Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview Plss help me to solve Qst 2 nd 3 both Balance sheet nd ratio. 2) Construct a balance sheet

Old MathJax webview

Old MathJax webview

Plss help me to solve Qst 2 nd 3 both Balance sheet nd ratio.

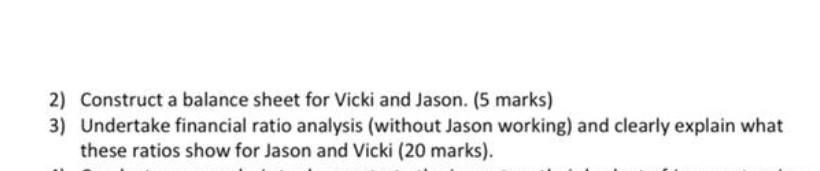

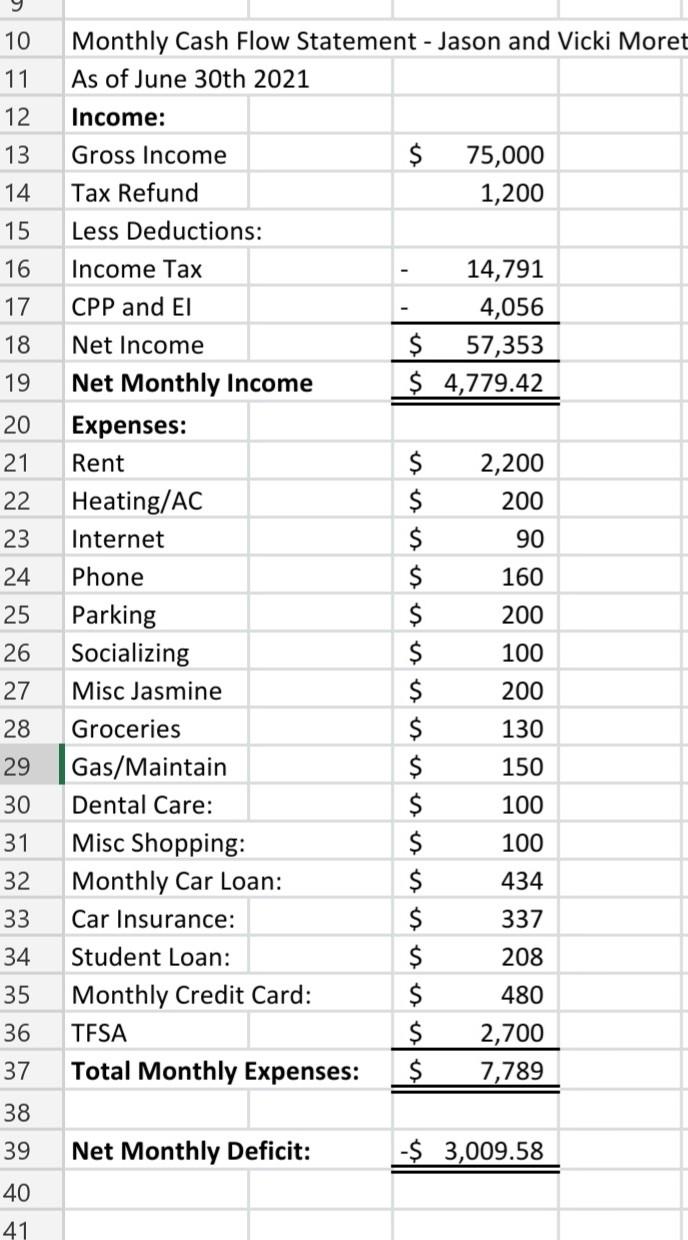

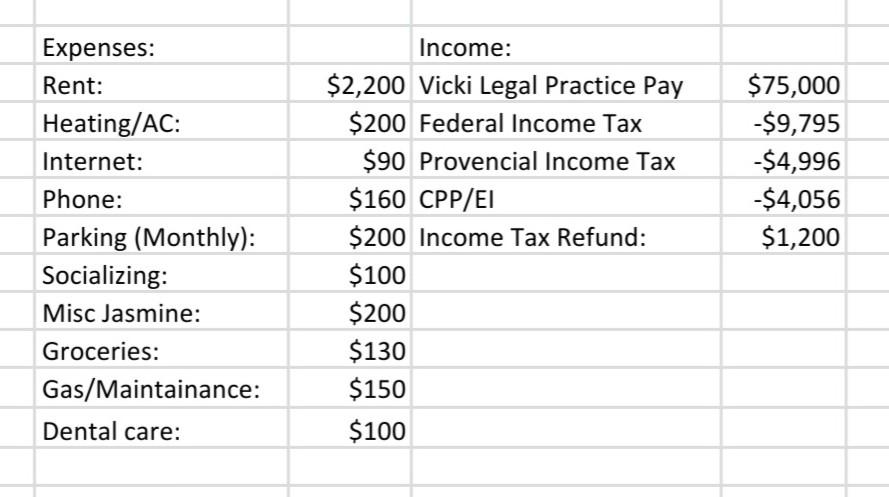

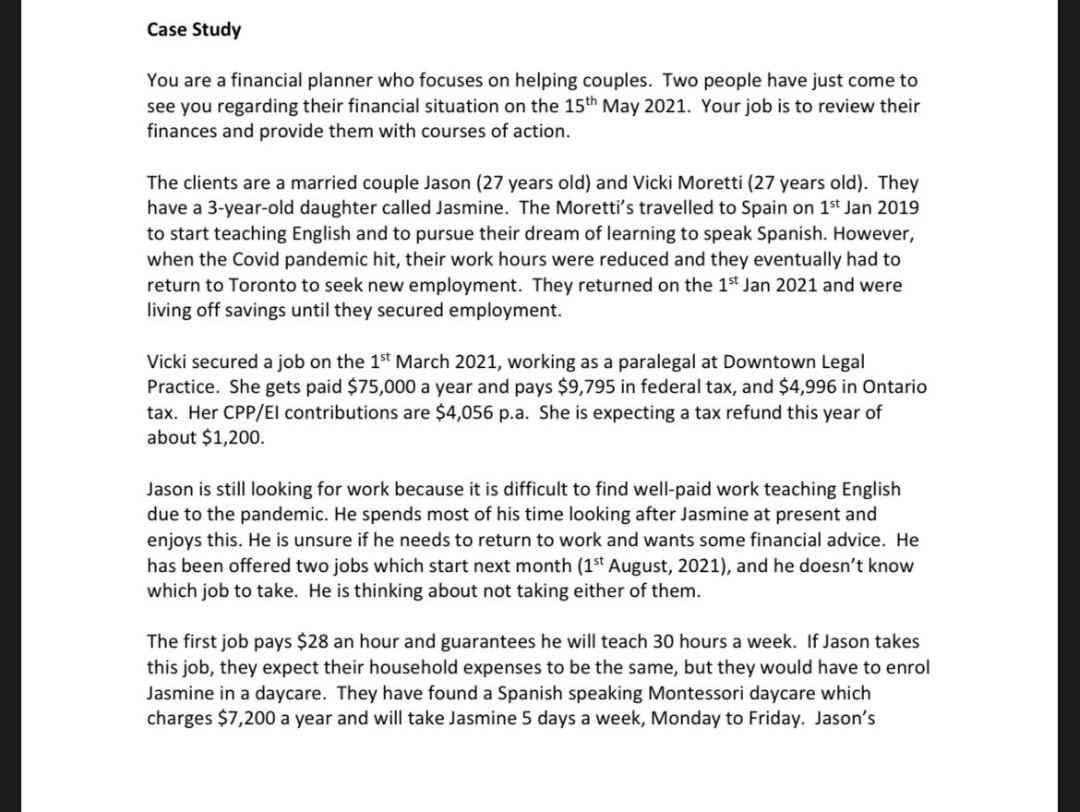

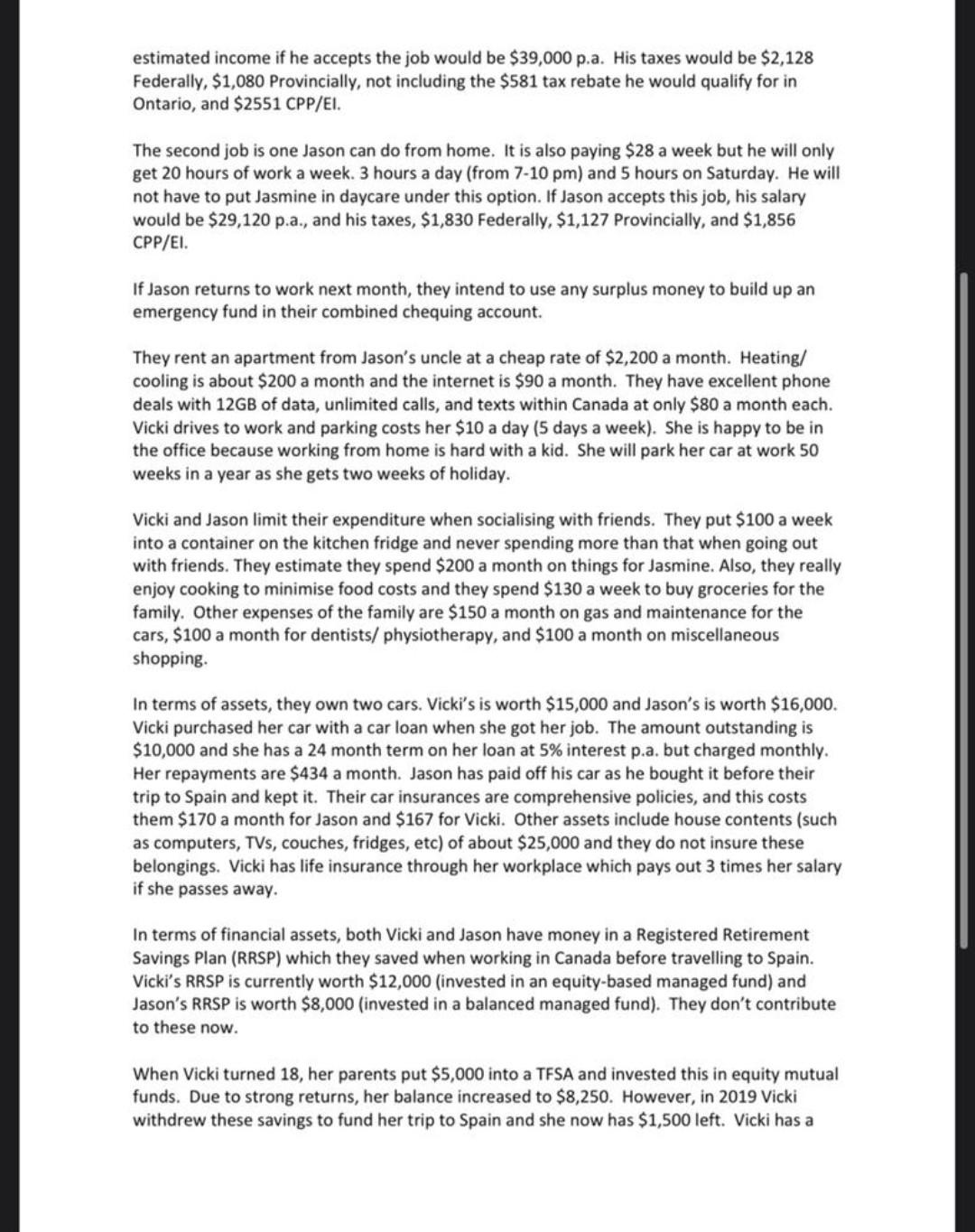

2) Construct a balance sheet for Vicki and Jason. (5 marks) 3) Undertake financial ratio analysis (without Jason working) and clearly explain what these ratios show for Jason and Vicki (20 marks). 10 Monthly Cash Flow Statement - Jason and Vicki Moret As of June 30th 2021 11 12 13 $ Income: Gross Income Tax Refund Less Deductions: 75,000 1,200 14 15 16 Income Tax 17 14,791 4,056 $ 57,353 $ 4,779.42 18 19 20 21 22 2,200 200 90 23 24 160 25 200 100 26 27 CPP and El Net Income Net Monthly Income Expenses: Rent Heating/AC Internet Phone Parking Socializing Misc Jasmine Groceries Gas/Maintain Dental Care: Misc Shopping: Monthly Car Loan: Car Insurance: Student Loan: Monthly Credit Card: TFSA Total Monthly Expenses: 200 28 130 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 29 150 30 31 100 100 434 32 33 337 34 208 35 480 36 2,700 7,789 37 $ 38 39 Net Monthly Deficit: -$ 3,009.58 40 41 Expenses: Rent: Heating/AC: Internet: Phone: Parking (Monthly): Socializing: Misc Jasmine: Groceries: Gas/Maintainance: Income: $2,200 Vicki Legal Practice Pay $200 Federal Income Tax $90 Provencial Income Tax $160 CPP/EI $200 Income Tax Refund: $100 $200 $130 $150 $100 $75,000 -$9,795 -$4,996 -$4,056 $1,200 Dental care: Case Study You are a financial planner who focuses on helping couples. Two people have just come to see you regarding their financial situation on the 15th May 2021. Your job is to review their finances and provide them with courses of action. The clients are a married couple Jason (27 years old) and Vicki Moretti (27 years old). They have a 3-year-old daughter called Jasmine. The Moretti's travelled to Spain on 1st Jan 2019 to start teaching