Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old Laser Printer Originally purchased three years ago at an installed cost of $ 400,000, it is being depreciated under MACRS using a 5-year

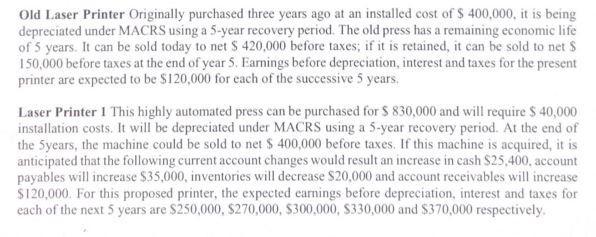

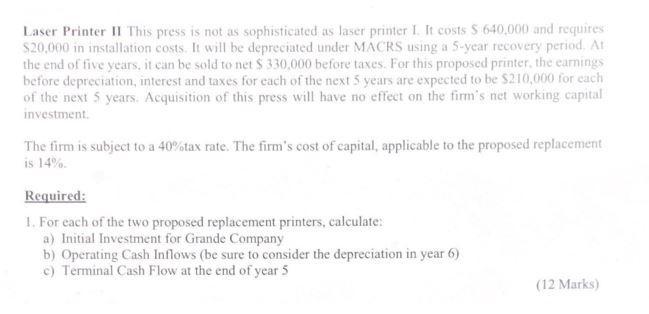

Old Laser Printer Originally purchased three years ago at an installed cost of $ 400,000, it is being depreciated under MACRS using a 5-year recovery period. The old press has a remaining economic life of 5 years. It can be sold today to net $ 420,000 before taxes; if it is retained, it can be sold to net S 150,000 before taxes at the end of year 5. Earnings before depreciation, interest and taxes for the present printer are expected to be $120,000 for each of the successive 5 years. Laser Printer I This highly automated press can be purchased for $ 830,000 and will require $ 40,000 installation costs. It will be depreciated under MACRS using a 5-year recovery period. At the end of the 5years, the machine could be sold to net $ 400,000 before taxes. If this machine is acquired, it is anticipated that the following current account changes would result an increase in cash $25,400, account payables will increase $35,000, inventories will decrease $20,000 and account receivables will increase $120,000. For this proposed printer, the expected earnings before depreciation, interest and taxes for each of the next 5 years are $250,000, $270,000, $300,000, $330,000 and $370,000 respectively. Laser Printer II This press is not as sophisticated as laser printer I. It costs S 640,000 and requires $20,000 in installation costs. It will be depreciated under MACRS using a 5-year recovery period. At the end of five years, it can be sold to net $ 330,000 before taxes. For this proposed printer, the earnings before depreciation, interest and taxes for each of the next 5 years are expected to be $210,000 for each of the next 5 years. Acquisition of this press will have no effect on the firm's net working capital investment. The firm is subject to a 40%tax rate. The firm's cost of capital, applicable to the proposed replacement is 14%. Required: 1. For each of the two proposed replacement printers, calculate: a) Initial Investment for Grande Company b) Operating Cash Inflows (be sure to consider the depreciation in year 6) c) Terminal Cash Flow at the end of year 5 (12 Marks)

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Old Printer was purchased 3 year ago for 400000 and is subjected to 5 year MACR Depreciation Year Book Value at beginning 5Years MACR Depreciation Depreciation Book Value at end 1 400000 2000 8000 392...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started