Answered step by step

Verified Expert Solution

Question

1 Approved Answer

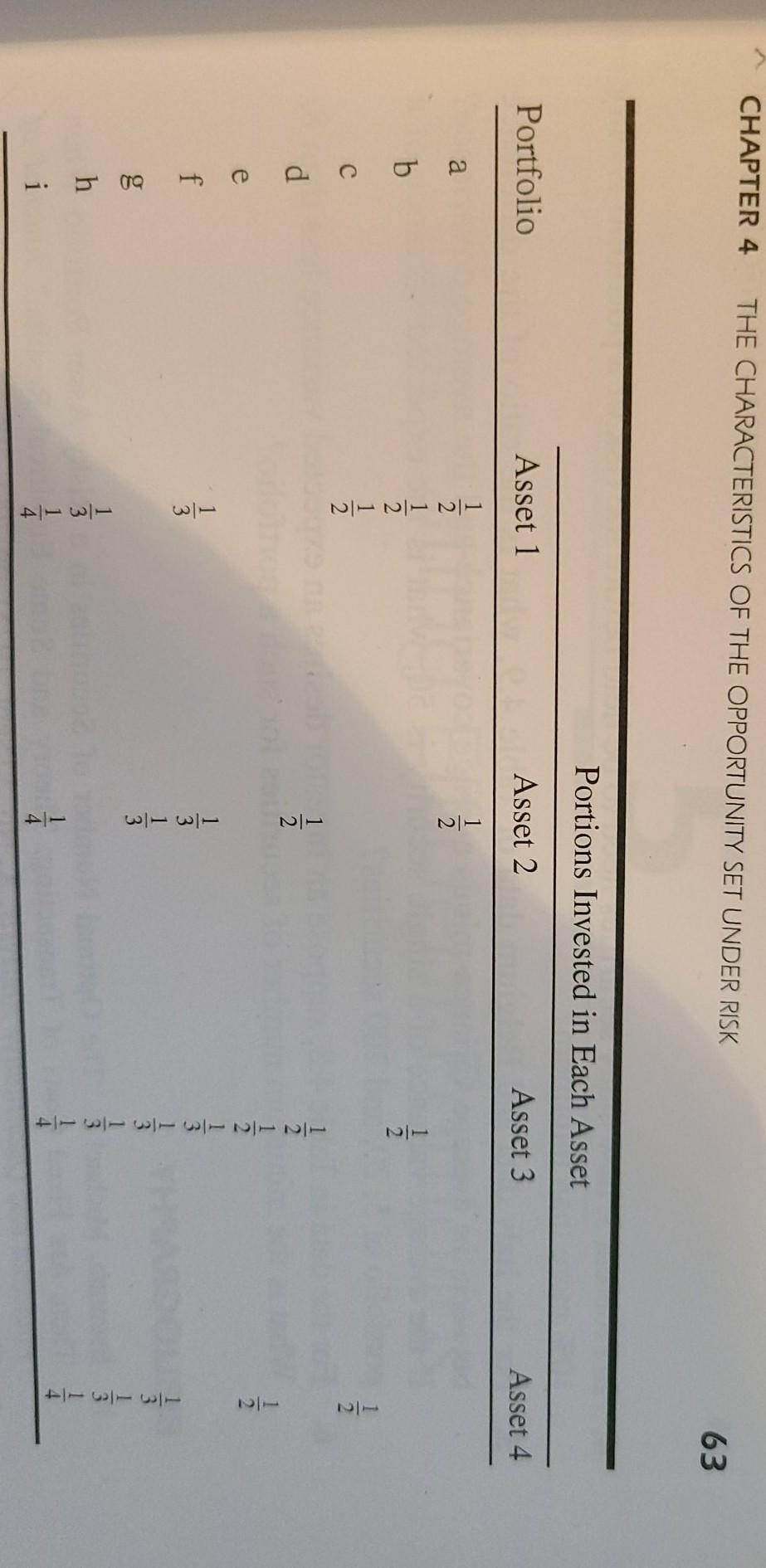

Old MathJax webview CHAPTER 4 THE CHARACTERISTICS OF THE OPPORTUNITY SET UNDER RISK 63 Portions Invested in Each Asset Portfolio Asset 1 Asset 2 Asset