English and to pursue their dream of learning to speak Spanish. However, when the Covid pandemic hit, their work hours were reduced and they eventually had to return to Toronto to seek new employment. They returned on the 1st Jan 2021 and were living off savings until they secured employment. Vicki secured a job on the 1st March 2021, working as a paralegal at Downtown Legal Practice. She gets paid $75,000 a year and pays $9,795 in federal tax, and $4,996 in Ontario tax. Her CPP/El contributions are $4,056 p.a. She is expecting a tax refund this year about $1,200. Jason is still looking for work because it is difficult to find well-paid work teaching English due to the pandemic. He spends most of his time looking after Jasmine at present and enjoys this. He is unsure if he needs to return to work and wants some financial advice. He has been offered two jobs which start next month (1st August, 2021), and he doesn't know which job to take. He is thinking about not taking either of them. The first job pays $28 an hour and guarantees he will teach 30 hours a week. If Jason takes this job, they expect their household expenses to be the same, but they would have to enrol Jasmine in a daycare. They have found a Spanish speaking Montessori daycare which charges $7,200 a year and will take Jasmine 5 days a week, Monday to Friday. Jason's estimated income if he accepts the job would be $39,000 p.a. His taxes would be $2,128 Federally, $1,080 Provincially, not including the $581 tax rebate he would qualify for in Ontario, and $2551 CPP/EI. The second job is one Jason can do from home. It is also paying $28 a week but he will only get 20 hours of work a week. 3 hours a day (from 7-10 pm) and 5 hours on Saturday. He will not have to put Jasmine in daycare under this option. If Jason accepts this job, his salary would be $29,120 p.a., and his taxes, $1,830 Federally, $1,127 Provincially, and $1,856 CPP/EI. If Jason returns to work next month, they intend to use any surplus money to build up an emergency fund in their combined chequing account. They rent an apartment from Jason's uncle at a cheap rate of $2,200 a