Answered step by step

Verified Expert Solution

Question

1 Approved Answer

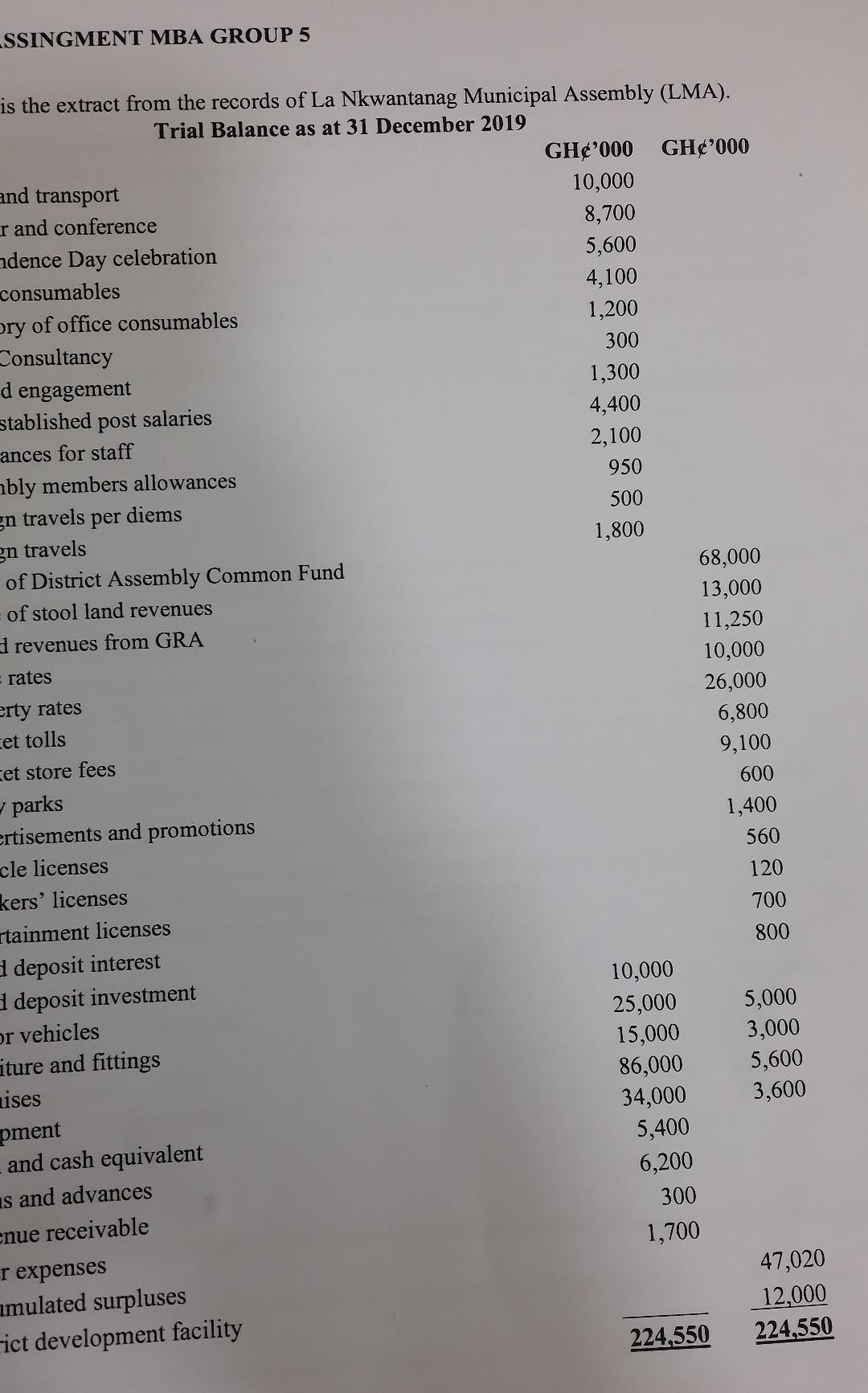

Old MathJax webview hr SSINGMENT MBA GROUP 5 is the extract from the records of La Nkwantanag Municipal Assembly (LMA). Trial Balance as at 31

Old MathJax webview

hr

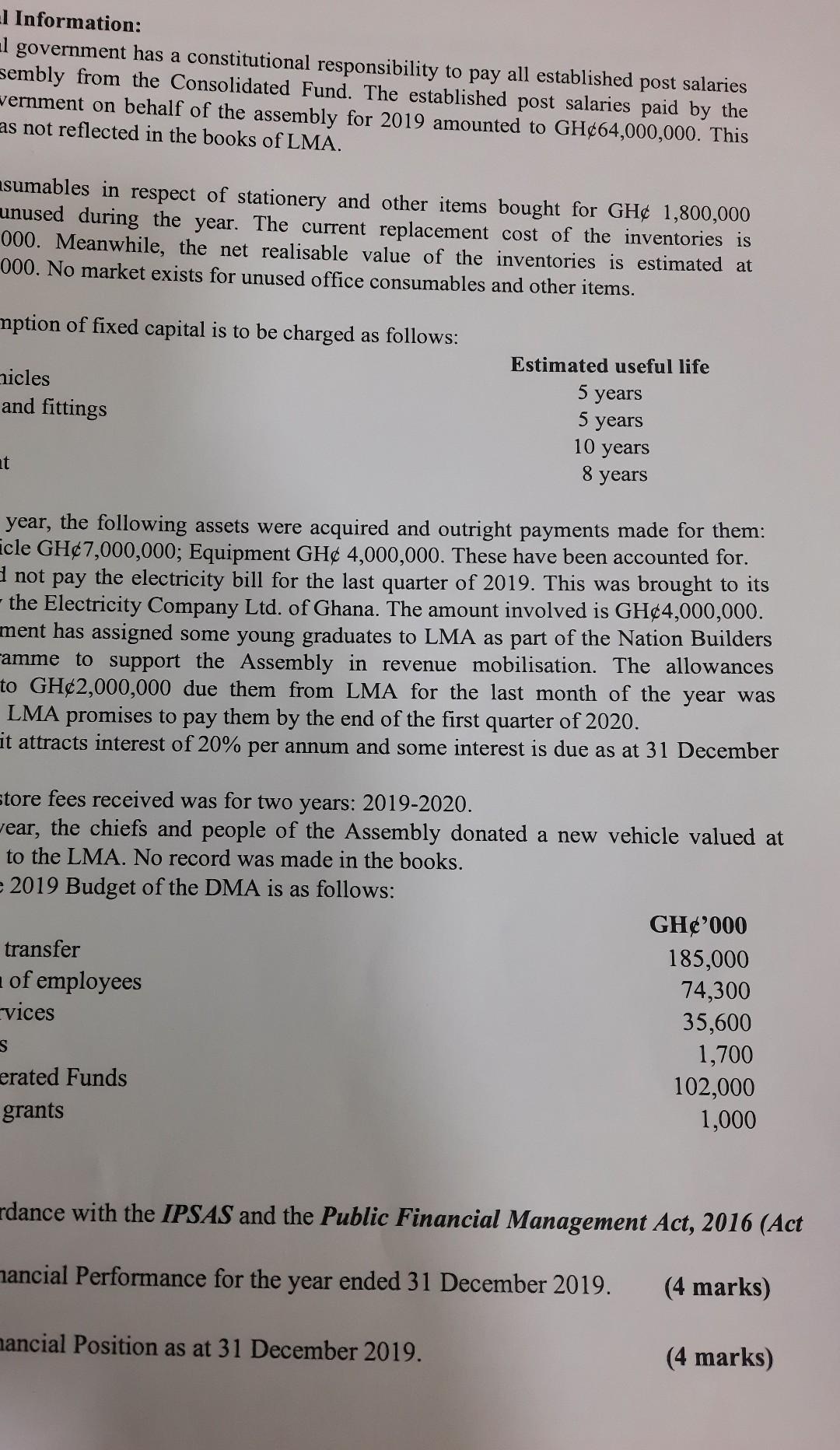

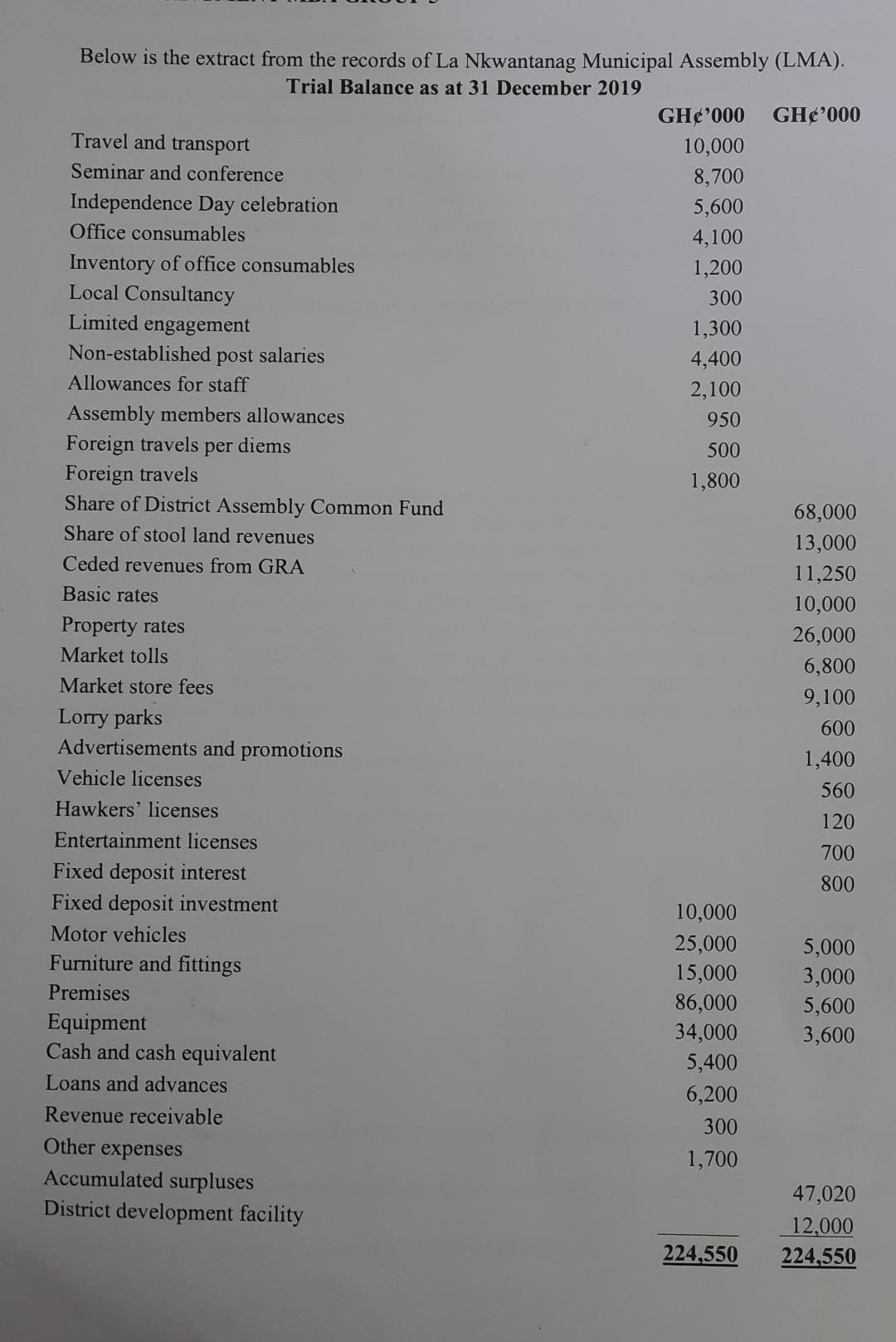

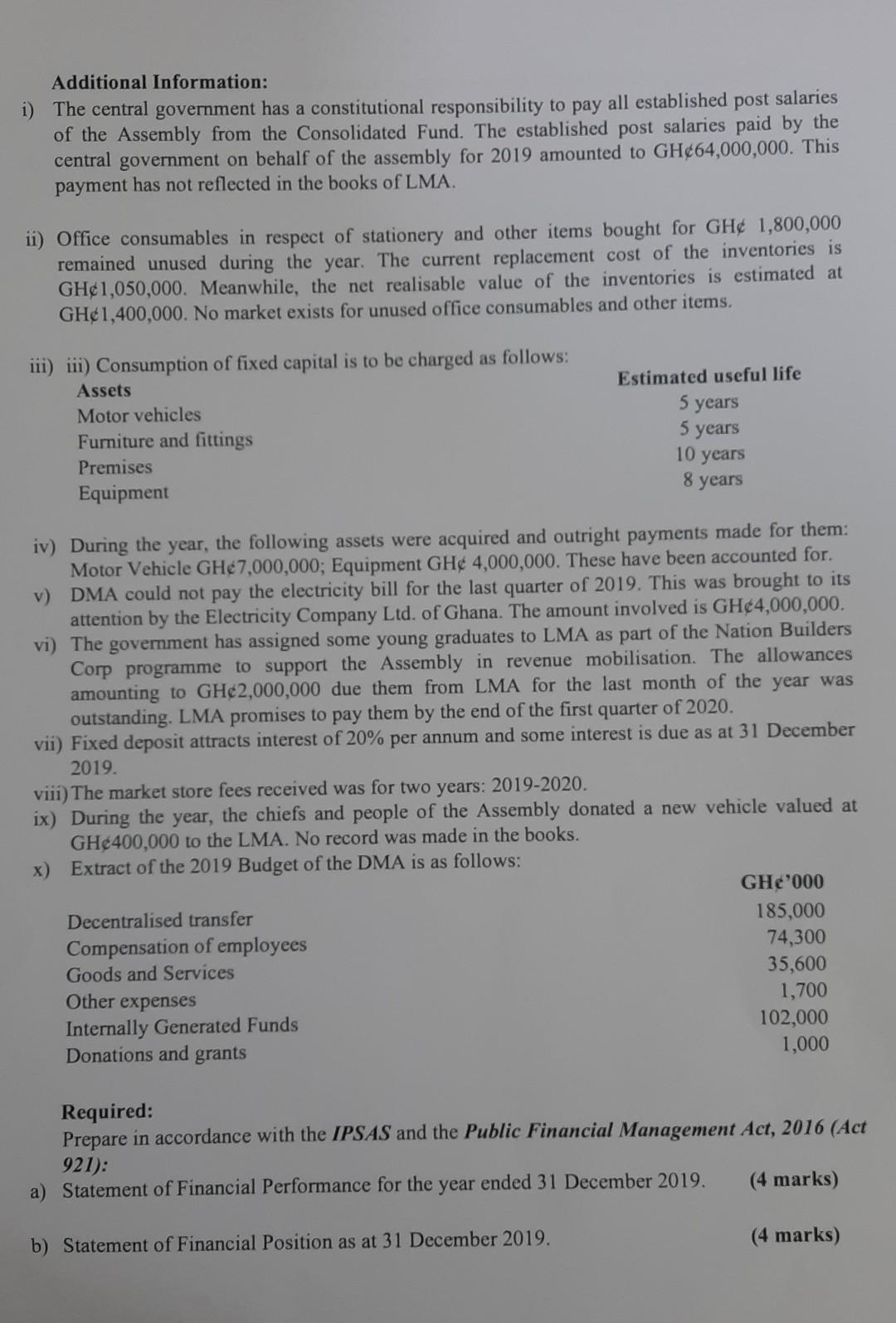

SSINGMENT MBA GROUP 5 is the extract from the records of La Nkwantanag Municipal Assembly (LMA). Trial Balance as at 31 December 2019 GH'000 GH'000 and transport 10,000 r and conference 8,700 ndence Day celebration 5,600 consumables 4,100 ory of office consumables 1,200 Consultancy 300 d engagement 1,300 stablished post salaries 4,400 ances for staff 2,100 ably members allowances 950 gn travels per diems 500 en travels 1,800 of District Assembly Common Fund 68,000 of stool land revenues 13,000 revenues from GRA 11,250 rates 10,000 erty rates 26,000 cet tolls 6,800 cet store fees 9,100 parks 600 ertisements and promotions 1,400 cle licenses 560 kers' licenses 120 rtainment licenses 700 deposit interest 800 deposit investment 10,000 or vehicles 25,000 5,000 iture and fittings 15,000 3,000 uises 86,000 5,600 34,000 3,600 pment and cash equivalent 5,400 as and advances 6,200 300 enue receivable 1,700 r expenses 47,020 amulated surpluses 12,000 rict development facility 224,550 224,550 El Information: al government has a constitutional responsibility to pay all established post salaries sembly from the Consolidated Fund. The established post salaries paid by the vernment on behalf of the assembly for 2019 amounted to GH64,000,000. This as not reflected in the books of LMA. asumables in respect of stationery and other items bought for GH 1,800,000 unused during the year. The current replacement cost of the inventories is 000. Meanwhile, the net realisable value