Okay then can u tell me the steps at least lmao?

Okay then can u tell me the steps at least lmao?

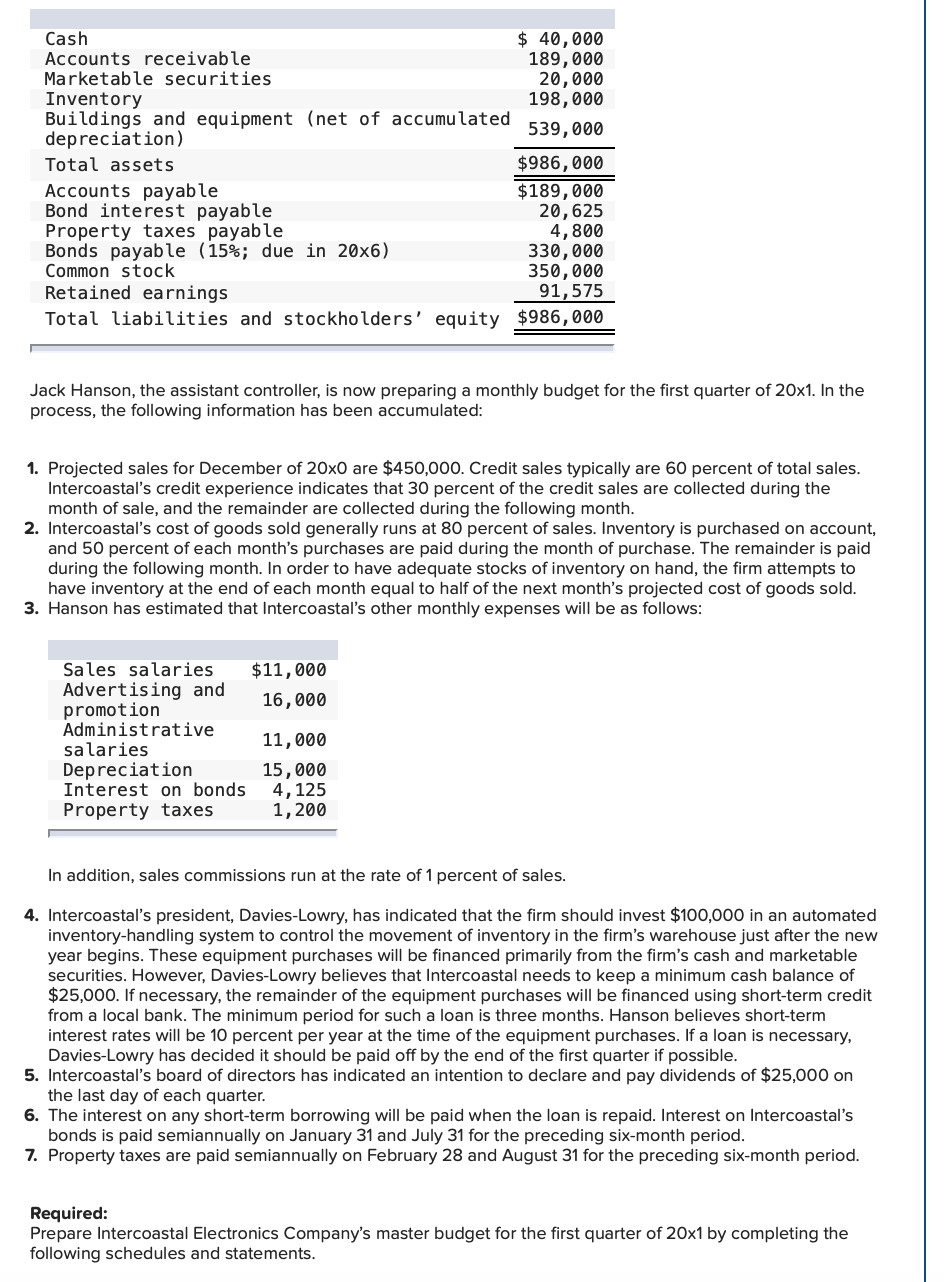

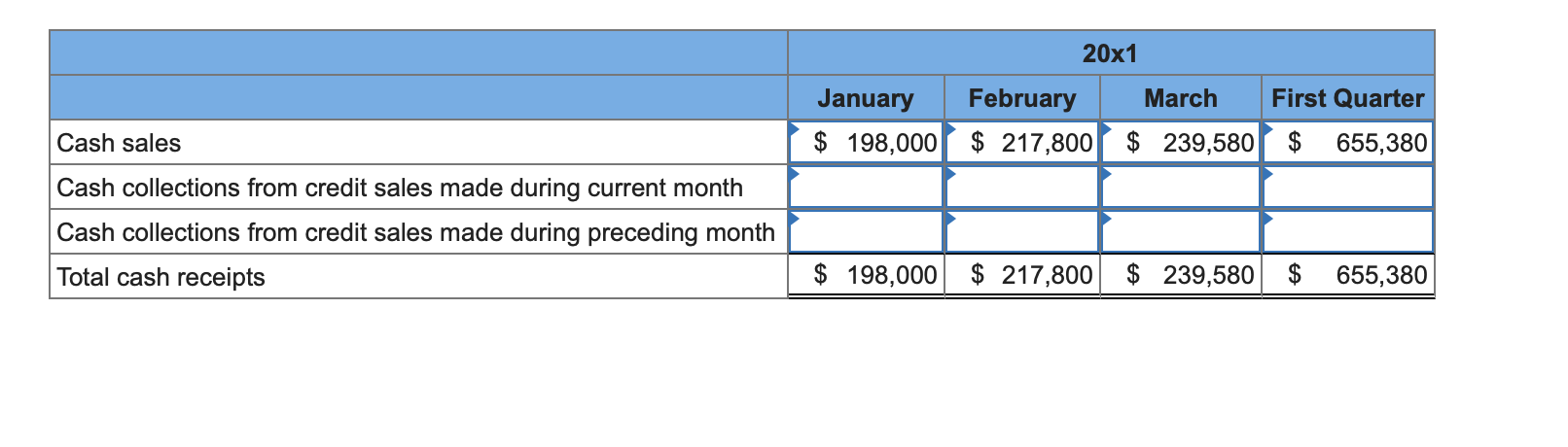

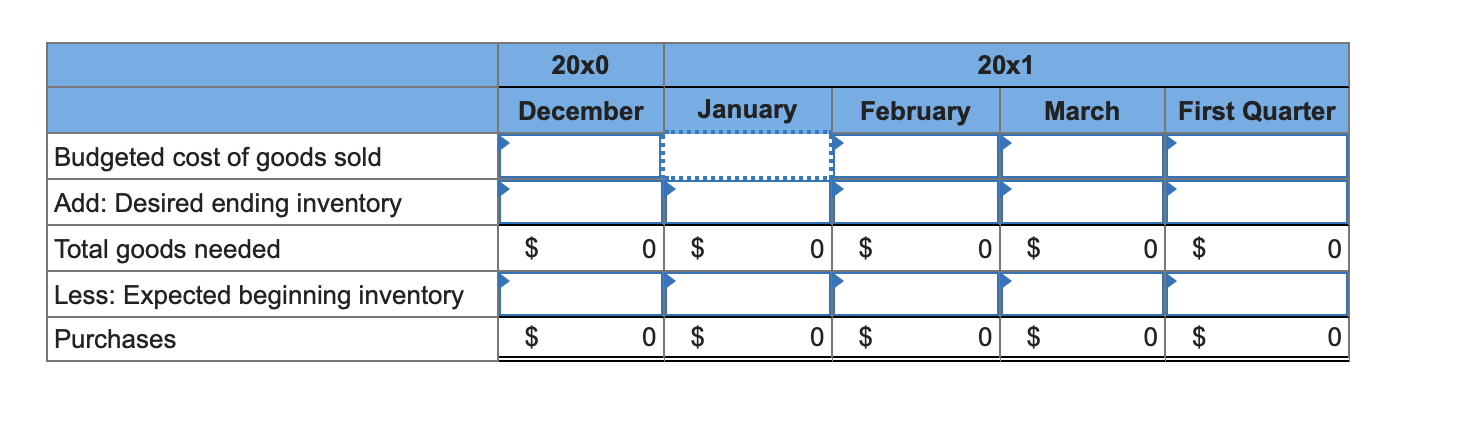

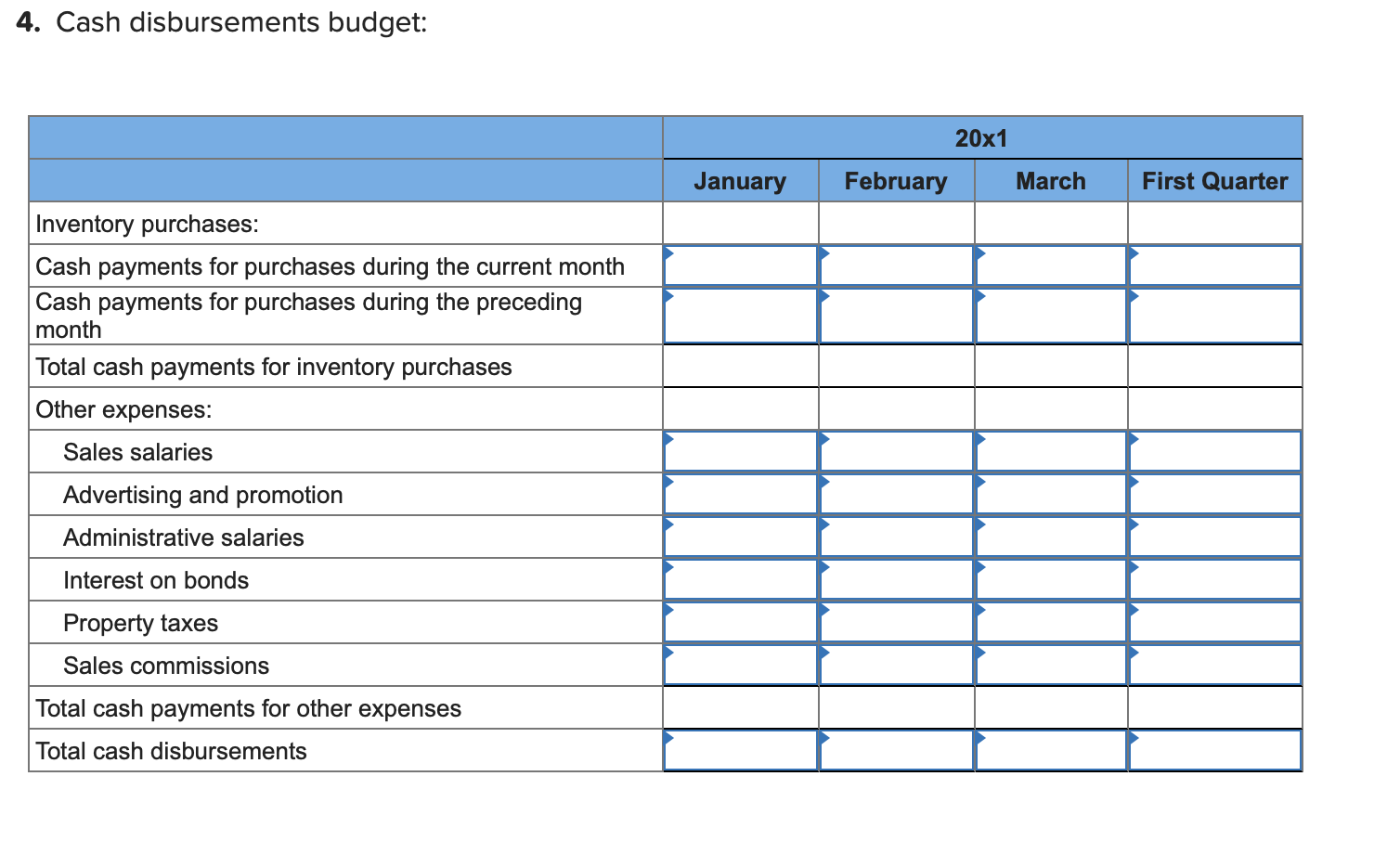

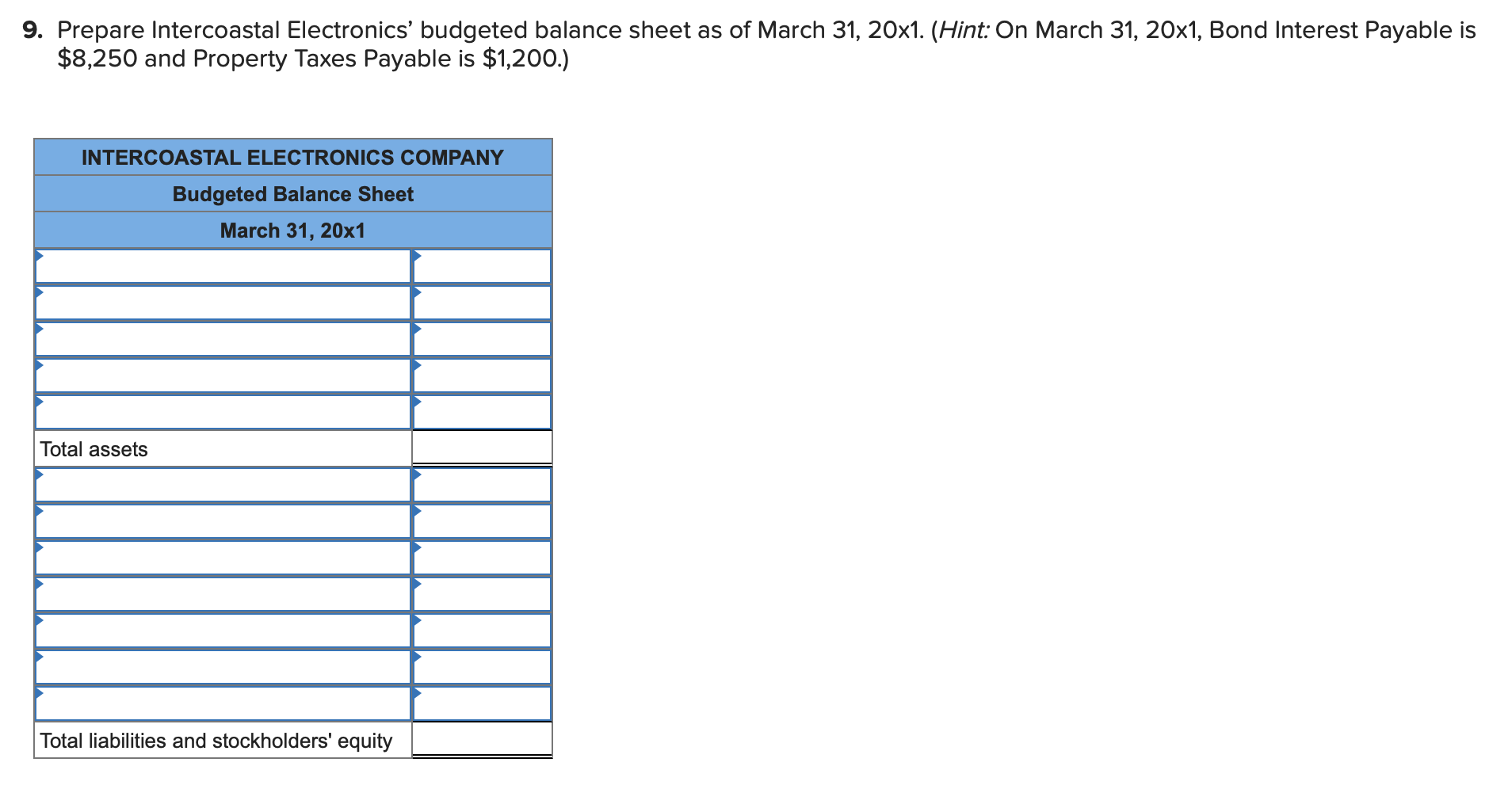

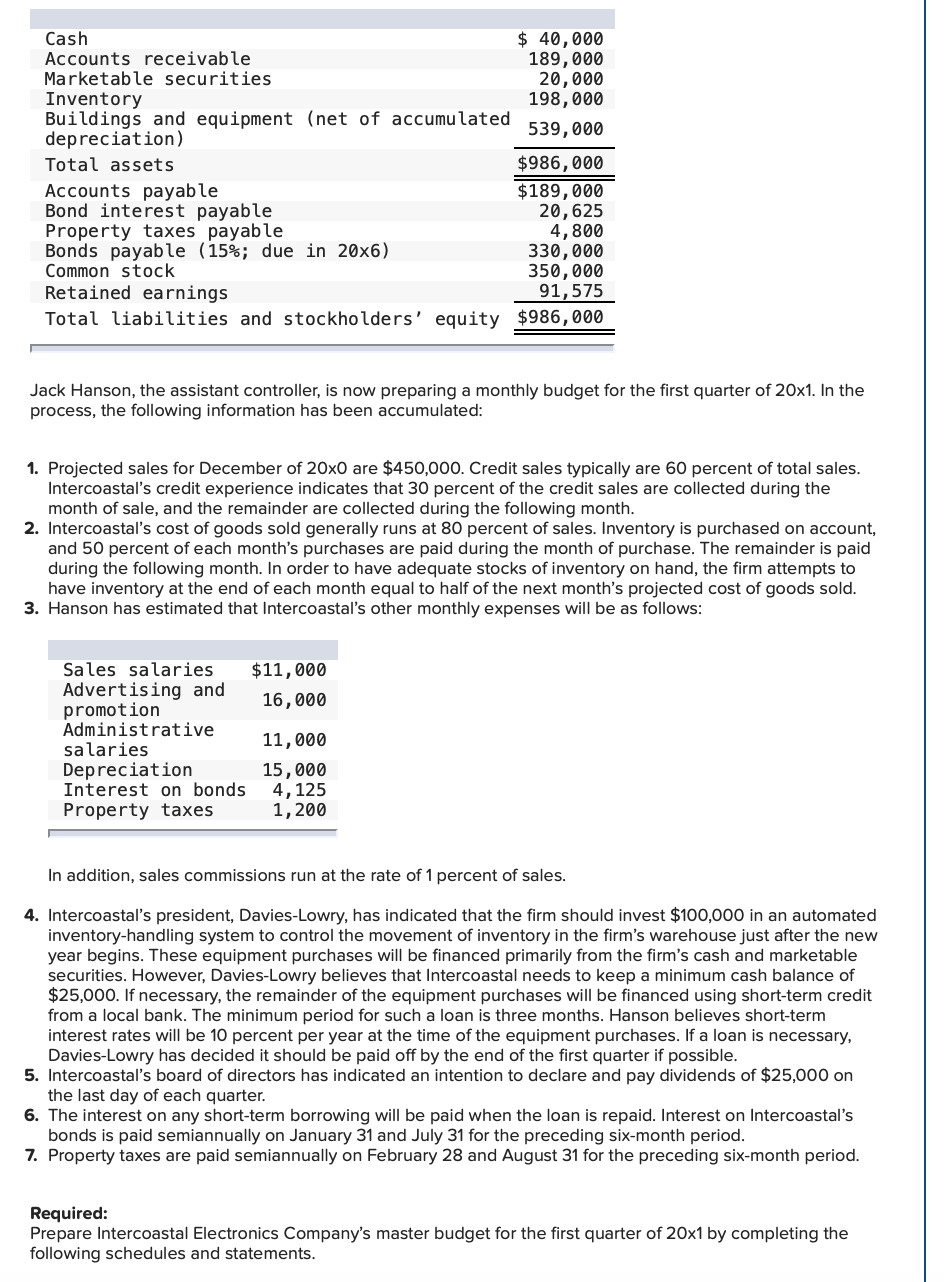

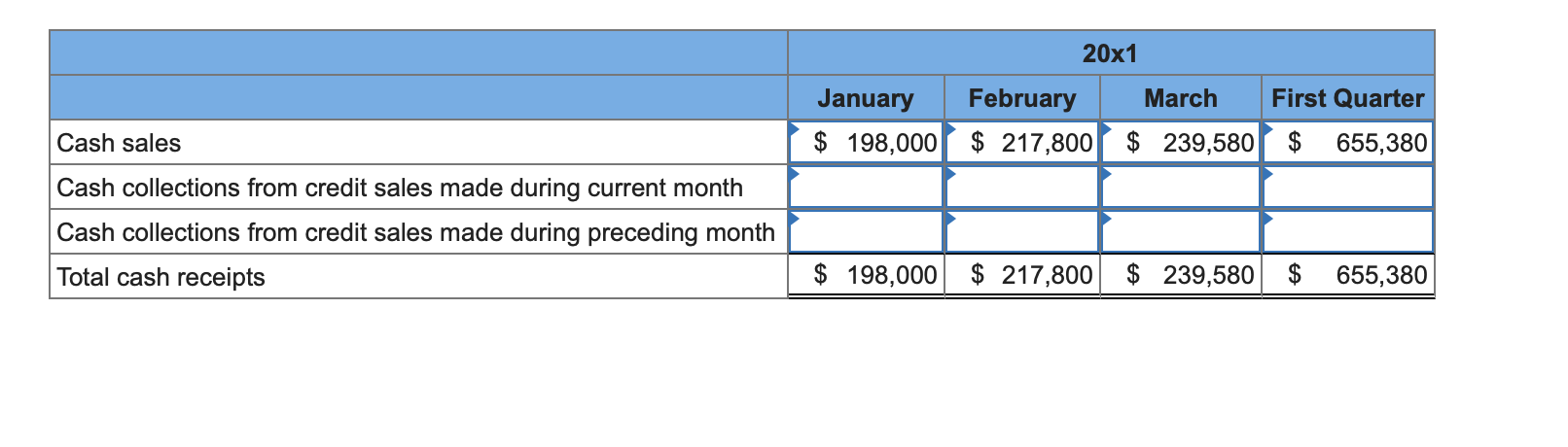

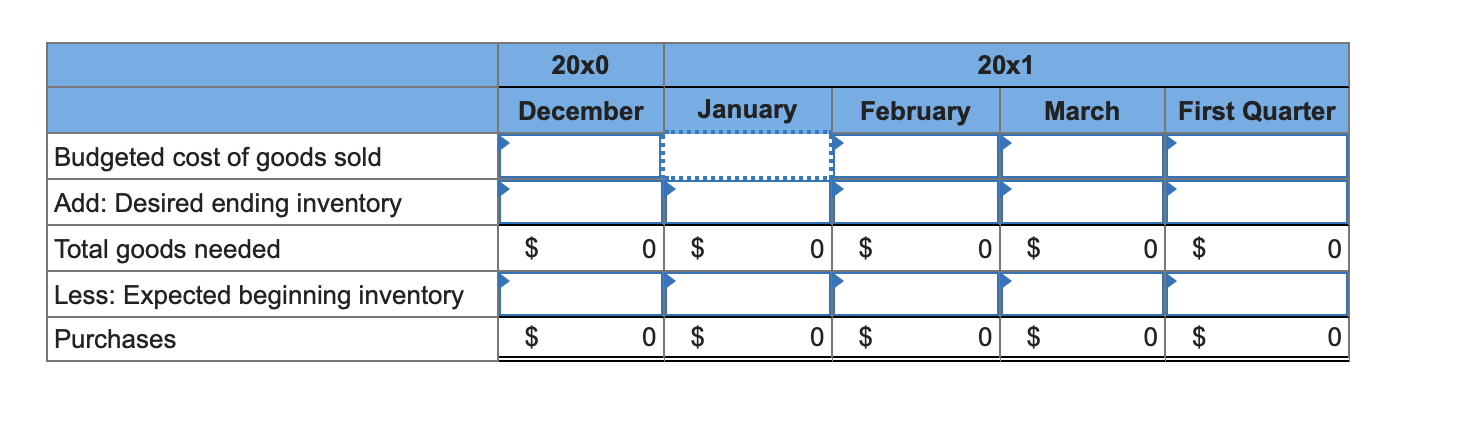

Cash $ 40,000 Accounts receivable 189,000 Marketable securities 20,000 Inventory 198,000 Buildings and equipment (net of accumulated depreciation) 539,000 Total assets $986,000 Accounts payable $189,000 Bond interest payable 20,625 Property taxes payable 4,800 Bonds payable (15%; due in 20x6) 330,000 Common stock 350,000 Retained earnings 91,575 Total liabilities and stockholders' equity $986,000 Jack Hanson, the assistant controller, is now preparing a monthly budget for the first quarter of 20x1. In the process, the following information has been accumulated: 1. Projected sales for December of 20x0 are $450,000. Credit sales typically are 60 percent of total sales. Intercoastal's credit experience indicates that 30 percent of the credit sales are collected during the month of sale, and the remainder are collected during the following month. 2. Intercoastal's cost of goods sold generally runs at 80 percent of sales. Inventory is purchased on account, and 50 percent of each month's purchases are paid during the month of purchase. The remainder is paid during the following month. In