month. Heating/ cooling is about $200 a month and the internet is $90 a month. They have excellent phone deals with 12GB of data, unlimited calls, and texts within Canada at only $80 a month each. Vicki drives to work and parking costs her $10 a day (5 days a week). She is happy to be in the office because working from home is hard with a kid. She will park her car at work 50 weeks in a year as she gets two weeks of holiday. Vicki and Jason limit their expenditure when socialising with friends. They put $100 a week into a container on the kitchen fridge and never spending more than that when going out with friends. They estimate they spend $200 a month on things for Jasmine. Also, they really enjoy cooking to minimise food costs and they spend $130 a week to buy groceries for the family. Other expenses of the family are $150 a month on gas and maintenance for the cars, $100 a month for dentists/ physiotherapy, and $100 a month on miscellaneous shopping In terms of assets, they own two cars. Vicki's is worth $15,000 and Jason's is worth $16,000. Vicki purchased her car with a car loan when she got her job. The amount outstanding is $10,000 and she has a 24 month term on her loan at 5% interest p.a. but charged monthly. Her repayments are $434 a month. Jason has paid off his car as he bought it before their trip to Spain and kept it. Their car insurances are comprehensive policies, and this costs them $170 a month for Jason and $167 for Vicki. Other assets include house contents (such as computers, TVs, couches, fridges, etc) of about $25,000 and they do not insure these belongings. Vicki has life insurance through her workplace which pays out 3 times her salary if she passes away. In terms of financial assets, both Vicki and Jason have money in a Registered Retirement Savings Plan (RRSP) which they saved when working in Canada before travelling to Spain. Vicki's RRSP is currently worth $12,000 (invested in an equity-based managed fund) and Jason's RRSP is worth $8,000 (invested in a balanced managed fund). They don't contribute to these now. When Vicki turned 18, her parents put $5,000 into a TFSA and