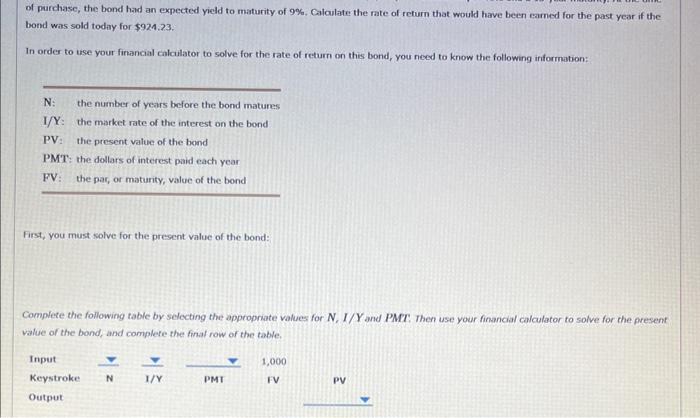

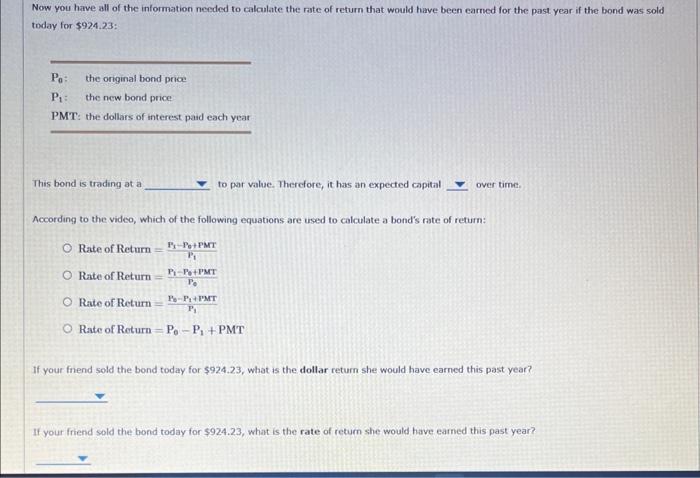

of parchasc, the bond had an expected yield to maturity of 9%. Calculate the rate of rehurn that would have been earned for the past year if the bond was sold todiy for $924.23. In ordes to use your firkancal calculator to solve for the rate of return on this bond, you need to know the following information: First, you must solve for the present value of the bond: Complete the following table by sclocting the appropriate values for N, I/Y and PMPI. Then use your financial calculator to solve for the present value of the bond, and complete the firaf row of the table. Now you have all of the information nesded to calculate the rate of return that would have been earned for the past year if the bond was sold today for 5924.23 This bond is trading at a to par value. Thercfore, it has an expected capital over time. According to the video, which of the following equations are used to calculate a bond's rate of return: Rate of Return =P1PsP6+PMT Rate of Return =P0P1Pe+PMT Revie of Return =P1P6P1+MMT Rate of Roturn =P6P1+PMT If your frend sold the bond today for $924.23, what is the dollar return she would have earned this past year? If your friend sold the bond today for $924.23, what is the rate of return she would have earned this past year? Now it's time for you to practice what you've learned. Consider a corporate bond that was purchased last year with a face value of $1,000, a 9% annual coupon rate and a 13 year maturity. At the time of parchase, the bond had an expected yield to maturity of 8%. Calculate the rate of return that would have been earned for the past year if the bond was sold today for $1,072,23. of parchasc, the bond had an expected yield to maturity of 9%. Calculate the rate of rehurn that would have been earned for the past year if the bond was sold todiy for $924.23. In ordes to use your firkancal calculator to solve for the rate of return on this bond, you need to know the following information: First, you must solve for the present value of the bond: Complete the following table by sclocting the appropriate values for N, I/Y and PMPI. Then use your financial calculator to solve for the present value of the bond, and complete the firaf row of the table. Now you have all of the information nesded to calculate the rate of return that would have been earned for the past year if the bond was sold today for 5924.23 This bond is trading at a to par value. Thercfore, it has an expected capital over time. According to the video, which of the following equations are used to calculate a bond's rate of return: Rate of Return =P1PsP6+PMT Rate of Return =P0P1Pe+PMT Revie of Return =P1P6P1+MMT Rate of Roturn =P6P1+PMT If your frend sold the bond today for $924.23, what is the dollar return she would have earned this past year? If your friend sold the bond today for $924.23, what is the rate of return she would have earned this past year? Now it's time for you to practice what you've learned. Consider a corporate bond that was purchased last year with a face value of $1,000, a 9% annual coupon rate and a 13 year maturity. At the time of parchase, the bond had an expected yield to maturity of 8%. Calculate the rate of return that would have been earned for the past year if the bond was sold today for $1,072,23