Answered step by step

Verified Expert Solution

Question

1 Approved Answer

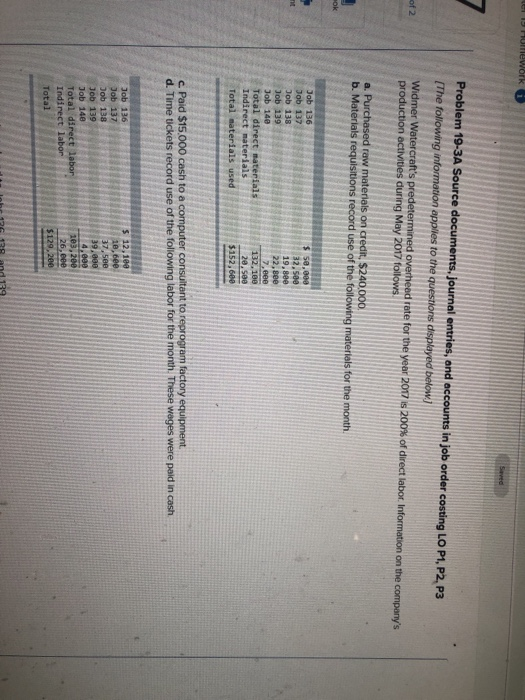

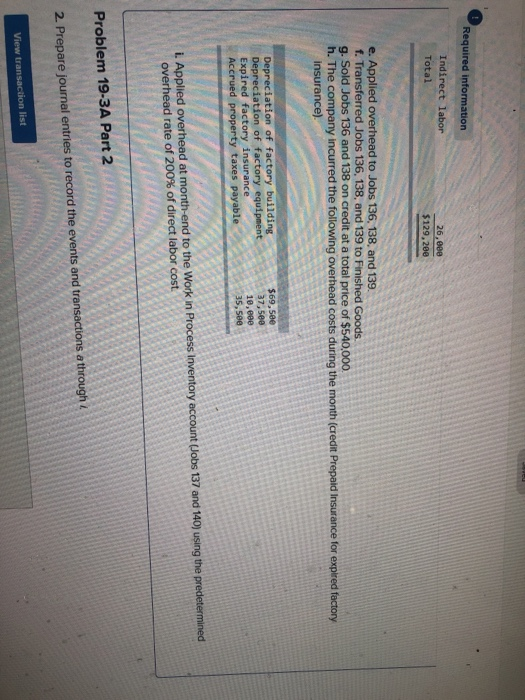

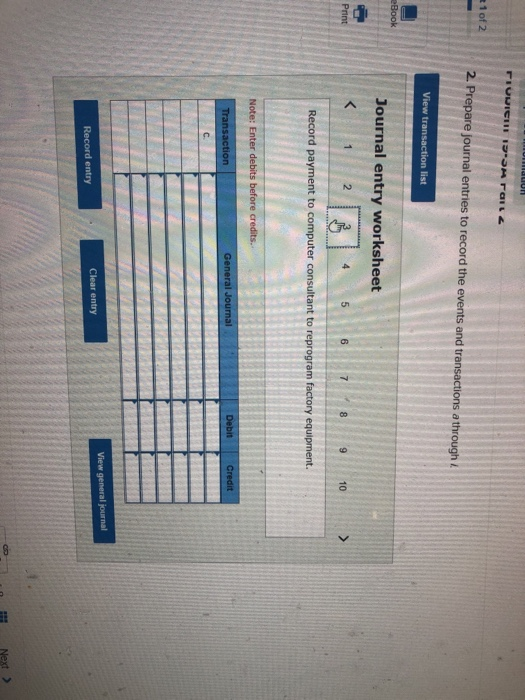

