Answered step by step

Verified Expert Solution

Question

1 Approved Answer

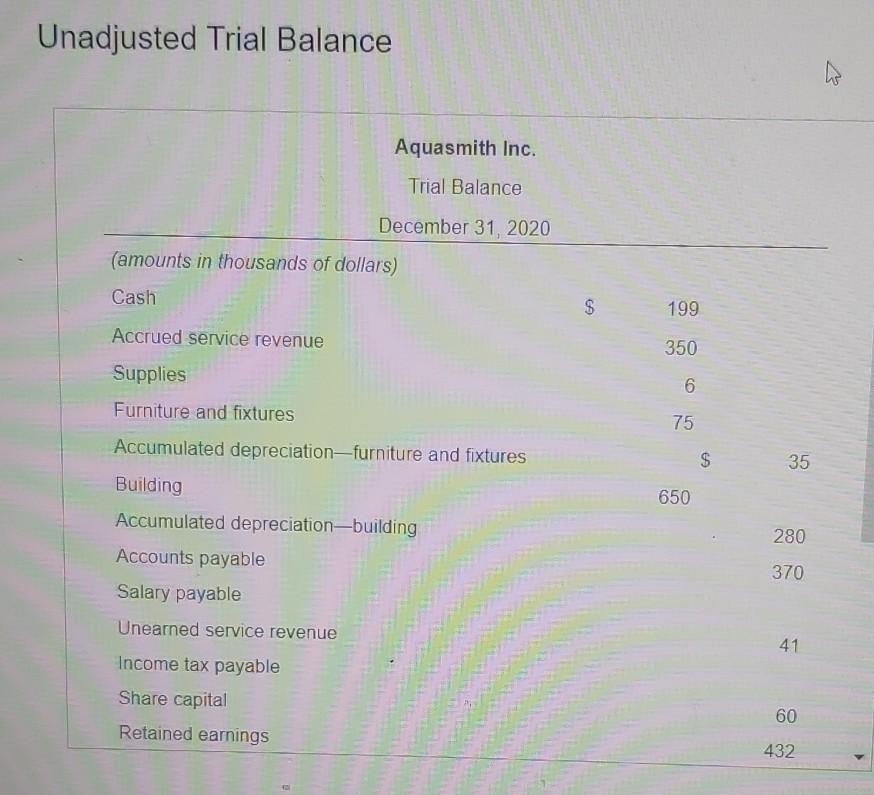

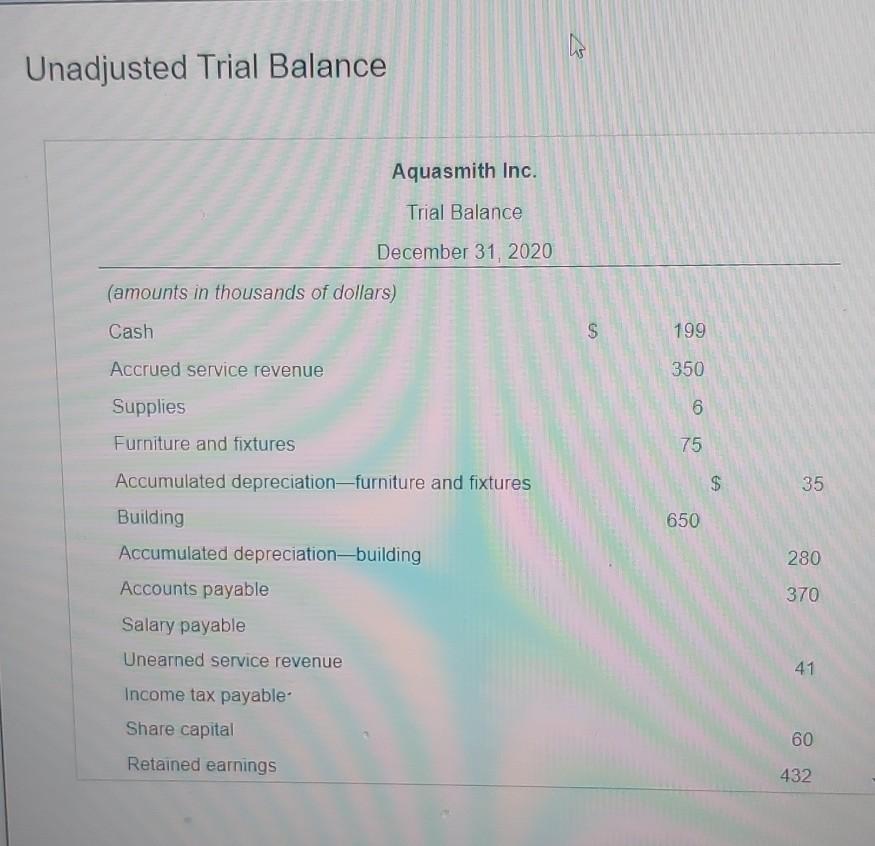

Old MathJax webview Old MathJax webview Unadjusted Trial Balance Aquasmith Inc. Trial Balance December 31, 2020 (amounts in thousands of dollars) Cash $ 199 Accrued