of the inventories is estimated at 000. No market exists for unused office consumables and other items. mption of fixed capital is to be charged as follows: nicles and fittings Estimated useful life 5 years 5 years at 10 years 8 years year, the following assets were acquired and outright payments made for them: acle GH7,000,000; Equipment GH 4,000,000. These have been accounted for. not pay the electricity bill for the last quarter of 2019. This was brought to its -the Electricity Company Ltd. of Ghana. The amount involved is GH$4,000,000. ment has assigned some young graduates to LMA as part of the Nation Builders Camme to support the Assembly in revenue mobilisation. The allowances to GH2,000,000 due them from LMA for the last month of the year was LMA promises to pay them by the end of the first quarter of 2020. it attracts interest of 20% per annum and some interest is due as at 31 December store fees received was for two years: 2019-2020. Vear, the chiefs and people of the Assembly donated a new vehicle valued at to the LMA. No record was made in the books. e 2019 Budget of the DMA is as follows: GH'000 transfer 185,000 of employees 74,300 vices 35,600 1,700 erated Funds 102,000 grants 1,000 S rdance with the IPSAS and the Public Financial Management Act, 2016 (Act mancial Performance for the year ended 31 December 2019. (4 marks) nancial Position as at 31 December 2019. (4 marks) 4,400 Below is the extract from the records of La Nkwantanag Municipal Assembly (LMA). Trial Balance as at 31 December 2019 GH'000 GH'000 Travel and transport 10,000 Seminar and conference 8,700 Independence Day celebration 5,600 Office consumables 4,100 Inventory of office consumables 1,200 Local Consultancy 300 Limited engagement 1,300 Non-established post salaries Allowances for staff 2,100 Assembly members allowances 950 Foreign travels per diems 500 Foreign travels 1,800 