Old MathJax webview

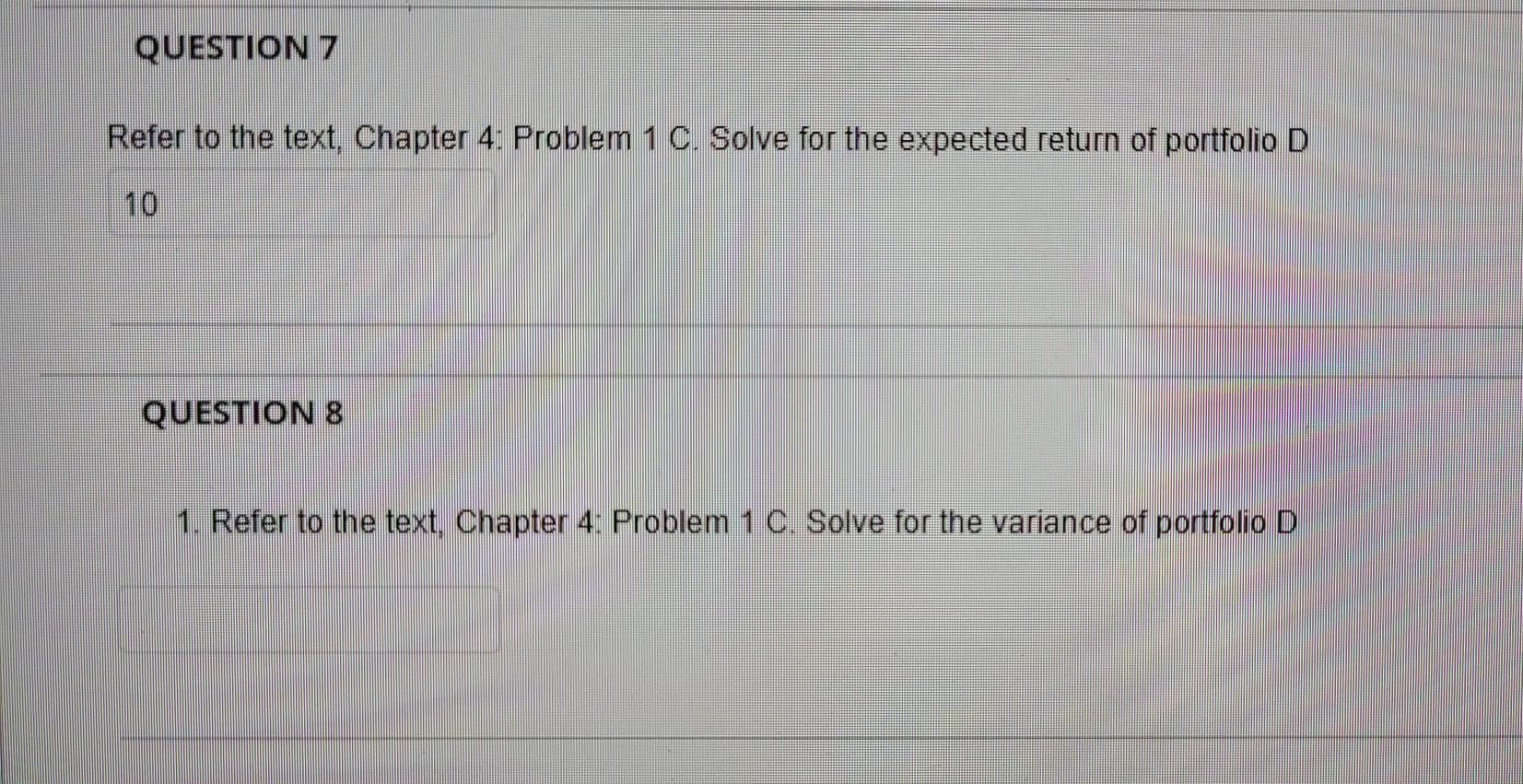

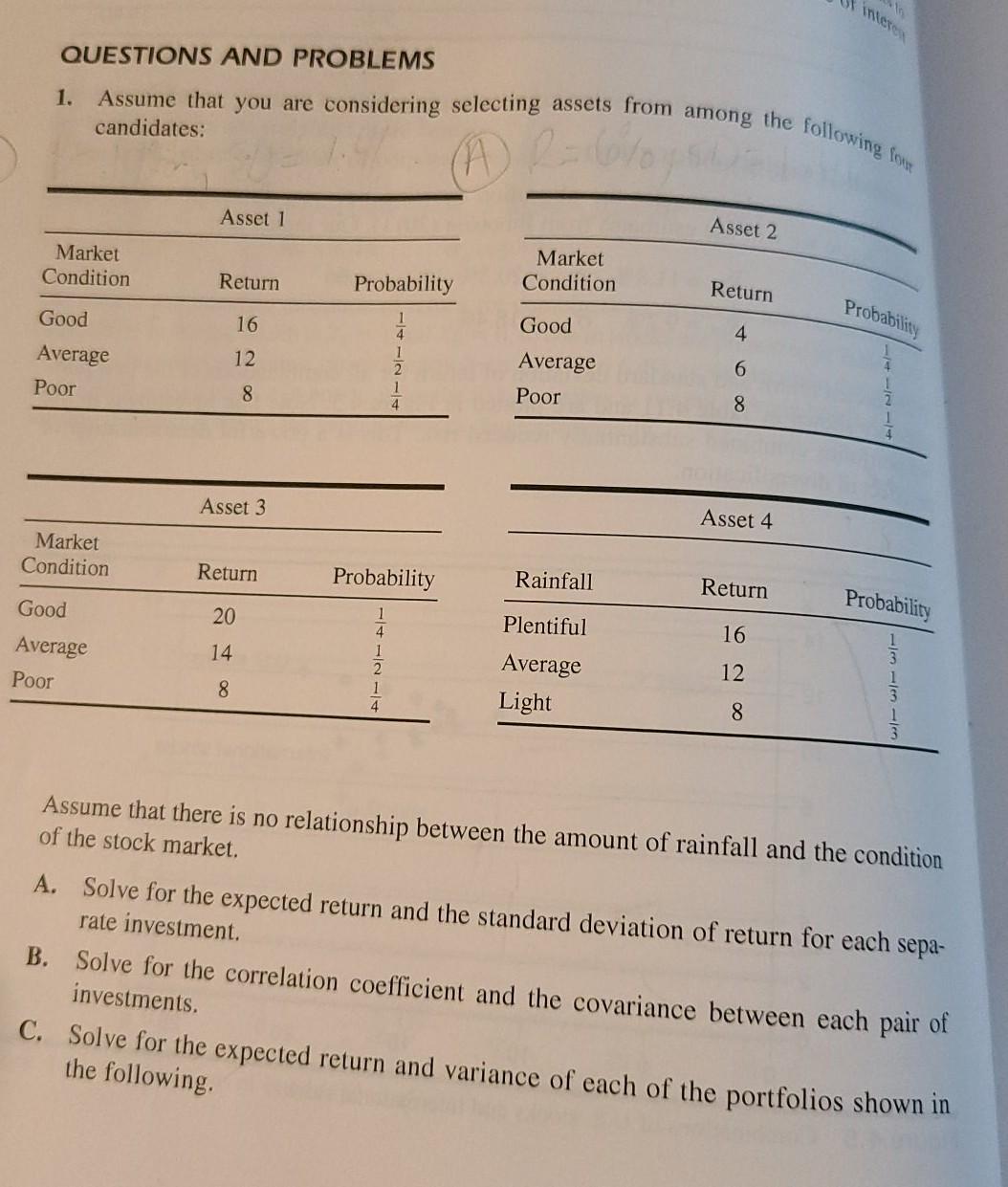

CHAPTER 4 THE CHARACTERISTICS OF THE OPPORTUNITY SET UNDER RISK 63 Portions Invested in Each Asset Portfolio Asset 1 Asset 2 Asset 3 Asset 4 a 11 b 1 2 1 2 1 2 2 d 1 2 e f 11/ ----10-10-10-1+ co h 1 3 1 i 4 QUESTION 7 Refer to the text, Chapter 4: Problem 1 C. Solve for the expected return of portfolio D QUESTION 8 1. Refer to the text, Chapter 4: Problem 1 C. Solve for the variance of portfolio D QUESTIONS AND PROBLEMS Assume that you are considering selecting assets from among the following for 1. candidates: = 0 Asset 1 Asset 2 Market Condition Market Condition Return Probability Return Good Probability 16 Good 4 4 12 Average Poor 6 2 1 4 Average Poor 8 8 Asset 3 Asset 4 Market Condition Return Probability Rainfall Return Probability 20 Plentiful Good Average Poor 16 14 1 4 1 2 1 4 12 8 Average Light 8 Assume that there is no relationship between the amount of rainfall and the condition of the stock market. A. Solve for the expected return and the standard deviation of return for each sepa- rate investment. B. Solve for the correlation coefficient and the covariance between each pair of investments. C. Solve for the expected return and variance of each of the portfolios