Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview 1. Calculate the total finance cost on the long-term loan for the year ended 30 June 20.19 that must

Old MathJax webview

Old MathJax webview

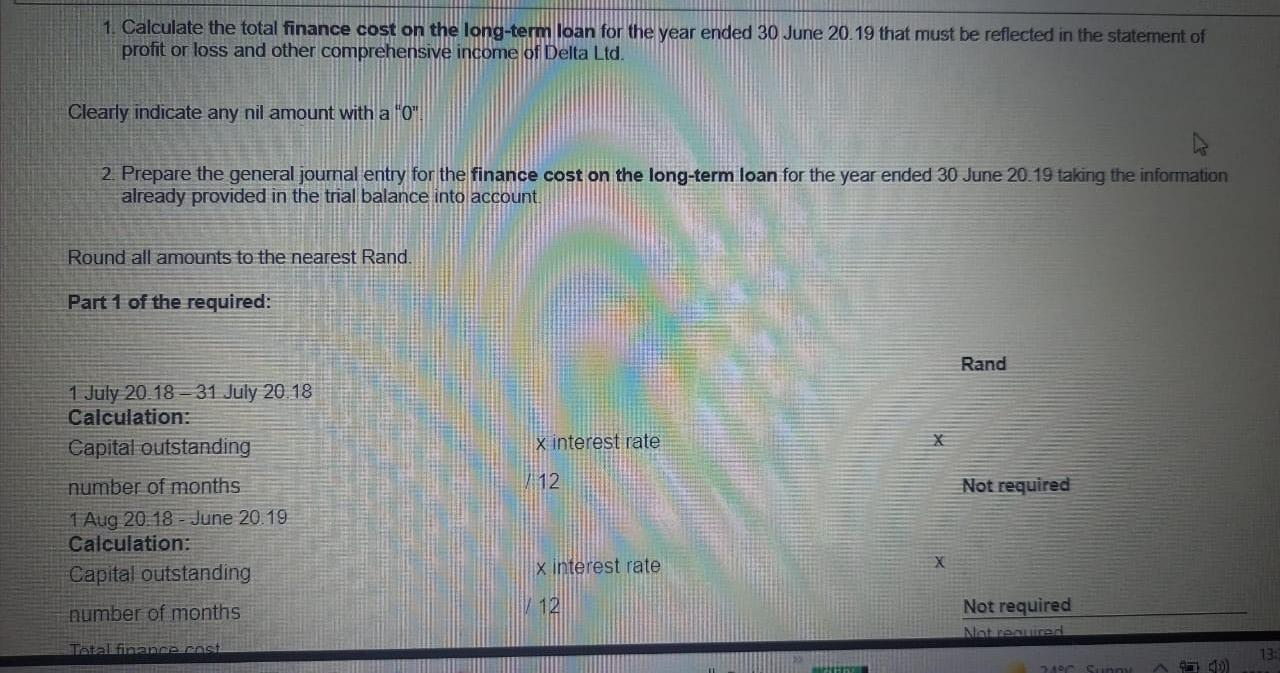

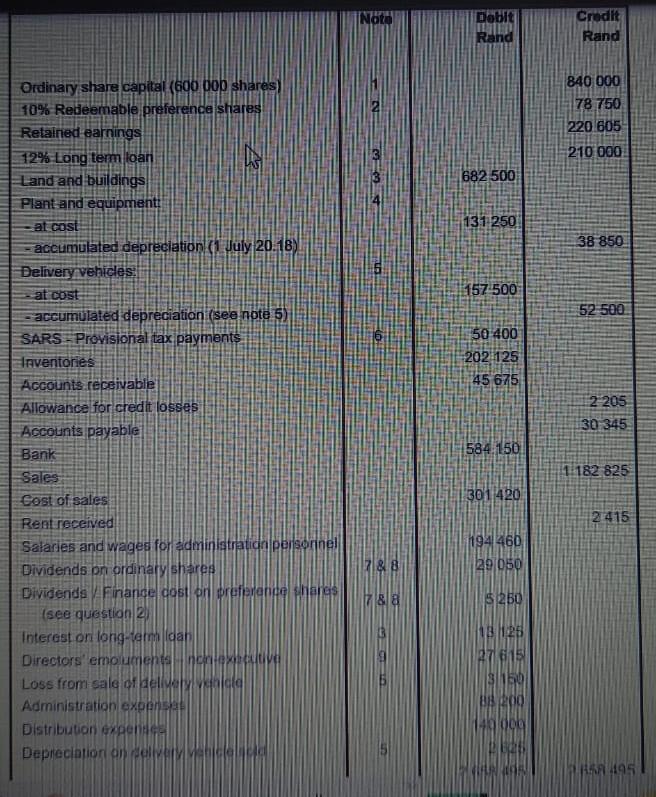

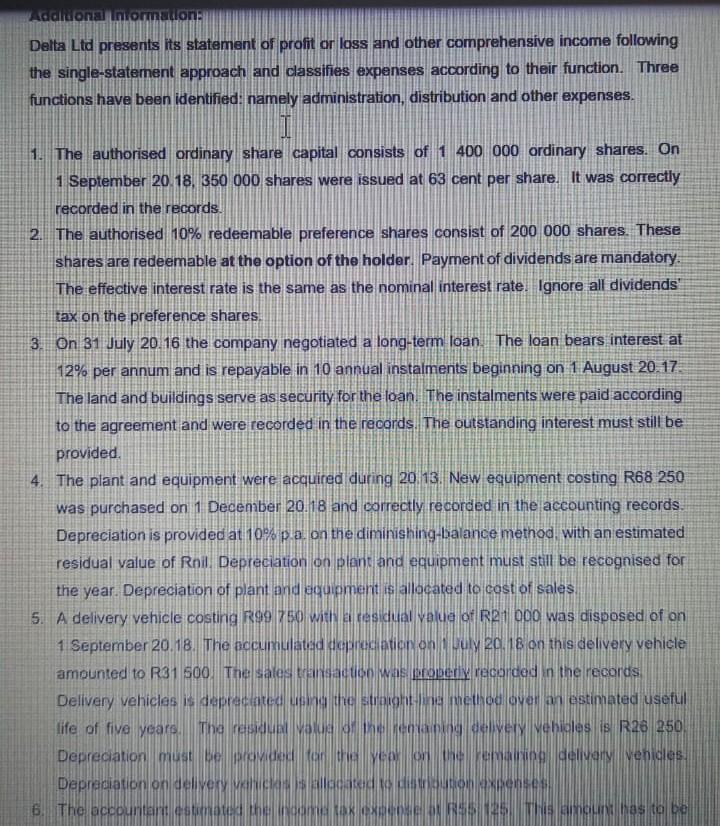

1. Calculate the total finance cost on the long-term loan for the year ended 30 June 20.19 that must be reflected in the statement of profit or loss and other comprehensive income of Delta Ltd. Clearly indicate any nil amount with a "0" 2. Prepare the general journal entry for the finance cost on the long-term loan for the year ended 30 June 20.19 taking the information already provided in the trial balance into account Round all amounts to the nearest Rand. Part 1 of the required: Rand X interest rate 1 July 20.18=31 July 20.18 Calculation: Capital outstanding number of months 1 Aug 20.18 - June 20.19 Calculation: Capital outstanding 112 Not required x interest rate number of months 12 Not required Natireured Tatal finance cost 13: 7400 Sunny Noto Dobit Credit Rand Rand 840 000 78 750 220 605 IN 210 000 682 500 131-250 38 850 157-500 52 500 50 400 202 125 45 675 Ordinary share capital (600 000 shares) 10% Redeemable preference shares Retained earnings 12% Long term loan Land and buildings Plant and equipment: at cost accumulated depreciation (1 July 20.18) Delivery vehicles at cost accumulated depreciation (see note 5) SARS - Provisional tax payments Inventories Accounts receivable Allowance for credit losses Accounts payable Bank Sales Cost of sales Rent received Salaries and wages for administrati ornell Dividends on ordinary shares Dividends Finanse dost on preference bangs (see question 2 Interest or long-term dan Directors emoluments IncrOXEL Loss from sale of delivella Administration expenses Distribution expenses Depreciation on al 2 205 30 345 584.150 1 182 825 1301 420 2 415 194460 29 050 17 & 8 5250 128 A7 B BB 14100 Dan 195 Addicionaliniormations Delta Ltd presents its statement of profit or loss and other comprehensive income following the single-statement approach and classifies expenses according to their function. Three functions have been identified: namely administration, distribution and other expenses. 