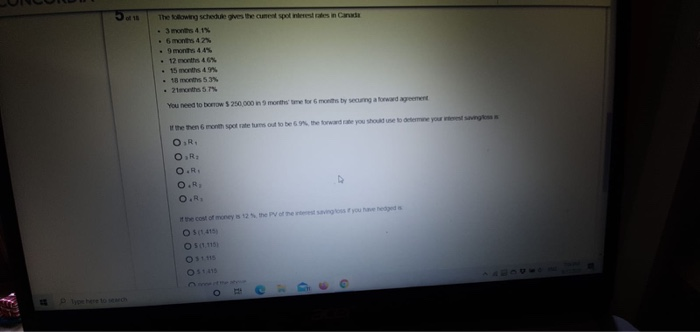

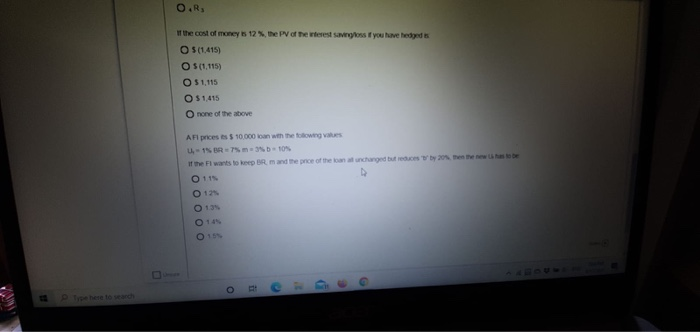

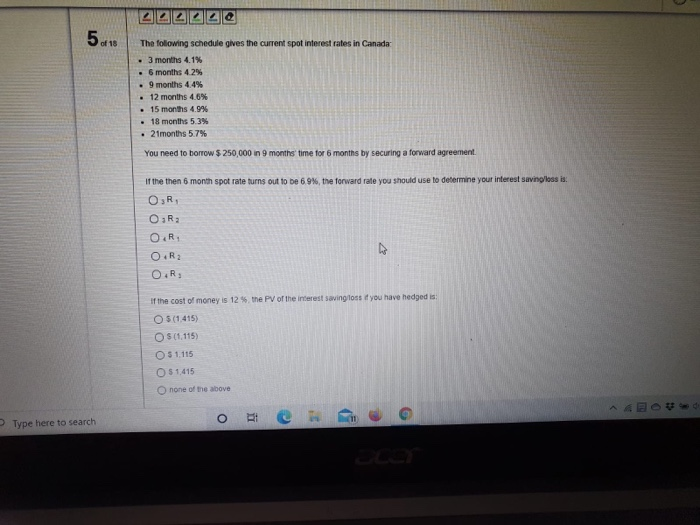

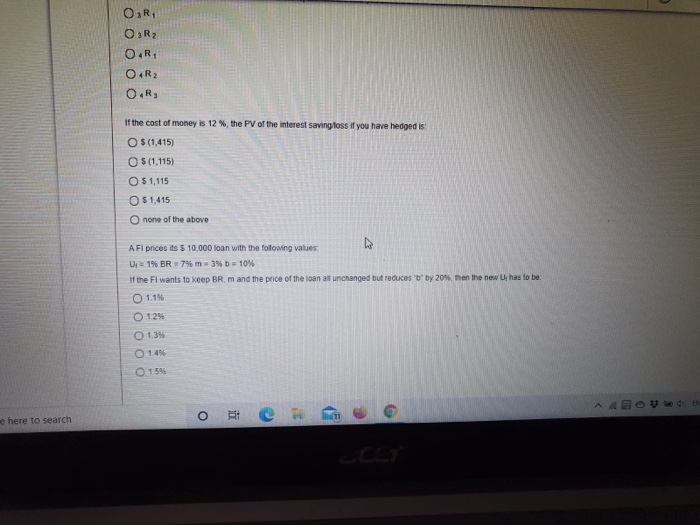

of 11 The schedule gives the mea spomere aes in Canada 6 months 42 9 months 44% 12 months 15 months . 18 months 21th 5 You need to borrow $ 250 000 9 months torty securing a forward sement the then mot spotte turns out to be the toward you should use to your own O.R. OR O.R. OR con of money is the PV of the west savings you seeds 0511115 O 2 o O.R the cost of money is 12%, the PV of the West savings you have hedged O 5 (1.415) O 5 (1115) O 51,115 O $1415 none of the above AFI prices $ 10.000 loan with the flowing - 15 BR-3109 of the Fl wants to keep BR mand the price of the loannchanged but by the two O 11 O 12 O 14 O lla 5 The following schedule gives the current spot interest rates in Canada . 3 months 4.1% 6 months 4.2% 9 months 4.4% 12 months 4.6% 15 months 4.9% 18 months 5.3% 2 months 5.7% You need to borrow $ 250,000 in 9 months time for 6 months by securing a forward agreement. If the then 6 month spot rate turns out to be 6.9%, the forward rate you should use to determine your interest saving less is: OR OR OR: O R2 O.R. if the cost of money is 12. the PV of the interest saving lost you have hedged is O 5 (1.415) O 5 (1.115) OS 1.115 OS 1,415 none of the above o i e Type here to search 12 OR OR O.R1 O.R2 O.RS If the cost of money is 12 %, the PV of the interest savingfoss if you have hedged is O $(1,415) OS (1.115) OS 1,115 O $1,415 O none of the above A Fl prices its $10,000 loan with the following values U= 19 BR = 7% m 3% b = 10% If the Fl wants to keep BR and the price of the loan al unchanged but reduces 'b' by 20%, then the new Uy has to be 01.15 O 12% 1396 1:49 O 159 O e here to search of 11 The schedule gives the mea spomere aes in Canada 6 months 42 9 months 44% 12 months 15 months . 18 months 21th 5 You need to borrow $ 250 000 9 months torty securing a forward sement the then mot spotte turns out to be the toward you should use to your own O.R. OR O.R. OR con of money is the PV of the west savings you seeds 0511115 O 2 o O.R the cost of money is 12%, the PV of the West savings you have hedged O 5 (1.415) O 5 (1115) O 51,115 O $1415 none of the above AFI prices $ 10.000 loan with the flowing - 15 BR-3109 of the Fl wants to keep BR mand the price of the loannchanged but by the two O 11 O 12 O 14 O lla 5 The following schedule gives the current spot interest rates in Canada . 3 months 4.1% 6 months 4.2% 9 months 4.4% 12 months 4.6% 15 months 4.9% 18 months 5.3% 2 months 5.7% You need to borrow $ 250,000 in 9 months time for 6 months by securing a forward agreement. If the then 6 month spot rate turns out to be 6.9%, the forward rate you should use to determine your interest saving less is: OR OR OR: O R2 O.R. if the cost of money is 12. the PV of the interest saving lost you have hedged is O 5 (1.415) O 5 (1.115) OS 1.115 OS 1,415 none of the above o i e Type here to search 12 OR OR O.R1 O.R2 O.RS If the cost of money is 12 %, the PV of the interest savingfoss if you have hedged is O $(1,415) OS (1.115) OS 1,115 O $1,415 O none of the above A Fl prices its $10,000 loan with the following values U= 19 BR = 7% m 3% b = 10% If the Fl wants to keep BR and the price of the loan al unchanged but reduces 'b' by 20%, then the new Uy has to be 01.15 O 12% 1396 1:49 O 159 O e here to search