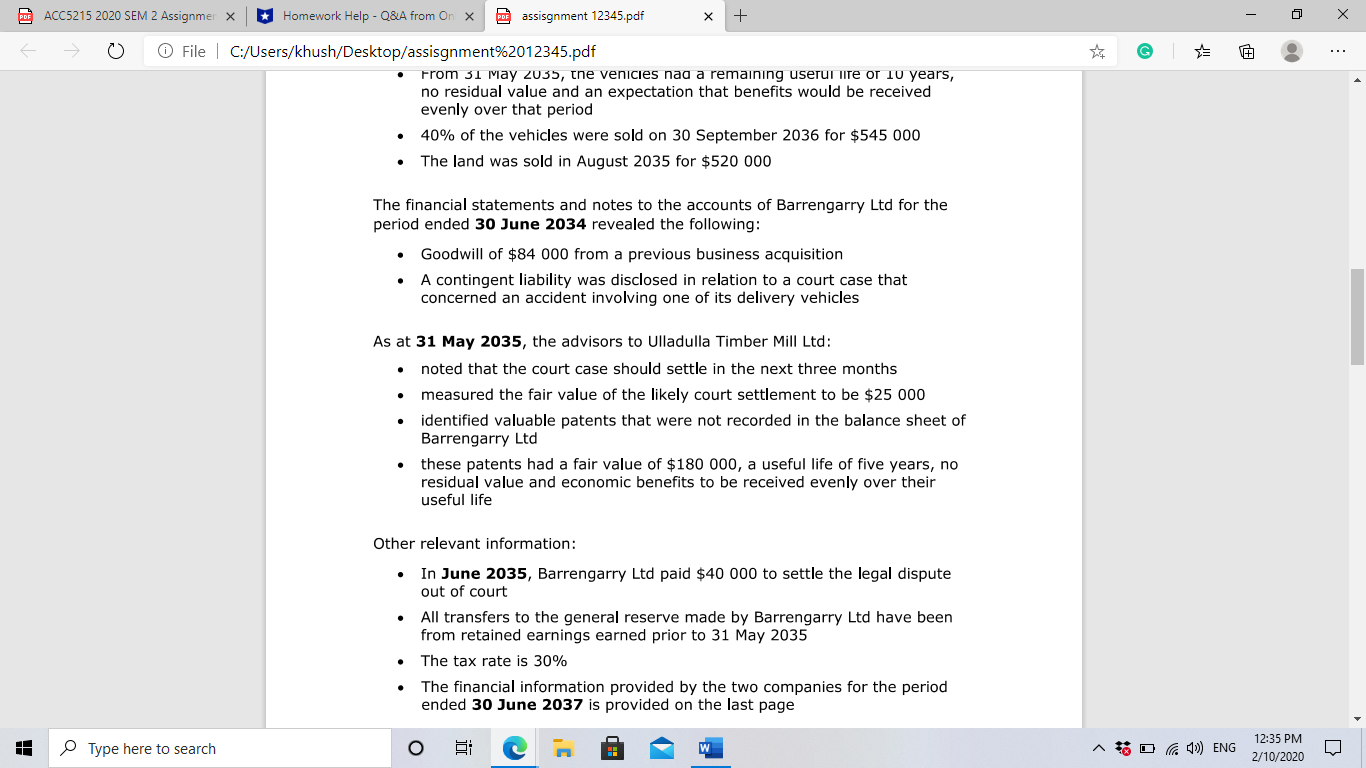

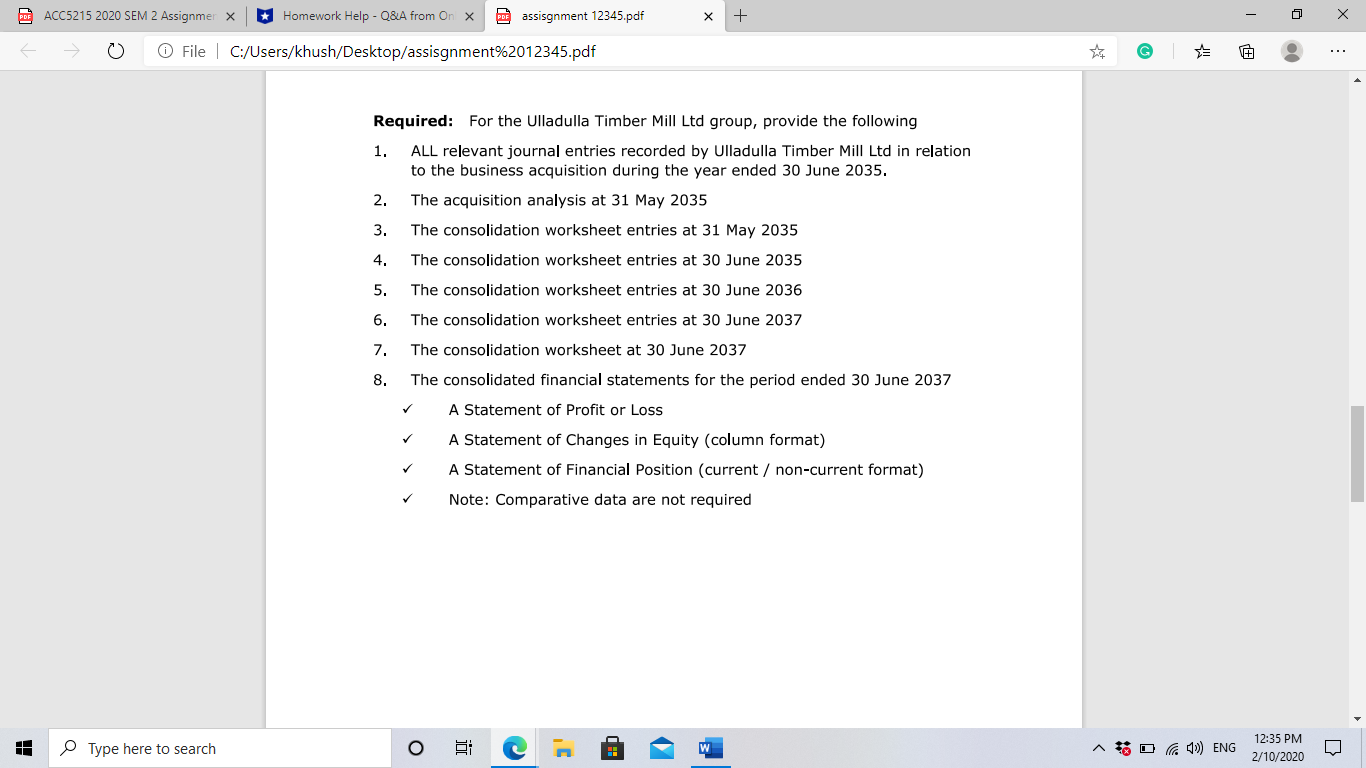

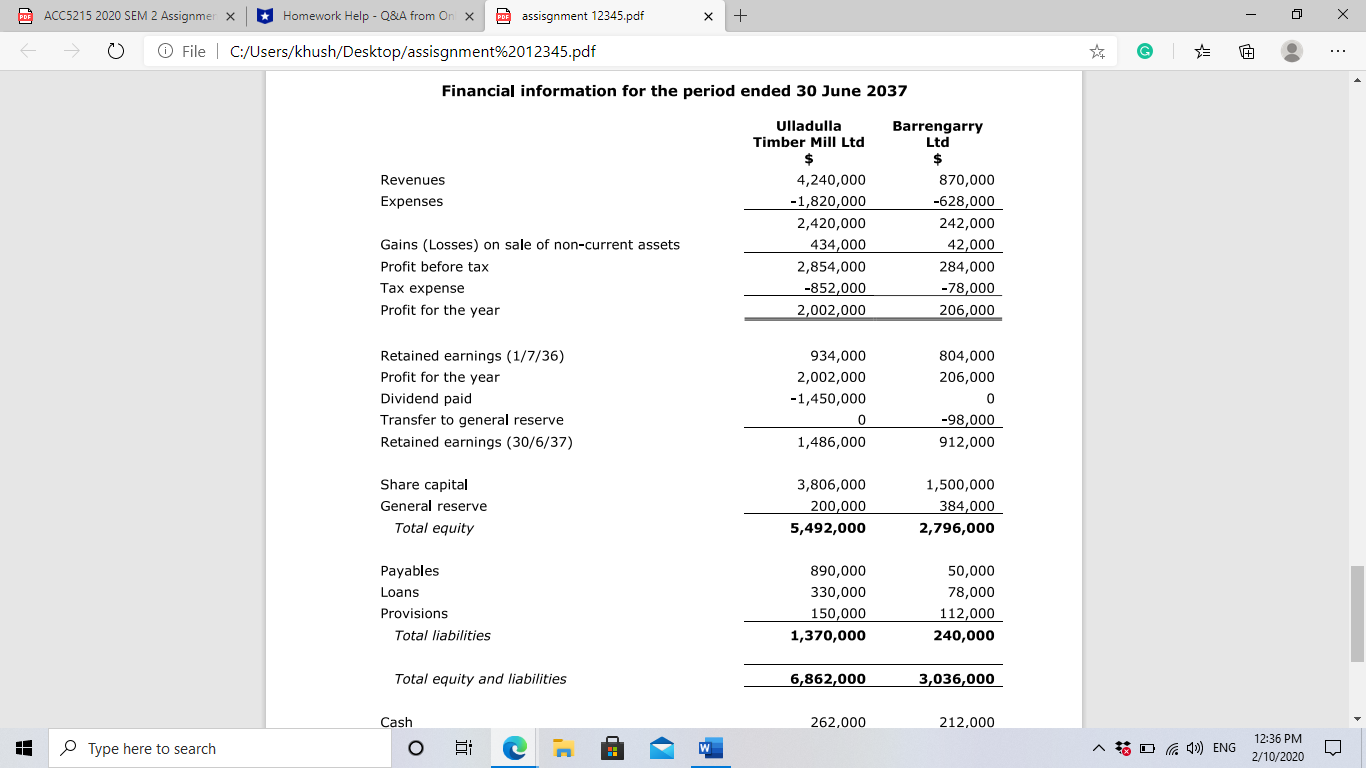

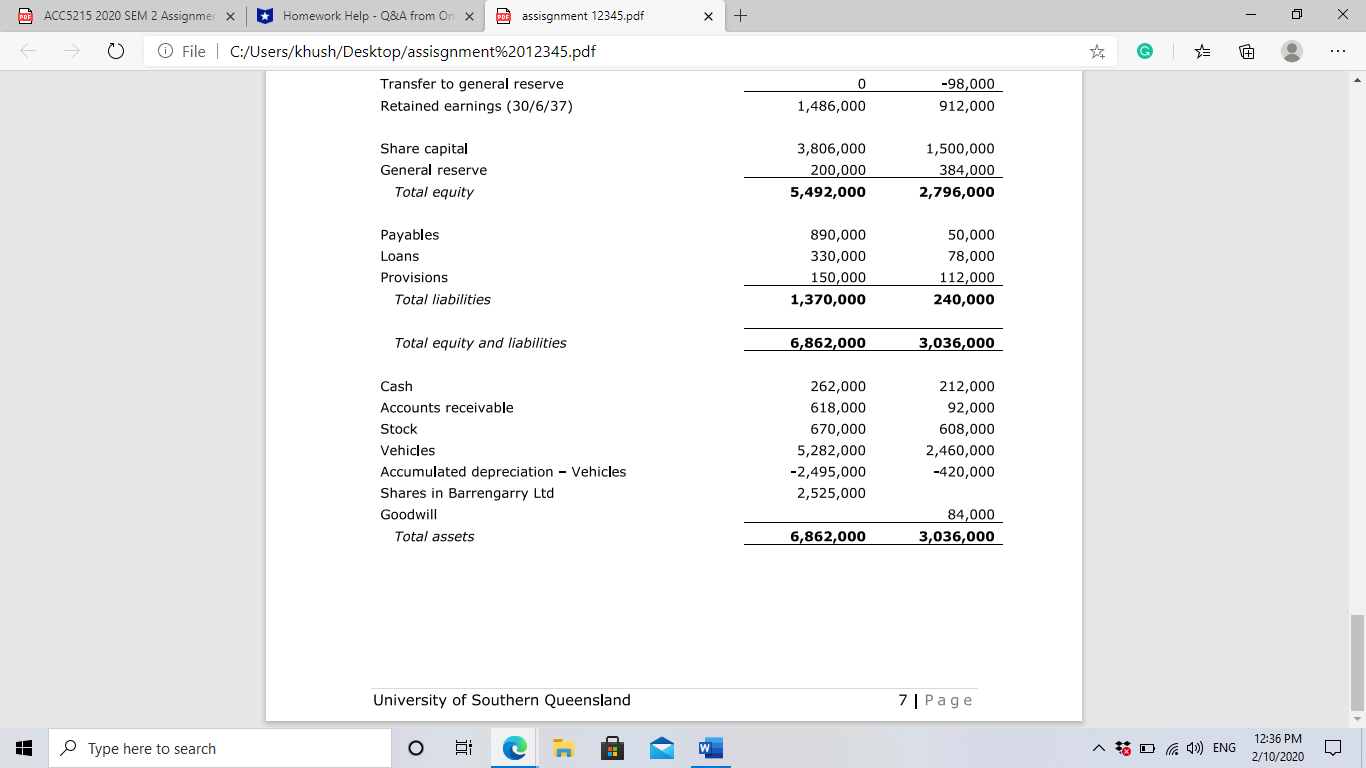

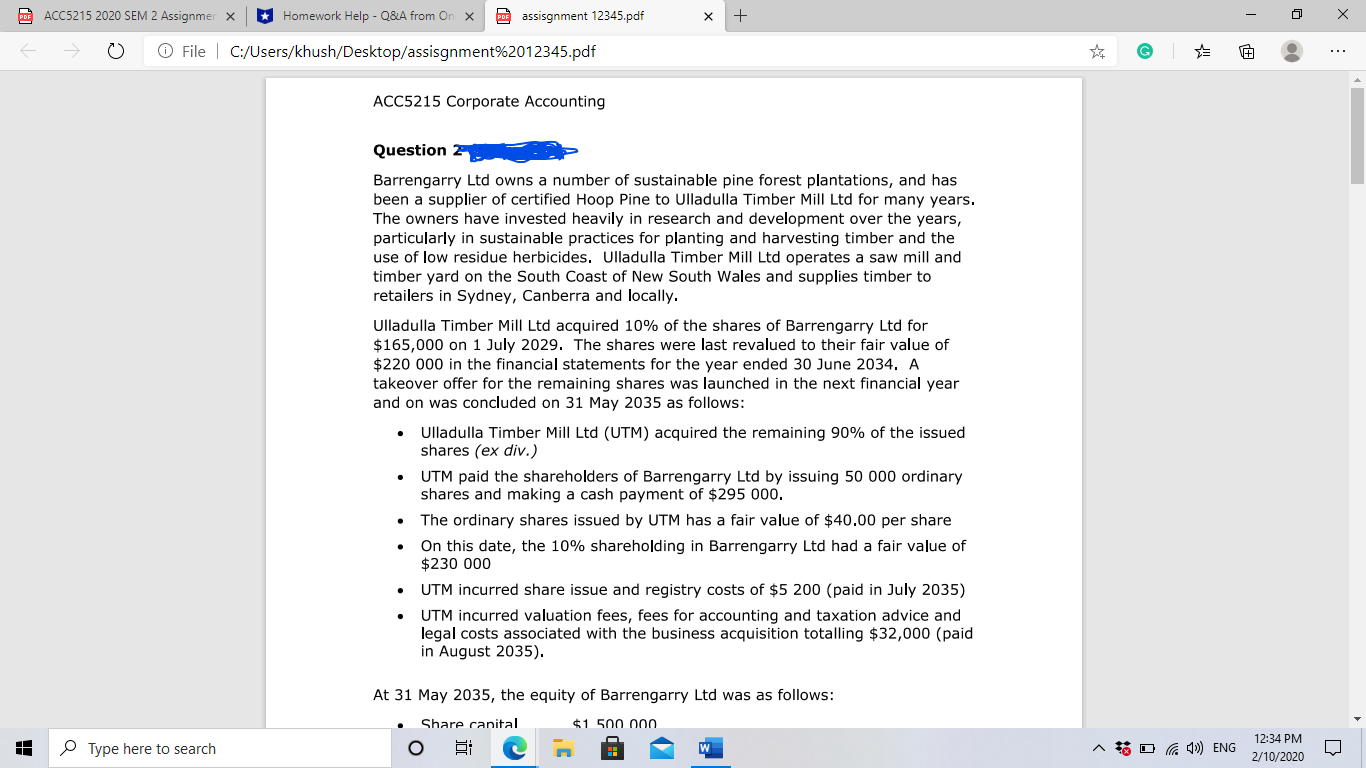

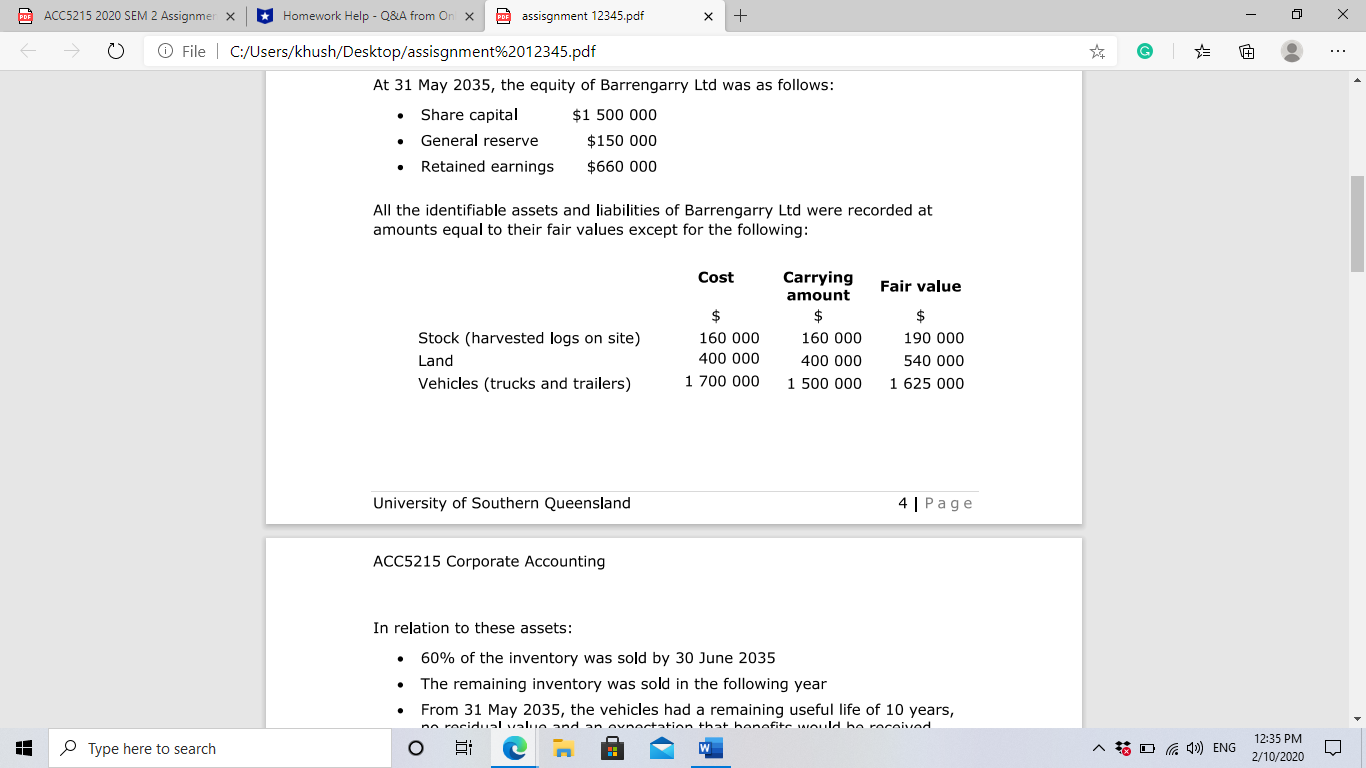

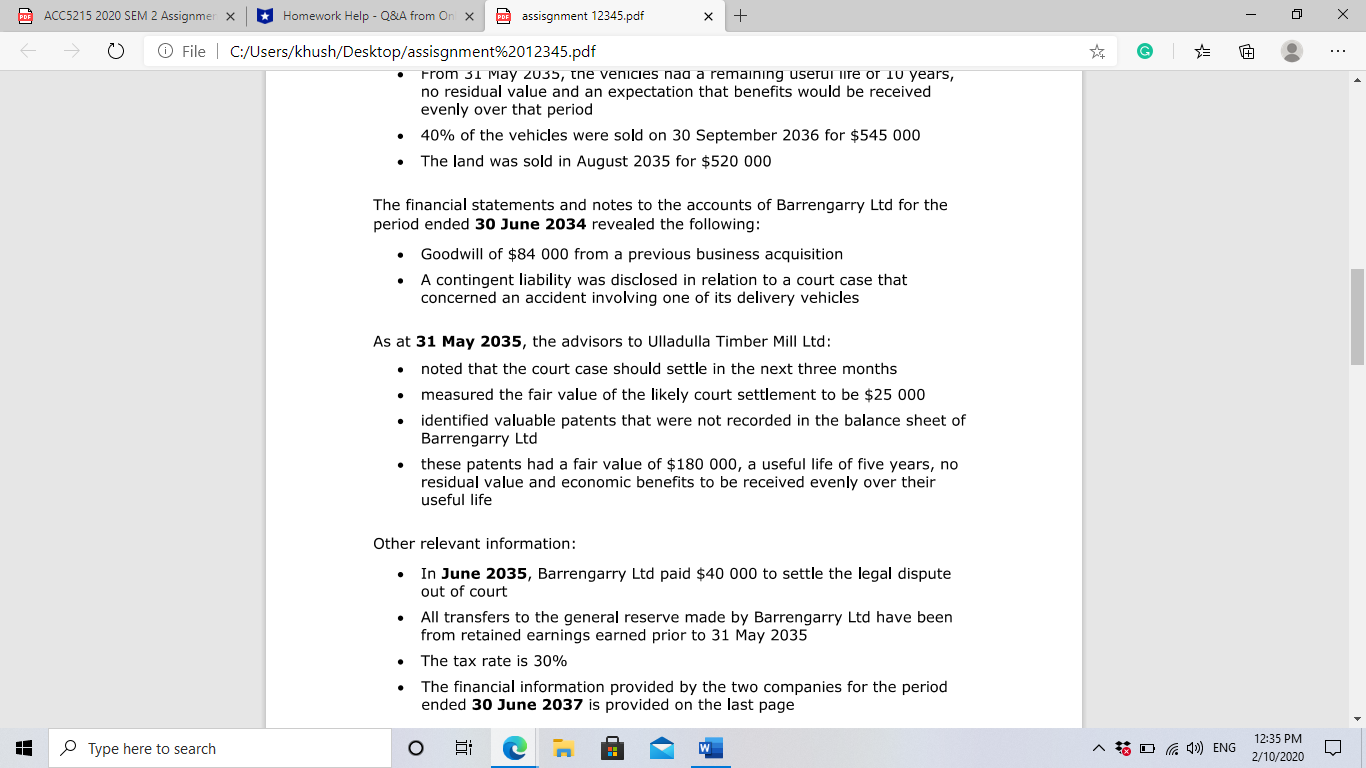

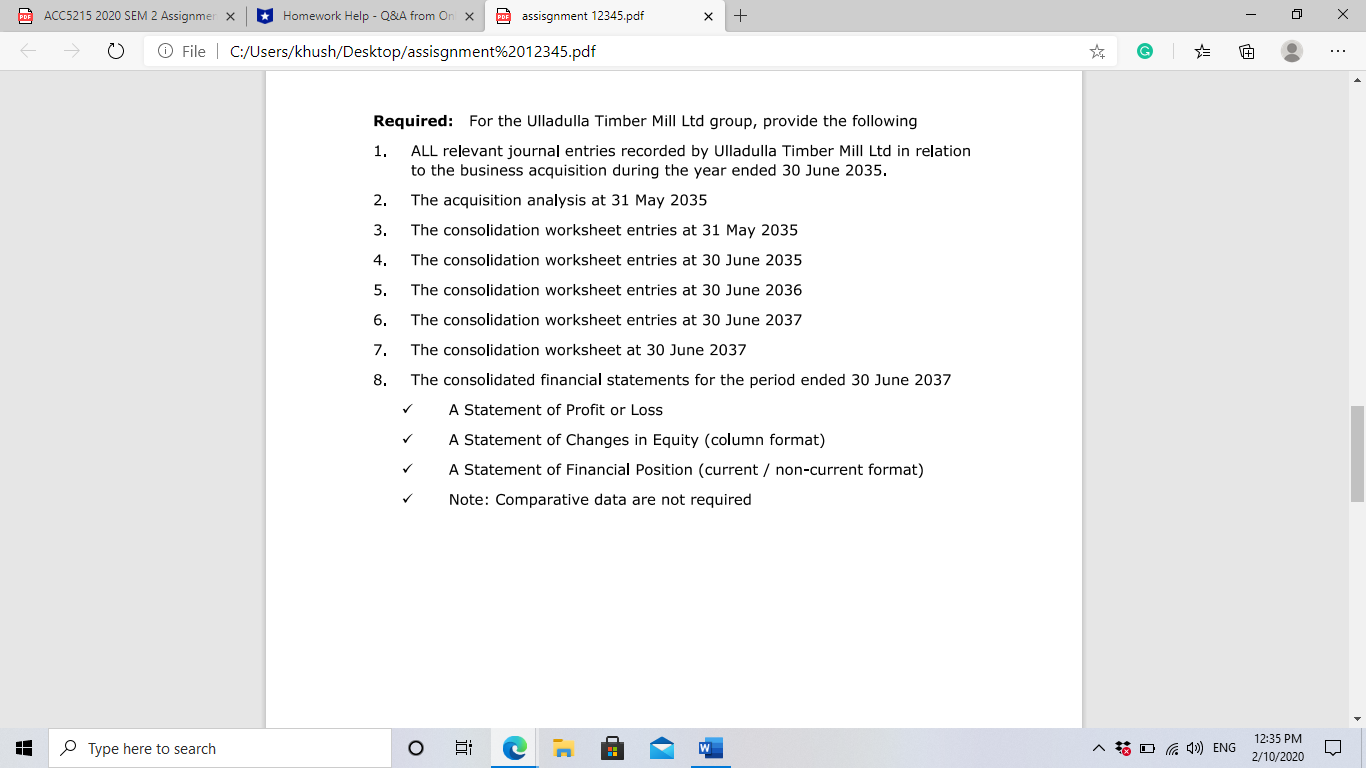

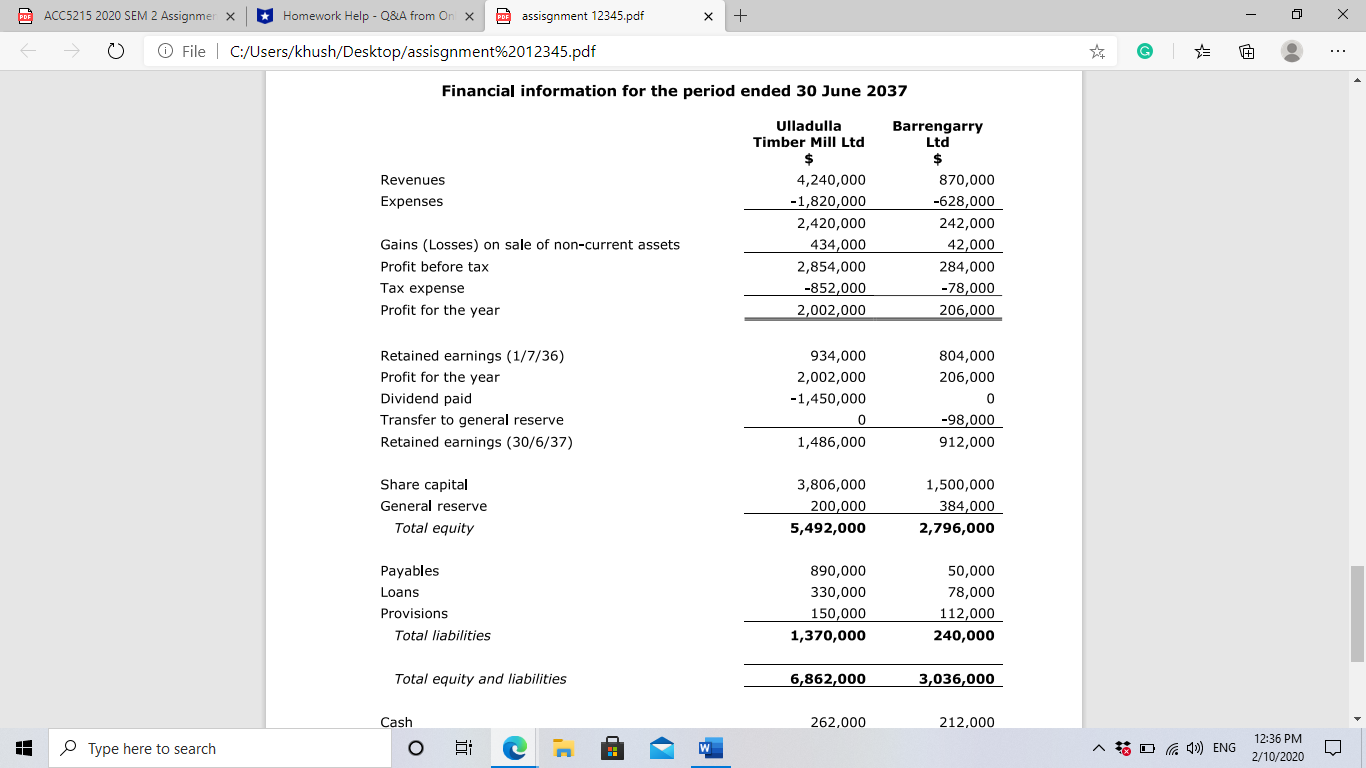

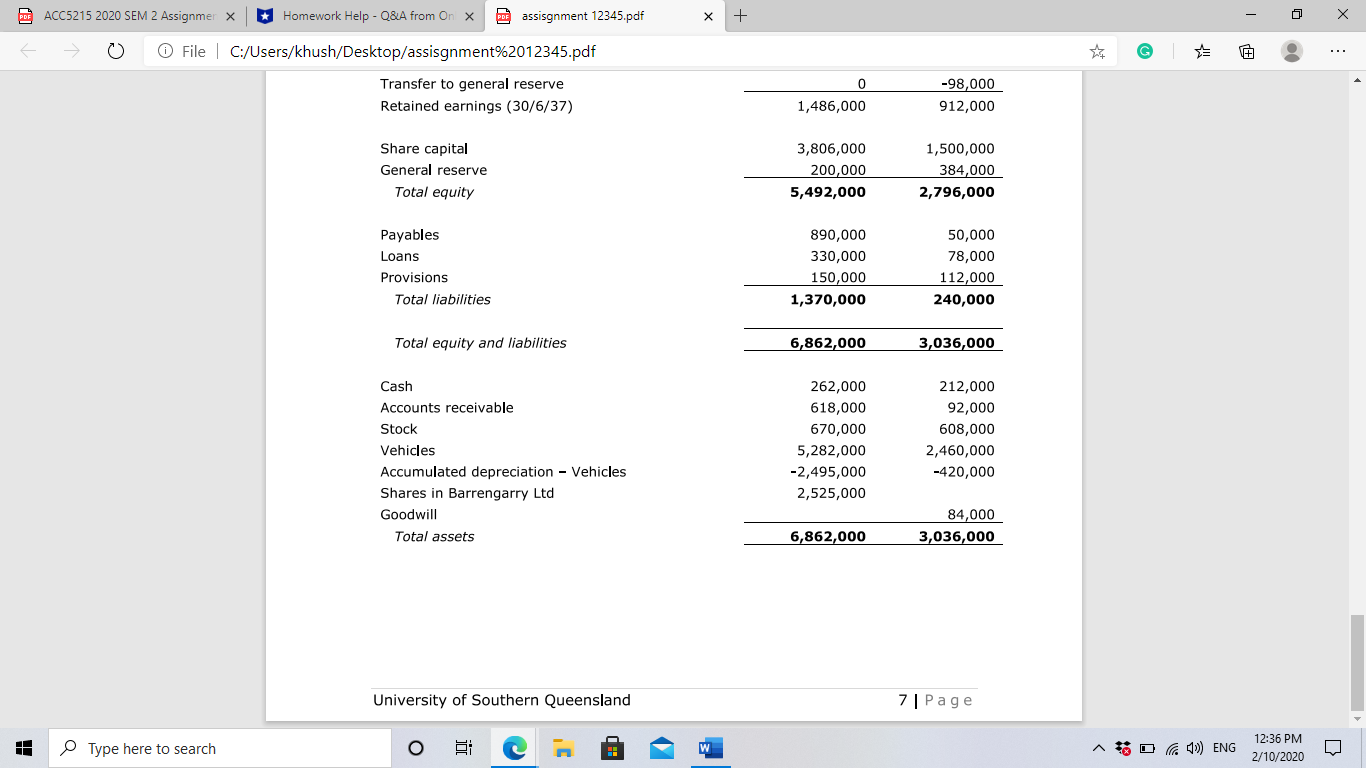

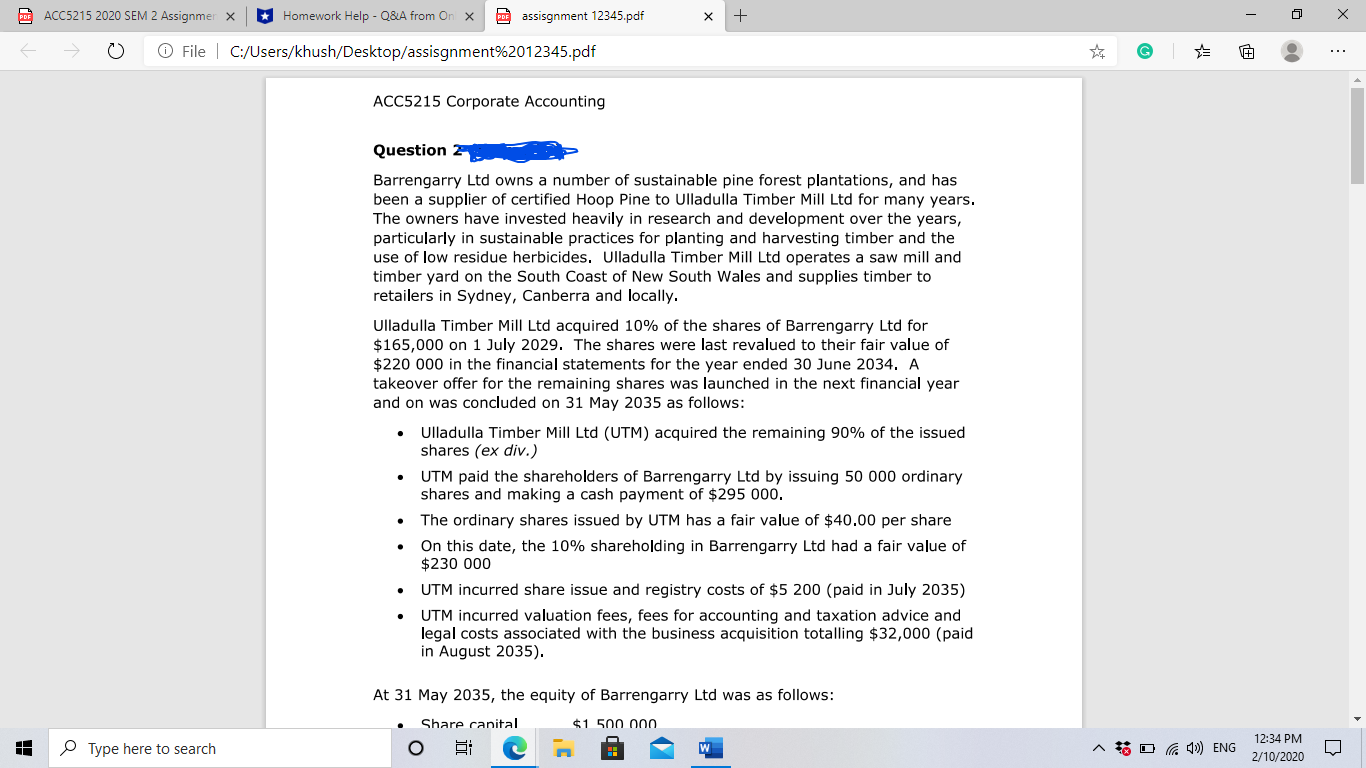

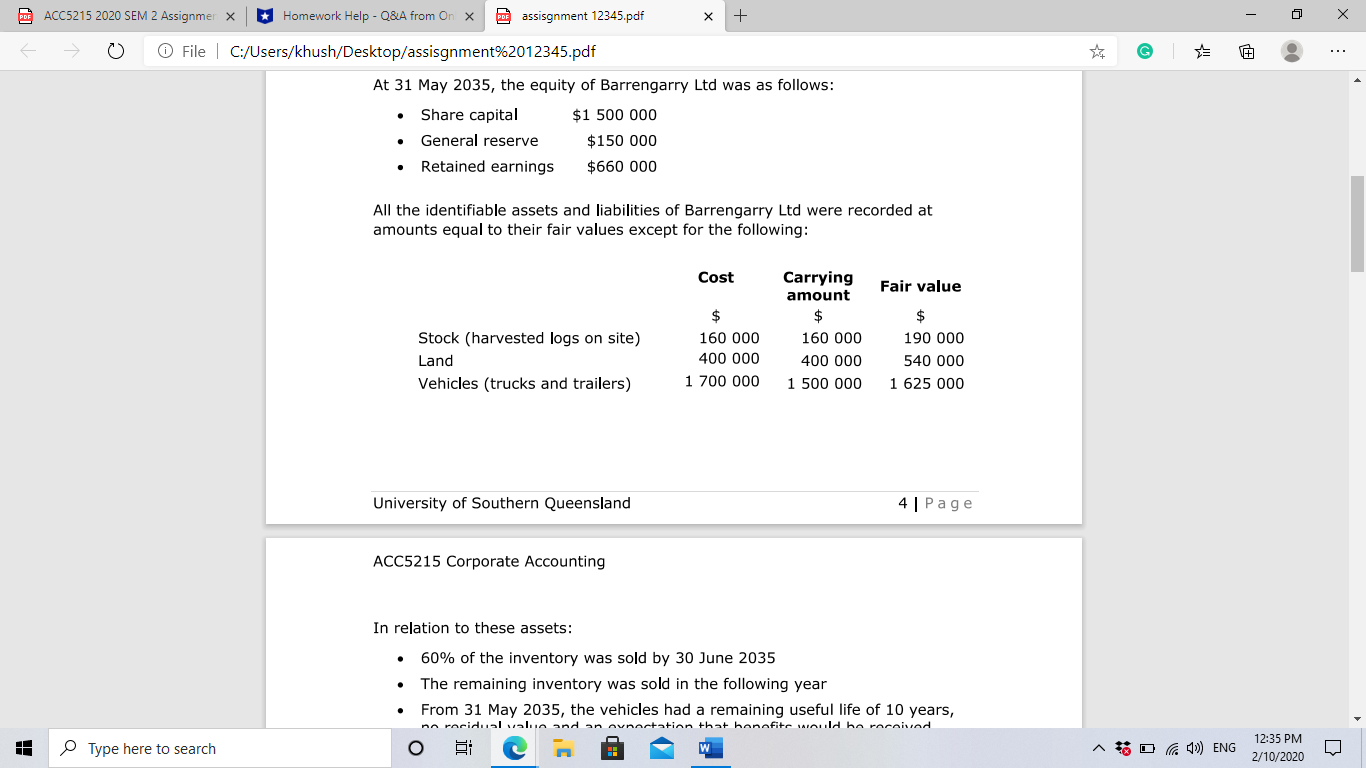

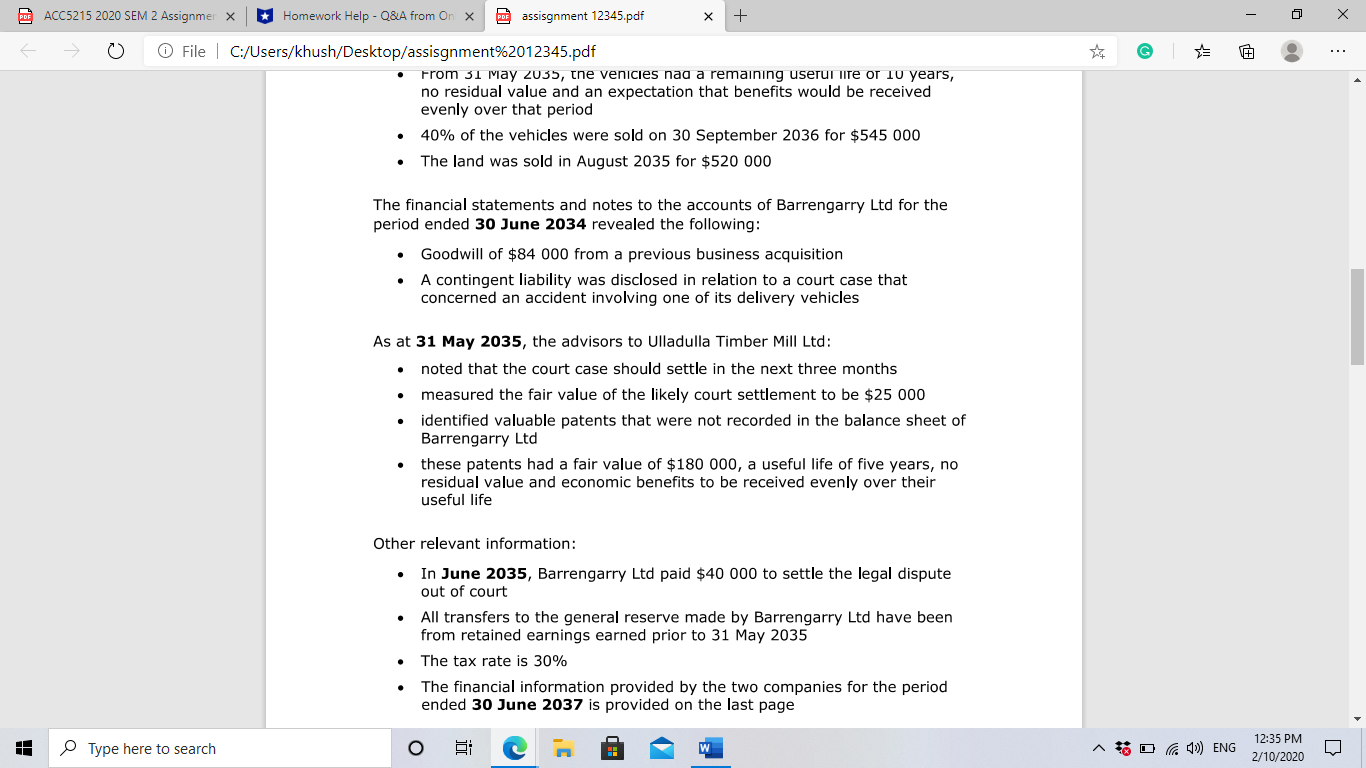

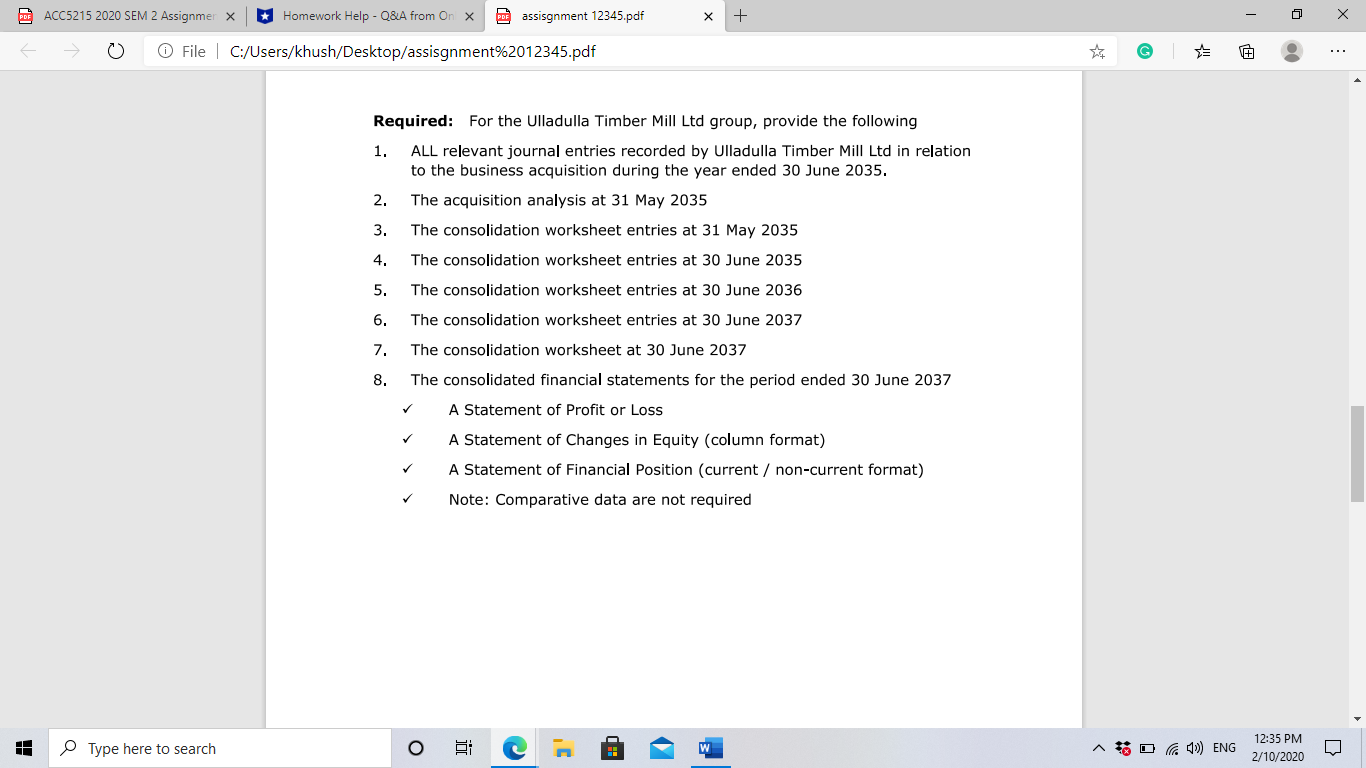

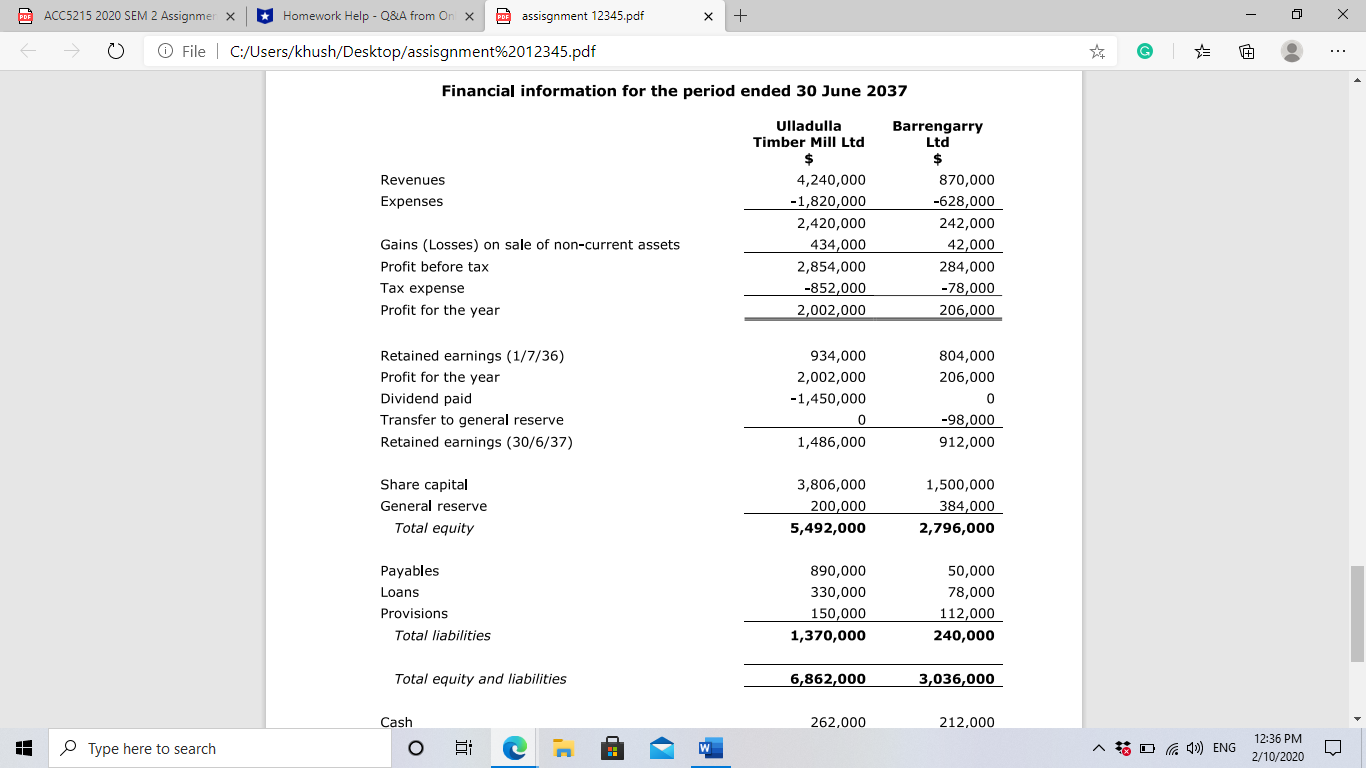

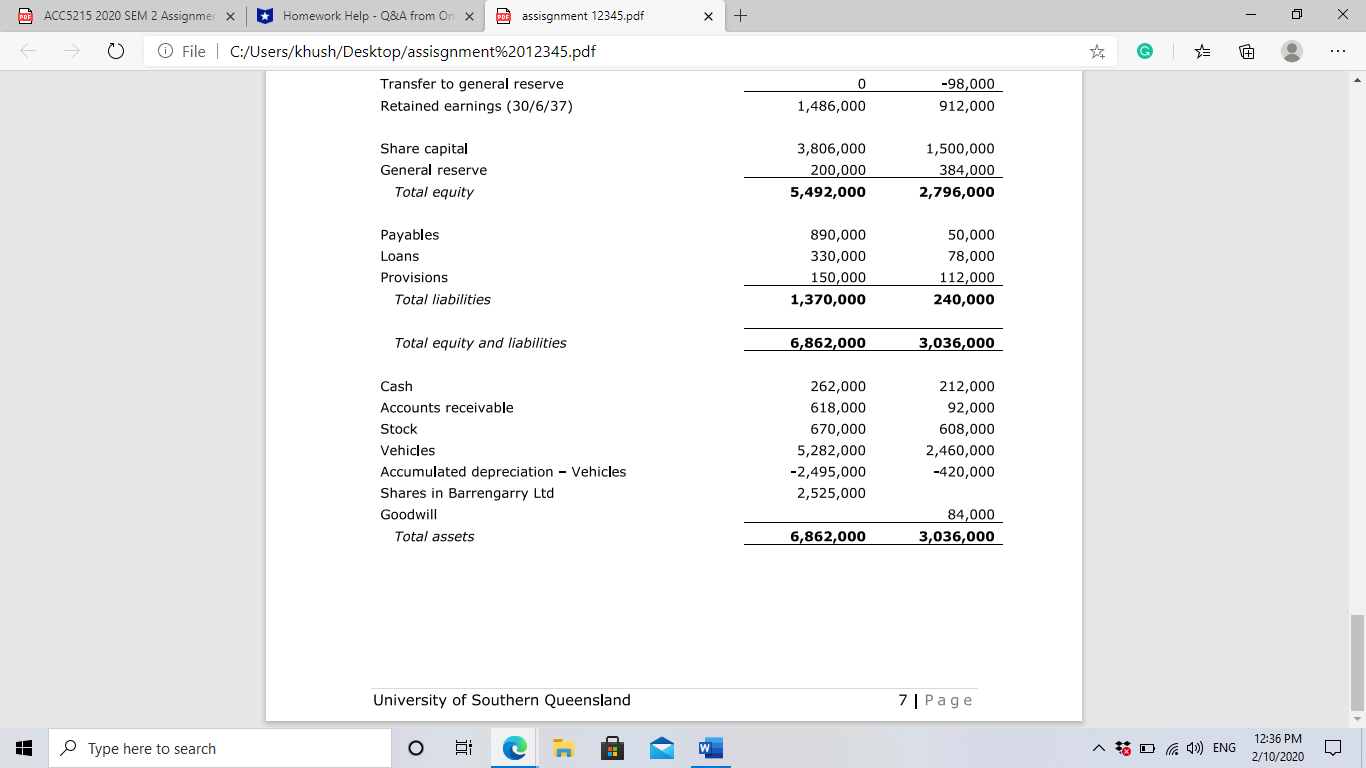

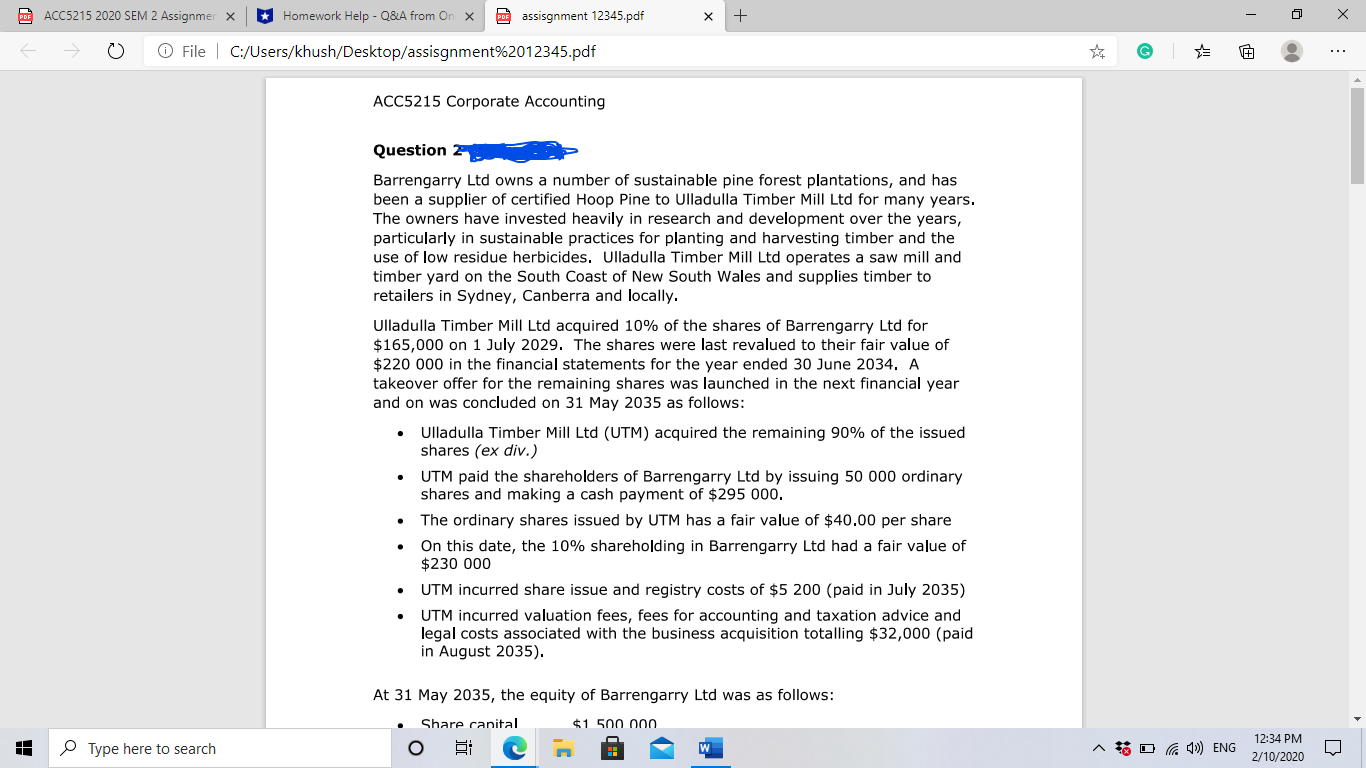

ODE ACC5215 2020 SEM 2 Assignmer X * Homework Help - Q&A from On X PBE assisgnment 12345.pdf X + X File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . At 31 May 2035, the equity of Barrengarry Ltd was as follows: Share capital $1 500 000 . General reserve $150 000 . Retained earnings $660 000 All the identifiable assets and liabilities of Barrengarry Ltd were recorded at amounts equal to their fair values except for the following: Cost Carrying amount Fair value $ $ $ Stock (harvested logs on site) 160 000 160 000 190 000 Land 400 000 400 000 540 000 Vehicles (trucks and trailers) 1 700 000 1 500 000 1 625 000 University of Southern Queensland 4 | Page ACC5215 Corporate Accounting In relation to these assets: 60% of the inventory was sold by 30 June 2035 . The remaining inventory was sold in the following year . From 31 May 2035, the vehicles had a remaining useful life of 10 years, no residual value and an avnertation that hanafite would ha rariund Type here to search O Ei m W ~ TO ( ) ENG 12:35 PM 2/10/2020BE ACC5215 2020 SEM 2 Assignmer * * Homework Help - Q&A from On x por assisgnment 12345.pdf X + X File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . From 31 May 2035, the venicies nad a remaining useful life or 10 years, no residual value and an expectation that benefits would be received evenly over that period 40% of the vehicles were sold on 30 September 2036 for $545 000 . The land was sold in August 2035 for $520 000 The financial statements and notes to the accounts of Barrengarry Ltd for the period ended 30 June 2034 revealed the following: Goodwill of $84 000 from a previous business acquisition A contingent liability was disclosed in relation to a court case that concerned an accident involving one of its delivery vehicles As at 31 May 2035, the advisors to Ulladulla Timber Mill Ltd: . noted that the court case should settle in the next three months measured the fair value of the likely court settlement to be $25 000 . identified valuable patents that were not recorded in the balance sheet of Barrengarry Ltd these patents had a fair value of $180 000, a useful life of five years, no residual value and economic benefits to be received evenly over their useful life Other relevant information: . In June 2035, Barrengarry Ltd paid $40 000 to