Question

Of this amount, P350,000 is in part exchange for services performed by employees for 2020, and the balance of P50,000 is in respect of

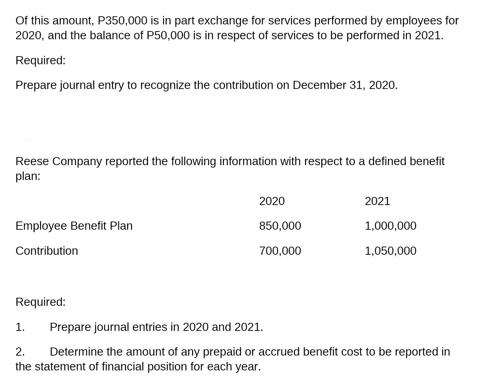

Of this amount, P350,000 is in part exchange for services performed by employees for 2020, and the balance of P50,000 is in respect of services to be performed in 2021. Required: Prepare journal entry to recognize the contribution on December 31, 2020. Reese Company reported the following information with respect to a defined benefit plan: Employee Benefit Plan Contribution Required: 2020 850,000 700,000 2021 1,000,000 1,050,000 1. Prepare journal entries in 2020 and 2021. 2. Determine the amount of any prepaid or accrued benefit cost to be reported in the statement of financial position for each year.

Step by Step Solution

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To recognize the contribution on December 31 2020 the journal entry would be Debit Employee Benefit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

18th edition

125969240X, 978-1259692406

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App