order to have adequate stocks of inventory on hand, the firm attempts to have inventory at the end of each month equal to half of the next month's projected cost of goods sold. 3. Hanson has estimated that Intercoastal's other monthly expenses will be as follows: Sales salaries $11,000 Advertising and promotion 16,000 Administrative salaries 11,000 Depreciation 15,000 Interest on bonds 4, 125 Property taxes 1,200 In addition, sales commissions run at the rate of 1 percent of sales. 4. Intercoastal's president, Davies-Lowry, has indicated that the firm should invest $100,000 in an automated inventory-handling system to control the movement of inventory in the firm's warehouse just after the new year begins. These equipment purchases will be financed primarily from the firm's cash and marketable securities. However, Davies-Lowry believes that Intercoastal needs to keep a minimum cash balance of $25,000. If necessary, the remainder of the equipment purchases will be financed using short-term credit from a local bank. The minimum period for such a loan is three months. Hanson believes short-term interest rates will be 10 percent per year at the time of the equipment purchases. If a loan is necessary, Davies-Lowry has decided it should be paid off by the end of the first quarter if possible. 5. Intercoastal's board of directors has indicated an intention to declare and pay dividends of $25,000 on the last day of each quarter. 6. The interest on any short-term borrowing will be paid when the loan is repaid. Interest on Intercoastal's bonds is paid semiannually on January 31 and July 31 for the preceding six- month period. 7. Property taxes are paid semiannually on February 28 and August 31 for the preceding six-month period. Required: Prepare Intercoastal Electronics Company's master budget for the first quarter of 20x1 by completing the following schedules and statements. 20x1 First Quarter January February March $ 198,000 $ 217,800 $ 239,580 Cash sales $ 655,380 Cash collections from credit sales made during current month Cash collections from credit sales made during preceding month Total cash receipts $ 198,000 $ 217,800 $ 239,580 $ 655,380 20x0 20x1 December January February March First Quarter Budgeted cost of goods sold Add: Desired ending inventory Total goods needed Less: Expected beginning inventory Purchases $ 0 $ 0 $ 0 $ 0 0 $ 0 0 0 $ 0 4. Cash disbursements budget: 20x1 January February March First Quarter Inventory purchases: Cash payments for purchases during the current month Cash payments for purchases during the preceding month Total cash payments for inventory purchases Other expenses: Sales salaries Advertising and promotion Administrative salaries Interest on bonds Property taxes Sales commissions Total cash payments for other expenses Total cash disbursements 5. Complete the first three lines of the summary cash budget. Then do the analysis of short-term financing needs in requirement (6). Then finish requirement (5). 