Old MathJax webview

Old MathJax webview

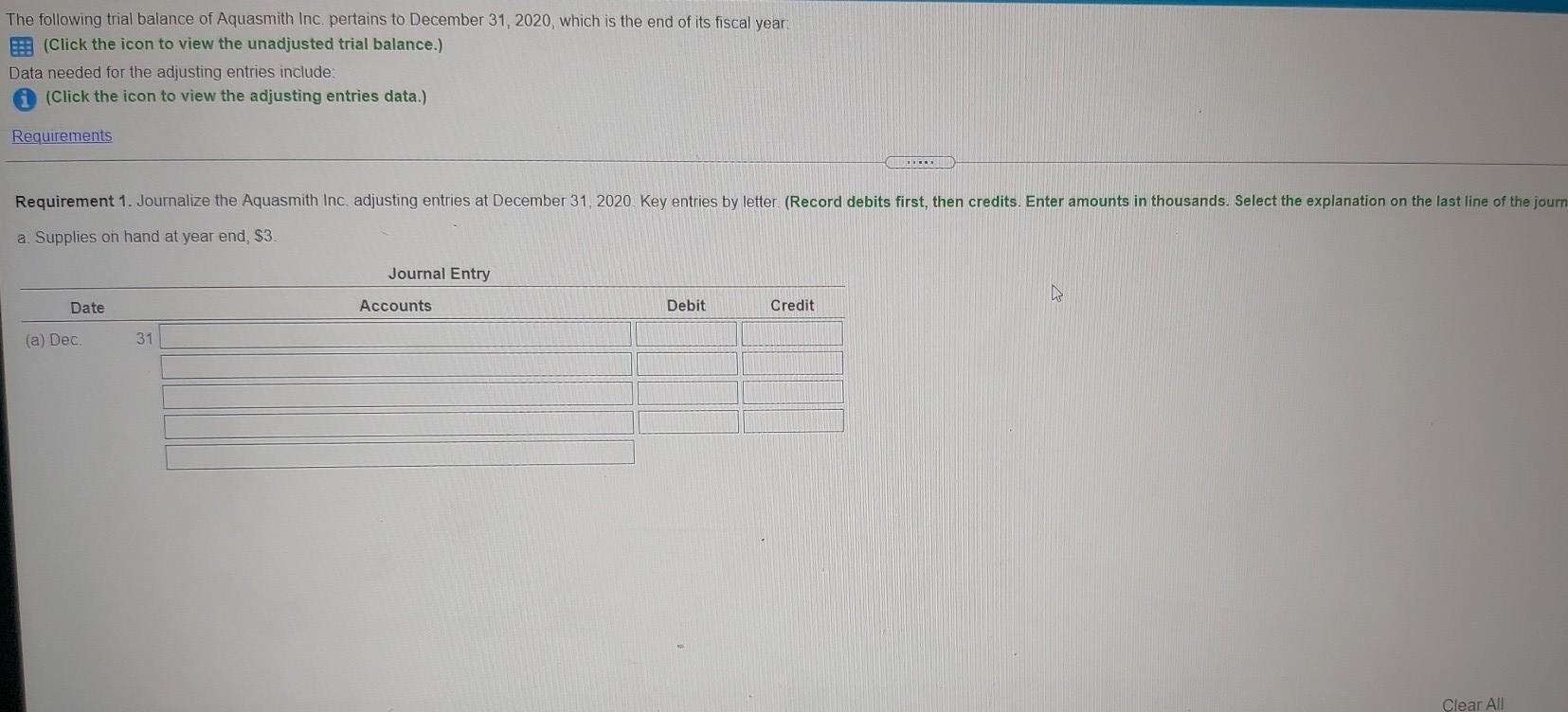

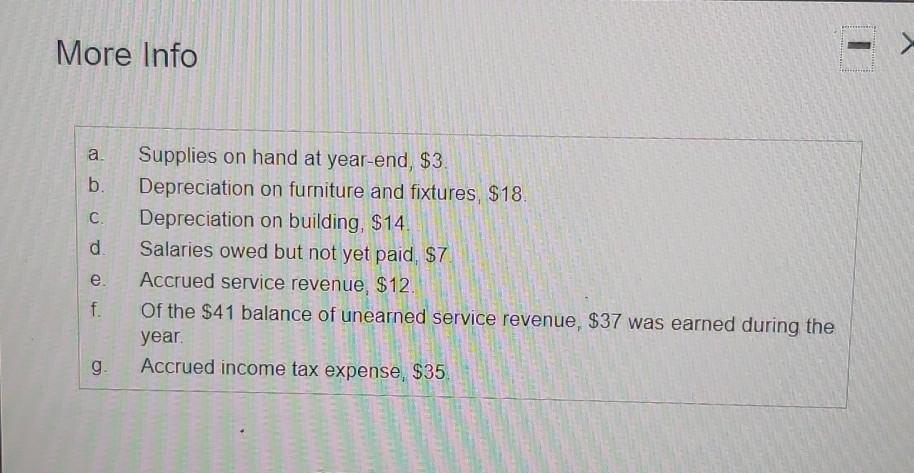

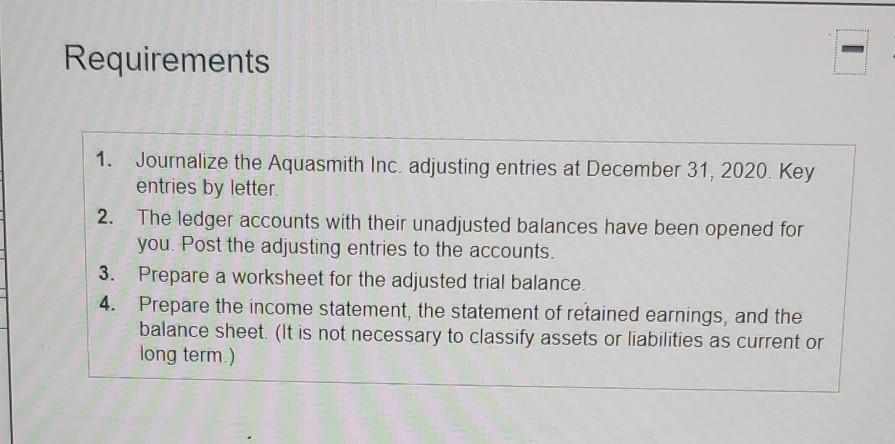

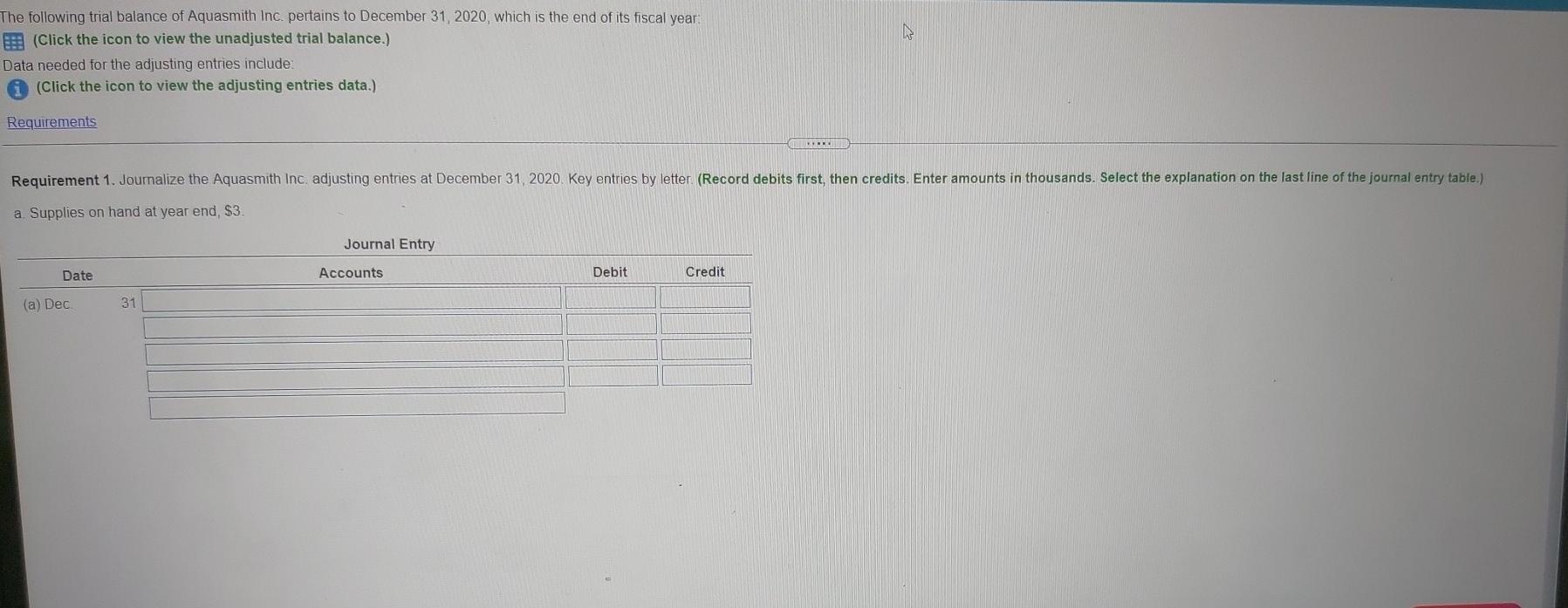

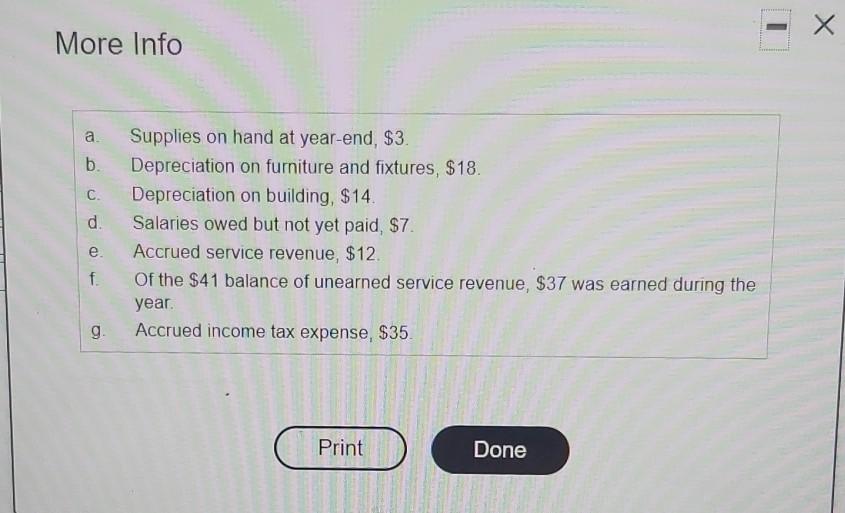

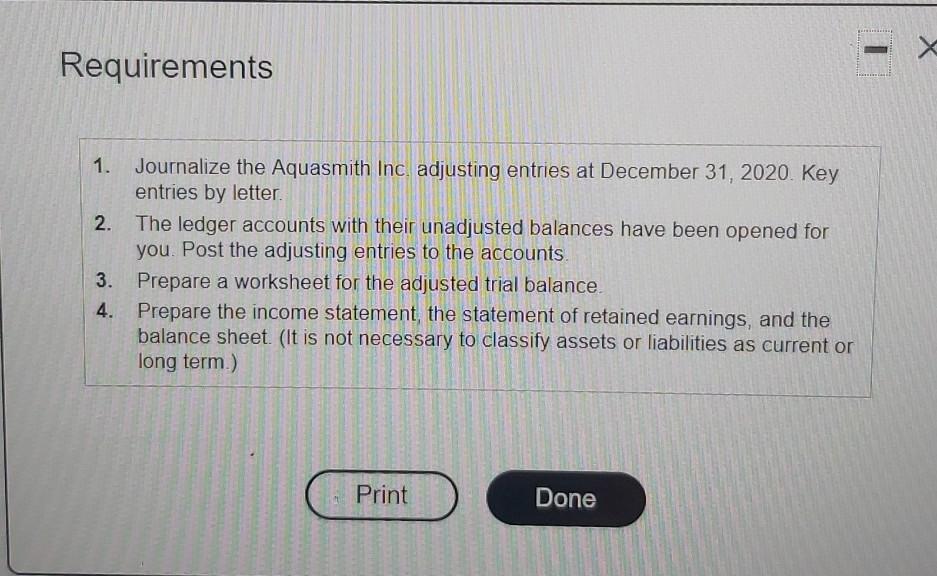

Unadjusted Trial Balance Aquasmith Inc. Trial Balance December 31, 2020 (amounts in thousands of dollars) Cash $ 199 Accrued service revenue 350 Supplies 6 Furniture and fixtures 75 $ 35 650 280 370 Accumulated depreciation-furniture and fixtures Building Accumulated depreciation-building Accounts payable Salary payable Unearned service revenue Income tax payable Share capital Retained earnings 41 60 432 - More Info a. b. C. d Supplies on hand at year-end, $3. Depreciation on furniture and fixtures, $18. Depreciation on building, $14 Salaries owed but not yet paid, $7 Accrued service revenue $12. Of the $41 balance of unearned service revenue, $37 was earned during the year. Accrued income tax expense, $35. e. f. g. Requirements 1. Journalize the Aquasmith Inc. adjusting entries at December 31, 2020. Key entries by letter 2. The ledger accounts with their unadjusted balances have been opened for you. Post the adjusting entries to the accounts. 