Question

Old MathJax webview 1. Consider Company A that holds mostly floating-rate short-term TL-denominated assets, partly financed with a 50m 4-year bonds with fixed 10% annual

Old MathJax webview

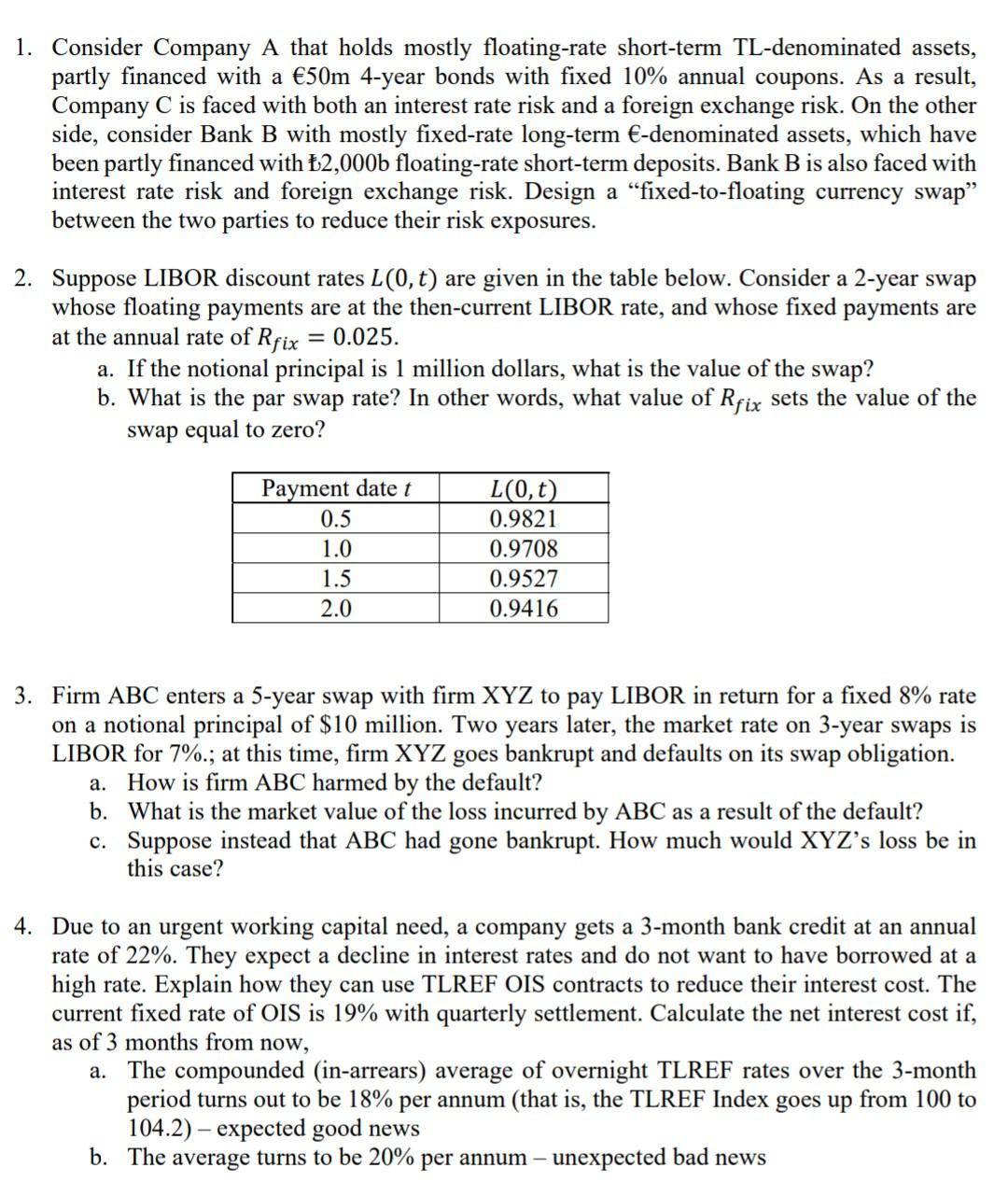

1. Consider Company A that holds mostly floating-rate short-term TL-denominated assets, partly financed with a 50m 4-year bonds with fixed 10% annual coupons. As a result, Company C is faced with both an interest rate risk and a foreign exchange risk. On the other side, consider Bank B with mostly fixed-rate long-term -denominated assets, which have been partly financed with 2,000b floating-rate short-term deposits. Bank B is also faced with interest rate risk and foreign exchange risk. Design a fixed-to-floating currency swap between the two parties to reduce their risk exposures. 2. Suppose LIBOR discount rates 0, are given in the table below. Consider a 2-year swap whose floating payments are at the then-current LIBOR rate, and whose fixed payments are at the annual rate of 0.025. a. If the notional principal is 1 million dollars, what is the value of the swap? b. What is the par swap rate? In other words, what value of sets the value of the swap equal to zero? Payment date t 0, 0.5 0.9821 1.0 0.9708 1.5 0.9527 2.0 0.9416 3. Firm ABC enters a 5-year swap with firm XYZ to pay LIBOR in return for a fixed 8% rate on a notional principal of $10 million. Two years later, the market rate on 3-year swaps is LIBOR for 7%.; at this time, firm XYZ goes bankrupt and defaults on its swap obligation. a. How is firm ABC harmed by the default? b. What is the market value of the loss incurred by ABC as a result of the default? c. Suppose instead that ABC had gone bankrupt. How much would XYZs loss be in this case? 4. Due to an urgent working capital need, a company gets a 3-month bank credit at an annual rate of 22%. They expect a decline in interest rates and do not want to have borrowed at a high rate. Explain how they can use TLREF OIS contracts to reduce their interest cost. The current fixed rate of OIS is 19% with quarterly settlement. Calculate the net interest cost if, as of 3 months from now, a. The compounded (in-arrears) average of overnight TLREF rates over the 3-month period turns out to be 18% per annum (that is, the TLREF Index goes up from 100 to 104.2) expected good news b. The average turns to be 20% per annum unexpected bad news