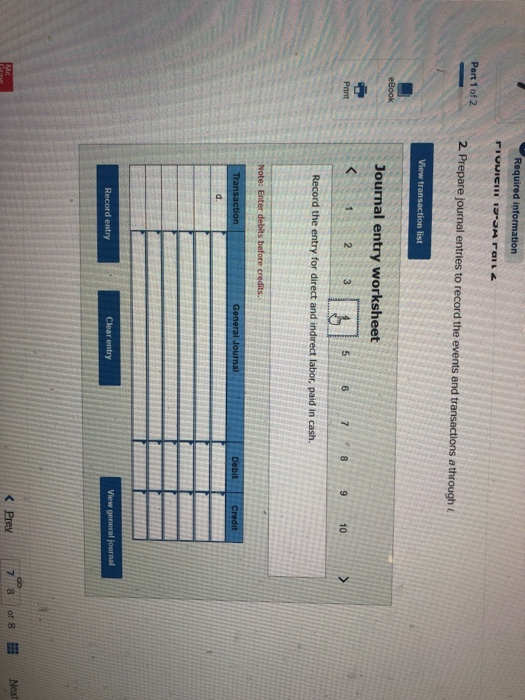

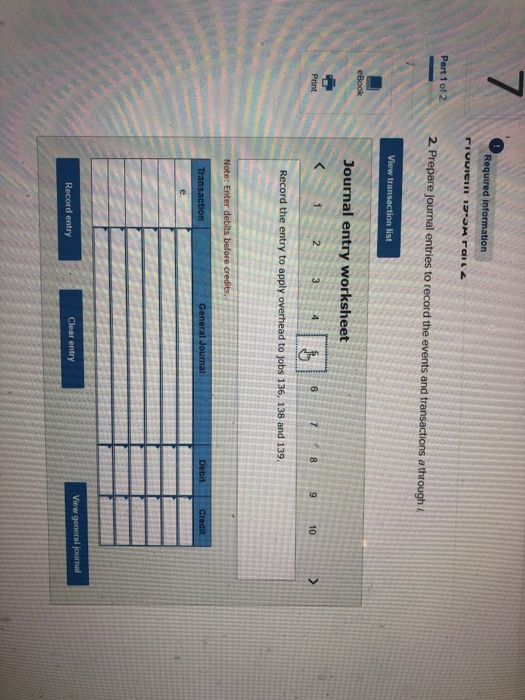

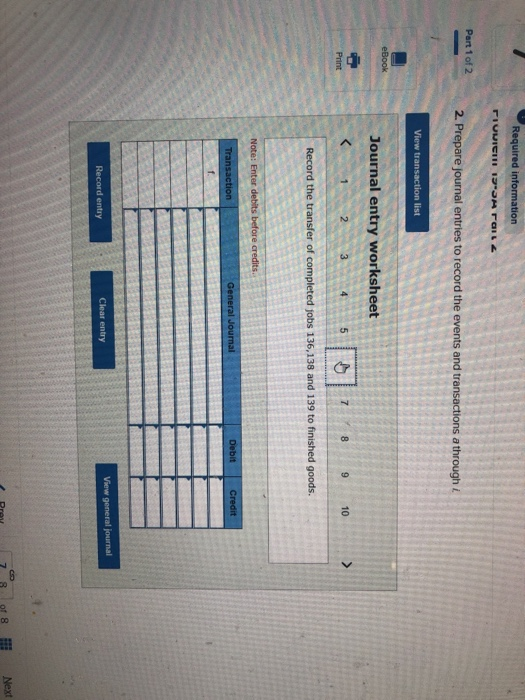

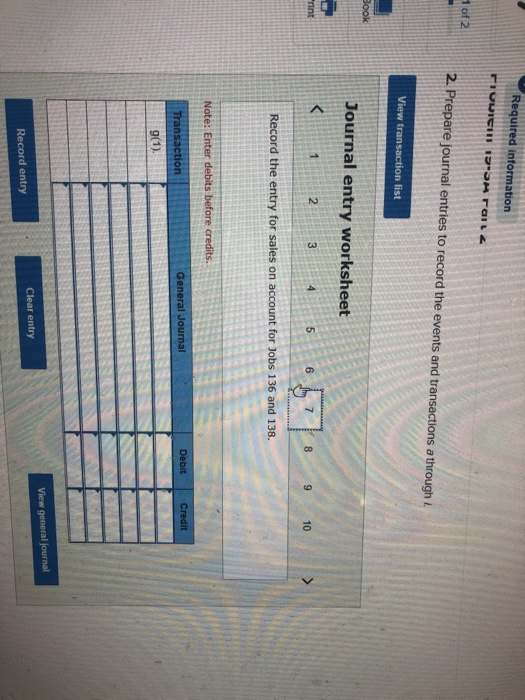

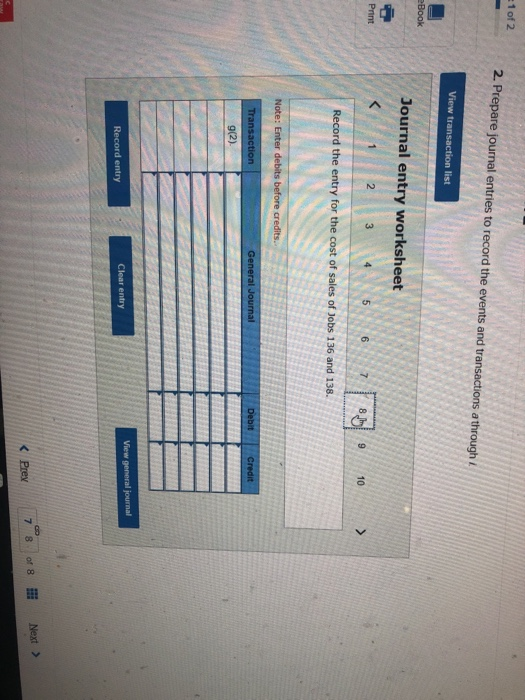

