Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Osawa, Inc planned and actually manufactured 210,000 units of its single product in 2017, its first year of operation Variable manufacturing cost

Old MathJax webview

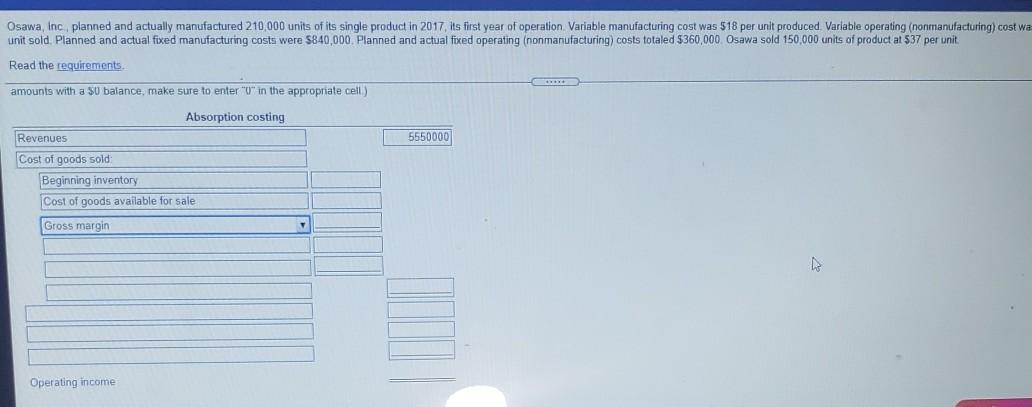

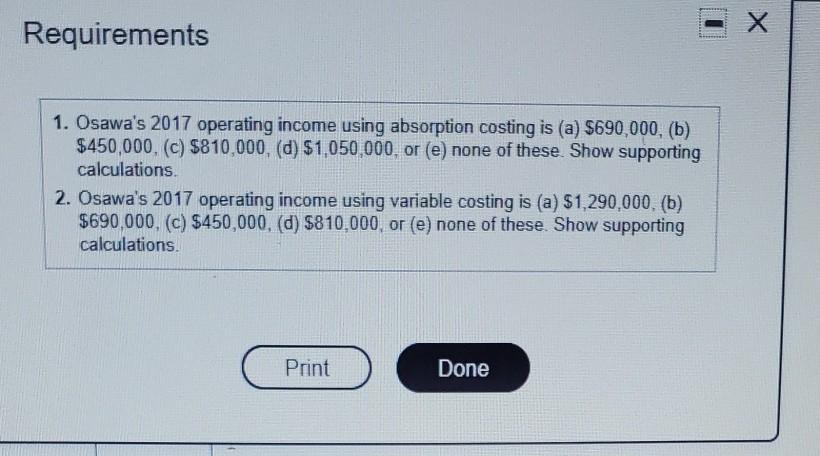

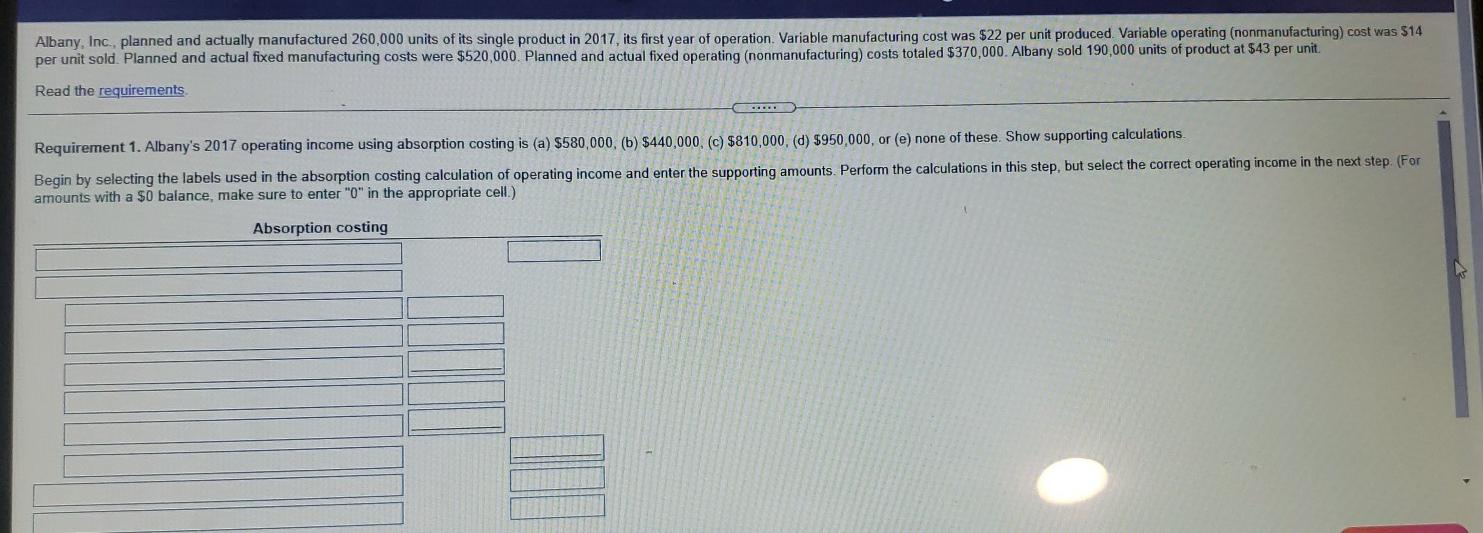

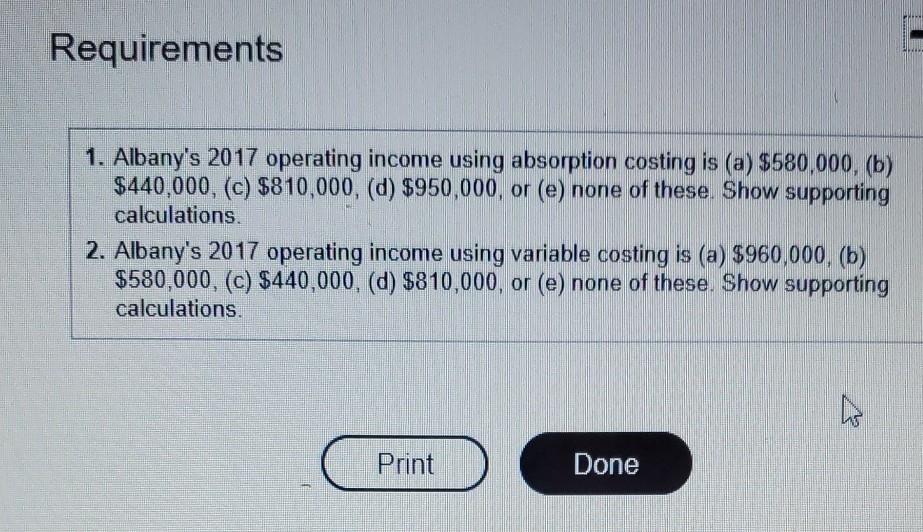

Osawa, Inc planned and actually manufactured 210,000 units of its single product in 2017, its first year of operation Variable manufacturing cost was 518 per unit produced Variable operating (nonmanufacturing) cost wa unit sold Planned and actual fixed manufacturing costs were $840,000 Planned and actual fixed operating (nonmanufacturing) costs totaled $360,000 Osawa sold 150,000 units of product at $37 per unit. Read the requirements amounts with a $0 balance, make sure to enter in the appropriate cell) 5550000 Absorption costing Revenues Cost of goods sold Beginning inventory Cost of goods available for sale Gross margin Operating income Requirements 1. Osawa's 2017 operating income using absorption costing is (a) $690,000, (b) $450,000. (c) $810,000, (d) $1,050,000, or (e) none of these. Show supporting calculations 2. Osawa's 2017 operating income using variable costing is (a) $1,290,000. (b) $690,000, (c) $450,000, (d) $810,000, or (e) none of these. Show supporting calculations. Print Done Albany, Inc., planned and actually manufactured 260,000 units of its single product in 2017, its first year of operation. Variable manufacturing cost was $22 per unit produced Variable operating (nonmanufacturing) cost was 514 per unit sold. Planned and actual fixed manufacturing costs were $520,000. Planned and actual fixed operating (nonmanufacturing) costs totaled $370,000. Albany sold 190,000 units of product at $43 per unit Read the requirements Requirement 1. Albany's 2017 operating income using absorption costing is (a) $580,000, (b) $440,000. (c) $810,000. (d) $950,000, or (e) none of these. Show supporting calculations Begin by selecting the labels used in the absorption costing calculation of operating income and enter the supporting amounts. Perform the calculations in this step, but select the correct operating income in the next step. (For amounts with a $0 balance, make sure to enter "0" in the appropriate cell.) Absorption costing Requirements 1. Albany's 2017 operating income using absorption costing is (a) $580,000, (b) $440,000, (c) $810,000, (d) $950,000, or (e) none of these. Show supporting calculations. 2. Albany's 2017 operating income using variable costing is (a) $960,000, (b) $580,000, (c) $440,000, (d) $810,000, or (e) none of these. Show supporting calculations ms Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started