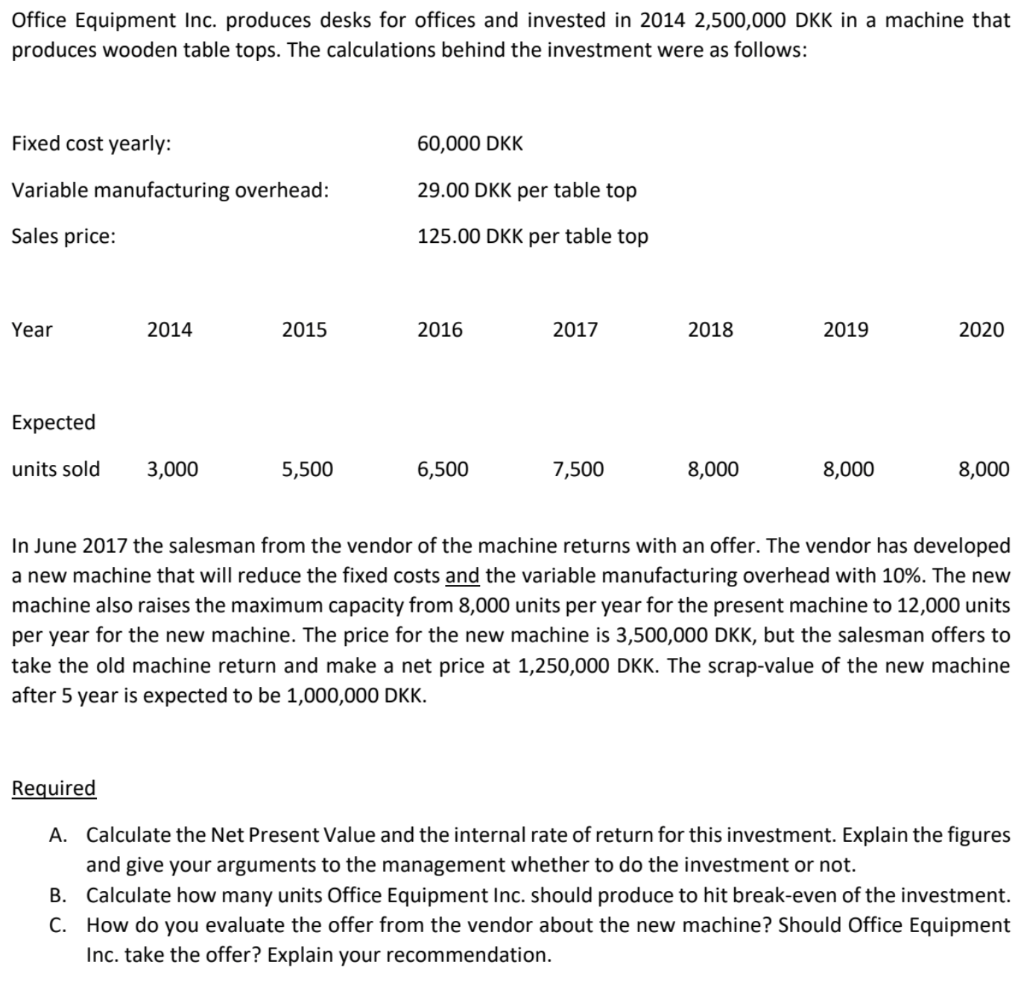

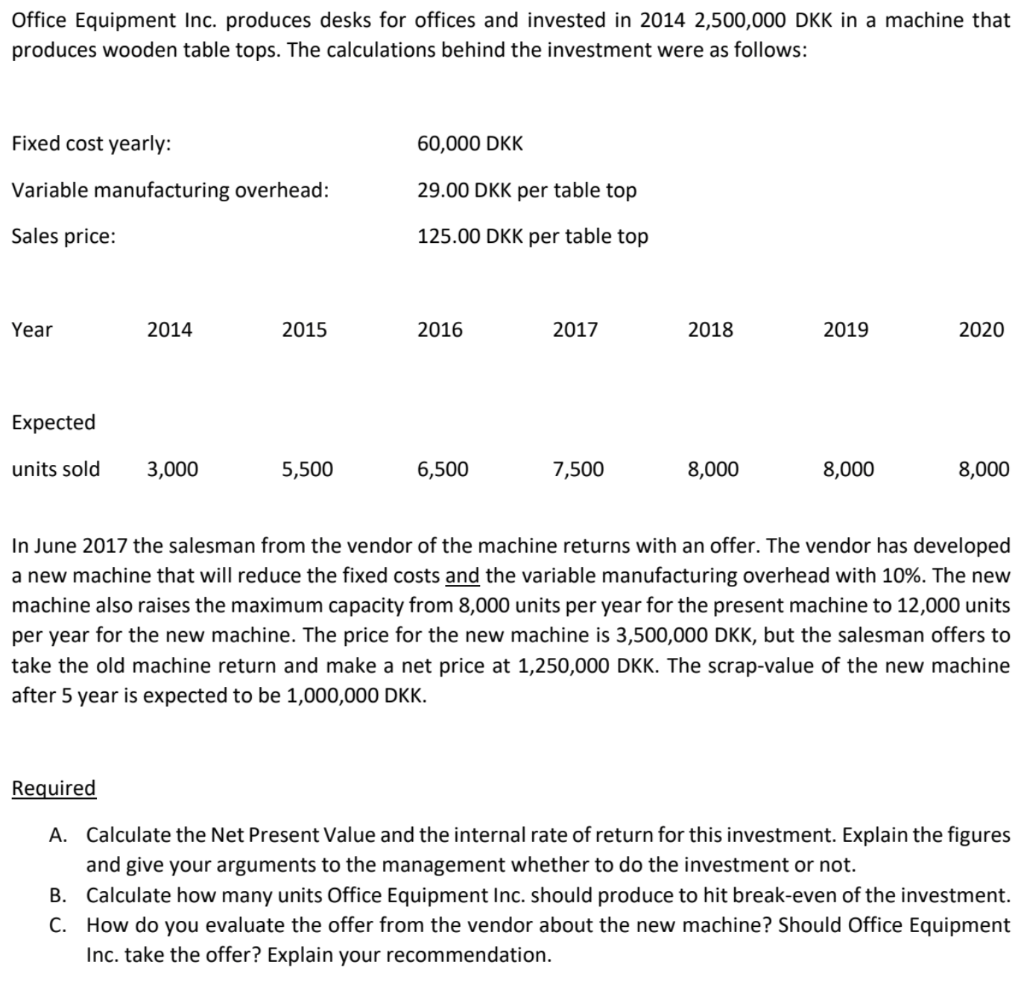

Office Equipment Inc. produces desks for offices and invested in 2014 2,500,000 DKK in a machine that produces wooden table tops. The calculations behind the investment were as follows: Fixed cost yearly: 60,000 DKK Variable manufacturing overhead: 29.00 DKK per table top Sales price: 125.00 DKK per table top Year Year 2014 2014 2015 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 Expected units sold 3,000 5,500 6,500 7,500 8,000 8,000 8,000 In June 2017 the salesman from the vendor of the machine returns with an offer. The vendor has developed a new machine that will reduce the fixed costs and the variable manufacturing overhead with 10%. The new machine also raises the maximum capacity from 8,000 units per year for the present machine to 12,000 units per year for the new machine. The price for the new machine is 3,500,000 DKK, but the salesman offers to take the old machine return and make a net price at 1,250,000 DKK. The scrap-value of the new machine after 5 year is expected to be 1,000,000 DKK. Required A. Calculate the Net Present Value and the internal rate of return for this investment. Explain the figures and give your arguments to the management whether to do the investment or not. B. Calculate how many units Office Equipment Inc. should produce to hit break-even of the investment. C. How do you evaluate the offer from the vendor about the new machine? Should Office Equipment Inc. take