Answered step by step

Verified Expert Solution

Question

1 Approved Answer

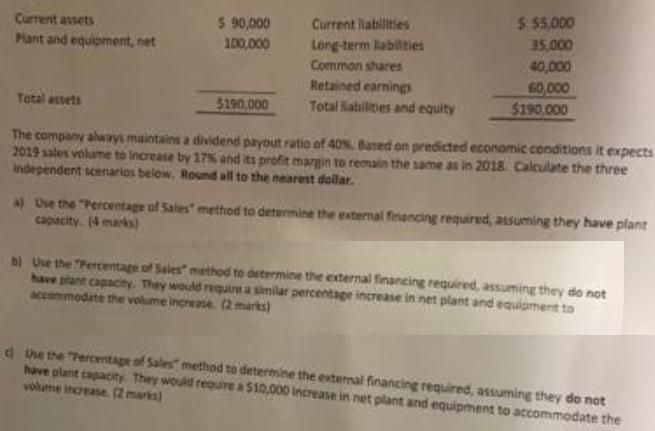

Okanagan Ltd. reported 2018 sales of $150,000 and earnings after tax of $15,000. Its December 31, 2018 condensed balance sheet follows: Current assets Plant and

Okanagan Ltd. reported 2018 sales of $150,000 and earnings after tax of $15,000. Its December 31, 2018 condensed balance sheet follows:

Current assets Plant and equipment, net Total assets $ 90,000 100,000 $190,000 Current Rabilities Long-term labilities Common shares Retained earnings Total abilities and equity $ $5,000 35,000 40,000 60,000 $190,000 The company always maintains a dividend payout ratio of 40%. Based on predicted economic conditions it expects 2019 sales volume to increase by 17% and its profit margin to remain the same as in 2018. Calculate the three independent scenarios below. Round all to the nearest dollar. al Use the "Percentage of Sales" method to determine the external financing required, assuming they have plant capacity. (4 marks) b) Use the Percentage of Sales" method to determine the external financing required, assuming they do not have plant capacity. They would require a similar percentage increase in net plant and equipment to accommodate the volume increase. (2 marks) Use the Percentage of Sales" method to determine the external financing required, assuming they do not have plant capacity. They would require a $10,000 Increase in net plant and equipment to accommodate the volume increase. (2 marks]

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution U1 1 WN 2 3 456 o 7 8 9 10 11 12 13 14 15 16 17 co 18 19 20 21 a 22...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started