20x1 January February March First Quarter Cash receipts (from part 2) Less: Cash disbursements (from part 4) Change in cash balance during period due to operations Sale of marketable securities (1/2/x1) Proceeds from bank loan (1/2/x1) Purchase of equipment Repayment of bank loan (3/31/x1) Interest on bank loan Payment of dividends Change in cash balance during first quarter Cash balance, 1/1/x1 Cash balance, 3/31/x1 6. Calculation of required short-term borrowing. Projected cash balance as of December 31, 20x0 Less: Minimum cash balance Cash available for equipment purchases Projected proceeds from sale of marketable securities Cash available Less: Cost of investment in equipment Required short-term borrowing 7. Prepare Intercoastal Electronics' budgeted income statement for the first quarter of 20x1. (Ignore income taxes.) INTERCOASTAL ELECTRONICS COMPANY Budgeted Income Statement For the First Quarter of 20x1 Selling and administrative expenses: Total selling and administrative expenses 8. Prepare Intercoastal Electronics' budgeted statement of retained earnings for the first quarter of 20x1. INTERCOASTAL ELECTRONICS COMPANY Budgeted Statement of Retained Earnings For the First Quarter of 20x1 Retained earnings, 12/31/x0 Retained earnings, 3/31/x1 9. Prepare Intercoastal Electronics' budgeted balance sheet as of March 31, 20x1. (Hint: On March 31, 20x1, Bond Interest Payable is $8,250 and Property Taxes Payable is $1,200.) INTERCOASTAL ELECTRONICS COMPANY Budgeted Balance Sheet March 31, 20x1 Total assets Total liabilities and stockholders' equity

Okay then can u tell me the steps at least lmao?

