Answered step by step

Verified Expert Solution

Question

1 Approved Answer

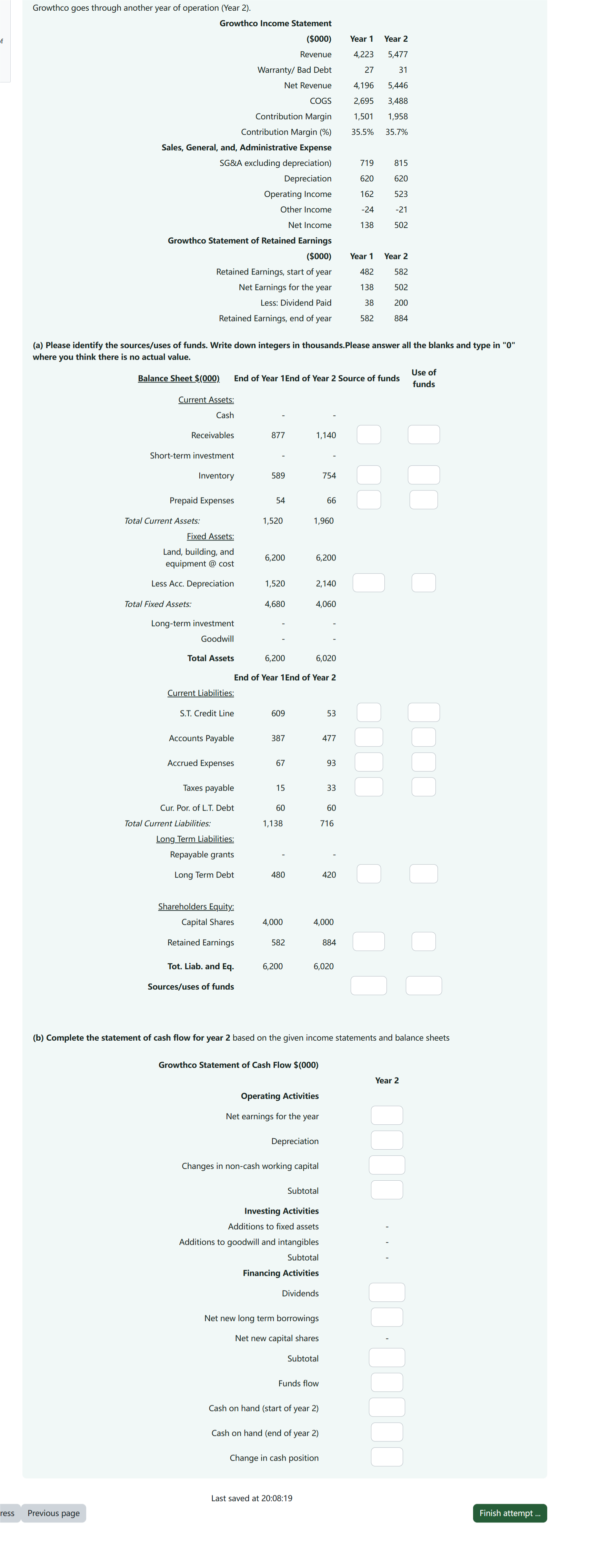

of Growthco goes through another year of operation (Year 2). Growthco Income Statement ($000) Year 1 Year 2 Revenue 4,223 5,477 Warranty/ Bad Debt

of Growthco goes through another year of operation (Year 2). Growthco Income Statement ($000) Year 1 Year 2 Revenue 4,223 5,477 Warranty/ Bad Debt 27 31 Net Revenue 4,196 5,446 COGS 2,695 3,488 Contribution Margin 1,501 1,958 Contribution Margin (%) 35.5% 35.7% Sales, General, and, Administrative Expense SG&A excluding depreciation) 719 815 Depreciation 620 620 Operating Income 162 523 Other Income -24 -21 Net Income 138 502 Growthco Statement of Retained Earnings ($000) Year 1 Year 2 Retained Earnings, start of year 482 582 Net Earnings for the year 138 502 Less: Dividend Paid 38 200 Retained Earnings, end of year 582 884 (a) Please identify the sources/uses of funds. Write down integers in thousands. Please answer all the blanks and type in "0" where you think there is no actual value. Use of Balance Sheet $(000). End of Year 1 End of Year 2 Source of funds funds Current Assets: Cash Receivables 877 1,140 Short-term investment Inventory 589 754 Prepaid Expenses 54 66 Total Current Assets: 1,520 1,960 Fixed Assets: Land, building, and 6,200 6,200 equipment @ cost Less Acc. Depreciation 1,520 2,140 Total Fixed Assets: 4,680 4,060 Long-term investment Goodwill Total Assets 6,200 6,020 End of Year 1 End of Year 2 Current Liabilities: S.T. Credit Line 609 53 Accounts Payable 387 477 Accrued Expenses 67 93 93 Taxes payable 15 Cur. Por. of L.T. Debt 60 36 33 60 Total Current Liabilities: 1,138 716 Long Term Liabilities: Repayable grants Long Term Debt 480 420 Shareholders Equity: Capital Shares 4,000 4,000 Retained Earnings 582 884 Tot. Liab. and Eq. Sources/uses of funds 6,200 6,020 (b) Complete the statement of cash flow for year 2 based on the given income statements and balance sheets Growthco Statement of Cash Flow $(000) Operating Activities Net earnings for the year Depreciation Changes in non-cash working capital Subtotal Investing Activities Additions to fixed assets Additions to goodwill and intangibles Subtotal Financing Activities Dividends Net new long term borrowings Net new capital shares Subtotal Year 2 ress Previous page Funds flow Cash on hand (start of year 2) Cash on hand (end of year 2) Change in cash position Last saved at 20:08:19 Finish attempt ...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started