the offer? Explain your recommendation. Office Equipment Inc. produces desks for offices and invested in 2014 2,500,000 DKK in a machine that produces wooden table tops. The calculations behind the investment were as follows: Fixed cost yearly: 60,000 DKK Variable manufacturing overhead: 29.00 DKK per table top Sales price: 125.00 DKK per table top Year Year 2014 2014 2015 2015 2016 2016 2017 2017 2018 2018 2019 2019 2020 2020 Expected units sold 3,000 5,500 6,500 7,500 8,000 8,000 8,000 In June 2017 the salesman from the vendor of the machine returns with an offer. The vendor has developed a new machine that will reduce the fixed costs and the variable manufacturing overhead with 10%. The new machine also raises the maximum capacity from 8,000 units per year for the present machine to 12,000 units per year for the new machine. The price for the new machine is 3,500,000 DKK, but the salesman offers to take the old machine return and make a net price at 1,250,000 DKK. The scrap-value of the new machine after 5 year is expected to be 1,000,000 DKK. Required A. Calculate the Net Present Value and the internal rate of return for this investment. Explain the figures and give your arguments to the management whether to do the investment or not. B. Calculate how many units Office Equipment Inc. should produce to hit break-even of the investment. C. How do you evaluate the offer from the vendor about the new machine? Should Office Equipment Inc. take the offer? Explain your recommendation