Answered step by step

Verified Expert Solution

Question

1 Approved Answer

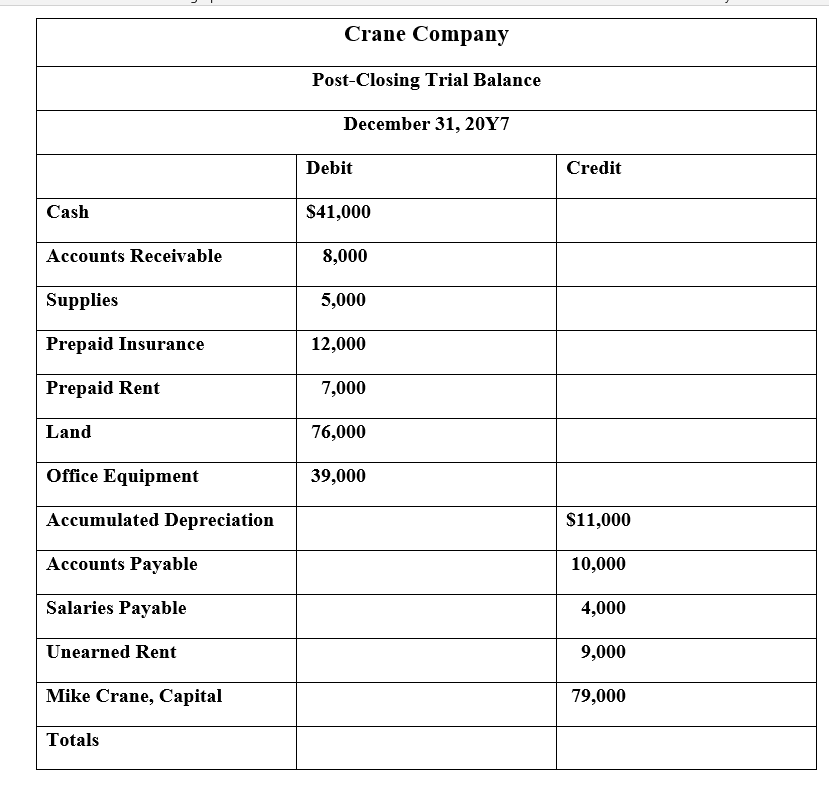

Okay, I already did the closing journal entries. However, while doing the post-closing trial balance, I don't get the totals of credit and debit to

Okay, I already did the closing journal entries. However, while doing the post-closing trial balance, I don't get the totals of credit and debit to be equal. I don't understand why?