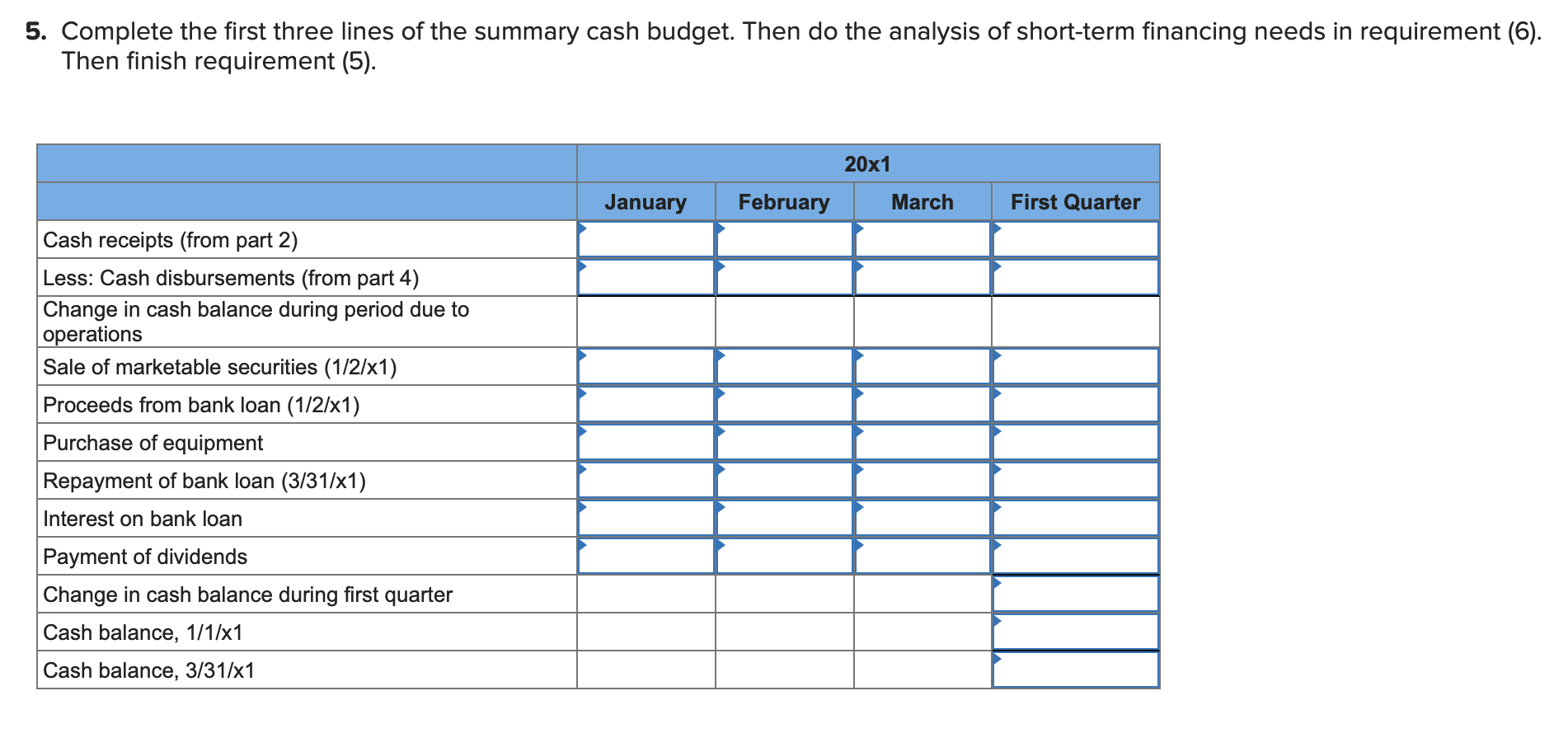

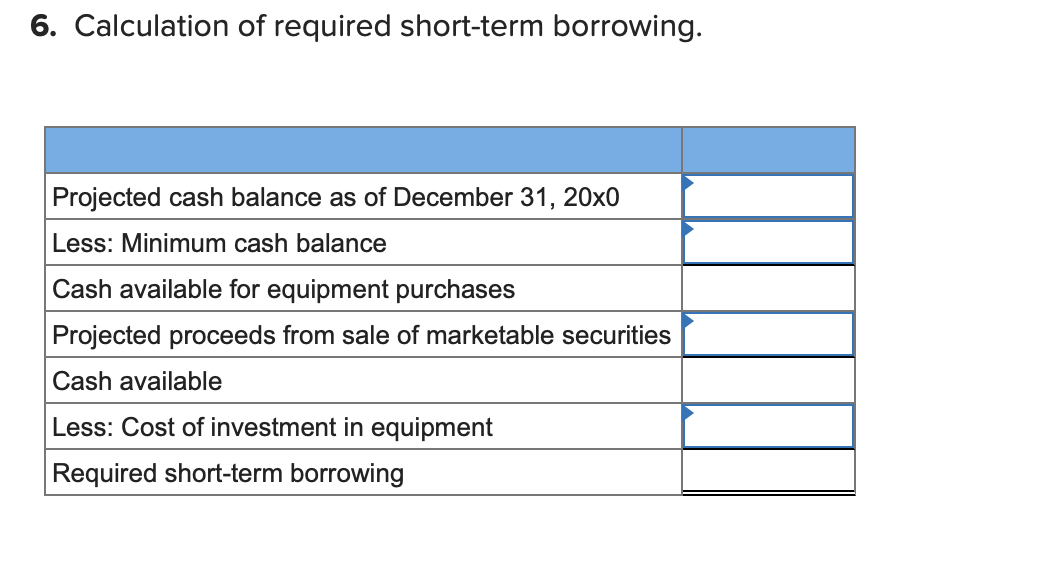

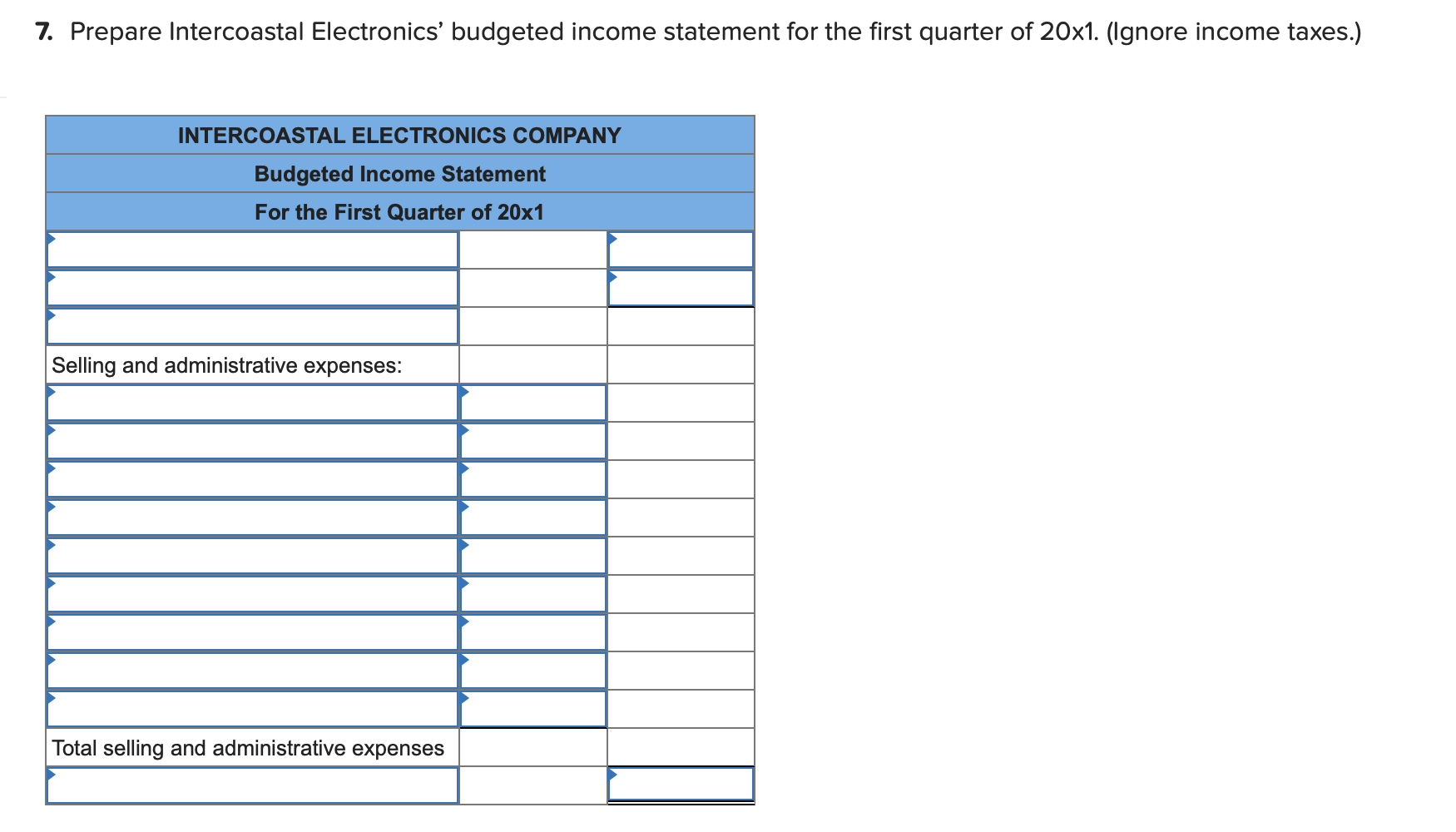