1. The authorised ordinary share capital consists of 1 400 000 ordinary shares. On 1 September 2018, 350 000 shares were issued at 63 cent per share. It was correctly recorded in the records. 2. The authorised 10% redeemable preference shares consist of 200 000 shares. These shares are redeemable at the option of the holder. Payment of dividends are mandatory. The effective interest rate is the same as the nominal interest rate. Ignore all dividends' tax on the preference shares. 3. On 31 July 20.16 the company negotiated a long-term loan. The loan bears interest at 12% per annum and is repayable in 10 annual instalments beginning on 1 August 20.17. The land and buildings serve as security for the loan. The instalments were paid according to the agreement and were recorded in the records. The outstanding interest must still be provided 4. The plant and equipment were acquired during 20 13. New equipment costing R68 250 was purchased on 1 December 20,18 and correctly recorded in the accounting records. Depreciation is provided at 10% pa, on the diminishing-balance method with an estimated residual value of Roil Depreciation on plant and equipment must still be recognised for the year. Depreciation of plant and equipment is allocated to cost of sales 5. A delivery vehicle costing R99 250 with a residual value of Relooo was disposed of on 1 September 20.18. The accumulated depreciation on July 20,18 on this delivery vehicle amounted to R31 500 The sales transaction was properly recorded in the records Delivery vehicles is deprecated on the straight line method over an estimated useful life of five years. The residual value aning delivery vehicles is R28 250 Depreciation must be provided on the year on the emaining delivery venides. Depreciation on delivery challecased on a sense 6. The accountant estimate the name to express This amount has to be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started