Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Important: To solve the problem, use AW (annual worth) and ROR (rate of return) analysis rather than NPV (present value). Use EXCEL

Old MathJax webview

Important: To solve the problem, use AW (annual worth) and ROR (rate of return) analysis rather than NPV (present value). Use EXCEL to show all of your formulas and explain everything in detail. thanks

****USE AW & ROR****USE EXCEL*********

don't use present value please !!!

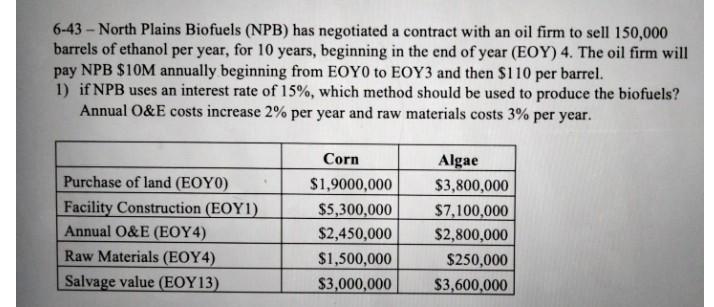

6-43 - North Plains Biofuels (NPB) has negotiated a contract with an oil firm to sell 150,000 barrels of ethanol per year, for 10 years, beginning in the end of year (EOY) 4. The oil firm will pay NPB $10M annually beginning from EOYO to EOY3 and then $110 per barrel. 1) if NPB uses an interest rate of 15%, which method should be used to produce the biofuels? Annual O&E costs increase 2% per year and raw materials costs 3% per year. Purchase of land (EOYO) Facility Construction (EOY1). Annual O&E (EOY4) Raw Materials (EOY4) Salvage value (EOY13) Corn $1,9000,000 $5,300,000 $2,450,000 $1,500,000 $3,000,000 Algae $3,800,000 $7,100,000 $2,800,000 $250,000 $3,600,000 6-43 - North Plains Biofuels (NPB) has negotiated a contract with an oil firm to sell 150,000 barrels of ethanol per year, for 10 years, beginning in the end of year (EOY) 4. The oil firm will pay NPB $10M annually beginning from EOYO to EOY3 and then $110 per barrel. 1) if NPB uses an interest rate of 15%, which method should be used to produce the biofuels? Annual O&E costs increase 2% per year and raw materials costs 3% per year. Purchase of land (EOYO) Facility Construction (EOY1). Annual O&E (EOY4) Raw Materials (EOY4) Salvage value (EOY13) Corn $1,9000,000 $5,300,000 $2,450,000 $1,500,000 $3,000,000 Algae $3,800,000 $7,100,000 $2,800,000 $250,000 $3,600,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started