3. Prepare a worksheet for the adjusted trial balance 4. Prepare the income statement, the statement of retained earnings, and the balance sheet (It is not necessary to classify assets or liabilities as current or long term.) The following trial balance of Aquasmith Inc. pertains to December 31, 2020, which is the end of its fiscal year B (Click the icon to view the unadjusted trial balance.) Data needed for the adjusting entries include: (Click the icon to view the adjusting entries data.) Requirements Requirement 1. Journalize the Aquasmith Inc adjusting entries at December 31, 2020. Key entries by letter. (Record debits first, then credits. Enter amounts in thousands. Select the explanation on the last line of the journal entry table.) a Supplies on hand at year end, $3. Journal Entry Date Accounts Debit Credit (a) Dec 31 Unadjusted Trial Balance Aquasmith Inc. Trial Balance December 31, 2020 (amounts in thousands of dollars) Cash CA 199 Accrued service revenue 350 6 75 $ 35 Supplies Furniture and fixtures Accumulated depreciation-furniture and fixtures Building Accumulated depreciation-building Accounts payable Salary payable 650 280 370 41 Unearned service revenue Income tax payable Share capital Retained earnings 60 432 More Info a. b. C. d. Supplies on hand at year-end, $3. Depreciation on furniture and fixtures, $18. Depreciation on building, $14. Salaries owed but not yet paid, $7. Accrued service revenue, $12 Of the $41 balance of unearned service revenue, $37 was earned during the year. Accrued income tax expense, $35 e. f. g Print Done - X Requirements 1. Journalize the Aquasmith Inc. adjusting entries at December 31, 2020. Key entries by letter 2. The ledger accounts with their unadjusted balances have been opened for you. Post the adjusting entries to the accounts 3. Prepare a worksheet for the adjusted trial balance 4. Prepare the income statement, the statement of retained earnings, and the balance sheet (It is not necessary to classify assets or liabilities as current or long term.) Print D Done Unadjusted Trial Balance Aquasmith Inc. Trial Balance December 31, 2020 (amounts in thousands of dollars) Cash $ 199 Accrued service revenue 350 Supplies 6 Furniture and fixtures 75 $ 35 650 280 370 Accumulated depreciation-furniture and fixtures Building Accumulated depreciation-building Accounts payable Salary payable Unearned service revenue Income tax payable Share capital Retained earnings 41 60 432 - More Info a. b. C. d Supplies on hand at year-end, $3. Depreciation on furniture and fixtures, $18. Depreciation