invested this in equity mutual funds. Due to strong returns, her balance increased to $8,250. However, in 2019 Vicki withdrew these savings to fund her trip to Spain and she now has $1,500 left. Vicki has a 2) Construct a balance sheet for Vicki and Jason. (5 marks) 3) Undertake financial ratio analysis (without Jason working) and clearly explain what these ratios show for Jason and Vicki (20 marks). 10 Monthly Cash Flow Statement - Jason and Vicki Moret As of June 30th 2021 11 12 13 $ Income: Gross Income Tax Refund Less Deductions: 75,000 1,200 14 15 16 Income Tax 17 14,791 4,056 $ 57,353 $ 4,779.42 18 19 20 21 22 2,200 200 90 23 24 160 25 200 100 26 27 CPP and El Net Income Net Monthly Income Expenses: Rent Heating/AC Internet Phone Parking Socializing Misc Jasmine Groceries Gas/Maintain Dental Care: Misc Shopping: Monthly Car Loan: Car Insurance: Student Loan: Monthly Credit Card: TFSA Total Monthly Expenses: 200 28 130 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 29 150 30 31 100 100 434 32 33 337 34 208 35 480 36 2,700 7,789 37 $ 38 39 Net Monthly Deficit: -$ 3,009.58 40 41 Expenses: Rent: Heating/AC: Internet: Phone: Parking (Monthly): Socializing: Misc Jasmine: Groceries: Gas/Maintainance: Income: $2,200 Vicki Legal Practice Pay $200 Federal Income Tax $90 Provencial Income Tax $160 CPP/EI $200 Income Tax Refund: $100 $200 $130 $150 $100 $75,000 -$9,795 -$4,996 -$4,056 $1,200 Dental care: Case Study You are a financial planner who focuses on helping couples. Two people have just come to see you regarding their financial situation on the 15th May 2021. Your job is to review their finances and provide them with courses of action. The clients are a married couple Jason (27 years old) and Vicki Moretti (27 years old). They have a 3-year-old daughter called Jasmine. The Moretti's travelled to Spain on 1st Jan 2019 to start teaching English and to pursue their dream of learning to speak Spanish. However, when the Covid pandemic hit, their work hours were reduced and they eventually had to return to Toronto to seek new employment. They returned on the 1st Jan 2021 and were living off savings