Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview Old MathJax webview 200 million 50 m 350 m 120 m 80 m total 800 million. need it urgently

Old MathJax webview

Old MathJax webview

Old MathJax webview

200 million 50 m 350 m 120 m 80 m total 800 million.

need it urgently I'll give you more likes.

calculate the average cost of capital. Asap. I'll give you more likes.

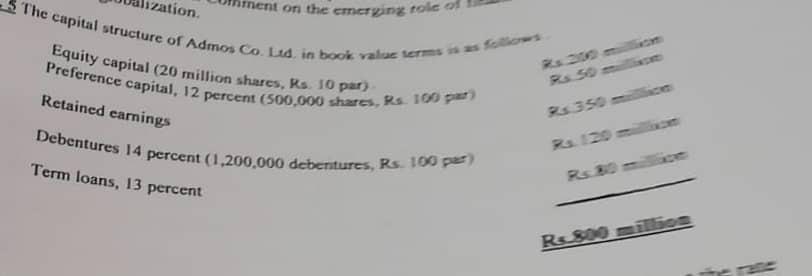

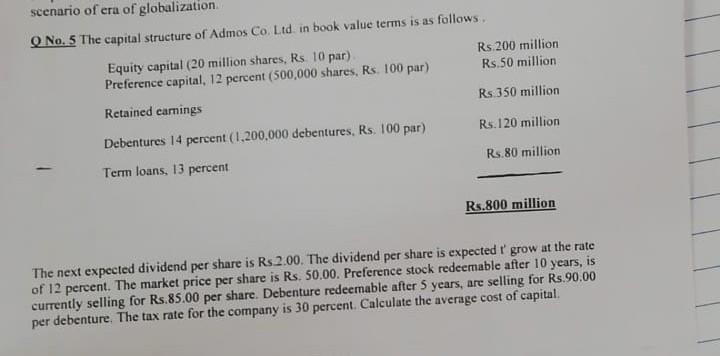

ation ent or the coming role of The capital structure of Admos Co. Ltd. in book value terms as fotos Equity capital (20 million shares, Rs. 10 par) Preference capital, 12 percent (500,000 shares, RS. 100 pat Retained earnings R350 - Debentures 14 percent (1,200,000 dcbertures, RS. 100 per Term loans, 13 percent R_800 to scenario of era of globalization O No. 5 The capital structure of Admos Co Ltd in book value terms is as follows Equity capital (20 million shares, Rs. 10 par) Rs 200 million Preference capital, 12 percent (500,000 shares, Rs. 100 par) Rs.50 million Retained earnings Rs 350 million Debentures 14 percent (1,200.000 debentures, Rs. 100 par) Rs. 120 million Term loans, 13 percent Rs.80 million Rs.800 million The next expected dividend per share is Rs.2.00. The dividend per share is expected 'grow at the rate of 12 percent. The market price per share is Rs. 50.00. Preference stock redeemable after 10 years, is currently selling for Rs.85.00 per share. Debenture redeemable after 5 years, are selling for Rs.90.00 per debenture. The tax rate for the company is 30 percent. Calculate the average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started