Share of District Assembly Common Fund 68,000 Share of stool land revenues 13,000 Ceded revenues from GRA 11,250 Basic rates 10,000 Property rates 26,000 Market tolls 6,800 Market store fees 9,100 Lorry parks 600 Advertisements and promotions 1,400 Vehicle licenses 560 Hawkers' licenses 120 Entertainment licenses 700 Fixed deposit interest 800 Fixed deposit investment 10,000 Motor vehicles 25,000 5,000 Furniture and fittings 15,000 3,000 Premises 86,000 5,600 Equipment 34,000 3,600 Cash and cash equivalent 5,400 Loans and advances 6,200 Revenue receivable 300 1,700 Accumulated surpluses 47,020 District development facility 12,000 224,550 224,550 Other expenses Additional Information: i) The central government has a constitutional responsibility to pay all established post salaries of the Assembly from the Consolidated Fund. The established post salaries paid by the central government on behalf of the assembly for 2019 amounted to GH64,000,000. This payment has not reflected in the books of LMA. ii) Office consumables in respect of stationery and other items bought for GH 1,800,000 remained unused during the year. The current replacement cost of the inventories is GH1,050,000. Meanwhile, the net realisable value of the inventories is estimated at GH1,400,000. No market exists for unused office consumables and other items. iii) iii) Consumption of fixed capital is to be charged as follows: Assets Motor vehicles Furniture and fittings Premises Equipment Estimated useful life 5 years 5 years 10 years 8 years iv) During the year, the following assets were acquired and outright payments made for them: Motor Vehicle GH7,000,000; Equipment GH 4,000,000. These have been accounted for. v) DMA could not pay the electricity bill for the last quarter of 2019. This was brought to its attention by the Electricity Company Ltd. of Ghana. The amount involved is GH4,000,000. vi) The