Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview I need with formula what kind of info ? everything is there QUESTION 2. Newtron Inc. is going to finance 60% of

Old MathJax webview

I need with formula

what kind of info ? everything is there

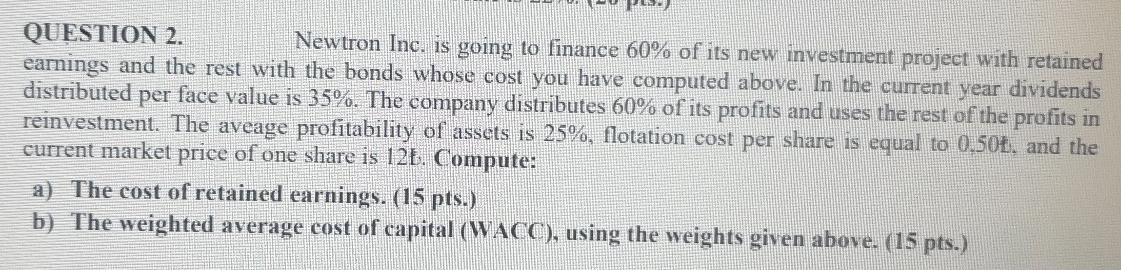

QUESTION 2. Newtron Inc. is going to finance 60% of its new investment project with retained eamings and the rest with the bonds whose cost you have computed above. In the current year dividends distributed per face value is 35%. The company distributes 60% of its profits and uses the rest of the profits in reinvestment. The aveage profitability of assets is 25%, flotation cost per share is equal to 0.504, and the current market price of one share is 122. Compute: a) The cost of retained earnings. (15 pts.) b) The weighted average cost of capital (WACC), using the weights given above. (15 pts.) QUESTION 2. Newtron Inc. is going to finance 60% of its new investment project with retained eamings and the rest with the bonds whose cost you have computed above. In the current year dividends distributed per face value is 35%. The company distributes 60% of its profits and uses the rest of the profits in reinvestment. The aveage profitability of assets is 25%, flotation cost per share is equal to 0.504, and the current market price of one share is 122. Compute: a) The cost of retained earnings. (15 pts.) b) The weighted average cost of capital (WACC), using the weights given above. (15 pts.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started