shown in the following CHAPTER 4 THE CHARACTERISTICS OF THE OPPORTUNITY SET UNDER RISK 63 Portions Invested in Each Asset Portfolio Asset 1 Asset 2 Asset 3 Asset 4 a 11 b 1 2 1 2 1 2 2 d 1 2 e f 11/ ----10-10-10-1+ co h 1 3 1 i 4 QUESTION 7 Refer to the text, Chapter 4: Problem 1 C. Solve for the expected return of portfolio D QUESTION 8 1. Refer to the text, Chapter 4: Problem 1 C. Solve for the variance of portfolio D QUESTIONS AND PROBLEMS Assume that you are considering selecting assets from among the following for 1. candidates: = 0 Asset 1 Asset 2 Market Condition Market Condition Return Probability Return Good Probability 16 Good 4 4 12 Average Poor 6 2 1 4 Average Poor 8 8 Asset 3 Asset 4 Market Condition Return Probability Rainfall Return Probability 20 Plentiful Good Average Poor 16 14 1 4 1 2 1 4 12 8 Average Light 8 Assume that there is no relationship between the amount of rainfall and the condition of the stock market. A. Solve for the expected return and the standard deviation of return for each sepa- rate investment. B. Solve for the correlation coefficient and the covariance between each pair of investments. C. Solve for the expected return and variance of each of the portfolios shown in the following

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started