Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Company Baldwin invested $24.700.000 in plant and equipment last year. The plant investment was funded with bonds at a face value of

Old MathJax webview

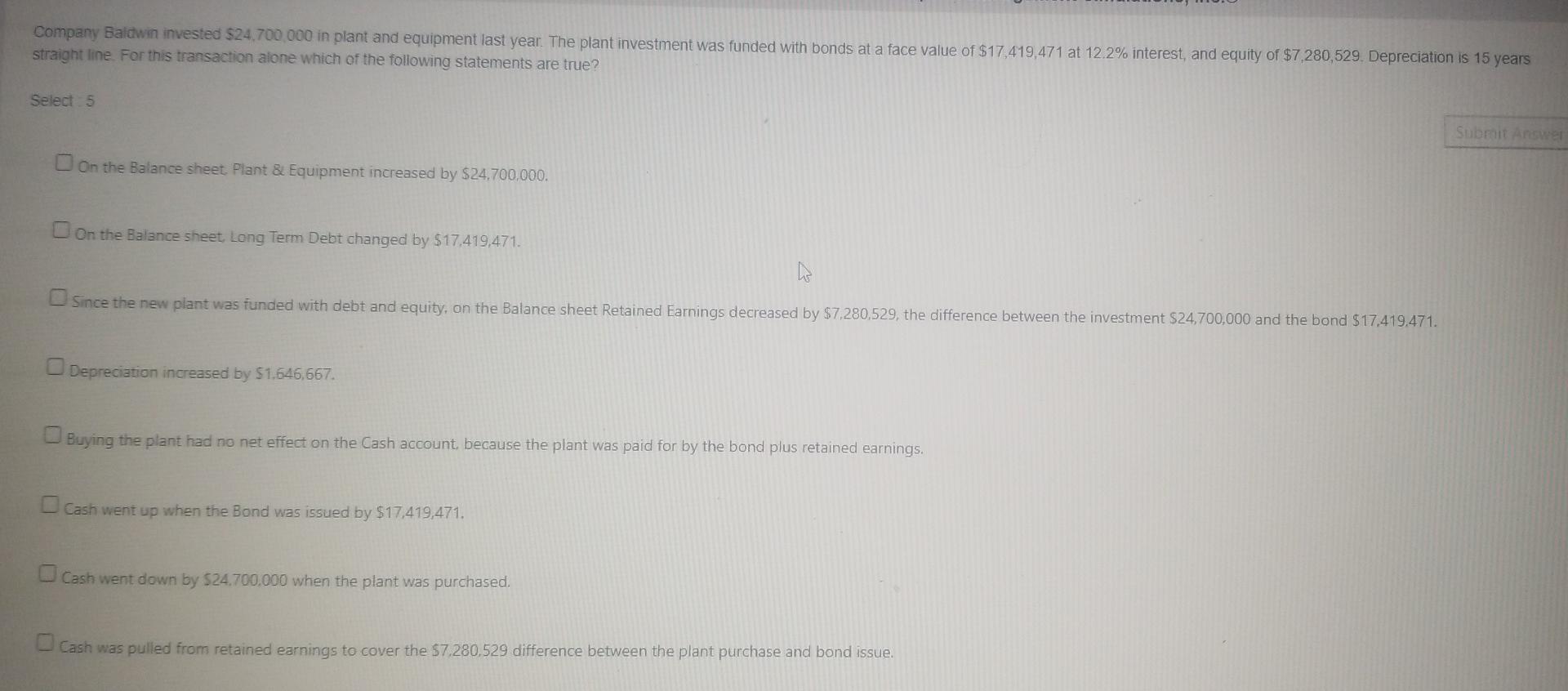

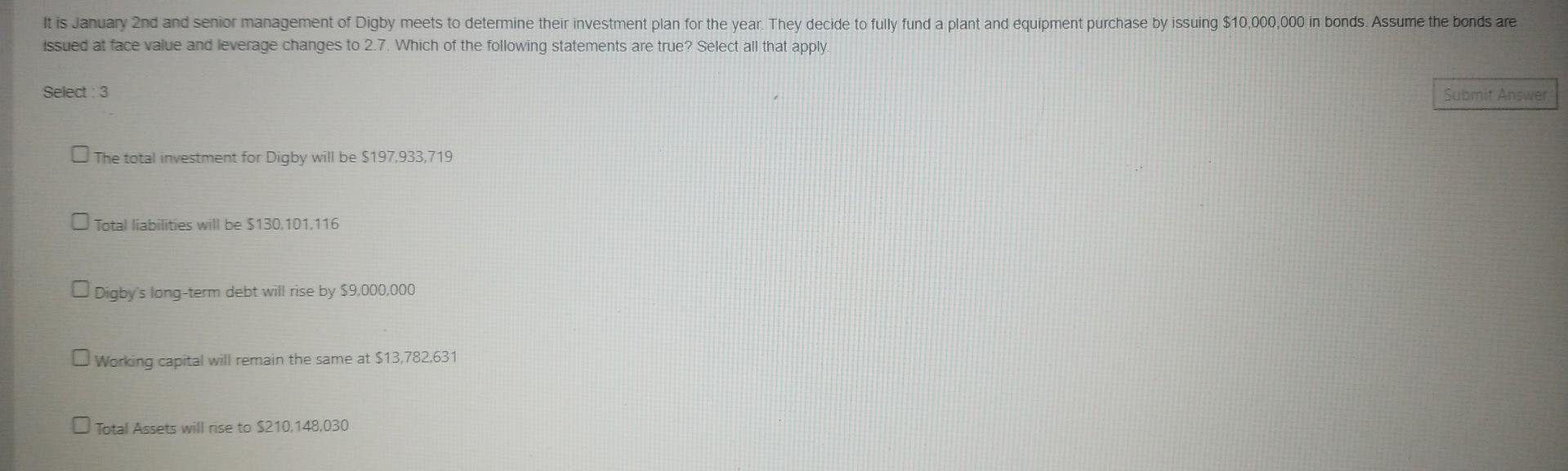

Company Baldwin invested $24.700.000 in plant and equipment last year. The plant investment was funded with bonds at a face value of $17,419,471 at 12.2% interest, and equity of $7,280,529. Depreciation is 15 years straight line For this transaction alone which of the following statements are true? Select 5 Submit Answer D on the Balance sheet. Plant & Equipment increased by $24.700,000. On the Balance sheet Long Term Debt changed by $17,419,471. Since the new plant was funded with debt and equity, on the Balance sheet Retained Earnings decreased by $7,280,529, the difference between the investment $24,700,000 and the bond $17,419,471. Depreciation increased by $1.646,667. Buying the plant had no net effect on the cash account because the plant was paid for by the bond plus retained earnings. cash went up when the Bond was issued by $17,419,471. Cash went down by $24.700.000 when the plant was purchased. Cash was pulled from retained earnings to cover the $7.280,529 difference between the plant purchase and bond issue. It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing $10,000,000 in bonds. Assume the bonds are issued at face value and leverage changes to 27. Which of the following statements are true? Select all that apply. Select 3 Submit Answer The total investment for Digby will be $197.933,719 Total liabilities will be $130.101.116 Digby's long-term debt will rise by 59.000.000 Working capital will remain the same at $13,782,631 Total Assets will rise to S210.148,030

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started