until they secured employment. Vicki secured a job on the 1st March 2021, working as a paralegal at Downtown Legal Practice. She gets paid $75,000 a year and pays $9,795 in federal tax, and $4,996 in Ontario tax. Her CPP/El contributions are $4,056 p.a. She is expecting a tax refund this year about $1,200. Jason is still looking for work because it is difficult to find well-paid work teaching English due to the pandemic. He spends most of his time looking after Jasmine at present and enjoys this. He is unsure if he needs to return to work and wants some financial advice. He has been offered two jobs which start next month (1st August, 2021), and he doesn't know which job to take. He is thinking about not taking either of them. The first job pays $28 an hour and guarantees he will teach 30 hours a week. If Jason takes this job, they expect their household expenses to be the same, but they would have to enrol Jasmine in a daycare. They have found a Spanish speaking Montessori daycare which charges $7,200 a year and will take Jasmine 5 days a week, Monday to Friday. Jason's estimated income if he accepts the job would be $39,000 p.a. His taxes would be $2,128 Federally, $1,080 Provincially, not including the $581 tax rebate he would qualify for in Ontario, and $2551 CPP/EI. The second job is one Jason can do from home. It is also paying $28 a week but he will only get 20 hours of work a week. 3 hours a day (from 7-10 pm) and 5 hours on Saturday. He will not have to put Jasmine in daycare under this option. If Jason accepts this job, his salary would be $29,120 p.a., and his taxes, $1,830 Federally, $1,127 Provincially, and $1,856 CPP/EI. If Jason returns to work next month, they intend to use any surplus money to build up an emergency fund in their combined chequing account. They rent an apartment from Jason's uncle at a cheap rate of $2,200 a month. Heating/ cooling is about $200 a month and the internet is $90 a month. They have excellent phone deals with 12GB of data, unlimited calls, and texts within Canada at only $80 a month each. Vicki drives to work and parking costs her $10 a day (5 days a week). She