Answered step by step

Verified Expert Solution

Question

1 Approved Answer

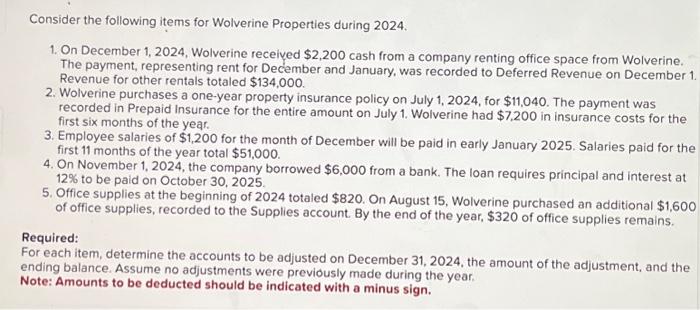

ok Consider the following items for Wolverine Properties during 2024. 1. On December 1, 2024, Wolverine received $2,200 cash from a company renting office space

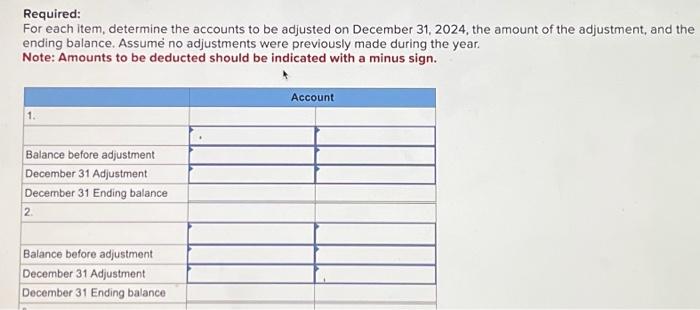

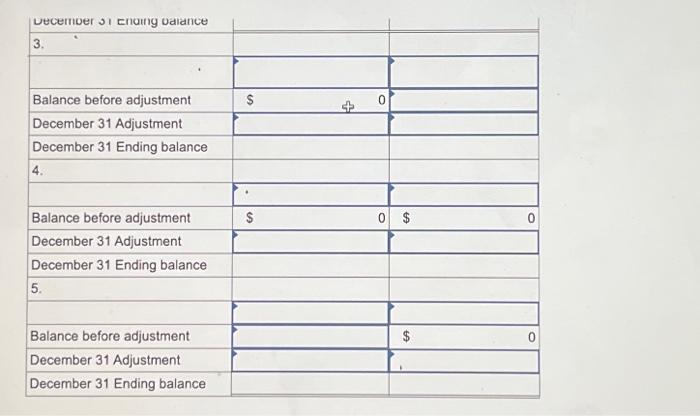

ok Consider the following items for Wolverine Properties during 2024. 1. On December 1, 2024, Wolverine received $2,200 cash from a company renting office space from Wolverine. The payment, representing rent for December and January, was recorded to Deferred Revenue on December 1. Revenue for other rentals totaled $134,000. 2. Wolverine purchases a one-year property insurance policy on July 1, 2024, for $11,040. The payment was recorded in Prepaid Insurance for the entire amount on July 1. Wolverine had $7,200 in insurance costs for the first six months of the year. 3. Employee salaries of $1,200 for the month of December will be paid in early January 2025. Salaries paid for the first 11 months of the year total $51,000. 4. On November 1, 2024, the company borrowed $6,000 from a bank. The loan requires principal and interest at 12% to be paid on October 30, 2025. 5. Office supplies at the beginning of 2024 totaled $820. On August 15, Wolverine purchased an additional $1,600 of office supplies, recorded to the Supplies account. By the end of the year, $320 of office supplies remains. Required: For each item, determine the accounts to be adjusted on December 31, 2024, the amount of the adjustment, and the ending balance. Assume no adjustments were previously made during the year. Note: Amounts to be deducted should be indicated with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started