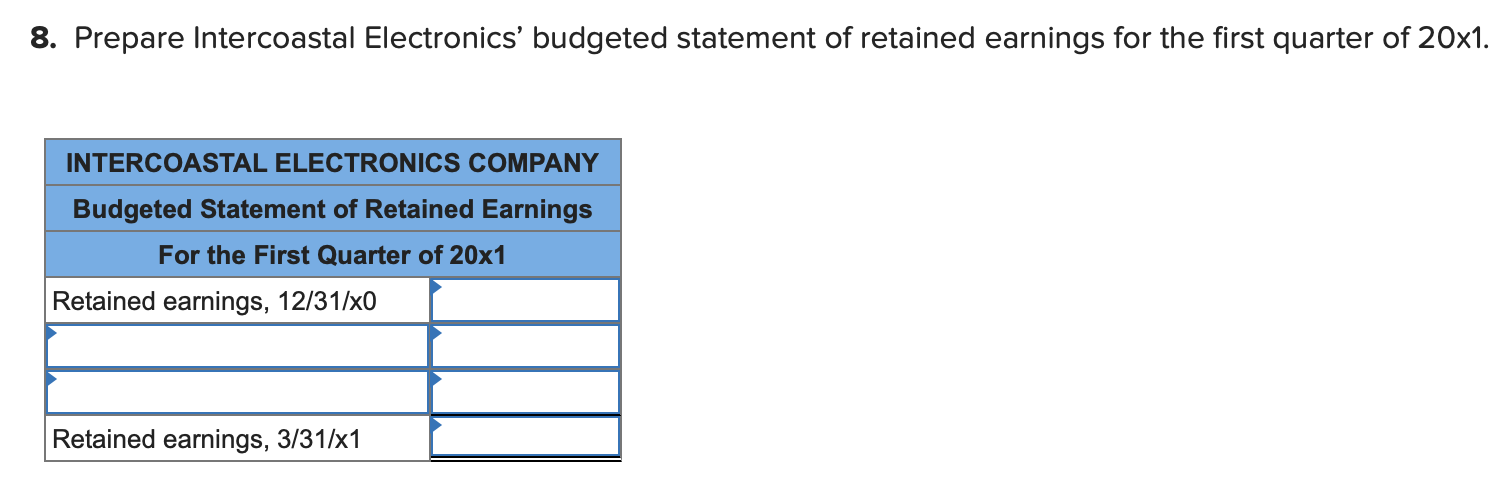

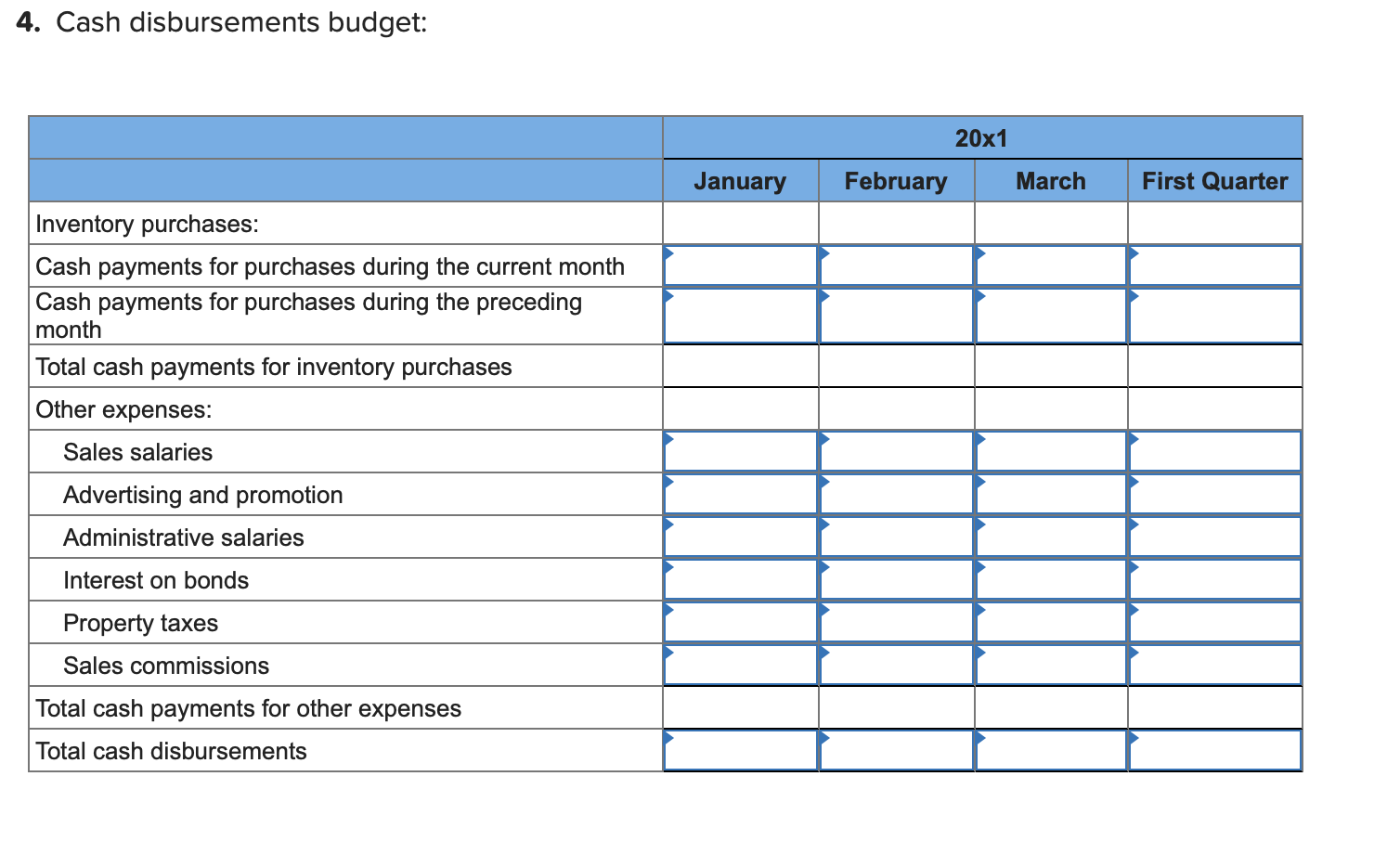

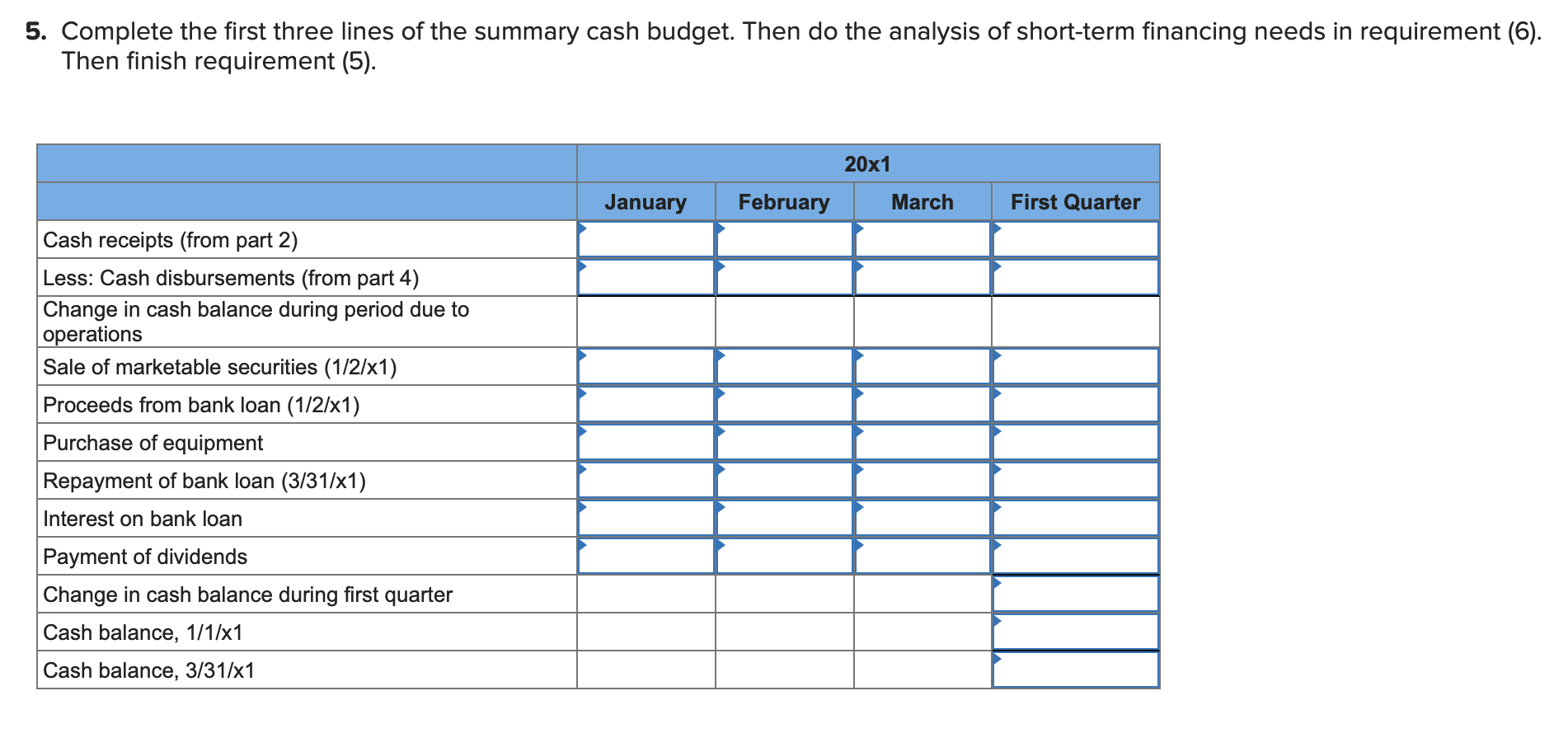