is happy to be in the office because working from home is hard with a kid. She will park her car at work 50 weeks in a year as she gets two weeks of holiday. Vicki and Jason limit their expenditure when socialising with friends. They put $100 a week into a container on the kitchen fridge and never spending more than that when going out with friends. They estimate they spend $200 a month on things for Jasmine. Also, they really enjoy cooking to minimise food costs and they spend $130 a week to buy groceries for the family. Other expenses of the family are $150 a month on gas and maintenance for the cars, $100 a month for dentists/ physiotherapy, and $100 a month on miscellaneous shopping In terms of assets, they own two cars. Vicki's is worth $15,000 and Jason's is worth $16,000. Vicki purchased her car with a car loan when she got her job. The amount outstanding is $10,000 and she has a 24 month term on her loan at 5% interest p.a. but charged monthly. Her repayments are $434 a month. Jason has paid off his car as he bought it before their trip to Spain and kept it. Their car insurances are comprehensive policies, and this costs them $170 a month for Jason and $167 for Vicki. Other assets include house contents (such as computers, TVs, couches, fridges, etc) of about $25,000 and they do not insure these belongings. Vicki has life insurance through her workplace which pays out 3 times her salary if she passes away. In terms of financial assets, both Vicki and Jason have money in a Registered Retirement Savings Plan (RRSP) which they saved when working in Canada before travelling to Spain. Vicki's RRSP is currently worth $12,000 (invested in an equity-based managed fund) and Jason's RRSP is worth $8,000 (invested in a balanced managed fund). They don't contribute to these now. When Vicki turned 18, her parents put $5,000 into a TFSA and invested this in equity mutual funds. Due to strong returns, her balance increased to $8,250. However, in 2019 Vicki withdrew these savings to fund her trip to Spain and she now has $1,500 left. Vicki has a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started