Answered step by step

Verified Expert Solution

Question

1 Approved Answer

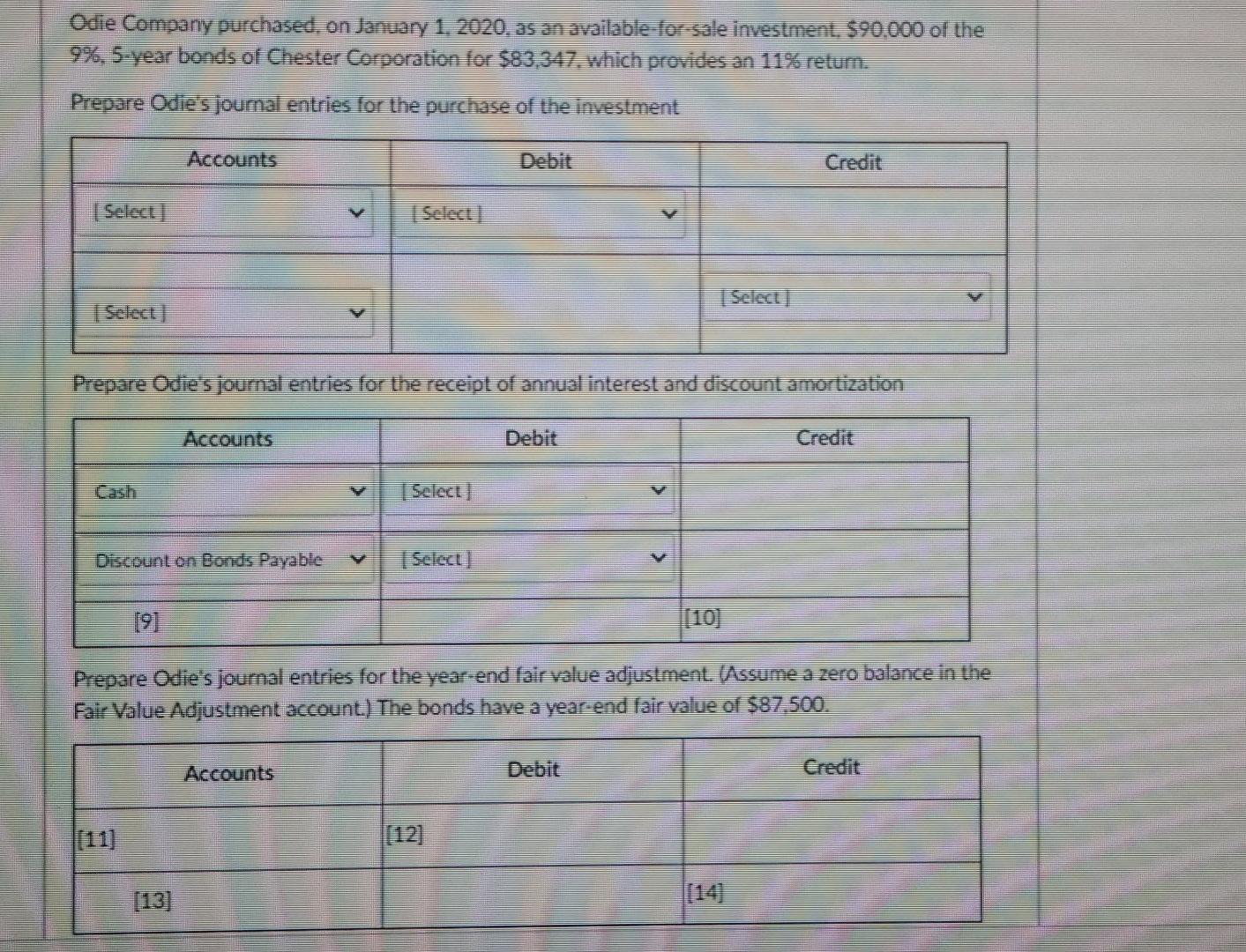

Odie Company purchased, on January 1, 2020. as an available for sale investment. $90,000 of the 9%. 5-year bonds of Chester Corporation for $83.347. which

