Answered step by step

Verified Expert Solution

Question

1 Approved Answer

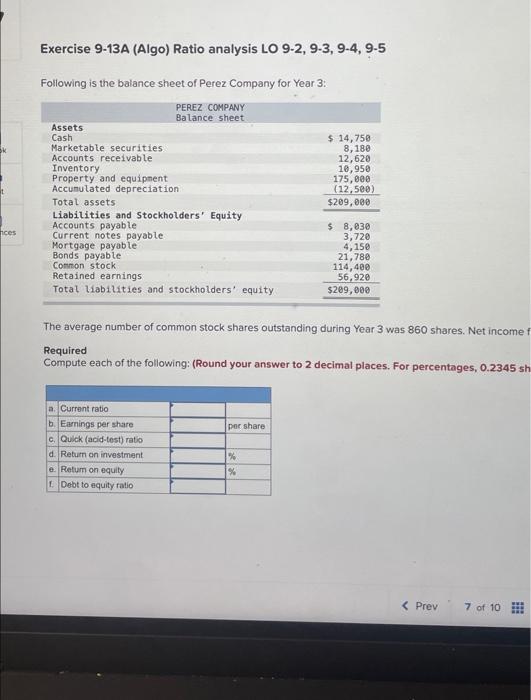

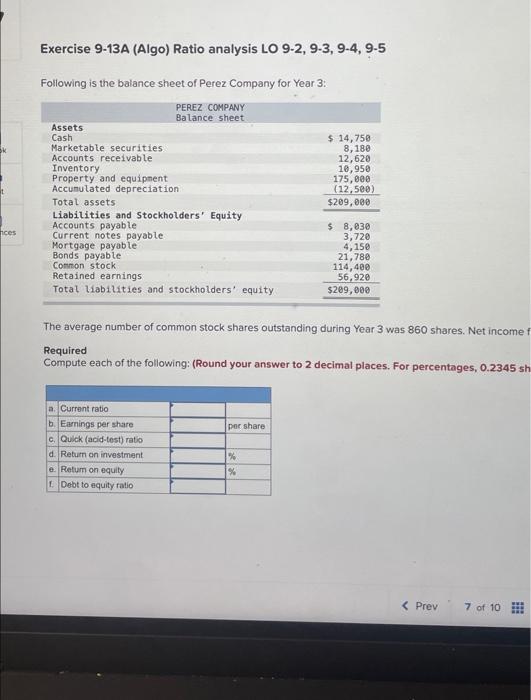

ok t nces Exercise 9-13A (Algo) Ratio analysis LO 9-2, 9-3, 9-4, 9-5 Following is the balance sheet of Perez Company for Year 3: Assets

ok t nces Exercise 9-13A (Algo) Ratio analysis LO 9-2, 9-3, 9-4, 9-5 Following is the balance sheet of Perez Company for Year 3: Assets Cash Marketable securities Accounts receivable Inventory Property and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Current notes payable Mortgage payable PEREZ COMPANY Balance sheet Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity a. Current ratio b. Earnings per share c. Quick (acid-test) ratio d. Return on investment e. Return on equity f. Debt to equity ratio The average number of common stock shares outstanding during Year 3 was 860 shares. Net income f $ 14,750 8,180 12,620 10,950 175,000 (12,500) $209,000 Required Compute each of the following: (Round your answer to 2 decimal places. For percentages, 0.2345 sh per share $ 8,030 3,720 4,150 % % 21,780 114,400 56,920 $209,000

Exercise 9-13A (Algo) Ratio analysis LO 9-2, 9-3, 9-4, 9-5 Following is the balance sheet of Perez Company for Year 3 : The average number of common stock shares outstanding during Year 3 was 860 shares. Net income Required Compute each of the following: (Round your answer to 2 decimal places. For percentages, 0.2345 sh Exercise 9-13A (Algo) Ratio analysis LO 9-2, 9-3, 9-4, 9-5 Following is the balance sheet of Perez Company for Year 3 : The average number of common stock shares outstanding during Year 3 was 860 shares. Net income Required Compute each of the following: (Round your answer to 2 decimal places. For percentages, 0.2345 sh

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started