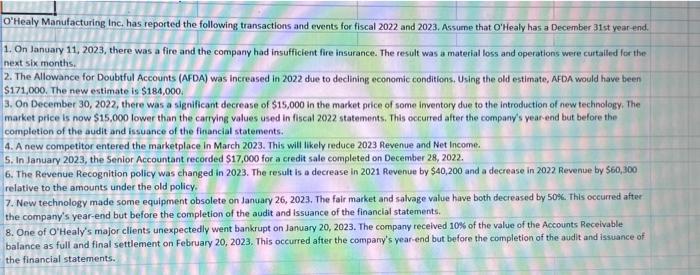

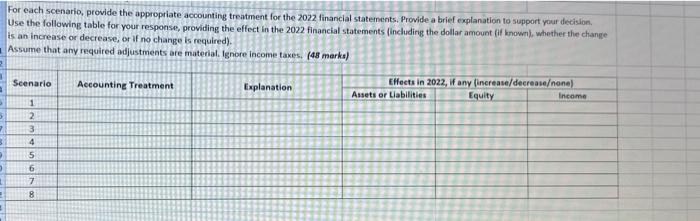

O'Healy Manufacturing Inc, has reported the following transactions and events for fiscal 2022 and 2023 . Assume that O'Healy has a December 31 st year end. 1. On January 11, 2023, there was a fire and the company had insufficient fire insurance. The result was a material loss and operations were curtailed for the next six months. 2. The Allowance for Doubtful Accounts (AFDA) was increased in 2022 due to declining economic conditions, Using the old estimate, AFDA would have been $171,000. The new estimate is $184,000. 3. On December 30,2022 , there was a significant decrease of $15,000 in the market price of some imventory due to the introduction of new technology, The market price is now $15,000 lower than the carrying values used in fiscal 2022 statements. This occurred after the company's year-end but before the completion of the audit and issuance of the financial statements. 4. A new competitor entered the marketplace in March 2023. This will likely reduce 2023 Revenue and Net Income. 5. In January 2023, the Senior Accountant recorded \$17,000 for a credit sale completed on December 28,2022. 6. The Revenue Recognition policy was changed in 2023. The result is a decrease in 2021 Revenue by $40,200 and a decrease in 2022 Revenue by $60,300 relative to the amounts under the old policy. 7. New technology made some equipment obsolete on January 26, 2023. The fair market and salvage value have both decreased by 50%. This occurred after the company's year-end but before the completion of the audit and issuance of the financial statements. 8. One of O'Healy's major clients unexpectedly went bankrupt on January 20, 2023. The company received 10% of the value of the Accounts Receivable balance as full and final settlement on February 20, 2023. This occurred after the company's year-end but before the completion of the audit and issuance of. the financial statements. For each scenario, provide the appropriate accounting treatment for the 2022 financial statements, Provide a brief explanation to support your decision, Use the following table for your response, providing the effect in the 2022 financial statements (includirig the dollar amount fif knownl, whether the change is an increase or decrease; or if no change is required). Assume that any required adjustments are material. Ignore income taxes, (4s marks)