settle the legal dispute out of court All transfers to the general reserve made by Barrengarry Ltd have been from retained earnings earned prior to 31 May 2035 The tax rate is 30% The financial information provided by the two companies for the period ended 30 June 2037 is provided on the last page Type here to search O W ~ TO ( ) ENG 12:35 PM 2/10/2020BE ACC5215 2020 SEM 2 Assignmer * * Homework Help - Q&A from On x per assisgnment 12345.pdf X + X File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . Required: For the Ulladulla Timber Mill Ltd group, provide the following 1. ALL relevant journal entries recorded by Ulladulla Timber Mill Ltd in relation to the business acquisition during the year ended 30 June 2035. 2. The acquisition analysis at 31 May 2035 3. The consolidation worksheet entries at 31 May 2035 4. The consolidation worksheet entries at 30 June 2035 5. The consolidation worksheet entries at 30 June 2036 6. The consolidation worksheet entries at 30 June 2037 7. The consolidation worksheet at 30 June 2037 The consolidated financial statements for the period ended 30 June 2037 V A Statement of Profit or Loss A Statement of Changes in Equity (column format) A Statement of Financial Position (current / non-current format) Note: Comparative data are not required Type here to search O W ~ TO ( ) ENG 12:35 PM 2/10/2020ODE ACC5215 2020 SEM 2 Assignmer X * Homework Help - Q&A from On x (BE assisgnment 12345.pdf X + X File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . Financial information for the period ended 30 June 2037 Ulladulla Barrengarry Timber Mill Ltd Ltd $ $ Revenues 4,240,000 870,000 Expenses -1,820,000 -628,000 2,420,000 242,000 Gains (Losses) on sale of non-current assets 434,000 42,000 Profit before tax 2,854,000 284,000 Tax expense -852,000 -78,000 Profit for the year 2,002,000 206,000 Retained earnings (1/7/36) 934,000 804,000 Profit for the year 2,002,000 206,000 Dividend paid -1,450,000 0 Transfer to general reserve -98,000 Retained earnings (30/6/37) 