Question

Oil Futures Read the quote from an article (see below). The table is an extract from the excel spreadsheet with futures oil prices for Feb

Oil Futures

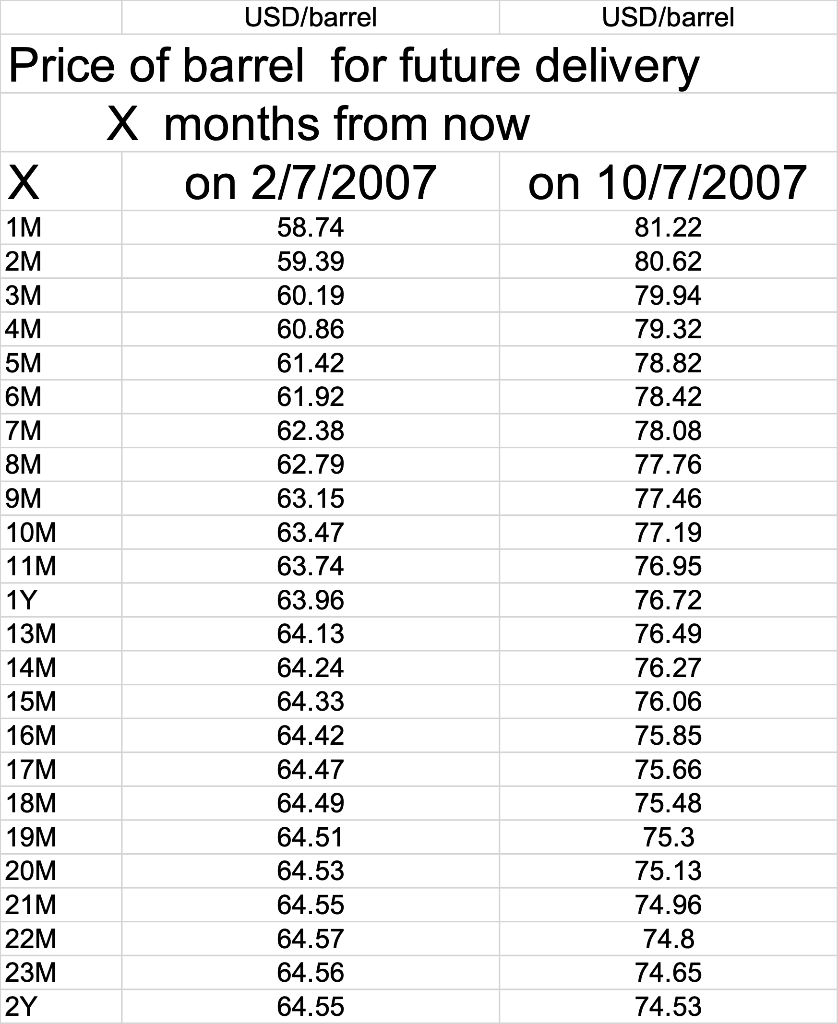

Read the quote from an article (see below). The table is an extract from the excel spreadsheet with futures oil prices for Feb 2007 and Oct 2007.

Assume that spot oil was sold on Feb7, 2007 for $57.96 per barrel and it was sold at $82 per barrel on Oct 7, 2007

Q. 2.2 Explain why so much oil was stored in Cushing in Feb but no oil was stored after mid-July; Are the reasons for Cushing's crude disappearing are surprisingly complex

Q. 2.3 Why some financial firms involved in oil trading got into the storage business?

Q. 2.4 Given: on February 7 the spot one-year interest rate was 4%.

Using the table below, show that on February 7 the cost of one-year storage was higher than $3.68 per barrel.

Where Has All The Oil Gone? WSJ Ann Davis Oct. 6, 2007

After Sitting on Crude, Speculators Unload It. The World's Eyes Fall on Cushing[1], Oklahoma .

Since summer, one of North America's most important oil towns (Cushing, Okla. ) has witnessed a disappearing act. The mammoth storage tanks that blanket the rolling grasslands around this remote prairie town had been filled to the brim with crude oil. (But now these tanks disappeared). Until mid-July, unprecedented conditions in the oil market had given oil companies and speculators alike a financial incentive to sock away oil in storage tanks for sale later. These days, the steel oil tankers on the outskirts of town stretch to the horizon, covering more than nine square miles. The biggest held 575,000 barrels.

some financial firms, (that had been) involved in oil trading, got into the storage business. That gave them the means to set aside oil when the market wasn't ripe to sell it profitably, and to take a cut as middlemen.

But the steel oil tankers aren't there anymore. Since May, millions of barrels of crude have been sold off, and Cushing's inventory has fallen by nearly 35%.

The reasons Cushing's crude has been disappearing are surprisingly complex

[1] Cushing isn't located on a major highway or railroad. It's home to just 8,500 people -- if you count the 1,000 or so prison inmates. Downtown has one stand-alone bar, the Buckhorn. At the movie theater near City Hall, tickets cost $1.50, $2 on weekends. Cushing's position as a global oil crossroads was cemented in 1983 when the New York Mercantile Exchange, or Nymex, designated it as the official delivery point for its new futures contract for light, sweet crude -- a grade preferred by gasoline refiners. This Nymex price now serves as a global benchmark. Cushing has also become an important way station for heavier Canadian crude.

USD/barrel USD/barrel Price of barrel for future delivery x months from now on 2/7/2007 on 10/7/2007 1M 2M 4M 5M OM 7M 8M 9M 10M 11M 1Y 13M 14M 15M 16M 17M 18M 19M 20M 21M 22M 23M 2Y 58.74 59.39 60.19 60.86 61.42 61.92 62.38 62.79 63.15 63.47 63.74 63.96 64.13 64.24 64.33 64.42 64.47 64.49 64.51 64.53 64.55 64.57 64.56 64.55 81.22 80.62 79.94 79.32 78.82 78.42 78.08 77.76 77.46 77.19 76.95 76.72 76.49 76.27 76.06 75.85 75.66 75.48 75.3 75.13 74.96 74.8 74.65 74.53 USD/barrel USD/barrel Price of barrel for future delivery x months from now on 2/7/2007 on 10/7/2007 1M 2M 4M 5M OM 7M 8M 9M 10M 11M 1Y 13M 14M 15M 16M 17M 18M 19M 20M 21M 22M 23M 2Y 58.74 59.39 60.19 60.86 61.42 61.92 62.38 62.79 63.15 63.47 63.74 63.96 64.13 64.24 64.33 64.42 64.47 64.49 64.51 64.53 64.55 64.57 64.56 64.55 81.22 80.62 79.94 79.32 78.82 78.42 78.08 77.76 77.46 77.19 76.95 76.72 76.49 76.27 76.06 75.85 75.66 75.48 75.3 75.13 74.96 74.8 74.65 74.53Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started