on building, $14 Salaries owed but not yet paid, $7 Accrued service revenue $12. Of the $41 balance of unearned service revenue, $37 was earned during the year. Accrued income tax expense, $35. e. f. g. Requirements 1. Journalize the Aquasmith Inc. adjusting entries at December 31, 2020. Key entries by letter 2. The ledger accounts with their unadjusted balances have been opened for you. Post the adjusting entries to the accounts. 3. Prepare a worksheet for the adjusted trial balance 4. Prepare the income statement, the statement of retained earnings, and the balance sheet (It is not necessary to classify assets or liabilities as current or long term.) The following trial balance of Aquasmith Inc. pertains to December 31, 2020, which is the end of its fiscal year B (Click the icon to view the unadjusted trial balance.) Data needed for the adjusting entries include: (Click the icon to view the adjusting entries data.) Requirements Requirement 1. Journalize the Aquasmith Inc adjusting entries at December 31, 2020. Key entries by letter. (Record debits first, then credits. Enter amounts in thousands. Select the explanation on the last line of the journal entry table.) a Supplies on hand at year end, $3. Journal Entry Date Accounts Debit Credit (a) Dec 31 Unadjusted Trial Balance Aquasmith Inc. Trial Balance December 31, 2020 (amounts in thousands of dollars) Cash CA 199 Accrued service revenue 350 6 75 $ 35 Supplies Furniture and fixtures Accumulated depreciation-furniture and fixtures Building Accumulated depreciation-building Accounts payable Salary payable 650 280 370 41 Unearned service revenue Income tax payable Share capital Retained earnings 60 432 More Info a. b. C. d. Supplies on hand at year-end, $3. Depreciation on furniture and fixtures, $18. Depreciation on building, $14. Salaries owed but not yet paid, $7. Accrued service revenue, $12 Of the $41 balance of unearned service revenue, $37 was earned during the year. Accrued income tax expense, $35 e. f. g Print Done - X Requirements 1. Journalize the Aquasmith Inc. adjusting entries at December 31, 2020. Key entries by letter 2. The ledger accounts with their unadjusted balances have been opened for you. Post the adjusting entries to the accounts 3. Prepare a worksheet for the adjusted trial balance 4. Prepare the income statement, the statement of retained earnings, and the balance sheet (It is not necessary to classify assets or liabilities as current or long term.) Print D Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started