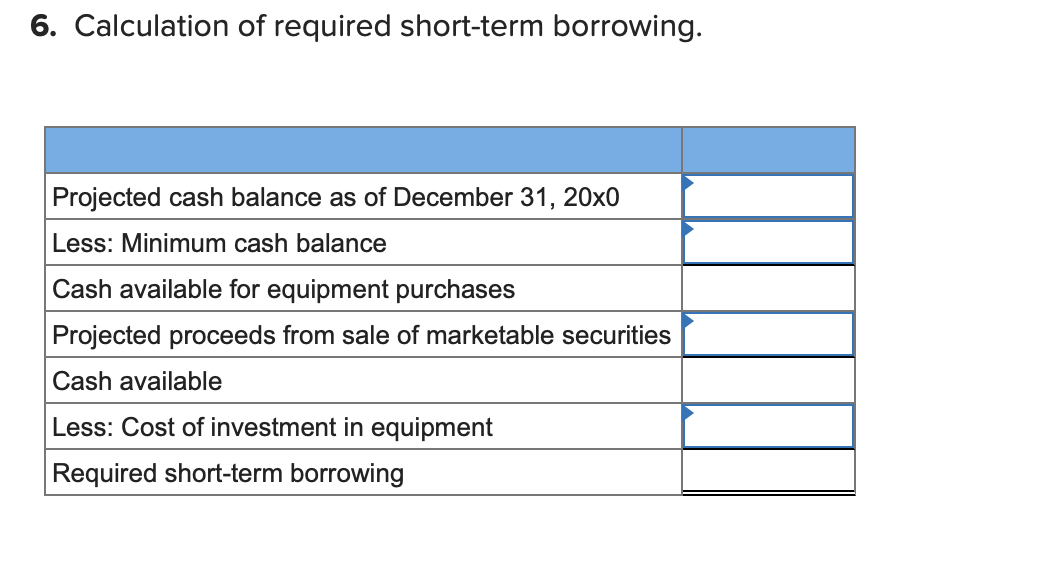

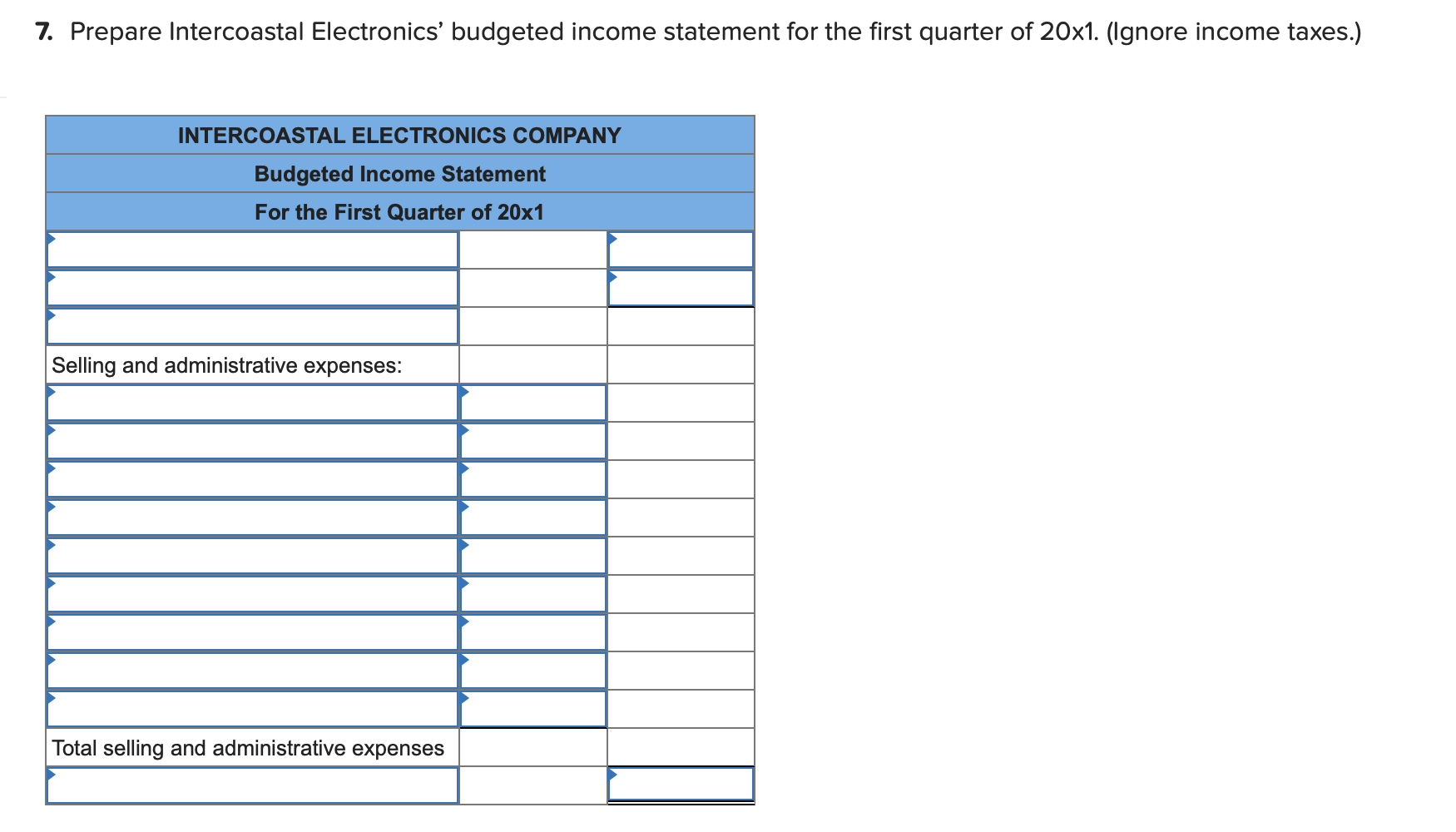

