Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Odom Enterprises Ltd. (OEL) completed construction of an investment property on November 30, 2020 (construction began earlier in 2020). The building was constructed for

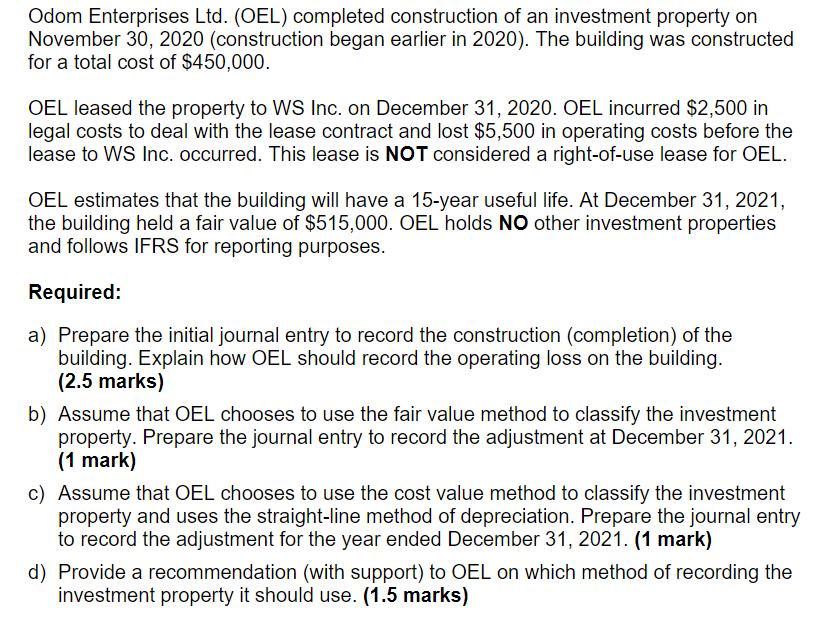

Odom Enterprises Ltd. (OEL) completed construction of an investment property on November 30, 2020 (construction began earlier in 2020). The building was constructed for a total cost of $450,000. OEL leased the property to WS Inc. on December 31, 2020. OEL incurred $2,500 in legal costs to deal with the lease contract and lost $5,500 in operating costs before the lease to WS Inc. occurred. This lease is NOT considered a right-of-use lease for OEL. OEL estimates that the building will have a 15-year useful life. At December 31, 2021, the building held a fair value of $515,000. OEL holds NO other investment properties and follows IFRS for reporting purposes. Required: a) Prepare the initial journal entry to record the construction (completion) of the building. Explain how OEL should record the operating loss on the building. (2.5 marks) b) Assume that OEL chooses to use the fair value method to classify the investment property. Prepare the journal entry to record the adjustment at December 31, 2021. (1 mark) c) Assume that OEL chooses to use the cost value method to classify the investment property and uses the straight-line method of depreciation. Prepare the journal entry to record the adjustment for the year ended December 31, 2021. (1 mark) d) Provide a recommendation (with support) to OEL on which method of recording the investment property it should use. (1.5 marks)

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Part a SI No Date Account Name Comment Debit Credit 2020 a 30Nov Invenstment Property Build...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started