Answered step by step

Verified Expert Solution

Question

1 Approved Answer

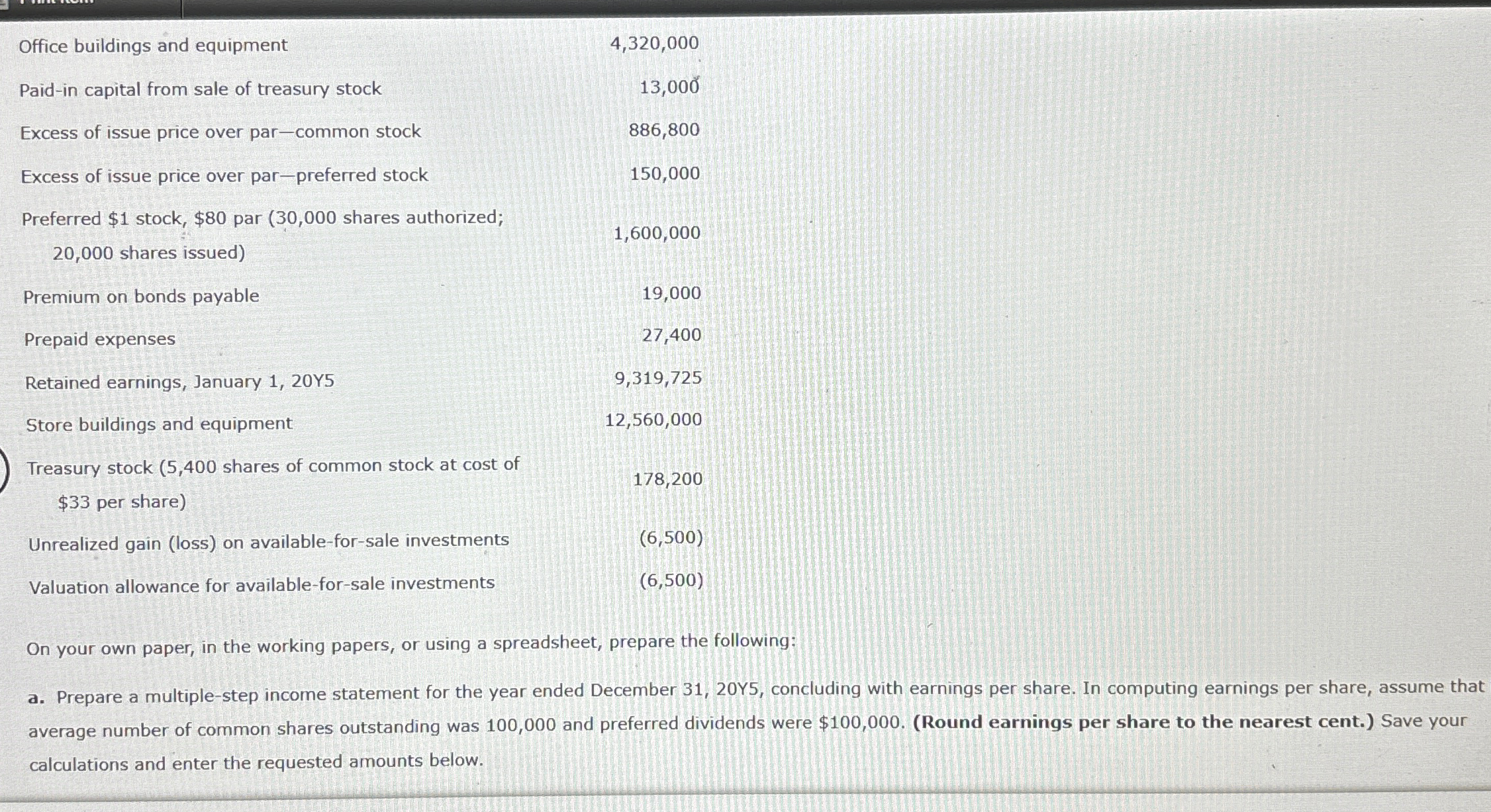

Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over par-common stock 886,800 Excess of issue

Office buildings and equipment 4,320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over par-common stock 886,800 Excess of issue price over par-preferred stock 150,000 Preferred $1 stock, $80 par (30,000 shares authorized; 1,600,000 20,000 shares issued) Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 20Y5 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 178,200 $33 per share) Unrealized gain (loss) on available-for-sale investments Valuation allowance for available-for-sale investments (6,500) (6,500) On your own paper, in the working papers, or using a spreadsheet, prepare the following: a. Prepare a multiple-step income statement for the year ended December 31, 20Y5, concluding with earnings per share. In computing earnings per share, assume that average number of common shares outstanding was 100,000 and preferred dividends were $100,000. (Round earnings per share to the nearest cent.) Save your calculations and enter the requested amounts below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started