Answered step by step

Verified Expert Solution

Question

1 Approved Answer

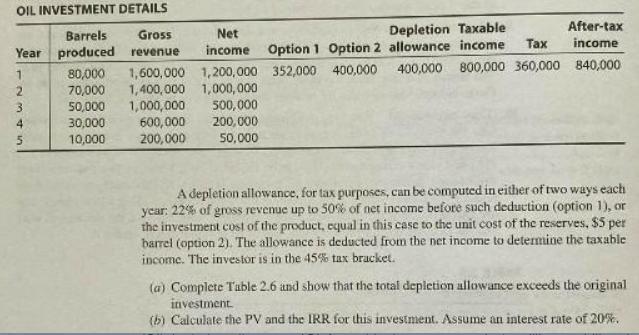

OIL INVESTMENT DETAILS Barrels Gross Year produced revenue 1 2 4 5 Net Depletion Taxable income Option 1 Option 2 allowance income 80,000 1,600,000

OIL INVESTMENT DETAILS Barrels Gross Year produced revenue 1 2 4 5 Net Depletion Taxable income Option 1 Option 2 allowance income 80,000 1,600,000 1,200,000 352,000 400,000 70,000 1,400,000 1,000,000 50,000 1,000,000 500,000 30,000 600,000 200,000 10,000 200,000 50,000 After-tax Tax income 400,000 800,000 360,000 840,000 A depletion allowance, for tax purposes, can be computed in either of two ways each year: 22% of gross revenue up to 50% of net income before such deduction (option 1), or the investment cost of the product, equal in this case to the unit cost of the reserves, $5 per barrel (option 2). The allowance is deducted from the net income to determine the taxable income. The investor is in the 45% tax bracket. (a) Complete Table 2.6 and show that the total depletion allowance exceeds the original investment. (b) Calculate the PV and the IRR for this investment. Assume an interest rate of 20%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Completing Table 26 To calculate the total depletion allowance for each year you can use either op...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started