Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview . decision. While applying the relevant accounting standard can this revision be considered as an extraordinary item or prior period item? 5

Old MathJax webview

.

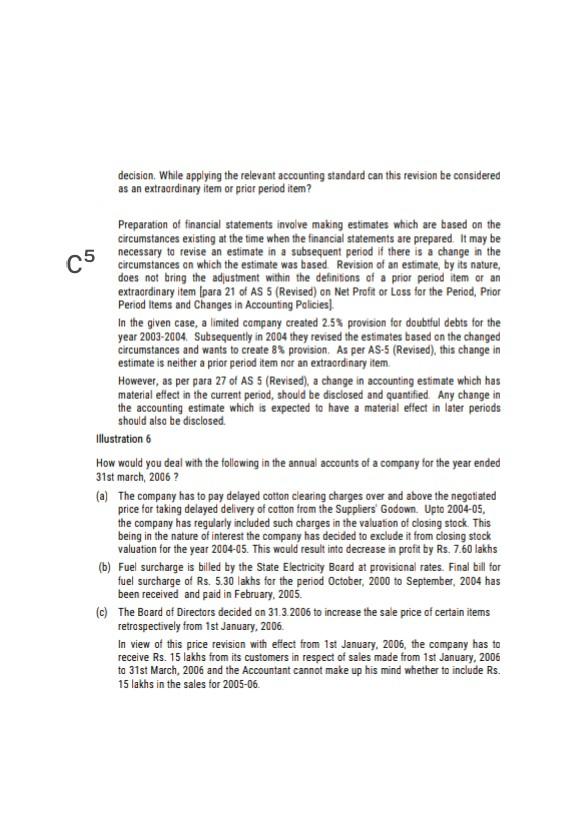

decision. While applying the relevant accounting standard can this revision be considered as an extraordinary item or prior period item? 5 05 Preparation of financial statements involve making estimates which are based on the circumstances existing at the time when the financial statements are prepared. It may be necessary to revise an estimate in a subsequent period if there is a change in the circumstances on which the estimate was based Revision of an estimate, by its nature, does not bring the adjustment within the definitions of a prior period item or an extraordinary item para 21 of AS 5 (Revised) on Net Profit or Loss for the Period, Prior Period items and Changes in Accounting Policies). In the given case, a limited company created 2.5% provision for doubtful debts for the year 2003-2004. Subsequently in 2004 they revised the estimates based on the changed circumstances and wants to create 8% provision. As per AS-5 (Revised), this change in estimate is neither a prior period item nor an extraordinary item. However, as per para 27 of AS 5 (Revised), a change in accounting estimate which has material ettect in the current period, should be disclosed and quantified. Any change in the accounting estimate which is expected to have a material effect in later periods should also be disclosed Illustration 6 How would you deal with the following in the annual accounts of a company for the year ended 31st march 2006 ? (a) The company has to pay delayed cotton clearing charges over and above the negotiated price for taking delayed delivery of cotton from the Suppliers Godown. Upto 2004-05, the company has regularly included such charges in the valuation of closing stock. This being in the nature of interest the company has decided to exclude it from closing stock valuation for the year 2004-05. This would result inte decrease in profit by Rs.7.60 lakhs (b) Fuel surcharge is billed by the State Electricity Board at provisional rates. Final bill for fuel surcharge of Rs. 5.30 lakhs for the period October, 2000 to September, 2004 has been received and paid in February, 2005. (c) The Board of Directors decided on 31.3.2006 to increase the sale price of certain items retrospectively from 1st January, 2006. In view of this price revision with effect from 1st January, 2006, the company has to receive Rs. 15 lakhs from its customers in respect of sales made from 1st January, 2006 to 31st March, 2006 and the Accountant cannot make up his mind whether to include Rs. 15 lakhs in the sales for 2005-06Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started