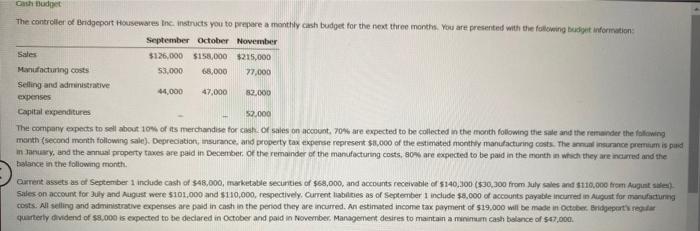

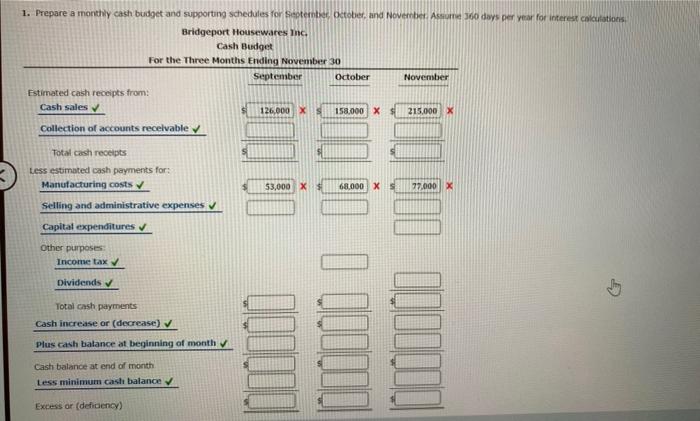

Oh budget The controller of Endgeport Housewares Inc. Instructs you to prepare a monthly cash budget for the next three months. You are presented with the following taget information September October November Sales $126,000 $150,000 $215,000 Manufacturing costs 53.000 65,000 77.000 Selling and administrative 44,000 47,000 expenses $2.000 Capital expenditures 52.000 The company expects to sell about 10% of its merchandise for cash of sales on account 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual insurance premium ispod in January, and the annual property taxes are paid in December of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of September 1 include cash of $48,000, marketable securities of $68,000, and accounts receivable of 5140,300 ($30,300 from July sales and $110.000 from August Sales on account for July and August were $101,000 and $110,000, respectively. Current liabilities as of September 1 include $8.000 of accounts payable incurred in August for manuuring costs. All selling and administrative expenses are paid in cash in the period they are incurred. An estimated income tax payment of $19.000 will be made in Octobe Bridgeport quarterly dividend of $8.000 is expected to be declared in October and paid in November. Management desires to maintain a minimum cash balance of $47.000. 1. Prepare a monthly cash budget and supporting schedules for Series October, and November Assume 360 days per year for interest calculations Bridgeport Housewares Inc. Cash Budget For the Three Months Ending November 30 September October November Estimated cash receipts from: Cash sales 126,000 X 158,000 X 215.000 X Collection of accounts receivable Total cash receipts Less estimated cash payments for: Manufacturing costs Selling and administrative expenses 53,000 X 68.000 X 77.000 x Capital expenditures Other purposes Income tax Dividends Total cash payments Cash increase or (decrease) Plus cash balance at beginning of month Cash balance at end of month Less minimum caste balance Excess or (deficiency)