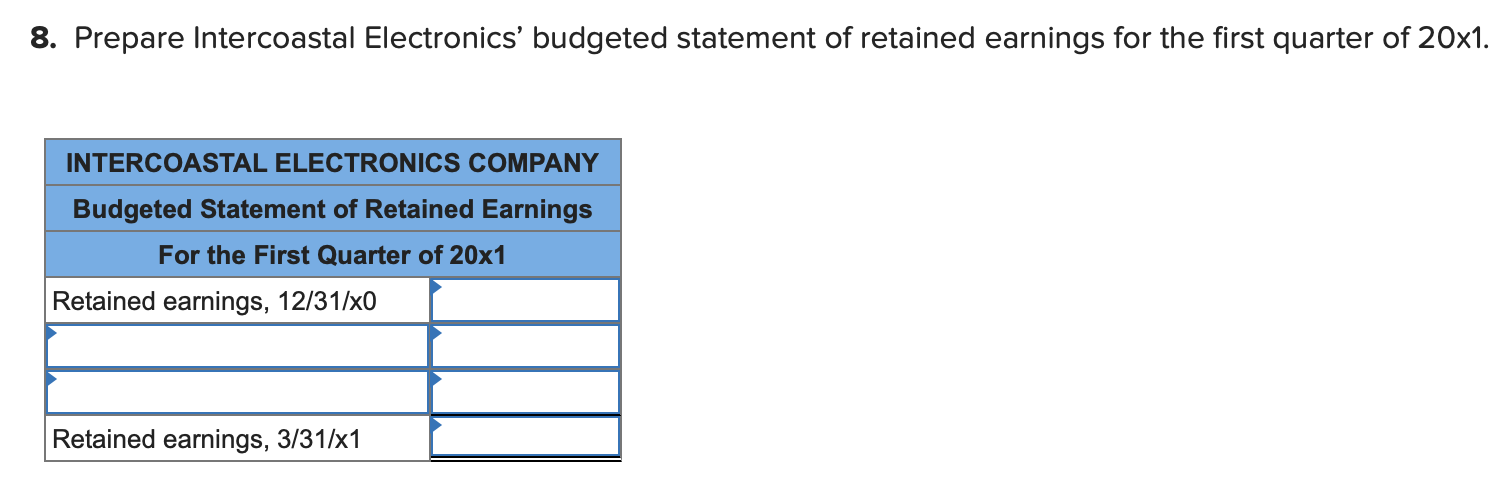

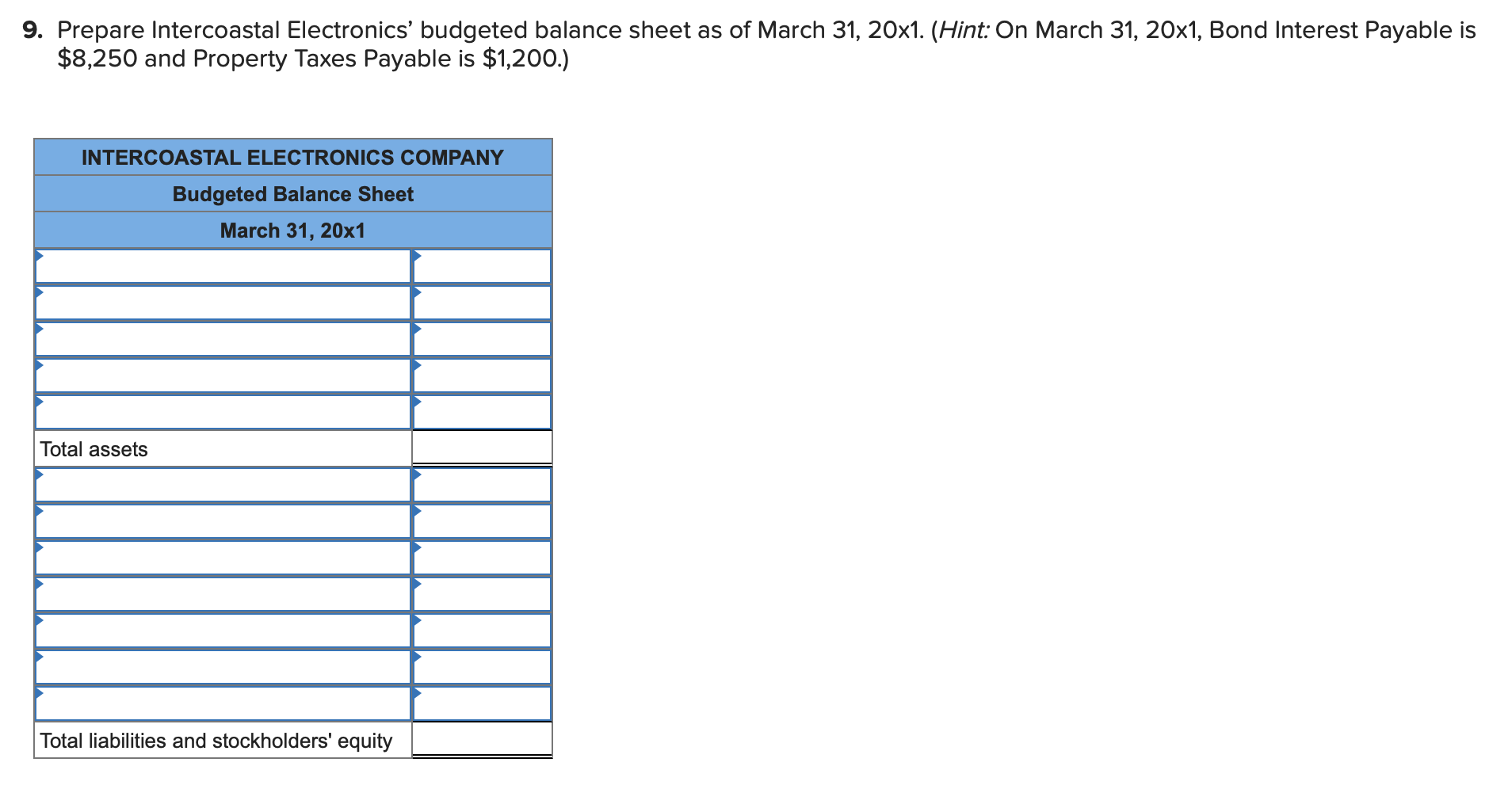

Okay then can u tell me the steps at least lmao?