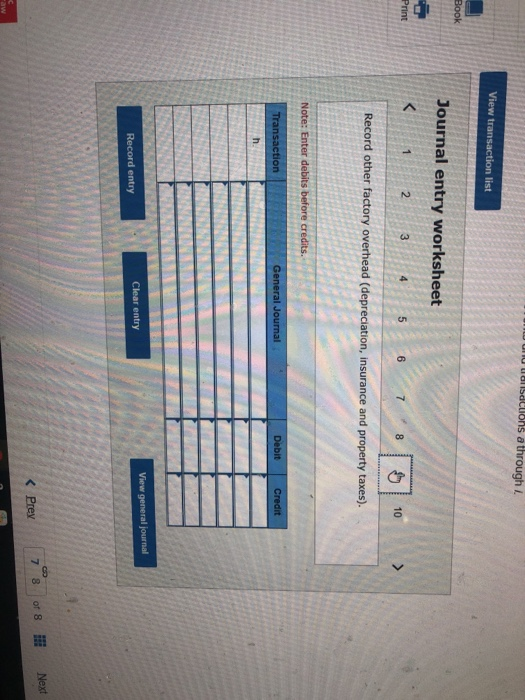

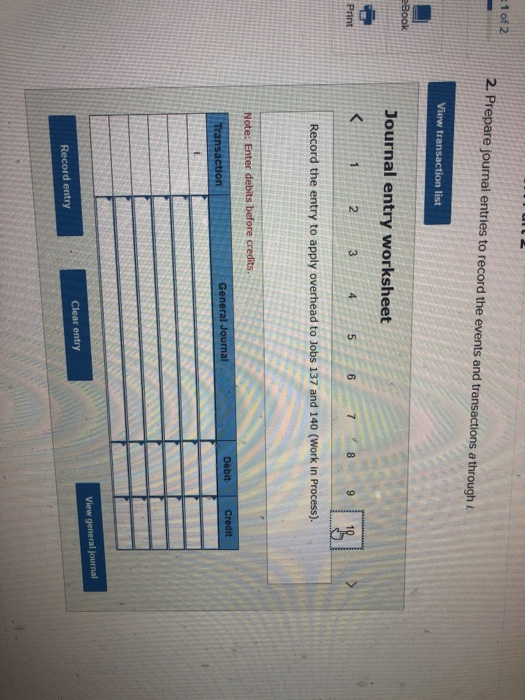

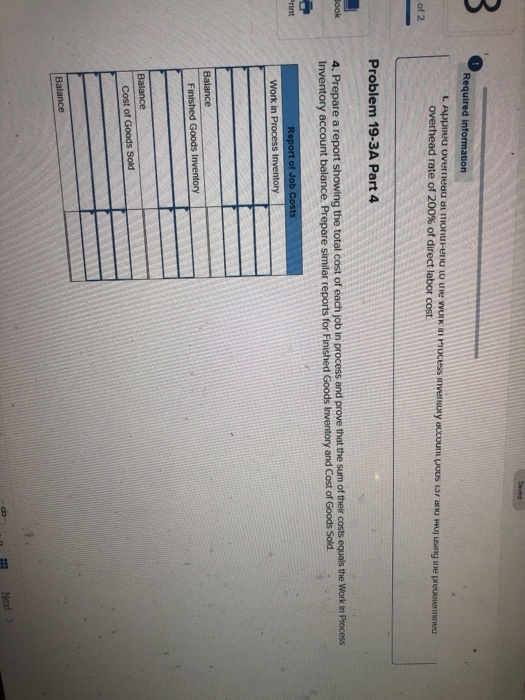

of 2 Job 137 0,580 Total Required information Indirect labor Total 26,000 $129,200 