government has assigned some young graduates to LMA as part of the Nation Builders Corp programme to support the Assembly in revenue mobilisation. The allowances amounting to GH2,000,000 due them from LMA for the last month of the year was outstanding. LMA promises to pay them by the end of the first quarter of 2020. vii) Fixed deposit attracts interest of 20% per annum and some interest is due as 31 December 2019. viii) The market store fees received was for two years: 2019-2020. ix) During the year, the chiefs and people of the Assembly donated a new vehicle valued at GH400,000 to the LMA. No record was made in the books. x) Extract of the 2019 Budget of the DMA is as follows: GH_000 Decentralised transfer 185,000 Compensation of employees 74,300 Goods and Services 35,600 Other expenses 1,700 Internally Generated Funds 102,000 Donations and grants 1,000 Required: Prepare in accordance with the IPSAS and the Public Financial Management Act, 2016 (Act 921): a) Statement of Financial Performance for the year ended 31 December 2019. (4 marks) b) Statement of Financial Position as at 31 December 2019. (4 marks) SSINGMENT MBA GROUP 5 is the extract from the records of La Nkwantanag Municipal Assembly (LMA). Trial Balance as at 31 December 2019 GH'000 GH'000 and transport 10,000 r and conference 8,700 ndence Day celebration 5,600 consumables 4,100 ory of office consumables 1,200 Consultancy 300 d engagement 1,300 stablished post salaries 4,400 ances for staff 2,100 ably members allowances 950 gn travels per diems 500 en travels 1,800 of District Assembly Common Fund 68,000 of stool land revenues 13,000 revenues from GRA 11,250 rates 10,000 erty rates 26,000 cet tolls 6,800 cet store fees 9,100 parks 600 ertisements and promotions 1,400 cle licenses 560 kers' licenses 120 rtainment licenses 700 deposit interest 800 deposit investment 10,000 or vehicles 25,000 5,000 