Question

Bill is a single taxpayer, age 27. In 2019, his salary is $29,000 and he has interest income of $1,500. In addition, he has

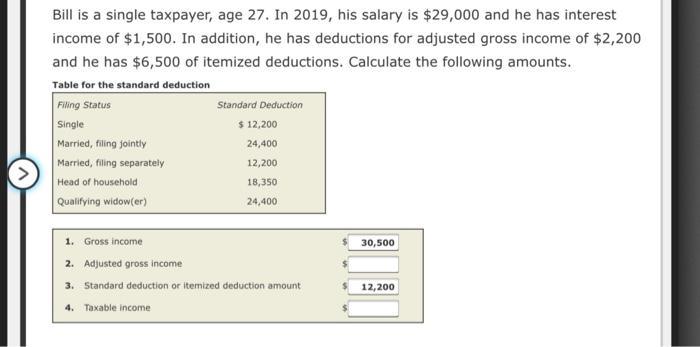

Bill is a single taxpayer, age 27. In 2019, his salary is $29,000 and he has interest income of $1,500. In addition, he has deductions for adjusted gross income of $2,200 and he has $6,500 of itemized deductions. Calculate the following amounts. Table for the standard deduction Filing Status Single Married, filing jointly Married, filing separately Head of household Qualifying widow(er) Standard Deduction $ 12,200 24,400 12,200 18,350 24,400 1. Gross income 2. Adjusted gross income 3. Standard deduction or itemized deduction amount 4. Taxable income 30,500 12,200

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Gross Income Salary Income Add Interest Income Gross Income 2 Adjusted Gross Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance

Authors: Jeff Madura

5th edition

132994348, 978-0132994347

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App