This is all the information given.

1. Consider Company A that holds mostly floating-rate short-term TL-denominated assets, partly financed with a 50m 4-year bonds with fixed 10% annual coupons. As a result, Company C is faced with both an interest rate risk and a foreign exchange risk. On the other side, consider Bank B with mostly fixed-rate long-term -denominated assets, which have been partly financed with 2,000b floating-rate short-term deposits. Bank B is also faced with interest rate risk and foreign exchange risk. Design a fixed-to-floating currency swap between the two parties to reduce their risk exposures. 2. Suppose LIBOR discount rates L(0,t) are given in the table below. Consider a 2-year swap whose floating payments are at the then-current LIBOR rate, and whose fixed payments are at the annual rate of Rfix = 0.025. a. If the notional principal is 1 million dollars, what is the value of the swap? b. What is the par swap rate? In other words, what value of Rfix sets the value of the swap equal to zero? Payment date t 0.5 1.0 1.5 2.0 L(0,0) 0.9821 0.9708 0.9527 0.9416 3. Firm ABC enters a 5-year swap with firm XYZ to pay LIBOR in return for a fixed 8% rate on a notional principal of $10 million. Two years later, the market rate on 3-year swaps is LIBOR for 7%.; at this time, firm XYZ goes bankrupt and defaults on its swap obligation. a. How is firm ABC harmed by the default? b. What is the market value of the loss incurred by ABC as a result of the default? c. Suppose instead that ABC had gone bankrupt. How much would XYZ's loss be in this case? 4. Due to an urgent working capital need, a company gets a 3-month bank credit at an annual rate of 22%. They expect a decline in interest rates and do not want to have borrowed at a high rate. Explain how they can use TLREF OIS contracts to reduce their interest cost. The current fixed rate of OIS is 19% with quarterly settlement. Calculate the net interest cost if, as of 3 months from now, a. The compounded (in-arrears) average of overnight TLREF rates over the 3-month period turns out to be 18% per annum (that is, the TLREF Index goes up from 100 to 104.2) - expected good news b. The average turns to be 20% per annum - unexpected bad newsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started