Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview 2-27 Variable and fixed costs. Consolidated Motors specializes in producing one specialty vehicle. It is called Surfer and is styled to easily

Old MathJax webview

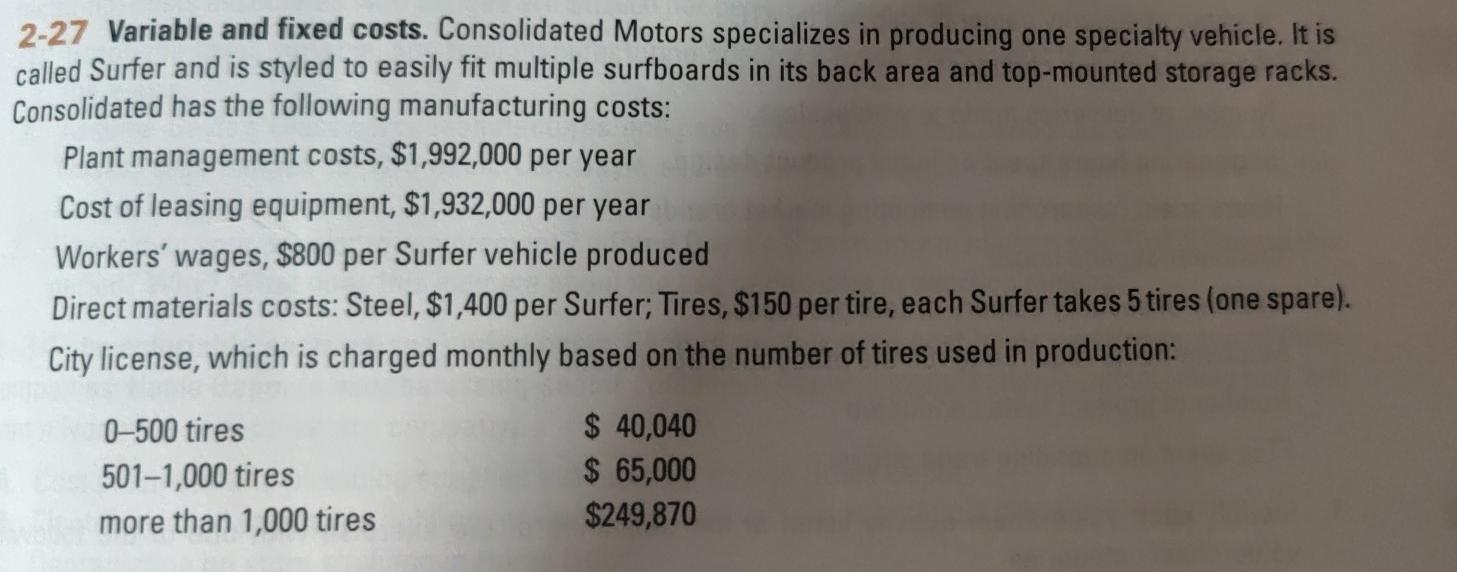

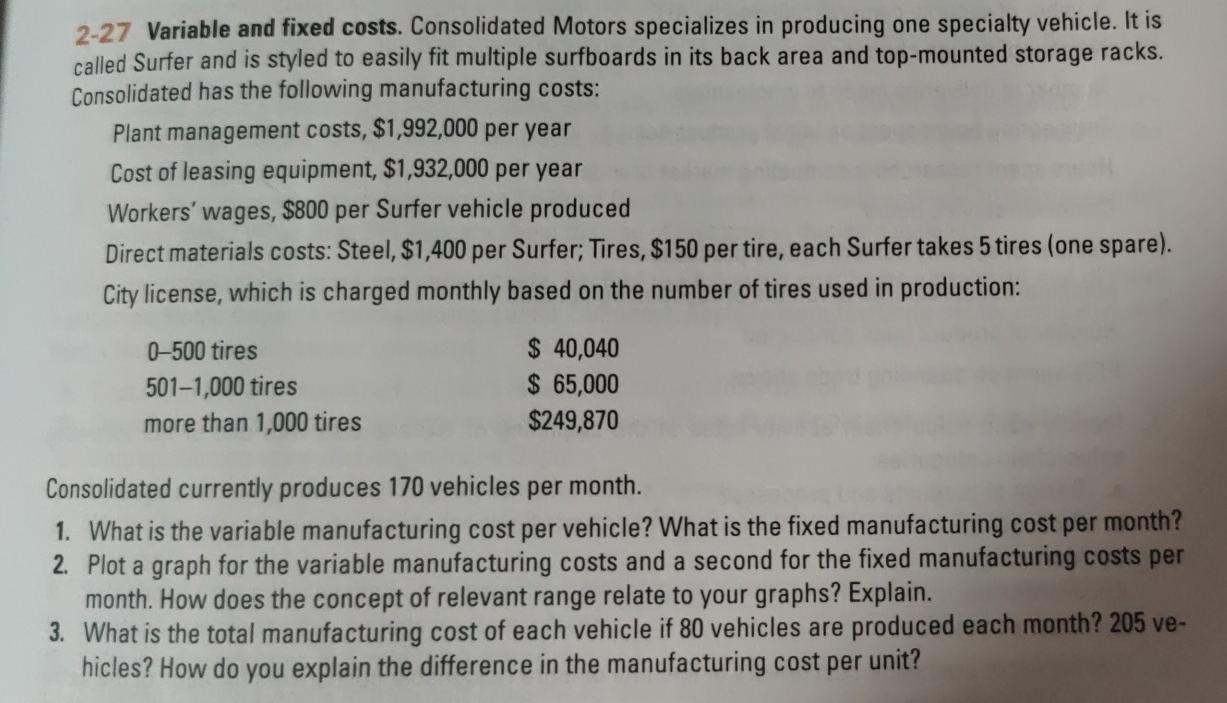

2-27 Variable and fixed costs. Consolidated Motors specializes in producing one specialty vehicle. It is called Surfer and is styled to easily fit multiple surfboards in its back area and top-mounted storage racks. Consolidated has the following manufacturing costs: Plant management costs, $1,992,000 per year Cost of leasing equipment, $1,932,000 per year Workers' wages, $800 per Surfer vehicle produced Direct materials costs: Steel, $1,400 per Surfer; Tires, $150 per tire, each Surfer takes 5 tires (one spare). City license, which is charged monthly based on the number of tires used in production: 0-500 tires 501-1,000 tires more than 1,000 tires $ 40,040 $ 65,000 $249,870 2-27 Variable and fixed costs. Consolidated Motors specializes in producing one specialty vehicle. It is called Surfer and is styled to easily fit multiple surfboards in its back area and top-mounted storage racks. Consolidated has the following manufacturing costs: Plant management costs, $1,992,000 per year Cost of leasing equipment, $1,932,000 per year Workers' wages, $800 per Surfer vehicle produced Direct materials costs: Steel, $1,400 per Surfer; Tires, $150 per tire, each Surfer takes 5 tires (one spare). City license, which is charged monthly based on the number of tires used in production: 0-500 tires 501-1,000 tires more than 1,000 tires $ 40,040 $ 65,000 $249,870 Consolidated currently produces 170 vehicles per month. 1. What is the variable manufacturing cost per vehicle? What is the fixed manufacturing cost per month? 2. Plot a graph for the variable manufacturing costs and a second for the fixed manufacturing costs per month. How does the concept of relevant range relate to your graphs? Explain. 3. What is the total manufacturing cost of each vehicle if 80 vehicles are produced each month? 205 ve- hicles? How do you explain the difference in the manufacturing cost per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started