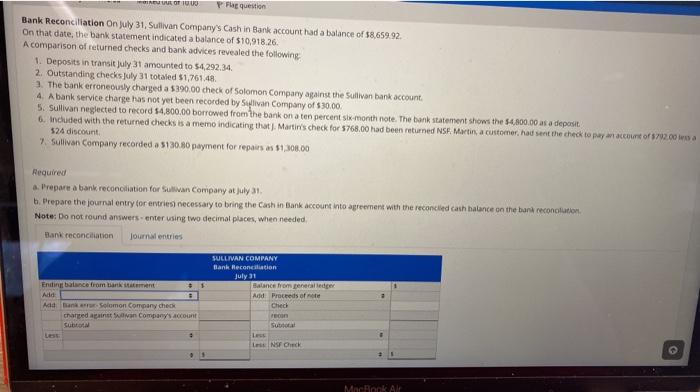

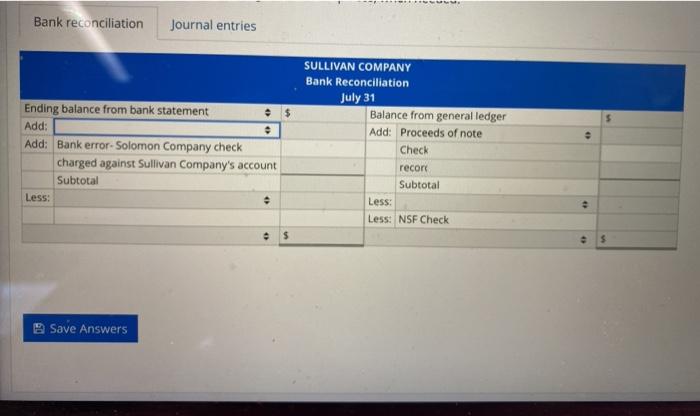

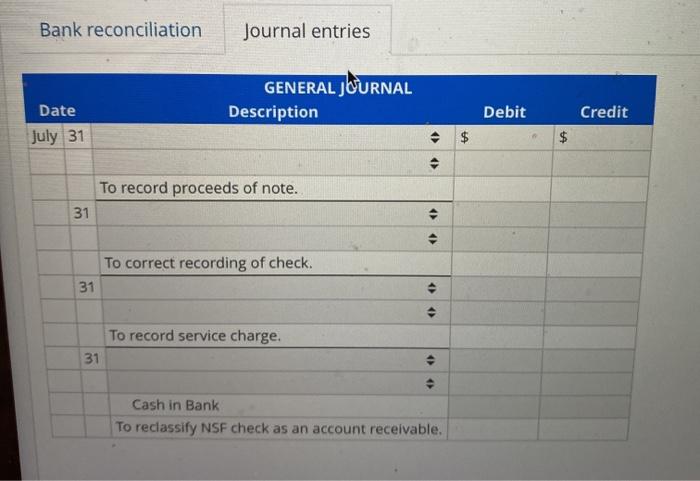

Of 1000 P Flag question Bank Reconciliation On July 31, Sullivan Company's Cash in Bank account had a balance of $8,659.92 On that date, the bank statement indicated a balance of $10,918.26. A comparison of returned checks and bank advices revealed the following 1. Deposits in transit July 31 amounted to 54.292.34 2. Outstanding checks July 31 totaled 51,761.48 1. The bank erroneously charged a 5390.00 check of Solomon Company against the Sullivan bank account 4. A bank service charge has not yet been recorded by Sivan Company of 530.00 5. Sullivan neglected to record 54,800.00 borrowed from the bank on a ten percent six month note. The bank statement shows the 54,800.00 as a deposit 6. Induced with the returned checks is a memo indicating that. Martin's check for 5768.00 had been returned NSF. Martin a customer, had sent the check to pay an account of 5792.00 a 524 discount 7. Sullivan Company recorded a 130.86 payment for repairs as $106.00 Required a. Prepare a bank reconciliation for Sullivan Company at July 31. b. Prepare the journal entry for entries necessary to bring the cash in Bank account into agreement with the reconciled cash balance on the bank reconclusion Note: Do not found answers.enter using two decimal places, when needed Bank reconciliation Journal entries Ending balance from banken 1 Add Add a Solomon Company check changed in an Company's account SULLIVAN COMPANY Bank Heconciliation July 31 Balance from general ledger Ad Proceeds of Chech LNSF C MacBook Air Bank reconciliation Journal entries Ending balance from bank statement Add: Add: Bank error- Solomon Company check charged against Sullivan Company's account Subtotal Less: SULLIVAN COMPANY Bank Reconciliation July 31 Balance from general ledger Add: Proceeds of note Check recort Subtotal Less: Less: NSF Check . $ E Save Answers Bank reconciliation Journal entries GENERAL JOURNAL Description Date Debit Credit July 31 To record proceeds of note. 31 > ( To correct recording of check. 31 To record service charge. 31 Cash in Bank To reclassify NSF check as an account receivable