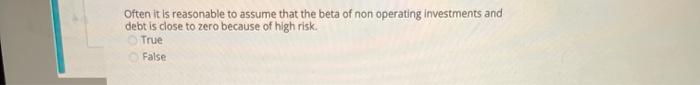

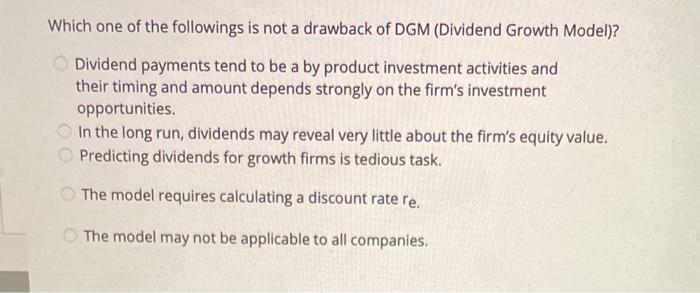

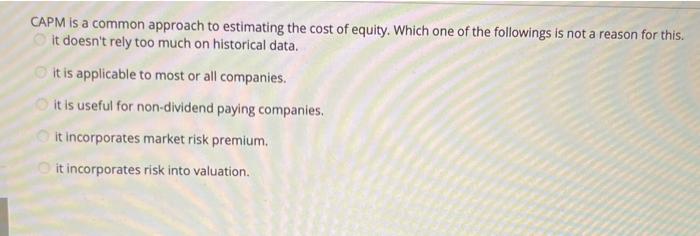

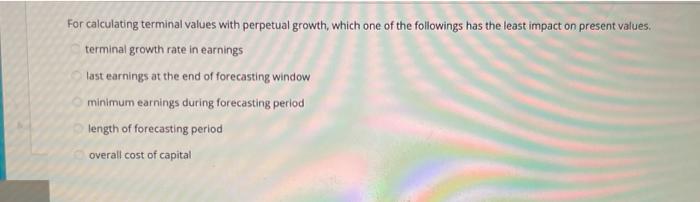

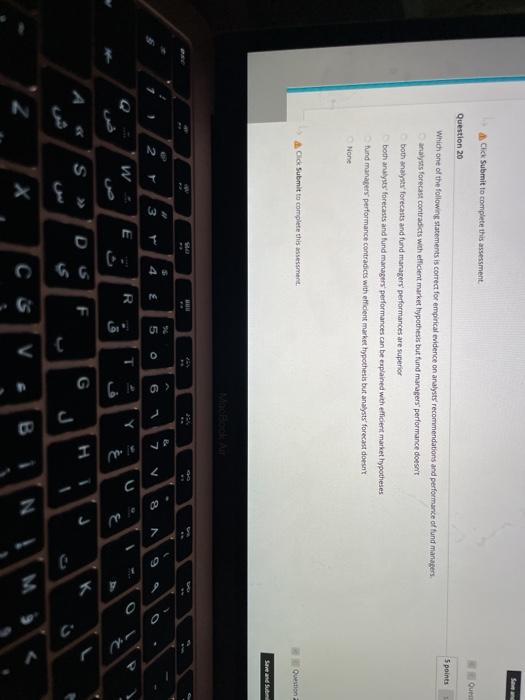

Often it is reasonable to assume that the beta of non operating investments and debt is close to zero because of high risk. True False Which one of the followings is not a drawback of DGM (Dividend Growth Model)? Dividend payments tend to be a by product investment activities and their timing and amount depends strongly on the firm's investment opportunities In the long run, dividends may reveal very little about the firm's equity value. Predicting dividends for growth firms is tedious task. The model requires calculating a discount rate re. The model may not be applicable to all companies. CAPM is a common approach to estimating the cost of equity. Which one of the followings is not a reason for this. it doesn't rely too much on historical data. it is applicable to most or all companies. it is useful for non-dividend paying companies. it incorporates market risk premium. it incorporates risk into valuation For calculating terminal values with perpetual growth, which one of the followings has the least impact on present values. terminal growth rate in earnings last earnings at the end of forecasting window minimum earnings during forecasting period length of forecasting period overall cost of capital Click Submit to complete this assessment Quel Question 20 Spoints Which one of the following statements is correct for empirical evidence on analysts recommendations and performance of fund managers analysts forecast contradicts with efficient market hypothesis but fund managers performance doesn't both analysts forecasts and fund managers performances are superior both analysts forecasts and fund managers performances can be explained with efficient market hypotheses Hand managers' performance contradicts with efficient market hypothesis but analysts forecast doesn't None Click Submit to complete this assessment Question Save and Sub 23 Bs 7 2 9 5 3 * 4 0 8 N 9 0 E R T . C Y ad E S DUS F G H 7 [ Often it is reasonable to assume that the beta of non operating investments and debt is close to zero because of high risk. True False Which one of the followings is not a drawback of DGM (Dividend Growth Model)? Dividend payments tend to be a by product investment activities and their timing and amount depends strongly on the firm's investment opportunities In the long run, dividends may reveal very little about the firm's equity value. Predicting dividends for growth firms is tedious task. The model requires calculating a discount rate re. The model may not be applicable to all companies. CAPM is a common approach to estimating the cost of equity. Which one of the followings is not a reason for this. it doesn't rely too much on historical data. it is applicable to most or all companies. it is useful for non-dividend paying companies. it incorporates market risk premium. it incorporates risk into valuation For calculating terminal values with perpetual growth, which one of the followings has the least impact on present values. terminal growth rate in earnings last earnings at the end of forecasting window minimum earnings during forecasting period length of forecasting period overall cost of capital Click Submit to complete this assessment Quel Question 20 Spoints Which one of the following statements is correct for empirical evidence on analysts recommendations and performance of fund managers analysts forecast contradicts with efficient market hypothesis but fund managers performance doesn't both analysts forecasts and fund managers performances are superior both analysts forecasts and fund managers performances can be explained with efficient market hypotheses Hand managers' performance contradicts with efficient market hypothesis but analysts forecast doesn't None Click Submit to complete this assessment Question Save and Sub 23 Bs 7 2 9 5 3 * 4 0 8 N 9 0 E R T . C Y ad E S DUS F G H 7 [