iture and fittings 15,000 3,000 uises 86,000 5,600 34,000 3,600 pment and cash equivalent 5,400 as and advances 6,200 300 enue receivable 1,700 r expenses 47,020 amulated surpluses 12,000 rict development facility 224,550 224,550 El Information: al government has a constitutional responsibility to pay all established post salaries sembly from the Consolidated Fund. The established post salaries paid by the vernment on behalf of the assembly for 2019 amounted to GH64,000,000. This as not reflected in the books of LMA. asumables in respect of stationery and other items bought for GH 1,800,000 unused during the year. The current replacement cost of the inventories is 000. Meanwhile, the net realisable value of the inventories is estimated at 000. No market exists for unused office consumables and other items. mption of fixed capital is to be charged as follows: nicles and fittings Estimated useful life 5 years 5 years at 10 years 8 years year, the following assets were acquired and outright payments made for them: acle GH7,000,000; Equipment GH 4,000,000. These have been accounted for. not pay the electricity bill for the last quarter of 2019. This was brought to its -the Electricity Company Ltd. of Ghana. The amount involved is GH$4,000,000. ment has assigned some young graduates to LMA as part of the Nation Builders Camme to support the Assembly in revenue mobilisation. The allowances to GH2,000,000 due them from LMA for the last month of the year was LMA promises to pay them by the end of the first quarter of 2020. it attracts interest of 20% per annum and some interest is due as at 31 December store fees received was for two years: 2019-2020. Vear, the chiefs and people of the Assembly donated a new vehicle valued at to the LMA. No record was made in the books. e 2019 Budget of the DMA is as follows: GH'000 transfer 185,000 of employees 74,300 vices 35,600 