1,486,000 912,000 Share capital 3,806,000 1,500,000 General reserve 200,000 384,000 Total equity 5,492,000 2,796,000 Payables 890,000 50,000 Loans 330,000 78,000 Provisions 150,000 112,000 Total liabilities 1,370,000 240,000 Total equity and liabilities 6,862,000 3,036,000 Cash 262,000 212,000 Type here to search O W ~ TO ( )) ENG 12:36 PM 2/10/2020ODE ACC5215 2020 SEM 2 Assignmer X * Homework Help - Q&A from On x PBE assisgnment 12345.pdf X + X File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . Transfer to general reserve 0 -98,000 Retained earnings (30/6/37) 1,486,000 912,000 Share capital 3,806,000 1,500,000 General reserve 200,000 384,000 Total equity 5,492,000 2,796,000 Payables 890,000 50,000 Loans 330,000 78,000 Provisions 150,000 112,000 iabilities 1,370,000 240,000 Total equity and liabilities 6,862,000 3,036,000 Cash 262,000 212,000 Accounts receivable 618,000 92,000 Stock 670,000 608,000 Vehicles 5,282,000 2,460,000 Accumulated depreciation - Vehicles -2,495,000 -420,000 Shares in Barrengarry Ltd 2,525,000 Goodwill 84,000 Total assets 6,862,000 3,036,000 University of Southern Queensland 7 | Page Type here to search O m W ~ TO ( ENG 12:36 PM 2/10/2020ODE ACC5215 2020 SEM 2 Assignmer X * Homework Help - Q&A from On x PBE assisgnment 12345.pdf X + X O File | C:/Users/khush/Desktop/assisgnment%2012345.pdf G . . . ACC5215 Corporate Accounting Question Z Barrengarry Ltd owns a number of sustainable pine forest plantations, and has been a supplier of certified Hoop Pine to Ulladulla Timber Mill Ltd for many years. The owners have invested heavily in research and development over the years, particularly in sustainable practices for planting and harvesting timber and the use of low residue herbicides. Ulladulla Timber Mill Ltd operates a saw mill and timber yard on the South Coast of New South Wales and supplies timber to retailers in Sydney, Canberra and locally. Ulladulla Timber Mill Ltd acquired 10% of the shares of Barrengarry Ltd for $165,000 on 1 July 2029. The shares were last revalued to their fair value of $220 000 in the financial statements for the year ended 30 June 2034. A takeover offer for the remaining shares was launched in the next financial year and on was concluded on 31 May 2035 as follows: . Ulladulla Timber Mill Ltd (UTM) acquired the remaining 90% of the issued shares (ex div.) . UTM paid the shareholders of Barrengarry Led by issuing 50 000 ordinary shares and making a cash payment of $295 000. The ordinary shares issued by UTM has a fair value of $40.00 per share . On this date, the 10% shareholding in Barrengarry Ltd had a fair value of $230 000 UTM incurred share issue and registry costs of $5 200 (paid in July 2035) . UTM incurred valuation fees, fees for accounting and taxation advice and legal costs associated with the business acquisition totalling $32,000 (paid in August 2035). At 31 May 2035, the equity of Barrengarry Ltd was as follows: Share canital $1 500 000 Type here to search O m W ~ TO ( )) ENG 12:34 PM 2/10/2020