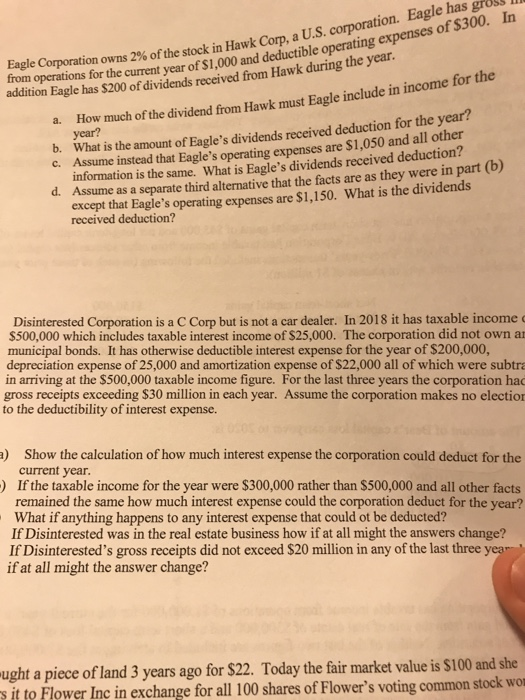

of S300. In 2% of the st ock in Hawk Corp, a U.S corporation. Eagle has gross Eagle Corporation onsforthns and deductible operating expenses addition Eagle has $200 of dividends received from Hawk during the year a. How much of the dividend from Hawk must Eagle include from operations for the current year of in income for the b. What is the amount of Eagle's dividends received deduction for the year? c. Assume instead that Eagle's operating expenses are $1,050 and all other information is the same. What is Eagle's dividends received deduction? d. Assume as a separate third alternative that the facts are as they were in part except that Eagle's operating expenses are $1,150. What is the dividends year? received deduction? Disinterested Corporation is a C Corp but is not a car dealer. In 2018 it has taxable income $500,000 which includes taxable interest income of $25,000. The corporation did not own a municipal bonds. It has otherwise deductible interest expense for the year of $200,000, depreciation expense of 25,000 and amortization expense of $22,000 all of which were subtra in arriving at the $500,000 taxable income figure. For the last three years the corporation hac gross receipts exceeding $30 million in each year. Assume the corporation makes no election to the deductibility of interest expense a) Show the calculation of how much interest expense the corporation could deduct for the current year If the taxable income for the year were $300,000 rather than $500,000 and all other facts remained the same how much interest expense could the corporation deduct for the year? What if anything happens to any interest expense that could ot be deducted? If Disinterested was in the real estate business how if at all might the answers change? If Disinterested's gross receipts did not exceed $20 million in any of the last three yea ) if at all might the answer change? ught a piece of land 3 years ago for $22. Today the fair market value is $100 and she s it to Flower Inc in exchange for all 100 shares of Flower's voting common stock wor of S300. In 2% of the st ock in Hawk Corp, a U.S corporation. Eagle has gross Eagle Corporation onsforthns and deductible operating expenses addition Eagle has $200 of dividends received from Hawk during the year a. How much of the dividend from Hawk must Eagle include from operations for the current year of in income for the b. What is the amount of Eagle's dividends received deduction for the year? c. Assume instead that Eagle's operating expenses are $1,050 and all other information is the same. What is Eagle's dividends received deduction? d. Assume as a separate third alternative that the facts are as they were in part except that Eagle's operating expenses are $1,150. What is the dividends year? received deduction? Disinterested Corporation is a C Corp but is not a car dealer. In 2018 it has taxable income $500,000 which includes taxable interest income of $25,000. The corporation did not own a municipal bonds. It has otherwise deductible interest expense for the year of $200,000, depreciation expense of 25,000 and amortization expense of $22,000 all of which were subtra in arriving at the $500,000 taxable income figure. For the last three years the corporation hac gross receipts exceeding $30 million in each year. Assume the corporation makes no election to the deductibility of interest expense a) Show the calculation of how much interest expense the corporation could deduct for the current year If the taxable income for the year were $300,000 rather than $500,000 and all other facts remained the same how much interest expense could the corporation deduct for the year? What if anything happens to any interest expense that could ot be deducted? If Disinterested was in the real estate business how if at all might the answers change? If Disinterested's gross receipts did not exceed $20 million in any of the last three yea ) if at all might the answer change? ught a piece of land 3 years ago for $22. Today the fair market value is $100 and she s it to Flower Inc in exchange for all 100 shares of Flower's voting common stock wor