1,700 erated Funds 102,000 grants 1,000 S rdance with the IPSAS and the Public Financial Management Act, 2016 (Act mancial Performance for the year ended 31 December 2019. (4 marks) nancial Position as at 31 December 2019. (4 marks) 4,400 Below is the extract from the records of La Nkwantanag Municipal Assembly (LMA). Trial Balance as at 31 December 2019 GH'000 GH'000 Travel and transport 10,000 Seminar and conference 8,700 Independence Day celebration 5,600 Office consumables 4,100 Inventory of office consumables 1,200 Local Consultancy 300 Limited engagement 1,300 Non-established post salaries Allowances for staff 2,100 Assembly members allowances 950 Foreign travels per diems 500 Foreign travels 1,800 Share of District Assembly Common Fund 68,000 Share of stool land revenues 13,000 Ceded revenues from GRA 11,250 Basic rates 10,000 Property rates 26,000 Market tolls 6,800 Market store fees 9,100 Lorry parks 600 Advertisements and promotions 1,400 Vehicle licenses 560 Hawkers' licenses 120 Entertainment licenses 700 Fixed deposit interest 800 Fixed deposit investment 10,000 Motor vehicles 25,000 5,000 Furniture and fittings 15,000 3,000 Premises 86,000 5,600 Equipment 34,000 3,600 Cash and cash equivalent 5,400 Loans and advances 6,200 Revenue receivable 300 1,700 Accumulated surpluses 47,020 District development facility 12,000 224,550 224,550 Other expenses Additional Information: i) The central government has a constitutional responsibility to pay all established post salaries of the Assembly from the Consolidated Fund. The established post salaries paid by the central government on behalf of the assembly for 2019 amounted to GH64,000,000. This payment has not reflected in the books of LMA. ii) Office consumables in respect of stationery and other items bought for GH 1,800,000 remained unused during the year. The current replacement cost of the inventories