e. Applied overhead to Jobs 136, 138, and 139. f. Transferred Jobs

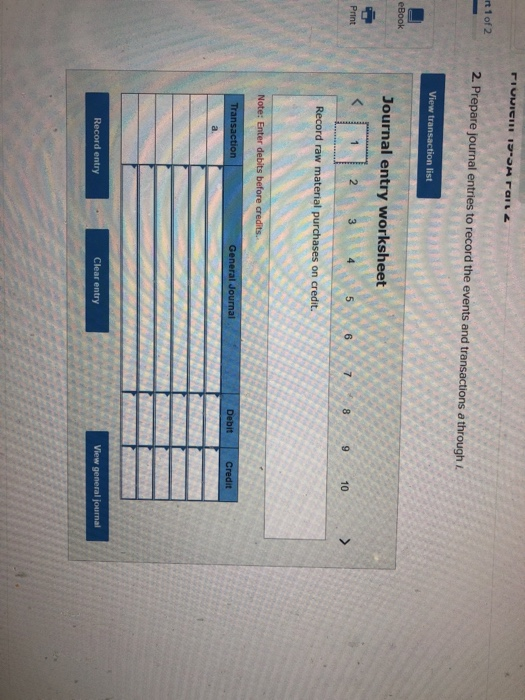

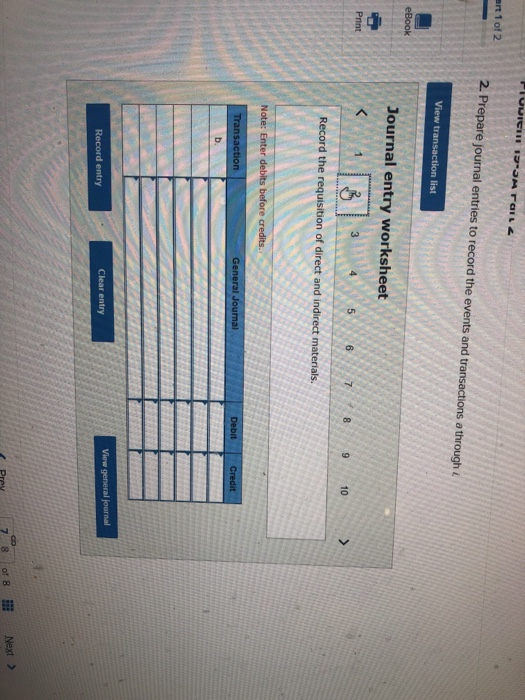

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started