Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview Old MathJax webview on question 2 I understand how to do the first picture but I don't understand at

Old MathJax webview

Old MathJax webview

Old MathJax webview

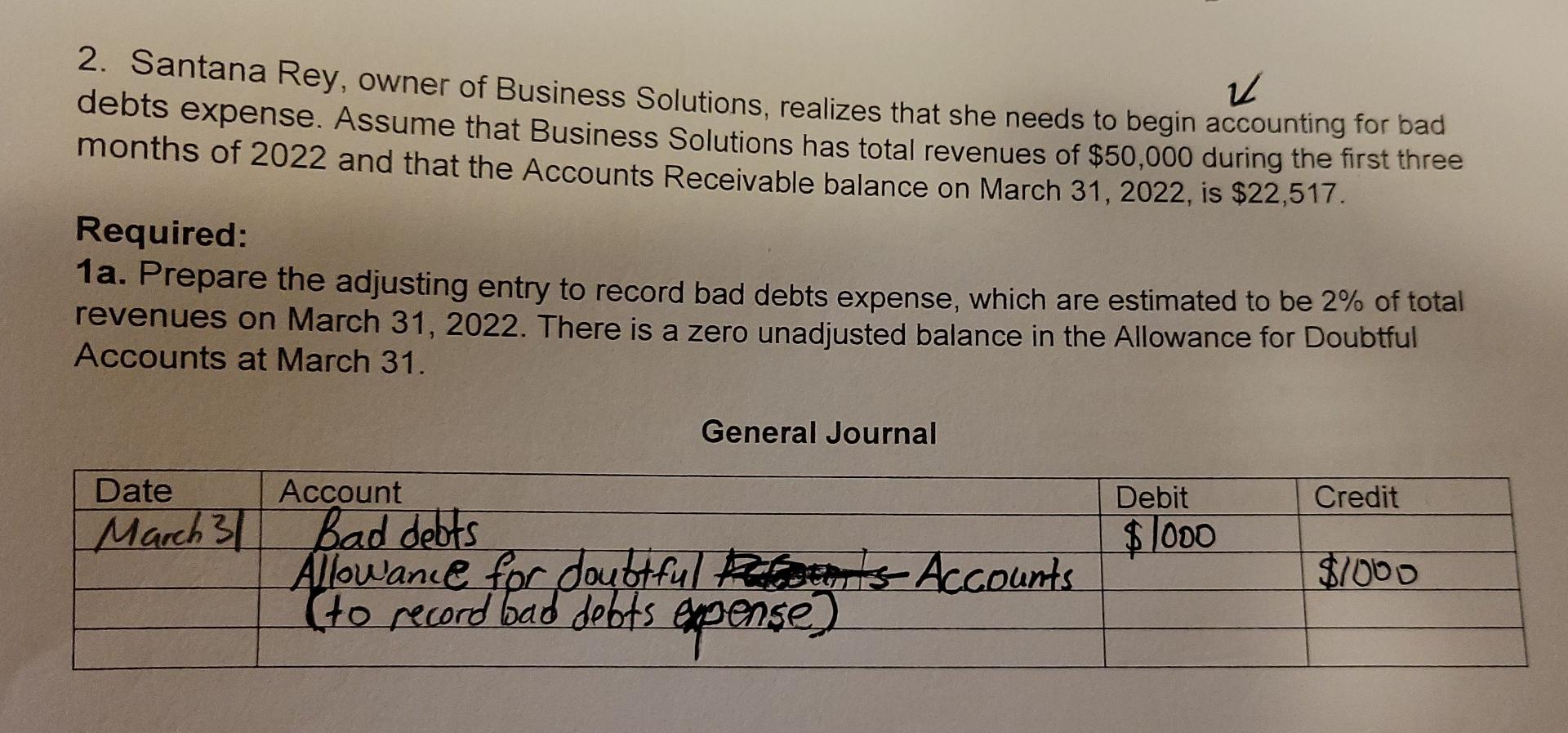

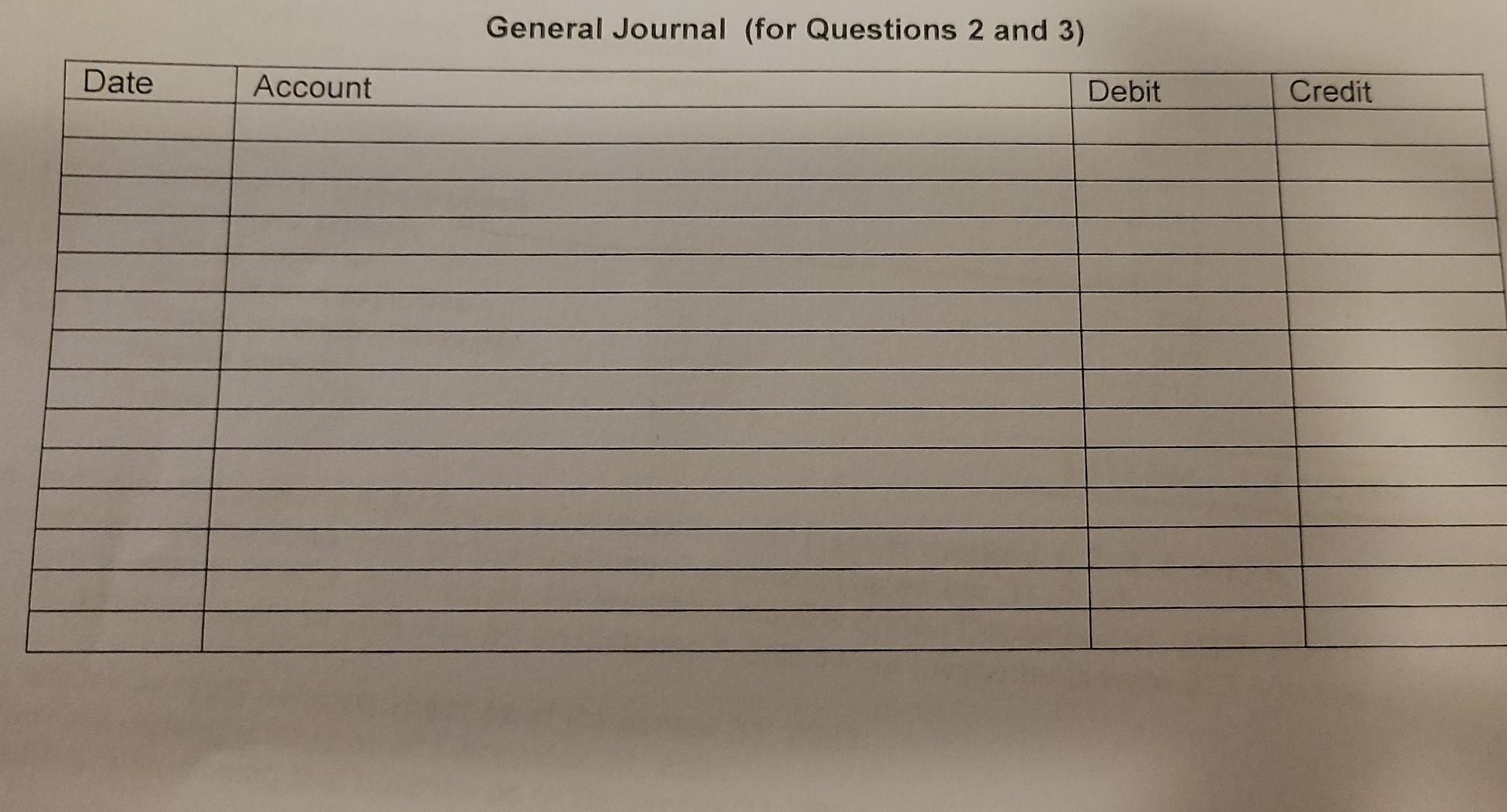

on question 2 I understand how to do the first picture but I don't understand at all what to put into the second general journal please help.

the second picture is confusing.

is this what is needed

2 and 3 questions. I am on question 2 please ignore question 3 that's is for a different problem

