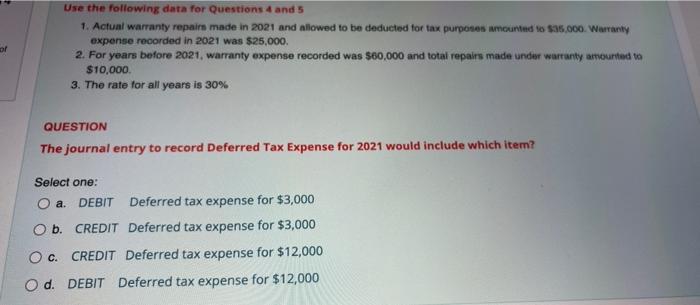

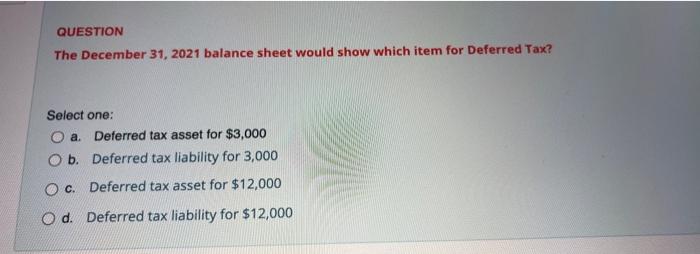

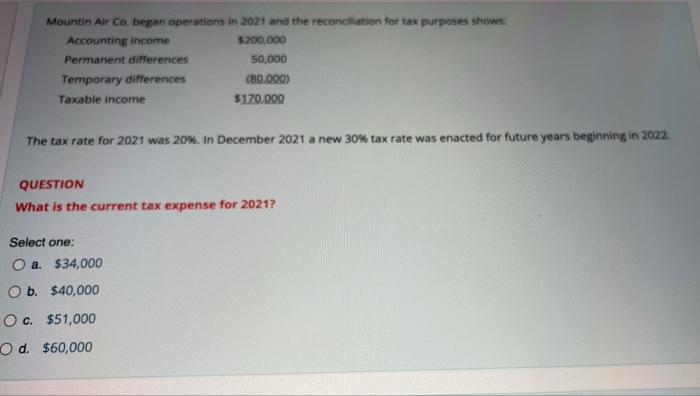

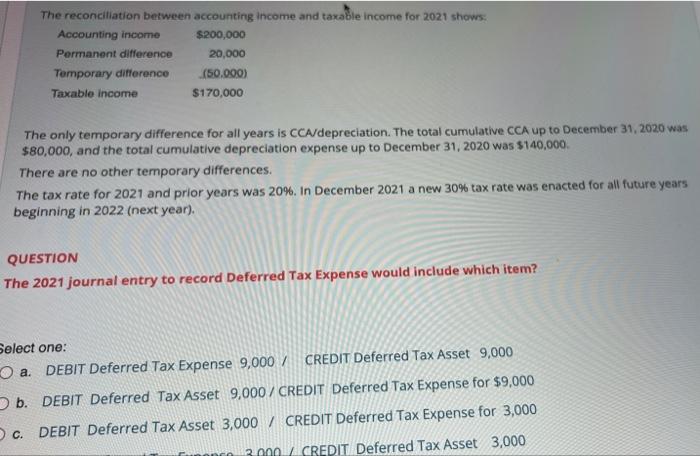

of Use the following data for Questions 4 and 5 1. Actual warranty repairs made in 2021 and allowed to be deducted for tax purposes amounted to $35.000. Warranty expense recorded in 2021 was $25,000. 2. For years before 2021 warranty expense recorded was $60,000 and total repairs made under warranty amounted to $10,000 3. The rate for all years is 30% QUESTION The journal entry to record Deferred Tax Expense for 2021 would include which item? Select one: a. DEBIT Deferred tax expense for $3,000 O b. CREDIT Deferred tax expense for $3,000 O c. CREDIT Deferred tax expense for $12,000 O d. DEBIT Deferred tax expense for $12,000 QUESTION The December 31, 2021 balance sheet would show which item for Deferred Tax? Select one: O a. Deferred tax asset for $3,000 O b. Deferred tax liability for 3,000 O c. Deferred tax asset for $12,000 O d. Deferred tax liability for $12,000 Mountin Air Co. began operations in 2021 and the reconciliation for tax purposes shows Accounting income 5200,000 Permanent differences 50,000 Temporary differences (B0.000) Taxable income $170.000 The tax rate for 2021 was 20%. In December 2021 a new 30% tax rate was enacted for future years beginning in 2022. QUESTION What is the current tax expense for 2021? Select one: O a. $34,000 O b. $40,000 O c. $51,000 O d. $60,000 The reconciliation between accounting income and taxable income for 2021 shows. Accounting income $200,000 Permanent difference 20,000 Temporary difference (50.000) Taxable income $170,000 The only temporary difference for all years is CCA/depreciation. The total cumulative CCA up to December 31, 2020 was $80,000, and the total cumulative depreciation expense up to December 31, 2020 was $140,000 There are no other temporary differences. The tax rate for 2021 and prior years was 20%. In December 2021 a new 30% tax rate was enacted for all future years beginning in 2022 (next year). QUESTION The 2021 journal entry to record Deferred Tax Expense would include which item? Select one: O a. DEBIT Deferred Tax Expense 9,000/ CREDIT Deferred Tax Asset 9,000 b. DEBIT Deferred Tax Asset 9,000/ CREDIT Deferred Tax Expense for $9,000 C. DEBIT Deferred Tax Asset 3,000 / CREDIT Deferred Tax Expense for 3,000 3000 CREDIT Deferred Tax Asset 3,000