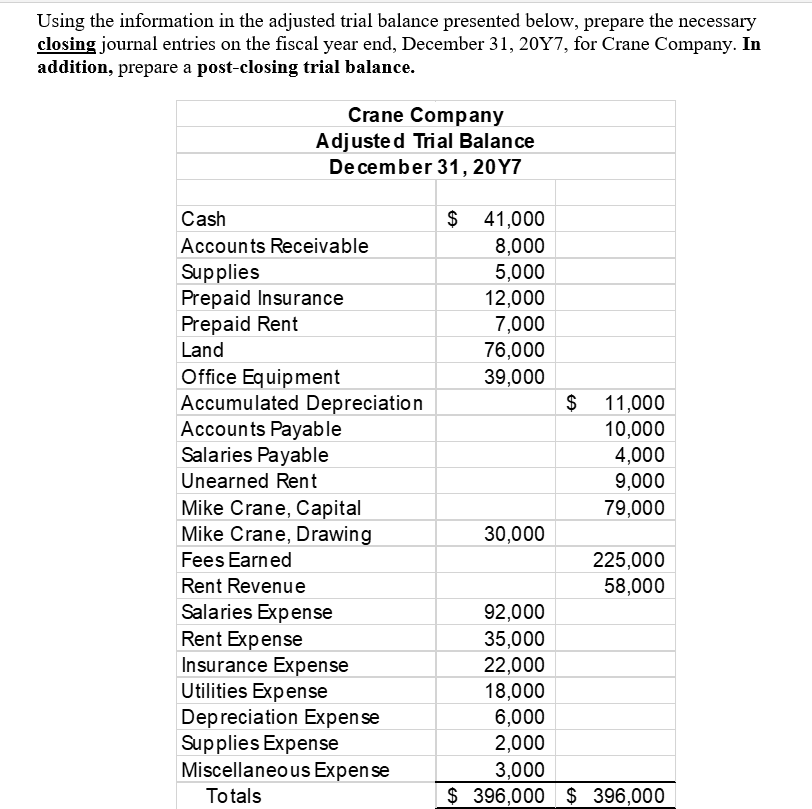

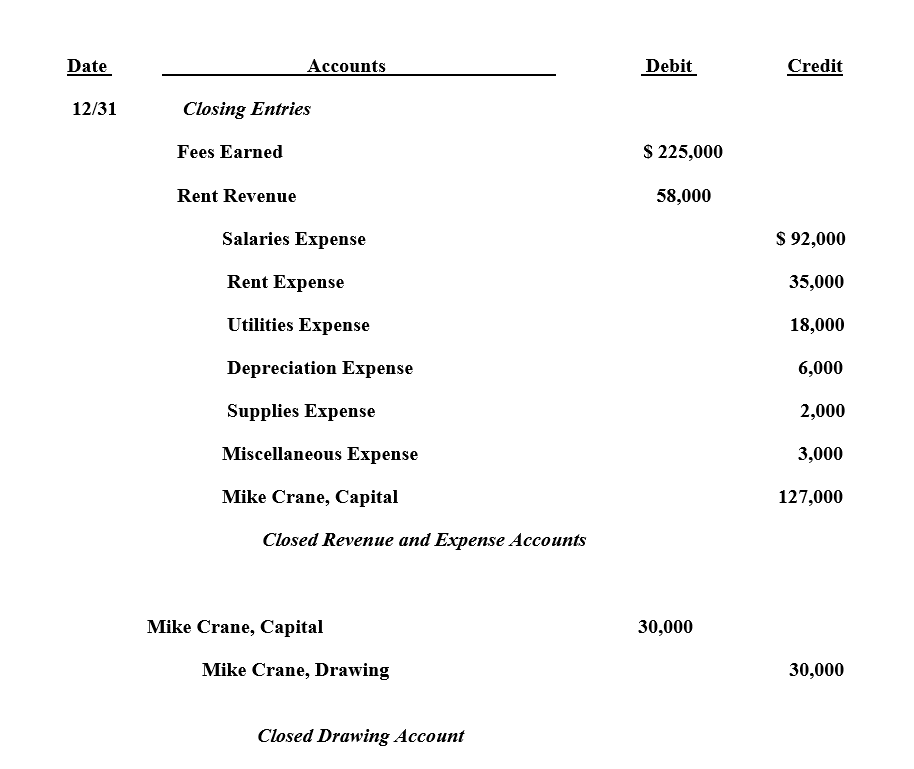

Using the information in the adjusted trial balance presented below, prepare the necessary closing journal entries on the fiscal year end, December 31, 2017, for Crane Company. In addition, prepare a post-closing trial balance. Crane Company Adjusted Trial Balance December 31, 20 Y7 Cash Accounts Receivable Supplies Prepaid Insurance Prepaid Rent Land Office Equipment Accumulated Depreciation Accounts Payable Salaries Payable Unearned Rent Mike Crane, Capital Mike Crane, Drawing Fees Earned Rent Revenue Salaries Expense Rent Expense Insurance Expense Utilities Expense Depreciation Expense Supplies Expense Miscellaneous Expense Totals $ 41,000 8,000 5,000 12,000 7,000 76,000 39,000 $ 11,000 10,000 4,000 9,000 79,000 30,000 225,000 58,000 92,000 35,000 22,000 18,000 6,000 2,000 3,000 $ 396,000 $ 396,000 Date Accounts Debit Credit 12/31 Closing Entries Fees Earned $ 225,000 Rent Revenue 58,000 Salaries Expense $ 92,000 Rent Expense 35,000 Utilities Expense 18,000 Depreciation Expense 6,000 Supplies Expense 2,000 Miscellaneous Expense 3,000 Mike Crane, Capital 127,000 Closed Revenue and Expense Accounts Mike Crane, Capital 30,000 Mike Crane, Drawing 30,000 Closed Drawing Account Crane Company Post-Closing Trial Balance December 31, 2017 Debit Credit Cash S41,000 Accounts Receivable 8,000 Supplies 5,000 Prepaid Insurance 12,000 Prepaid Rent 7,000 Land 76,000 Office Equipment 39,000 Accumulated Depreciation $11,000 Accounts Payable 10,000 Salaries Payable 4,000 Unearned Rent 9,000 Mike Crane, Capital 79,000 TotalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started