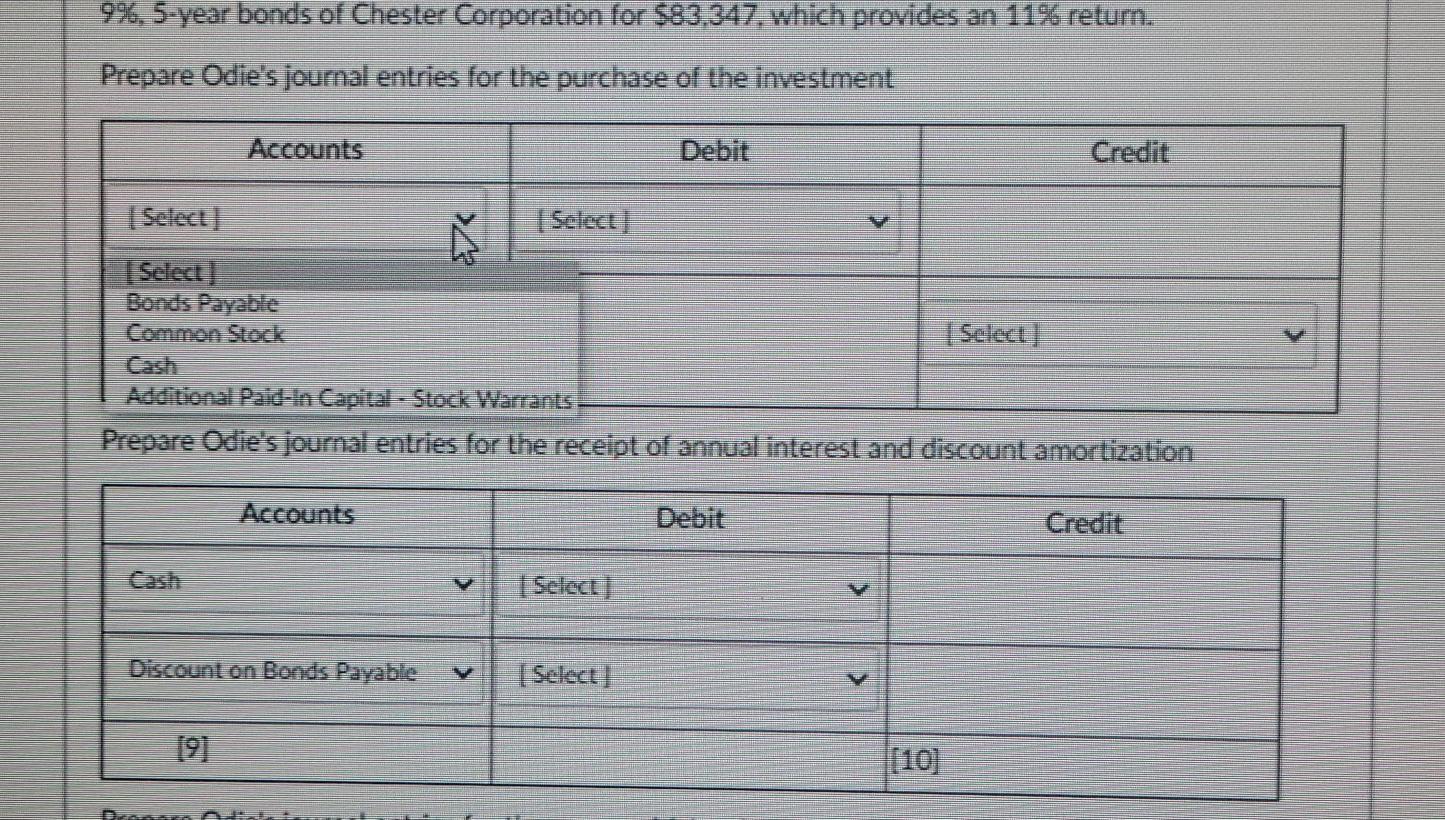

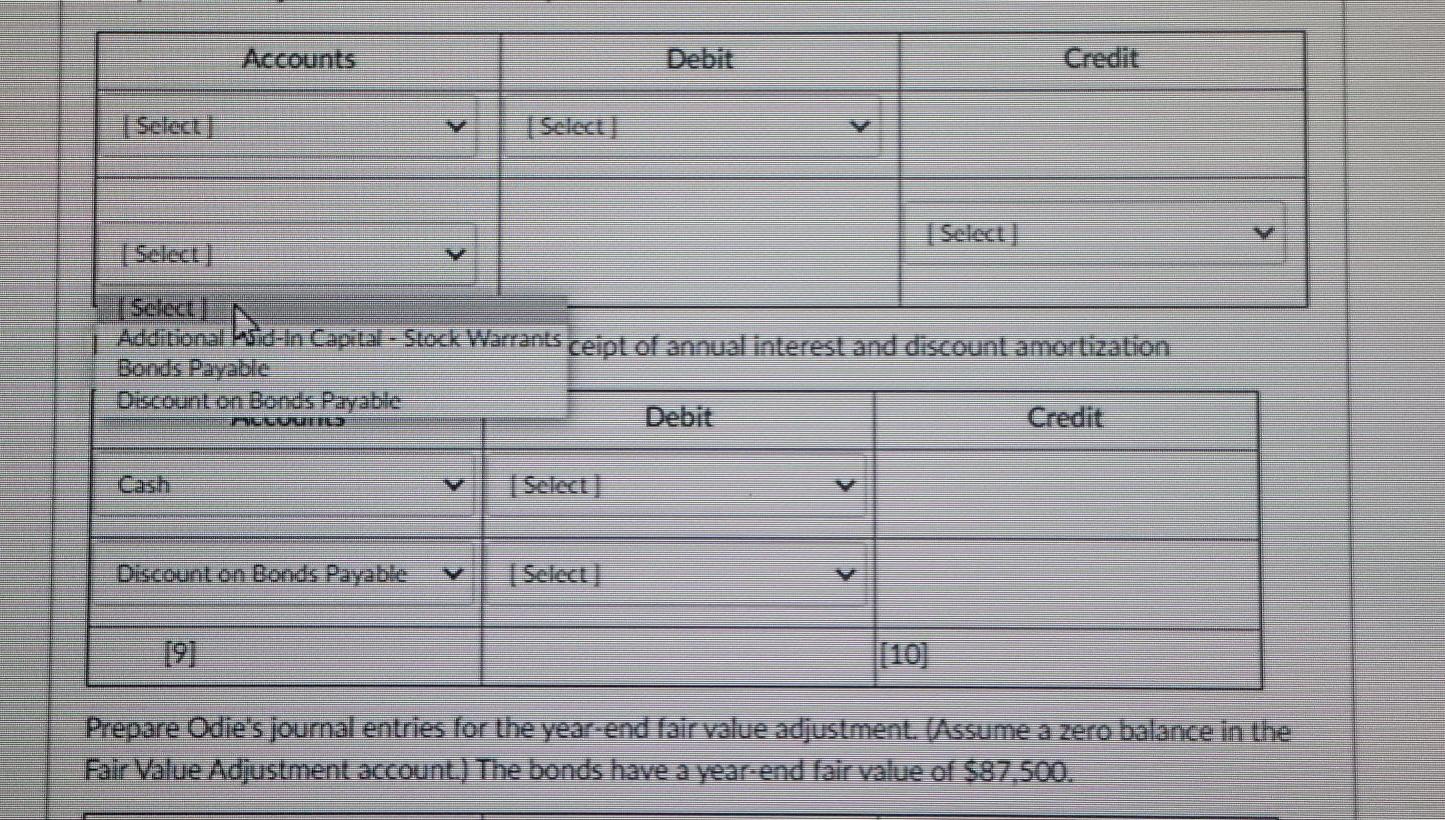

Odie Company purchased, on January 1, 2020. as an available for sale investment. $90,000 of the 9%. 5-year bonds of Chester Corporation for $83.347. which provides an 11% retum. Prepare Odie's journal entries for the purchase of the investment Accounts Debit 1 Select] 1 Select) ISelect I Select] Prepare Odie's journal entries for the receipt of annual interest and discount amortization Accounts Debit Credit I Select] Discount on Bonds Payable I Select) [9] (10) Prepare Odie's journal entries for the year-end fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) The bonds have a year-end fair value of $87.500. Accounts Debit Credit (11] (12] [13] 976, 5-year bonds of Chester Corporation for $83.347. which provides an 11% return. Prepare Odie's journal entries for the purchase of the investment Accounts Debit Credit I Select! Select] 1 Select ! Bonds Payable I Select) Additional Paid-in Capital - Stock Warrants Prepare Odie's journal entries for the receipt of annual interest and discount amortization Accounts Debit Credit 1 Sclect! Discount on Bonds Payable [ Select ! 19] |(10) Prepare Odie's journal entries for the year-end fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) The bonds have a year-end fair value of $87.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started