is GH1,050,000. Meanwhile, the net realisable value of the inventories is estimated at GH1,400,000. No market exists for unused office consumables and other items. iii) iii) Consumption of fixed capital is to be charged as follows: Assets Motor vehicles Furniture and fittings Premises Equipment Estimated useful life 5 years 5 years 10 years 8 years iv) During the year, the following assets were acquired and outright payments made for them: Motor Vehicle GH7,000,000; Equipment GH 4,000,000. These have been accounted for. v) DMA could not pay the electricity bill for the last quarter of 2019. This was brought to its attention by the Electricity Company Ltd. of Ghana. The amount involved is GH4,000,000. vi) The government has assigned some young graduates to LMA as part of the Nation Builders Corp programme to support the Assembly in revenue mobilisation. The allowances amounting to GH2,000,000 due them from LMA for the last month of the year was outstanding. LMA promises to pay them by the end of the first quarter of 2020. vii) Fixed deposit attracts interest of 20% per annum and some interest is due as 31 December 2019. viii) The market store fees received was for two years: 2019-2020. ix) During the year, the chiefs and people of the Assembly donated a new vehicle valued at GH400,000 to the LMA. No record was made in the books. x) Extract of the 2019 Budget of the DMA is as follows: GH_000 Decentralised transfer 185,000 Compensation of employees 74,300 Goods and Services 35,600 Other expenses 1,700 Internally Generated Funds 102,000 Donations and grants 1,000 Required: Prepare in accordance with the IPSAS and the Public Financial Management Act, 2016 (Act 921): a) Statement of Financial Performance for the year ended 31 December 2019. (4 marks) b) Statement of Financial Position as at 31 December 2019. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started