what information am I missing that needs to be there

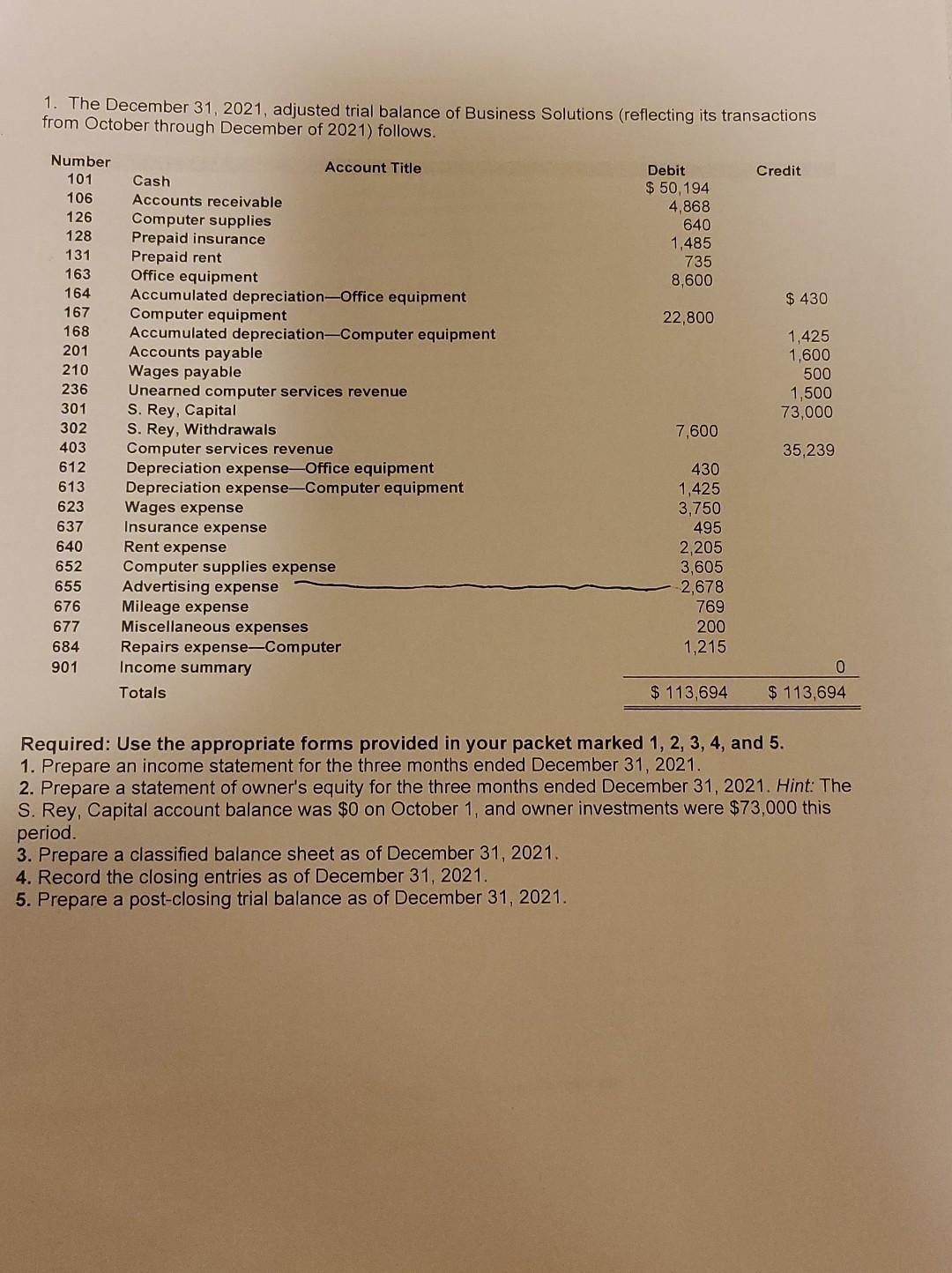

2. Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $50,000 during the first three months of 2022 and that the Accounts Receivable balance on March 31, 2022, is $22,517. 12 Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. General Journal Debit Credit Date March 31 Account Bad debts Allowance for doubtful Resorts Accounts (to record bad debts $ 1000 $1000 spense) General Journal (for Questions 2 and 3) Date Account Debit Credit 1. The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows. Credit Debit $ 50,194 4,868 640 1,485 735 8,600 $ 430 22,800 Number 101 106 126 128 131 163 164 167 168 201 210 236 301 302 403 612 613 623 1,425 1,600 500 1,500 73,000 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable Wages payable Unearned computer services revenue S. Rey, Capital S. Rey, Withdrawals Computer services revenue Depreciation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Income summary Totals 7,600 35,239 637 640 652 655 676 677 684 901 430 1,425 3,750 495 2,205 3,605 2,678 769 200 1,215 0 $ 113,694 $ 113,694 Required: Use the appropriate forms provided in your packet marked 1, 2, 3, 4, and 5. 1. Prepare an income statement for the three months ended December 31, 2021. 2. Prepare a statement of owner's equity for the three months ended December 31, 2021. Hint: The S. Rey, Capital account balance was $0 on October 1, and owner investments were $73,000 this period. 3. Prepare a classified balance sheet as of December 31, 2021. 4. Record the closing entries as of December 31, 2021. 5. Prepare a post-closing trial balance as of December 31, 2021. 2. Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $50,000 during the first three months of 2022 and that the Accounts Receivable balance on March 31, 2022, is $22,517. 12 Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. General Journal Debit Credit Date March 31 Account Bad debts Allowance for doubtful Resorts Accounts (to record bad debts $ 1000 $1000 spense) General Journal (for Questions 2 and 3) Date Account Debit Credit 1. The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows. Credit Debit $ 50,194 4,868 640 1,485 735 8,600 $ 430 22,800 Number 101 106 126 128 131 163 164 167 168 201 210 236 301 302 403 612 613 623 1,425 1,600 500 1,500 73,000 Account Title Cash Accounts receivable Computer supplies Prepaid insurance Prepaid rent Office equipment Accumulated depreciation-Office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable Wages payable Unearned computer services revenue S. Rey, Capital S. Rey, Withdrawals Computer services revenue Depreciation expense-Office equipment Depreciation expense-Computer equipment Wages expense Insurance expense Rent expense Computer supplies expense Advertising expense Mileage expense Miscellaneous expenses Repairs expense-Computer Income summary Totals 7,600 35,239 637 640 652 655 676 677 684 901 430 1,425 3,750 495 2,205 3,605 2,678 769 200 1,215 0 $ 113,694 $ 113,694 Required: Use the appropriate forms provided in your packet marked 1, 2, 3, 4, and 5. 1. Prepare an income statement for the three months ended December 31, 2021. 2. Prepare a statement of owner's equity for the three months ended December 31, 2021. Hint: The S. Rey, Capital account balance was $0 on October 1, and owner investments were $73,000 this period. 3. Prepare a classified balance sheet as of December 31, 2021. 4. Record the closing entries as of December 31, 2021. 5. Prepare a post-closing trial balance as of December 31, 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started